Can I Get My Property Tax Bill Online

You can access this new web site by clicking the link below or by directing your browser to. You can make online payments 24 hours a day 7 days a week until 1159 pm.

Secured Property Taxes Treasurer Tax Collector

Secured Property Taxes Treasurer Tax Collector

You can pay your taxes or reprint your bill online using e-checks debit and credit cards.

Can i get my property tax bill online. Real Estate Tax Payment. Find out if your delinquent taxes have been sold. Pacific Time on the delinquency date.

Use an e-Check or credit card to make a payment. You can always download and print a copy of your Property Tax Bill on this web site. The information on the bill can also help you determine whether your assessment is accurate.

How You Can Pay Your Taxes. You will need to use the AIN and Personal Identification Number PIN which is printed on your original Secured Property Tax Bill to complete the transaction. It is recommended that you copy and paste the tax key account number on to the Make a Payment page at US Bank to assure accurate payment application.

You can pay your property andor school tax online by clicking here or by calling Paymentus toll-free at 877-225-7351. Property tax bills and receipts contain a lot of helpful information for taxpayers. The Tax Office accepts full and partial payment of property taxes online.

There are no convenience fees for paying by e-check. Real Property Tax Electronic Payment Site Pay your real property tax online or by telephone by credit card. The only exception is that a property tax collector may wait to send a bill until the total taxes due for all taxing units the collector serves is 15 or more.

Creditdebit cards payments are done using a PayPal module available within our website. 1-1-1-001-011-0000-000 and select an amount to pay as shown on your tax bill. Call 317-327-4444 if you have any questions.

If you have further questions please contact our office at 951955-3900 or e-mail. Electronic check eCheck payments require your bank account and routing numbers. Our online bill presentment and payment solution provides.

This module is encrypted and meets current internet security standards. It offers premium security and ease of use. Download a copy of your tax bill.

Please check with the Harris County Appraisal District HCAD for further information. Search any Lake County property free of charge by entering an address property PIN number or property owner name to view tax bill information property history exemptions permits sketches sales history and a host of other property characteristics. You can mail your payment.

Beyond the amount of taxes you owe the bills indicate where your taxes are going and how much more is being collected by your local governments each year. A property owner may file a written request with the collector that a tax bill not be sent until the total amount of taxes due on the property is 15 or more. Payments can also be made using creditdebit cards American Express Discover MasterCard and Visa.

See local governments debt and pensions. Convenience fees for cards will apply. There is no cost to you for electronic check eCheck payments.

Enter your parcel number name or street name to view your invoice. If you lost the original bill and are making a payment you can pay electronically or print out and send in the online copy with your tax payment. You also can check and update key information about your property such as.

1 the amount due now or 2 new balance. To make a Property Tax Payment Online select the Resources Menu icon which is the third icon from the right in the blue bar at the top of the page and select PAY ONLINE. If you are having trouble searching please visit Assessor Property Cards to lookup the address and parcel number.

After you make an online payment it can take up to five business days for your tax bill to be updated with your new balance. PAMS offers customers an easy and secure way to view print and pay their Real Estate Tax bills online. PAMS in partnership with Invoice Cloud accepts ACHelectronic check electronic fund transfer from your checking or savings account and creditdebit card payments of bills.

You will be asked to enter the numeric parcel IDTMK example. Search for your property Search by address Search by parcel number For best search results enter a partial street name and partial owner name ie. If you currently owe property tax on your account but your account information does not display the values may not yet have been certified by the appraisal district.

The Office of Finance has provided the capability for citizens and businesses to pay their Real Estate and Personal Property taxes online using the a credit card on e-check. See if a refund is available. Sign up to receive tax bills by email.

124 Main rather than 124 Main Street or Doe rather than John Doe. A 24 convenience fee 200 minimum is applied to each creditdebit card transaction. Tax Bill Search The information provided in these databases is public record and available through public information requests.

Electronic payments will be accepted until further notice. The Department of Local Government Finance has compiled this information in an easy-to-use format to assist Hoosiers in obtaining information about property taxes.

Appealing Property Taxes How To Challenge Your Tax Assessment Property Tax Assessment Real Estate Advice

Appealing Property Taxes How To Challenge Your Tax Assessment Property Tax Assessment Real Estate Advice

Pay Your Property Tax Bill Online

Pay Your Property Tax Bill Online

Secured Property Taxes Treasurer Tax Collector

Secured Property Taxes Treasurer Tax Collector

What S My Property S Tax Identification Number

What S My Property S Tax Identification Number

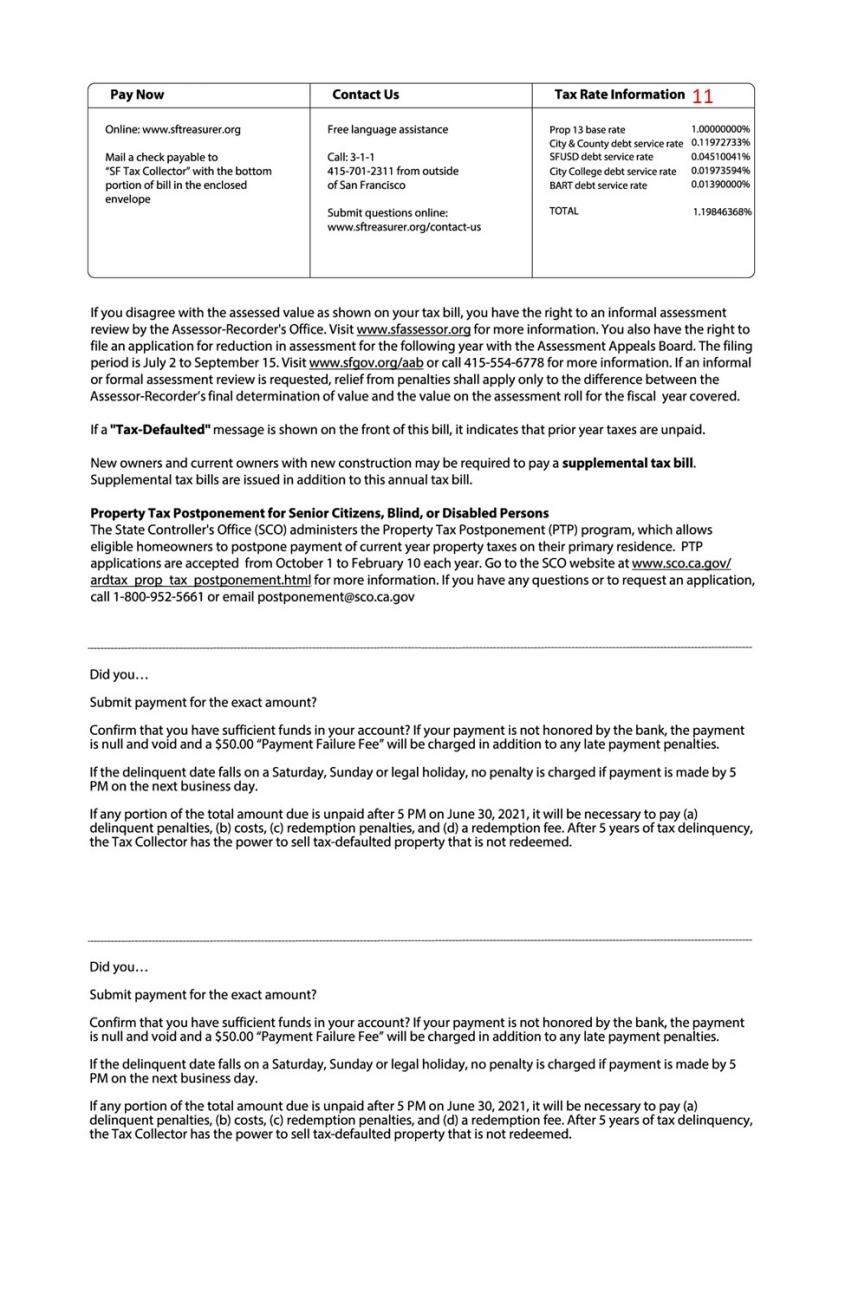

Understanding Property Tax In California Property Tax Tax Understanding

Understanding Property Tax In California Property Tax Tax Understanding

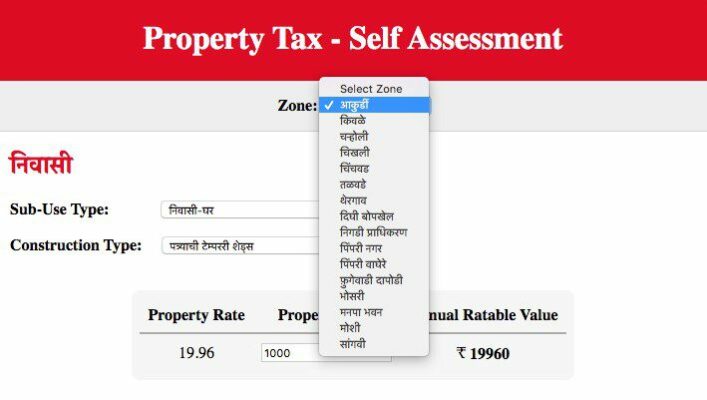

Pay Pcmc Property Tax Online A Step By Step Guide

Pay Pcmc Property Tax Online A Step By Step Guide

What S My Property S Tax Identification Number

What S My Property S Tax Identification Number

Secured Property Taxes Treasurer Tax Collector

Secured Property Taxes Treasurer Tax Collector

Property Tax Information Lake County Il

What S My Property S Tax Identification Number

What S My Property S Tax Identification Number

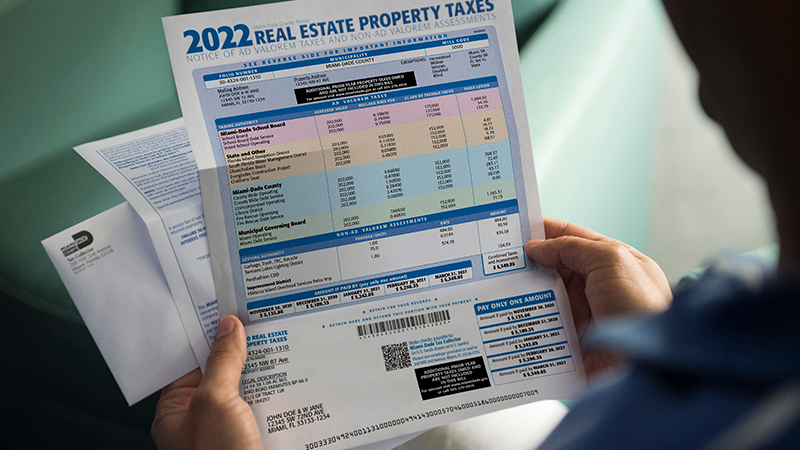

How To Read Your Property Tax Bill O Connor Property Tax Reduction Experts Property Tax Tax Reduction Tax

How To Read Your Property Tax Bill O Connor Property Tax Reduction Experts Property Tax Tax Reduction Tax

Current Payment Status Lake County Il

Labels: property

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home