Union County Oregon Property Tax Records

Contact the union county assessortax collectors office at 541 963-1002 for your current balance owing Click here to pay your property tax online If having trouble accessing the payment site please click here. Oregon state law establishes the property tax payment deadlines and requires interest to be charged on properties with delinquent tax amounts.

Alameda County Ca Property Tax Calculator Smartasset

Alameda County Ca Property Tax Calculator Smartasset

8195206 - 1000-1300 W.

Union county oregon property tax records. The chart on the 2020 tax bills addresses all categories of expenditures included in. Enter your search criteria into at least one of the following fields. The information provided here is for convenience ONLY.

8195207 - 1300-1600 W. Welcome to the Union County Clerks Online Public Land Records Search Page. The information provided here is for convenience ONLY.

As County Clerk I present this information as a service to the public our residents and. This includes commercial industrial residential farm forest manufactured structures and business personal property. Enter below an inquiry for a piece of property.

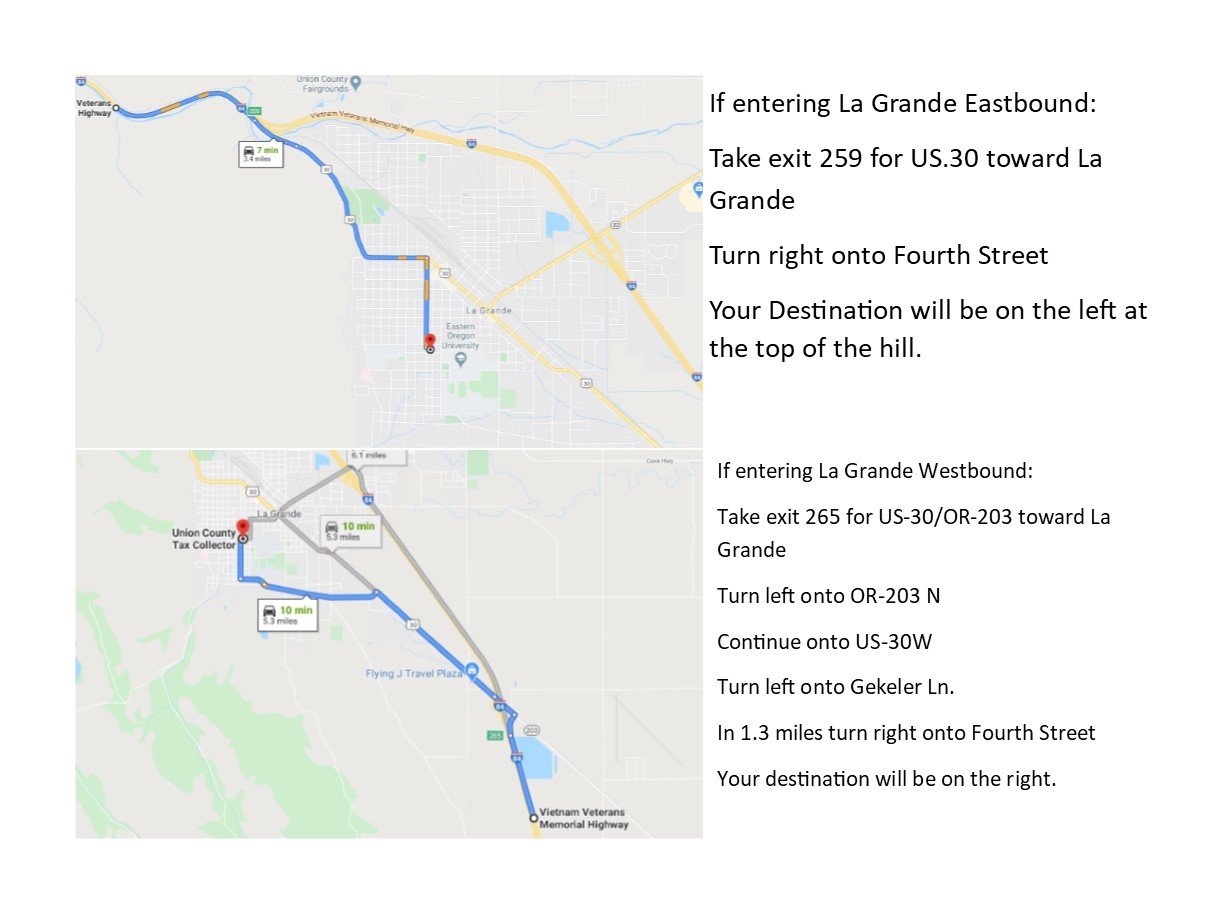

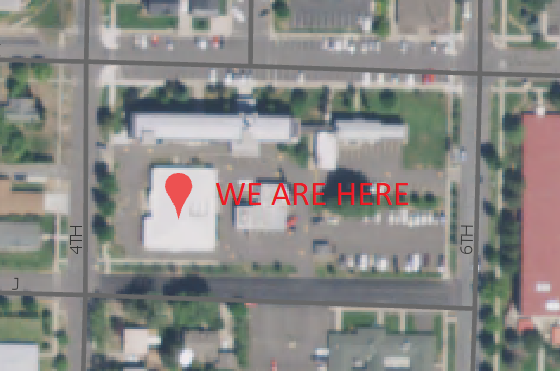

Search Union County property tax and assessment records by street name map number or reference number. Assessor Delinquent Taxes Tax Foreclosures Union County Assessment and Taxation Department 1001 Fourth St Suite A and B La Grande OR 97850 Phone 541963-1002. The records located at the Union County AssessorTax Collectors office are the one and only legal instruments for assessment and taxation purposes.

Historically a footnote and chart included on the tax bill have provided a categorical breakdown of only general fund expenditures. Find Oregon residential property tax records including land real property tax assessments appraisals tax payments exemptions improvements valuations deeds mortgages titles more. Union County Tax Warrants httpsunioncountysheriffus Find Union County Oregon tax warrant and lien information by delinquent tax payer name and case number.

Union County Property Search. For a list of known compatible browsers. We are pleased you are visiting this site which contains information recorded into the Official Land Records of Union County New Jersey from June 1 1977 through April 7 2021.

We endeavor to keep you abreast of the activities of your elected officials and county departments. Union County Property Search. The Union County web site is devoted to bringing county government information to you the citizen.

Find Oregon Property Records. The records located at the Union County AssessorTax Collectors office are the one and only legal instruments for assessment and taxation purposes. County Clerk and Recorders Office.

089 of home value. Union County collects on average 089 of a propertys assessed fair market value as property tax. Union County General Information.

Search either by reference number map number or street name. Enter below an inquiry for a piece of property. The best way to search is to enter your Property Key or Last Name as it appears on your Tax Bill.

The AssessorTax Collectors office is responsible for the assessment and collection of taxes on all properties in Union County. Median Property Taxes Mortgage 1715. Union County Property Tax Payments Annual Union County Oregon.

Free Oregon Property Tax Records Search. Search either by reference number map number or street name. Oregon is ranked 972nd of the 3143 counties in the United States in order of the median amount of property taxes collected.

Property tax payments are due May 17th. Multnomah County does not have the authority to waive interest charges as a result of late property tax payments and the Oregon State Legislature has not at this time extended the property tax deadline. Oregon Department of Revenue Programs Property Tax Assessor information by county Assessor information by county Menu Oregongov.

Public Property Records provide information on land homes and commercial properties including titles property deeds mortgages property tax assessment records. Union County taxpayers recently received their 2020 property tax bills. The median property tax in Union County Oregon is 1344 per year for a home worth the median value of 151200.

Review of Disclaimer and Limitation of Liability required before relying on data or information available on or through this web site. 8491253 - 1000-1600 SKYWAY DR. Center for Human Development.

An Oregon Property Records Search locates real estate documents related to property in OR. Yearly median tax in Union County.

Union County Tax Assessor S Office

Union County Tax Assessor S Office

Union County Tax Assessor S Office

Union County Tax Assessor S Office

Queens Property Tax Records Queens Property Taxes Ny

Queens Property Tax Records Queens Property Taxes Ny

Union County Property Tax Records Union County Property Taxes Nj

Union County Property Tax Records Union County Property Taxes Nj

Union County Tax Assessor S Office

Union County Tax Assessor S Office

Jackson County Tax Assessor S Office

Jackson County Tax Assessor S Office

Wayne County Property Tax Records Wayne County Property Taxes Ny

Wayne County Property Tax Records Wayne County Property Taxes Ny

Interactive Map Scopi Snohomish County Wa Official Website

Payment Information Douglas County Government

Payment Information Douglas County Government

Assessor Douglas County Government

Assessor Douglas County Government

Assessor Tax Collector Union County

Assessor Tax Collector Union County

Assessor Tax Collector Union County

Assessor Tax Collector Union County

Oregon Property Tax Calculator Smartasset

Oregon Property Tax Calculator Smartasset

Banner Elk Nc Property Tax Records Banner Elk Nc Best Banner Design Banner Elk

Banner Elk Nc Property Tax Records Banner Elk Nc Best Banner Design Banner Elk

Hudson County Property Tax Records Hudson County Property Taxes Nj

Hudson County Property Tax Records Hudson County Property Taxes Nj

Cape May County Property Tax Records Cape May County Property Taxes Nj

Cape May County Property Tax Records Cape May County Property Taxes Nj

Somerset County Property Tax Records Somerset County Property Taxes Nj

Somerset County Property Tax Records Somerset County Property Taxes Nj

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home