Why Are Property Taxes So High In Ct

Ward says that there isnt as much state money coming down to Connecticuts towns and cities as in the past which leaves real estate taxes as the primary revenue source and thus theyre likely to continue increasing over time. Home values are another reason why one city has a higher property tax than another.

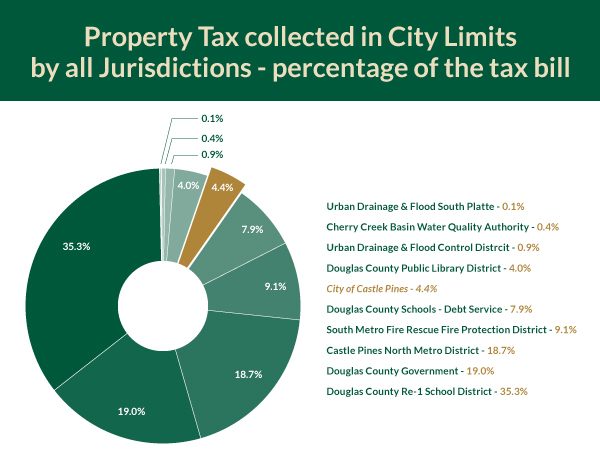

Taxation In Castle Pines City Of Castle Pines

Taxation In Castle Pines City Of Castle Pines

Heres why your property taxes may be so high and what you can do if they keep going up each year.

Why are property taxes so high in ct. Indiana has one of the lowest median property tax rates in the United States with only ten states collecting a lower median property tax than Indiana. The more attractive our cities are the more people will want to come and stay. 53 rows But data comparing the share of state and local revenue generated by property taxes shows.

So if your property is assessed at 300000 and your local government sets your tax rate at 25 your annual tax bill will be 7500. In Florida my property taxes were lower about two thirds of what I pay here. The three key reasons for Texas high property taxes are.

Rising property taxes can put a strain on your budget. Property taxes depend on legislation passed at the State level specifically for the City of Hartford. Appraisal values on real estate continually go up.

Last year the state ranked fifth nationwide in property taxes as a percentage of state revenue. Those areas with higher housing values can charge a lower tax rate but still raise a lot in revenue. Well its the capitol city.

Why Are Property Taxes So High in Texas. Thats the reason why theres a giant sucking sound of people and companies fleeing the state. Connecticut is heavily dependent on property taxes.

But I used to pay 13000 for my daughters private school since public schools are so bad there. Leaving Connecticut because of the high taxes and relocating to Boston is like leaving Connecticut because of the cold winters and moving to well Boston. This along with the high cost of living in the Northeast healthcare electricity etc places a heavy burden on the property tax and property taxpayers.

One mill is equal to one dollar of tax per 1000 of assessed property value. The higher rents and property prices go the wealthier property owners become and the more the city earns in taxes. How Are Property Taxes Calculated.

With my second daughter starting school in September that would have been 26000. The taxes are much too high in CT. The median property tax in Indiana is 105100 per year for a home worth the median value of 12310000.

283 rows Real estate taxes are the primary revenue source for Connecticuts towns and cities. An average of 950 people move to Florida every day and per the Miami Report the majority come from bureaucracy-heavy high-tax. What makes Hartford so special.

Travelers which is the second-highest taxpayer in the city with 1432 million in assessed real estate and property is aware of the high property-tax rate but is also bullish about Hartfords. So the complete story isnt just. The more people come and stay the higher rents and property prices go.

The state has no personal income tax. I would leave the state myself if I didnt have family in Ct. This is why.

Were taxed on everything but the air we breathe and if that could be arranged we would be. Local taxing authorities set their own property tax rates. Counties in Indiana collect an average of 085 of a propertys assesed fair market value as property tax per year.

Given that residential properties far exceed commercial properties in almost all of the states municipalities including cities municipal governments are overwhelmingly reliant on the property tax. The primary goal of the special law is to protect homeowners by shifting a portion of the tax burden from residential property to other property classes mainly the business community.

How To Cut Your Property Taxes Credit Com

How To Cut Your Property Taxes Credit Com

Property Taxes By State Why We Should All Embrace Higher Property Taxes

Property Taxes By State Why We Should All Embrace Higher Property Taxes

Texas Property Tax Travis Central Appraisal District

Texas Property Tax Travis Central Appraisal District

Are There Any States With No Property Tax In 2021 Free Investor Guide

Are There Any States With No Property Tax In 2021 Free Investor Guide

New Hampshire Property Tax Calculator Smartasset

New Hampshire Property Tax Calculator Smartasset

Property Tax City Of Commerce City Co

How School Funding S Reliance On Property Taxes Fails Children Npr

Are There Any States With No Property Tax In 2021 Free Investor Guide

Are There Any States With No Property Tax In 2021 Free Investor Guide

California Property Taxes Explained Big Block Realty

California Property Taxes Explained Big Block Realty

States With The Highest And Lowest Property Taxes Property Tax Tax States

States With The Highest And Lowest Property Taxes Property Tax Tax States

States With The Highest And Lowest Property Taxes Property Tax Social Studies Worksheets States

States With The Highest And Lowest Property Taxes Property Tax Social Studies Worksheets States

Florida Property Tax H R Block

Florida Property Tax H R Block

Reduce Reliance On Local Property Taxes The Fourth Regional Plan

Property Tax City Of Commerce City Co

Will Your Property Taxes Fall Due To Covid 19 Millionacres

Will Your Property Taxes Fall Due To Covid 19 Millionacres

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home