Nyc Property Tax Transitional Value

But you pay taxes on the assessed value of a house not its market value. Just outside of NYC in Westchester the effective property tax rate is 239 percent.

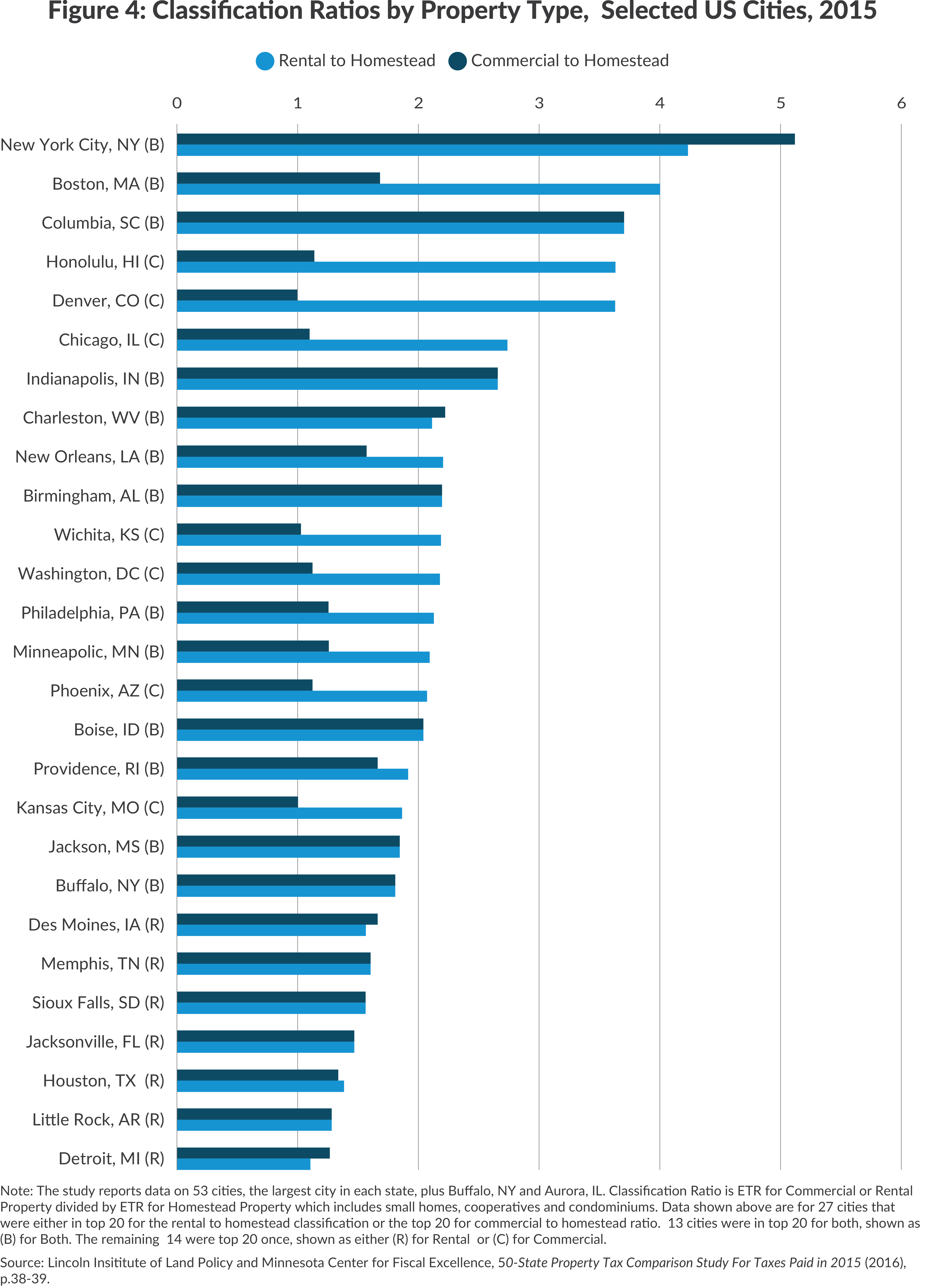

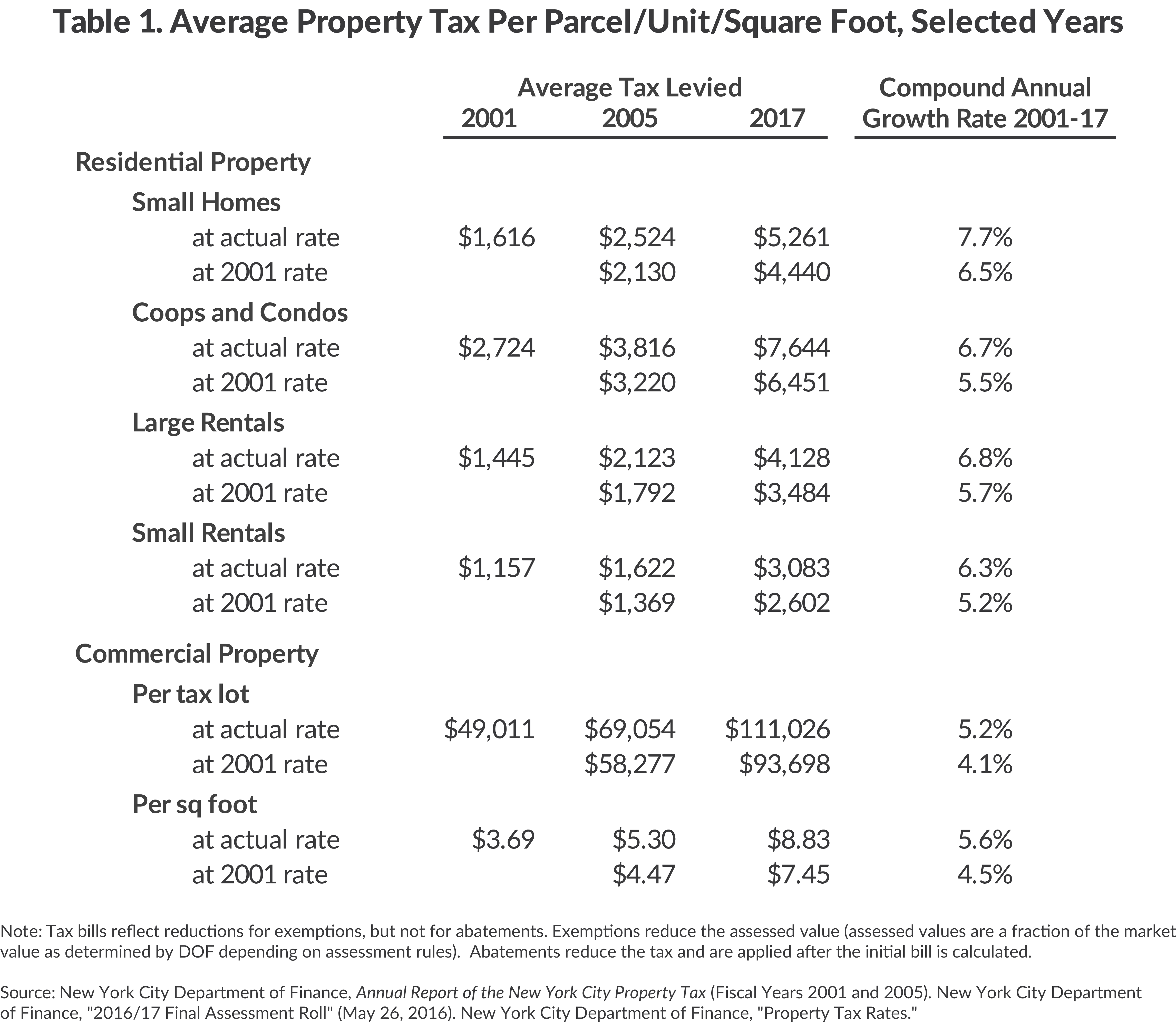

New York City Property Taxes Cbcny

New York City Property Taxes Cbcny

The law mandates phasing in 20 of the change in your assessed value each year over a five-year period which yields your Transitional Assessed Value.

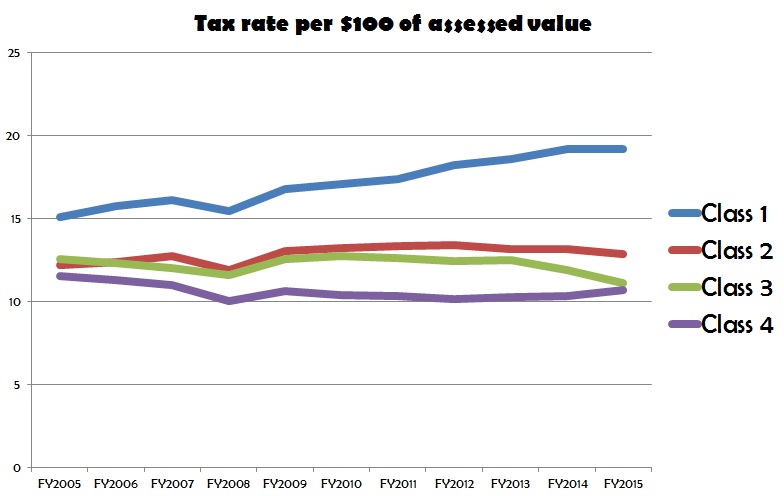

Nyc property tax transitional value. For Class 2a b and c properties it is calculated by dividing your Assessed Value by 45. 8 per year or. Real estate tax rates in New York are given in mills or millage rates.

If this were a new tax lot the assessed and transitional value in the first year would be 450000 or 450 percent of the market value. Tax class 1 - 6 per year no more than 20 over 5 years. Others are partially exempt such as veterans who qualify for an exemption on part of their homes and homeowners who are eligible for the School Tax Relief STAR program.

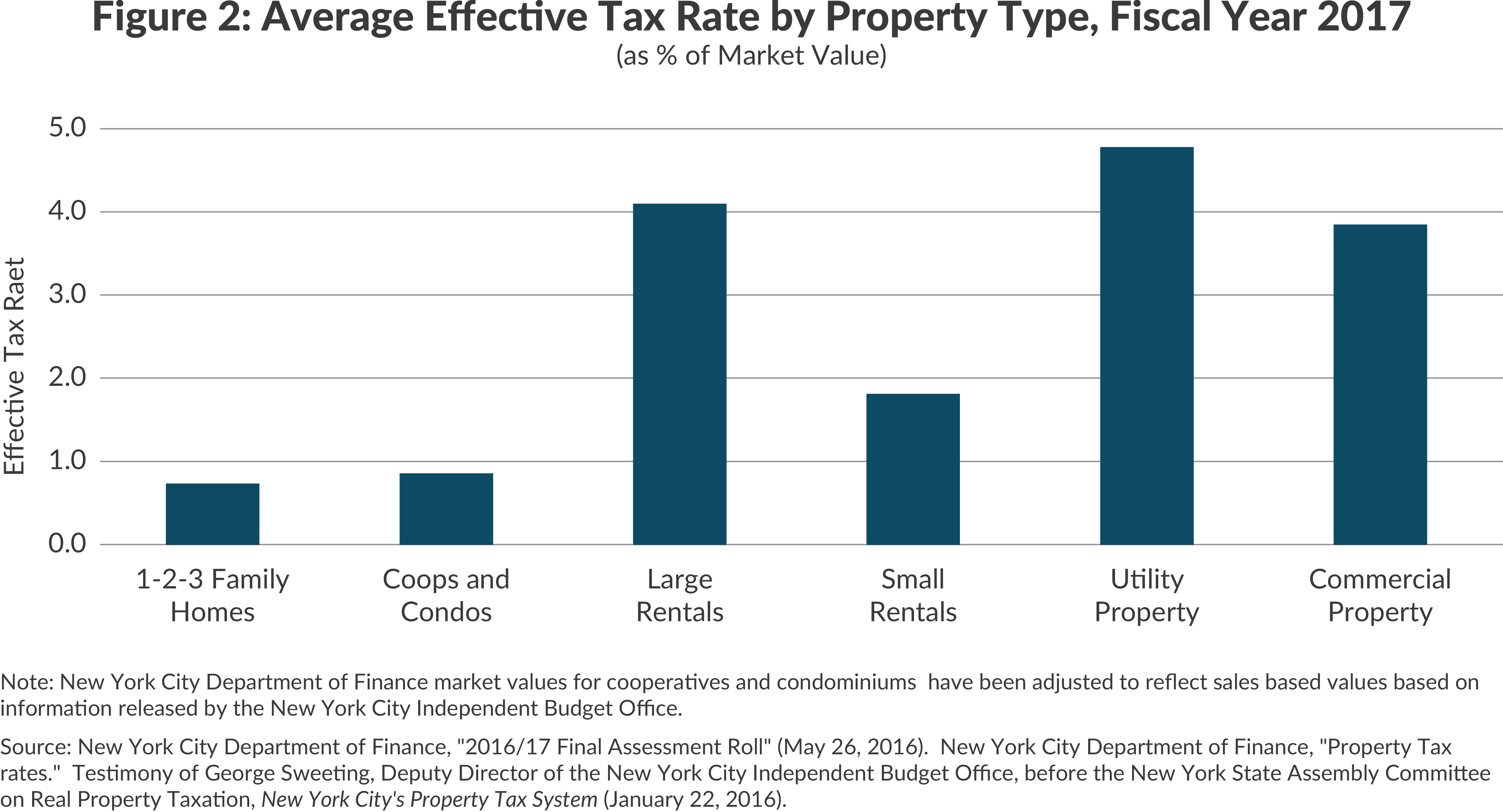

6 per year or. In 2007 the market value would become 1060000 and the actual assessed value would increase to 477000. Since these can be a little confusing it is also useful to look at effective tax rates.

The Department of Finance assigns market values to all properties in New York City. The reason for this comparatively modest rate is that NYC hits residents hard on income taxes charged by the city and state governments. A mill is equal to 1 of tax for every 1000 in property value.

Your tax class determines what limits apply to your property. After determining the assessed value the city government then applies the appropriate tax rate which was 20919 in 2019 and will rise to 21167 in 2020. Your propertys assessed value or transitional assessed value.

For Class 1 properties it is calculated by dividing your Assessed Value based on caps by 6. As outlined in our post on Assessment Basics a propertys assessed value is determined by applying the assessment ratio to the propertys market value finances estimate of your propertys worth. For example if the market value of your home is 200000 and assessments in your community are at 30 percent of market value your assessment should be 60000.

This transitional assessed value reflecting the phase-in is compared to the actual assessed. In the 201516 tax year the actual assessed value of Parcel A is 1125000 45 of 25mln. In New York City the assessed value of a Class 1 property is 6 of its market value.

Properties in tax class 1 can count on a 6 assessment rate while those in tax class 2 3 and 4 have a 45 rate applied to assessed value calculations. It can change annually. The transitional value would only increase by 200 percent of the 27000 increase or 5400.

The amount of your exemption credit is based upon. The assessment rate in turn is dependent upon the propertys tax class. Some properties such as those owned by religious organizations or governments are completely exempt from paying property taxes.

You must prove that your property is worth less than this number to have the value adjusted by the NYC Tax Commission or. Market Value is the worth of your property determined by the Department of Finance based on your propertys tax class and the New York State Law requirements for determining market value. The assessed value of a class 2 property with 10 units or less cannot increase by more than.

For more information download the Class 1 and Class 2 property tax guides. NYC property owners receive a property tax bill from the Department of Finance a few times a year. All New York City real estate is subject to annual valuation.

Your prior year savings. Whichever is lower the assessed value or the transitional value minus exemptions is your buildings taxable value. For class 2 properties with more than 10 units and all class 4 properties changes to the assessed value are phased in over five years.

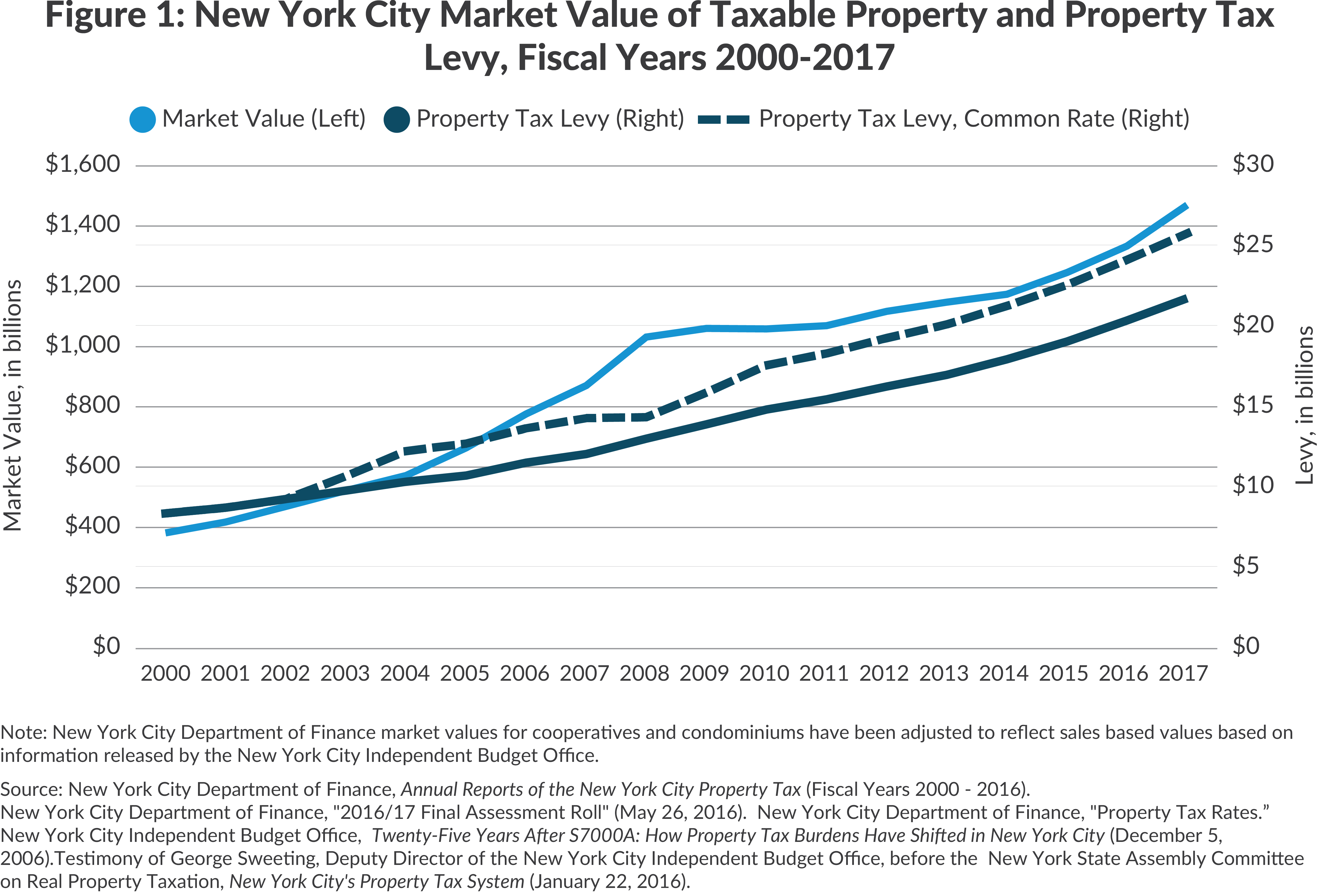

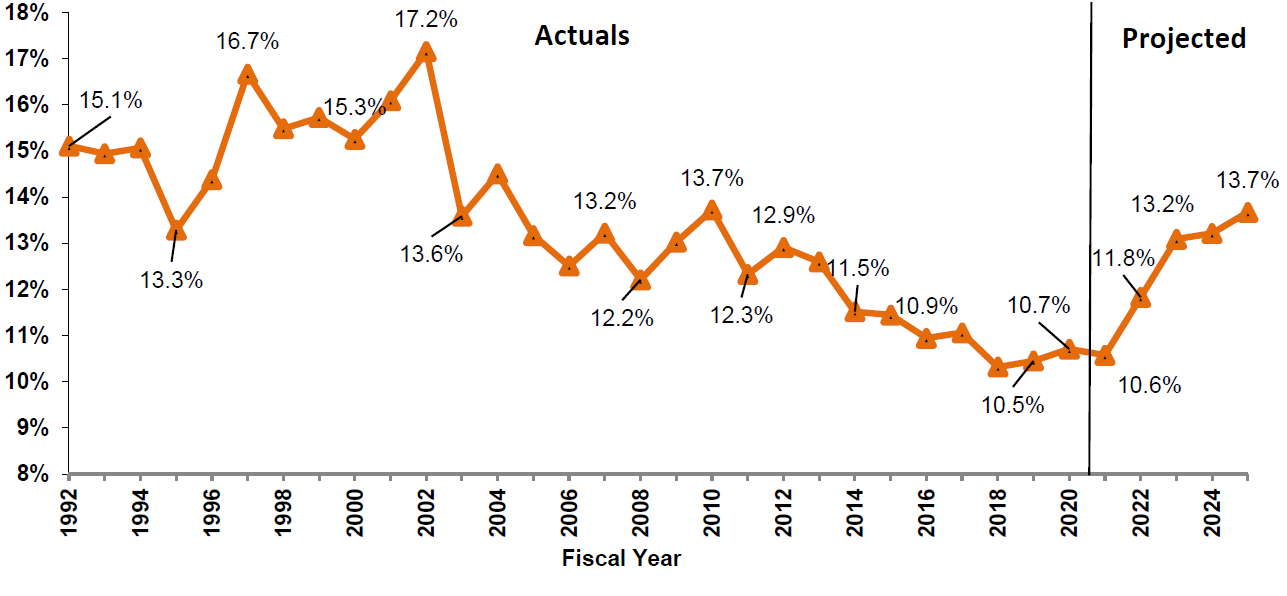

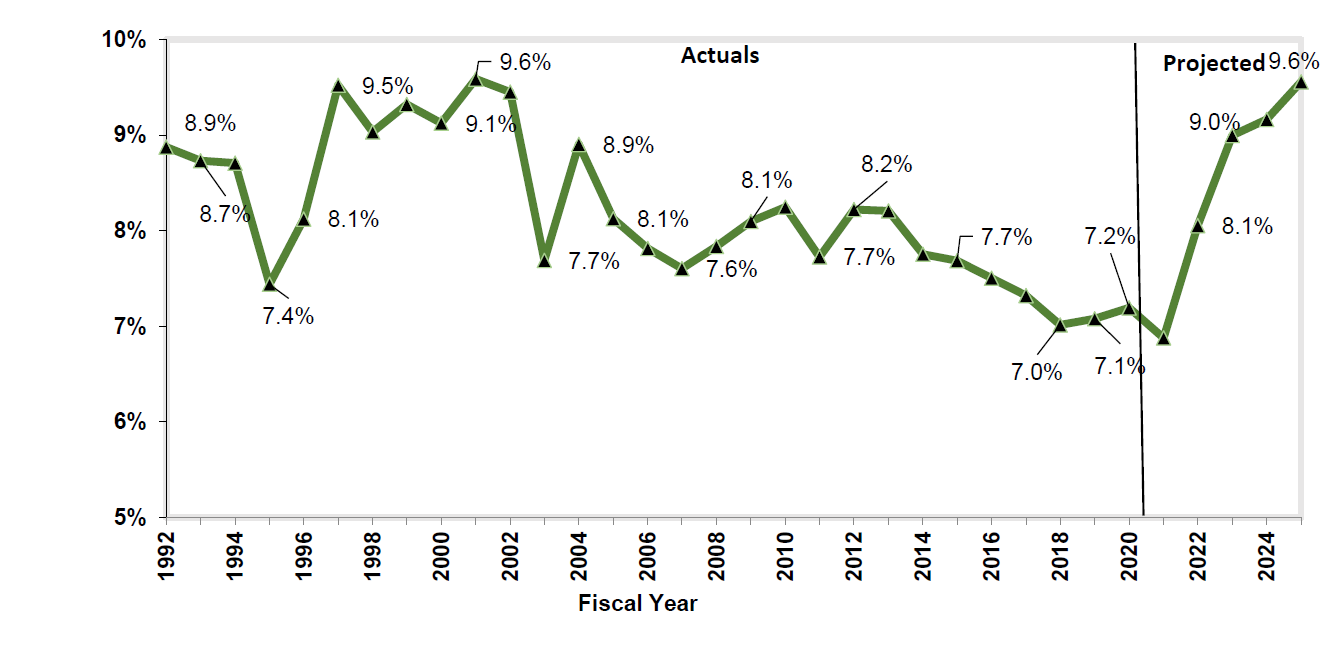

Tax class 2a 2b 2c - 8 per year no more than 30 over 5 years for building with 10 or less units. It is projected to generate 24 billion in fiscal year 2017 or 44 percent of all City tax revenues and about twice as much as the second largest source the local personal income tax. In other words all taxable properties in your city or town must be assessed at market value or at the same percentage of market value.

New York State NYS sets the rates for the STAR Enhanced STAR Senior Citizen Homeowners Disabled Homeowners and Veteran Exemptions. Assume that the transitional assessed value in 201516 is 800000 and the aggregate phase-ins in transitional value equal 150000. These are actual tax amounts paid as a percentage of home value.

30 over five years. Tax classes 2 and 4 - Read about Transitional Assessed Values for information on how your Assessed Values are phased in. The taxes collected by your school district.

This section will help you understand how your property is valued and how those values are used to calculate your property taxes. The average property tax rate in NYC is 02 percent compared to 15 percent for New York State. 20 over five years.

The property tax is New York Citys largest source of revenue. In NYC a propertys assessed value is determined by the market values assessment rate. The assessment ratio for Tax Class One 1 properties is 6 while the assessment ratio for tax class two 2 three 3 and four.

New York City Property Taxes Cbcny

New York City Property Taxes Cbcny

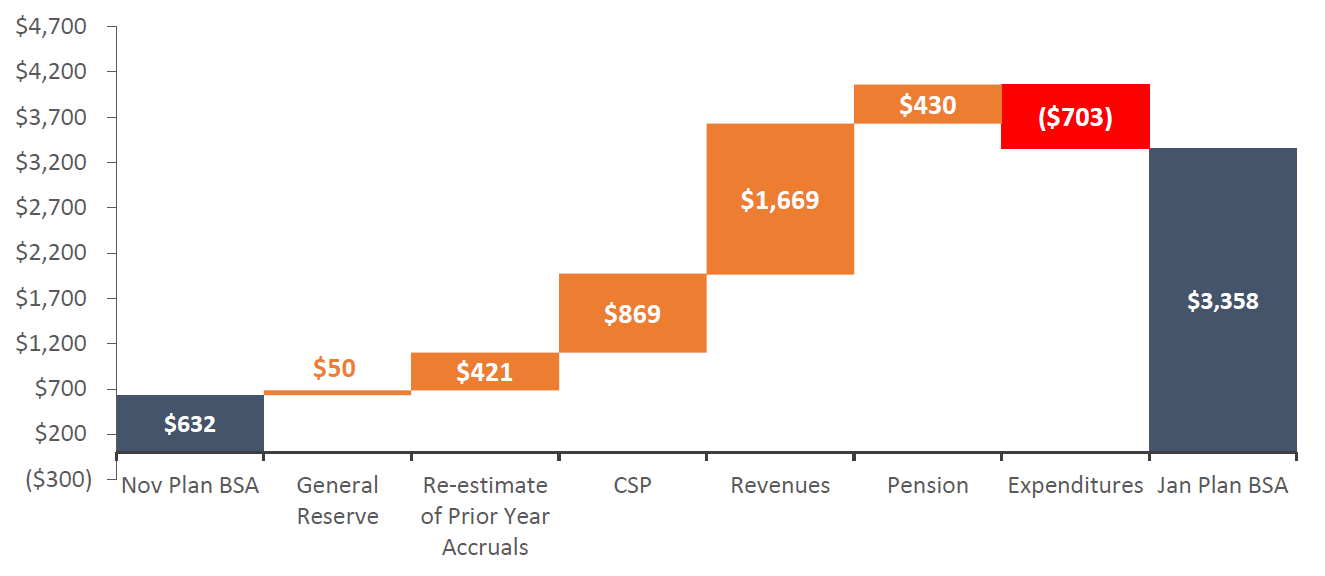

Comments On New York City S Preliminary Budget For Fiscal Year 2022 And Financial Plan For Fiscal Years 2021 2025 Office Of The New York City Comptroller Scott M Stringer

Comments On New York City S Preliminary Budget For Fiscal Year 2022 And Financial Plan For Fiscal Years 2021 2025 Office Of The New York City Comptroller Scott M Stringer

Https Www1 Nyc Gov Assets Finance Downloads Pdf Reports Reports Property Tax Nyc Property Fy17 Pdf

New York City Property Taxes Cbcny

New York City Property Taxes Cbcny

Annual State Of The City S Economy And Finances Office Of The New York City Comptroller Scott M Stringer

Annual State Of The City S Economy And Finances Office Of The New York City Comptroller Scott M Stringer

The Numbers On Nyc S Property Tax Non Problem

The Numbers On Nyc S Property Tax Non Problem

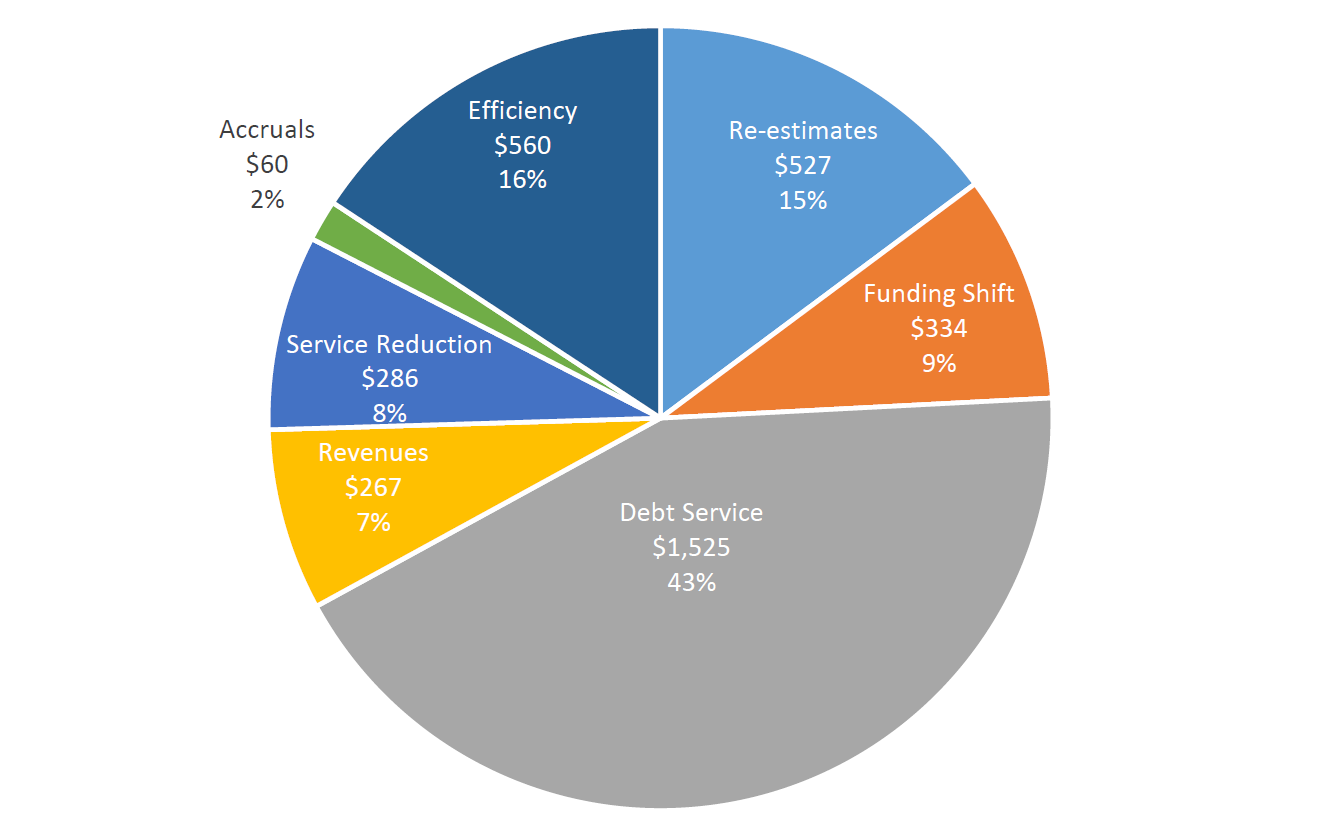

Comments On New York City S Preliminary Budget For Fiscal Year 2022 And Financial Plan For Fiscal Years 2021 2025 Office Of The New York City Comptroller Scott M Stringer

Comments On New York City S Preliminary Budget For Fiscal Year 2022 And Financial Plan For Fiscal Years 2021 2025 Office Of The New York City Comptroller Scott M Stringer

Comments On New York City S Preliminary Budget For Fiscal Year 2022 And Financial Plan For Fiscal Years 2021 2025 Office Of The New York City Comptroller Scott M Stringer

Comments On New York City S Preliminary Budget For Fiscal Year 2022 And Financial Plan For Fiscal Years 2021 2025 Office Of The New York City Comptroller Scott M Stringer

Understanding The Difference Between Market Value And Assessed Value Propertyshark Real Estate Blog

Understanding The Difference Between Market Value And Assessed Value Propertyshark Real Estate Blog

Virtual Cle Announcement Nyc Property Tax Cle 2021 Wednesday January 13th Cityland Cityland

Virtual Cle Announcement Nyc Property Tax Cle 2021 Wednesday January 13th Cityland Cityland

Prospect Heights Row House Gets Stunning Budget Transformation Row House Architecture House Exterior

Prospect Heights Row House Gets Stunning Budget Transformation Row House Architecture House Exterior

Http Helenrosenthal Com Wp Content Uploads 2011 04 Tax Assessments Fact Sheet Pdf

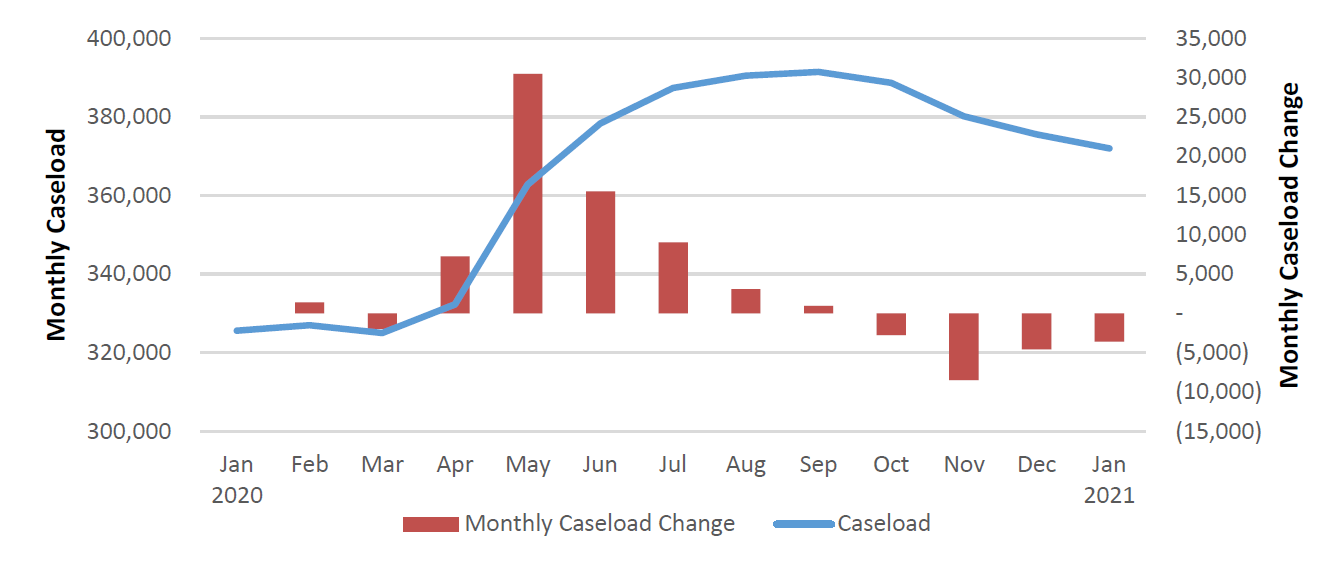

Comments On New York City S Preliminary Budget For Fiscal Year 2022 And Financial Plan For Fiscal Years 2021 2025 Office Of The New York City Comptroller Scott M Stringer

Comments On New York City S Preliminary Budget For Fiscal Year 2022 And Financial Plan For Fiscal Years 2021 2025 Office Of The New York City Comptroller Scott M Stringer

Http Www Cynthiaramirez Nyc Uploads 1 1 8 7 118704813 Class 1 Guide 1 Pdf

If Property Values Are Down Why Are Property Taxes Up Habitat Magazine New York S Co Op And Condo Community

If Property Values Are Down Why Are Property Taxes Up Habitat Magazine New York S Co Op And Condo Community

Metro Loft Management Apartment Home Luxury Rentals

Metro Loft Management Apartment Home Luxury Rentals

Comments On New York City S Preliminary Budget For Fiscal Year 2022 And Financial Plan For Fiscal Years 2021 2025 Office Of The New York City Comptroller Scott M Stringer

Comments On New York City S Preliminary Budget For Fiscal Year 2022 And Financial Plan For Fiscal Years 2021 2025 Office Of The New York City Comptroller Scott M Stringer

New York City Property Taxes Cbcny

New York City Property Taxes Cbcny

Http Www Cynthiaramirez Nyc Uploads 1 1 8 7 118704813 Class 1 Guide 1 Pdf

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home