Senior Property Tax Exemption New York

Senior citizens exemption. The exemption must be renewed every two years.

Good News For Homeowners Who Have Illegal Properties In The Civic Body Area The Municipal Corporation Of Gurugram Ha Property Tax Commercial Property Property

Good News For Homeowners Who Have Illegal Properties In The Civic Body Area The Municipal Corporation Of Gurugram Ha Property Tax Commercial Property Property

The exemption must be renewed every two years.

Senior property tax exemption new york. As the name implies exemptions exclude all or a portion of a propertys assessed value from the tax base. SCHE gives property tax help to senior homeowners. Due to changes in New York State law beginning with applications for 2019 you must apply separately.

If you are married the income of your spouse must be included in the total unless your spouse is absent from the residence due to a legal separation or abandonment. Property Tax Benefits for Homeowners The City of New York offers tax exemptions and abatements for seniors veterans clergy members people with disabilities and other homeowners. You cannot receive the senior citizens exemption if the income of the owner or the combined income of all the owners exceeds the maximum income limit set by the locality.

Your homes taxable assessment will get a 50 reduction if your income isnt higher than the set maximum income limit. The Senior Citizen Homeowners Exemption SCHE provides a reduction of 5 to 50 on New York Citys real property tax to seniors age 65 and older. To qualify seniors generally must be 65 years of age or older and meet certain income limitations and other.

The person claiming the exemption must live in the home as their primary residence The minimum age requirement for senior property tax exemptions is generally between the ages of. To be eligible for SCHE you must be 65 or older earn no more than 58399 for the last calendar year and the property must be your primary residence. Senior Citizen Homeowners Exemption SCHE A property tax break for seniors who own one- two- or three-family homes condominiums or cooperative apartments.

Property Tax Exemptions for Seniors. Though all property is assessed not all of it is taxable. Seek Qualified Advice from a New York Estate Planning Lawyer.

Others are partially exempt such as veterans who qualify for an exemption on part of their homes and homeowners who are eligible for the School Tax Relief. This is accomplished by reducing the taxable assessment of the seniors home by as much as 50. New Yorks Senior Citizen Exemption is 50 of your homes appraised value but you must be age 65 or older and have an annual income of no more than 29000 as of 2020.

STAR Program STAR is the New York State School Tax Relief Program that provides an exemption from school property taxes for owner-occupied primary residences. These benefits can lower your property tax bill. One area of the real property tax that affects both local governments and taxpayers is the issue of property tax exemptions.

Documents on this page are provided in pdf format. The NY senior citizen property tax exemption is essentially a tax reduction. The Senior Citizen Homeowners Exemption SCHE provides a reduction of 5 to 50 on New York Citys real property tax to seniors age 65 and older.

Apply online by March 15th for benefits to begin on July 1. Certain local governments allow homeowners whose income exceeds the limit to receive the reduction but a much lower percentage. In 2012 the full market value full value of all real property in New York.

Senior citizens exemption Income requirements. Business investment instructions Persons with disabilities. Some properties such as those owned by religious organizations or governments are completely exempt from paying property taxes.

Some New York jurisdictions offer a specific property tax exemption for veterans who served in the military during the Cold War from September 2 1945 to December 26 1991. Seniors over age 65 whose income is less than 88050 may apply for the enhanced Star exemption. Local governments and school districts in New York State can opt to grant a reduction on the amount of property taxes paid by qualifying senior citizens.

Veterans may only select one exemption even if they are eligible for two or three. It lowers the taxes of seniors who own one to three homes condos or coop apartments. If March 15 falls on a weekend or holiday the deadline is the next business day.

To be eligible for SCHE you must be 65 or older earn no more than 58399 for the last calendar year and the property must be your primary residence. Senior citizens exemption nys Verified Just Now. New Yorks Senior Citizen Exemption is 50 of your homes appraised value but you must be age 65 or older and have an annual income of no more than 29000 as of 2020.

130 rows Application for Partial Tax Exemption for Real Property of Senior Citizens. Thanks to changes in city and state law the SCHE and DHE Disabled Homeowners Exemption tax breaks are now available to homeowners with a combined annual income of 58399 or less. Most exemptions are granted under Article four of the Real Property Tax law but others are authorized by a wide variety of statutes.

In the past older adults who qualified for the Partial Tax Exemption for Real Property of Senior Citizens also known as the senior citizens or aged exemption were automatically granted the Enhanced STAR exemption. If you live in a co-op you can apply online using the SCHE co-ops application.

Are There Any States With No Property Tax In 2020 Free Investor Guide Property Tax South Dakota States

Are There Any States With No Property Tax In 2020 Free Investor Guide Property Tax South Dakota States

/gettyimages-1197184592-2048x2048-22e8a8e779514a43a8347a0b583c1813.jpg) Property Tax Exemptions For Seniors

Property Tax Exemptions For Seniors

The Wallet Guru Social Security Benefits Senior Discounts Childcare Costs

The Wallet Guru Social Security Benefits Senior Discounts Childcare Costs

Https Keeganlaw Us Wp Content Uploads 2013 02 Property Tax Exemptions Pdf

Pin By Deborah Glassford On For The Home Senior Discounts Property Tax Tax Attorney

Pin By Deborah Glassford On For The Home Senior Discounts Property Tax Tax Attorney

Will I Get A Check Or Property Tax Credit For The Senior Freeze Property Tax Tax Credits Seniors

Will I Get A Check Or Property Tax Credit For The Senior Freeze Property Tax Tax Credits Seniors

Guest Opinion These Two Utah Bills Would Give Property Tax Relief To Seniors In 2021

Guest Opinion These Two Utah Bills Would Give Property Tax Relief To Seniors In 2021

What Is The 421g Tax Abatement In Nyc Hauseit Nyc Lower Manhattan Tax

What Is The 421g Tax Abatement In Nyc Hauseit Nyc Lower Manhattan Tax

Property Taxes 101 Redfin Estate Tax Property Tax Tax Deductions

Property Taxes 101 Redfin Estate Tax Property Tax Tax Deductions

What Is The Fair Market Value Of My Nyc Apartment Hauseit Nyc Nyc Apartment Nyc Market Value

What Is The Fair Market Value Of My Nyc Apartment Hauseit Nyc Nyc Apartment Nyc Market Value

All The Nassau County Property Tax Exemptions You Should Know About

All The Nassau County Property Tax Exemptions You Should Know About

Https Www Brookhavenny Gov Documentcenter View 15370 Rp 467 Partial 2021 22

What Is The Disability Property Tax Exemption Millionacres

What Is The Disability Property Tax Exemption Millionacres

Https Www Osc State Ny Us Files Local Government Documents Pdf 2020 07 Property Tax Exemptions Pdf

Types Of Property Tax Exemptions Millionacres

Types Of Property Tax Exemptions Millionacres

Ge To Close New York Plant Move Work To China General Electric Show Me The Money Things To Sell

Ge To Close New York Plant Move Work To China General Electric Show Me The Money Things To Sell

Https Keeganlaw Us Wp Content Uploads 2013 02 Property Tax Exemptions Pdf

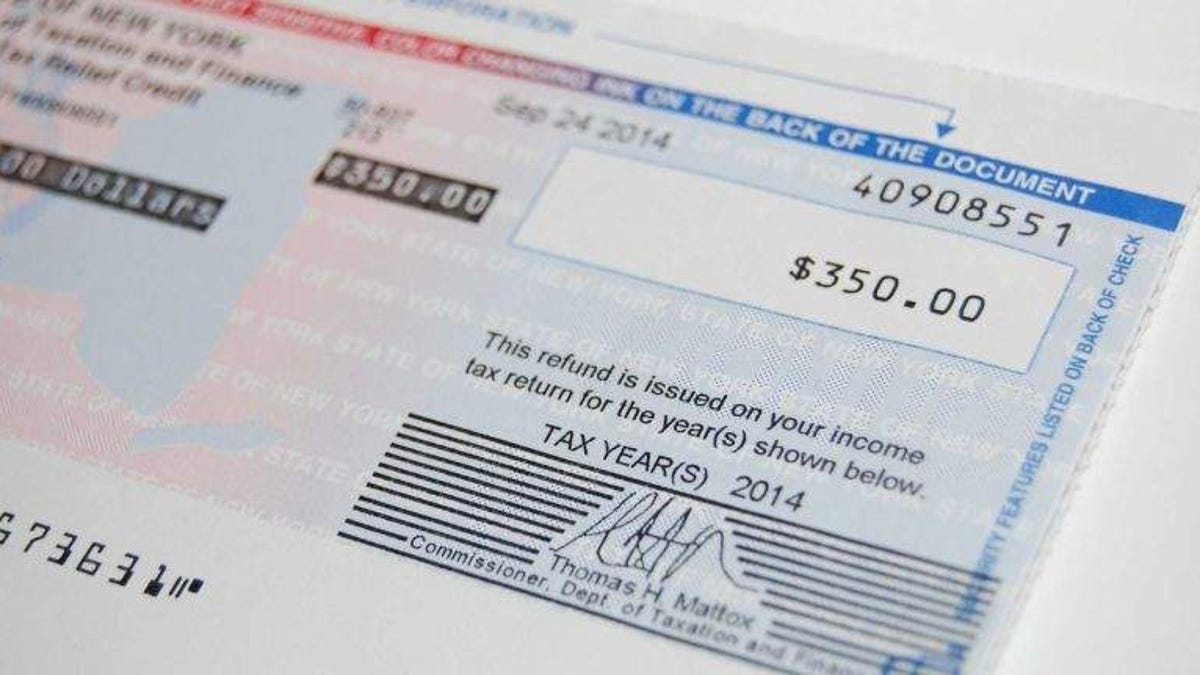

Ny Ended The Property Tax Relief Checks Why They May Not Come Back

Ny Ended The Property Tax Relief Checks Why They May Not Come Back

What Is The Nyc Senior Citizen Homeowners Exemption Sche Senior Citizen Property Tax Nyc

What Is The Nyc Senior Citizen Homeowners Exemption Sche Senior Citizen Property Tax Nyc

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home