Bc Property Tax Assessment History

THE PROPERTY APPRAISER DOES NOT SEND TAX BILLS. The notice contains your assessed value which is the estimated market value of your property as of July 1st of the previous year the property classification and tax exemption status.

To learn more about BC Assessments history read our Corporate History document.

Bc property tax assessment history. THE PROPERTY APPRAISER DOES NOT SET OR COLLECT TAXES. Your property is assessed to determine its. BC Assessment provides current actual value assessments for tax purposes on all properties in British Columbia and provides expertise in real estate data mass appraisal systems and management.

Assessor Auditor-Controller Treasurer and Tax Collector and Assessment Appeals Board have prepared this property tax information site to provide taxpayers with an overview and some specific detail about the property tax process in Los Angeles County. Access the Assessment Search and start your search for British Columbias property assessments information. Maintain records of deed sale transactions building permits and other records necessary for a continuous reassessment program.

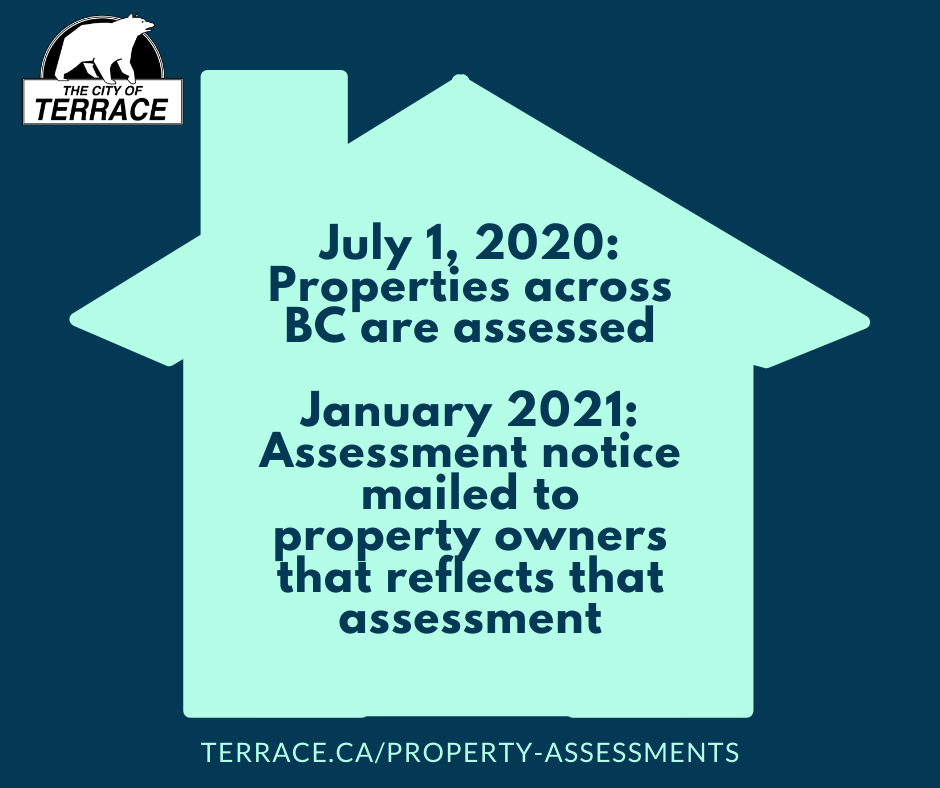

The State Tax Commission recommends all properties be re-inspected every 5 years to update property information and assure more accurate and equitable assessments. These tax bills would have become delinquent if not paid in full by April 1. Each January BC Assessment Authority mails property assessment notices to the owners of 2 million properties in the province.

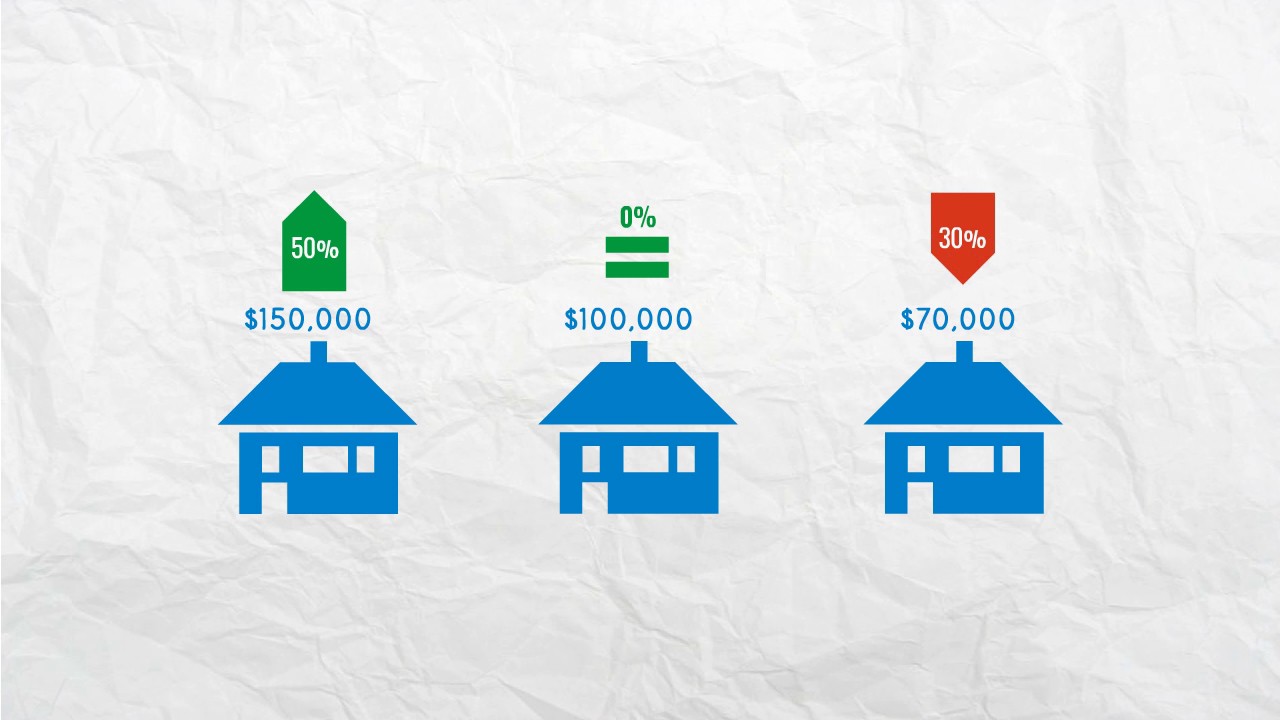

To determine the value of your property an assessor compares your property to actual sales in the same area. Represent the County in property tax appeals to the Board of Assessment Appeals and the Administrative Law Judge Division. NOT part of our office mailed the 2020 tax bills during the first week of November.

Timing of Property Assessments in BC. The assessments outline the market value of land and its improvements. BC Assessment was created in 1974 in response to the need for a fair independent organization that valued property in the province.

Exemptions if any apply In most cases the value is an estimate of your propertys value as of July 1 of the previous year. West Vancouver Property West Vancouver Canada property assessment database. Search the City of Victoria British Columbia records for property tax information by folio number plan PID address select Civic or MHR.

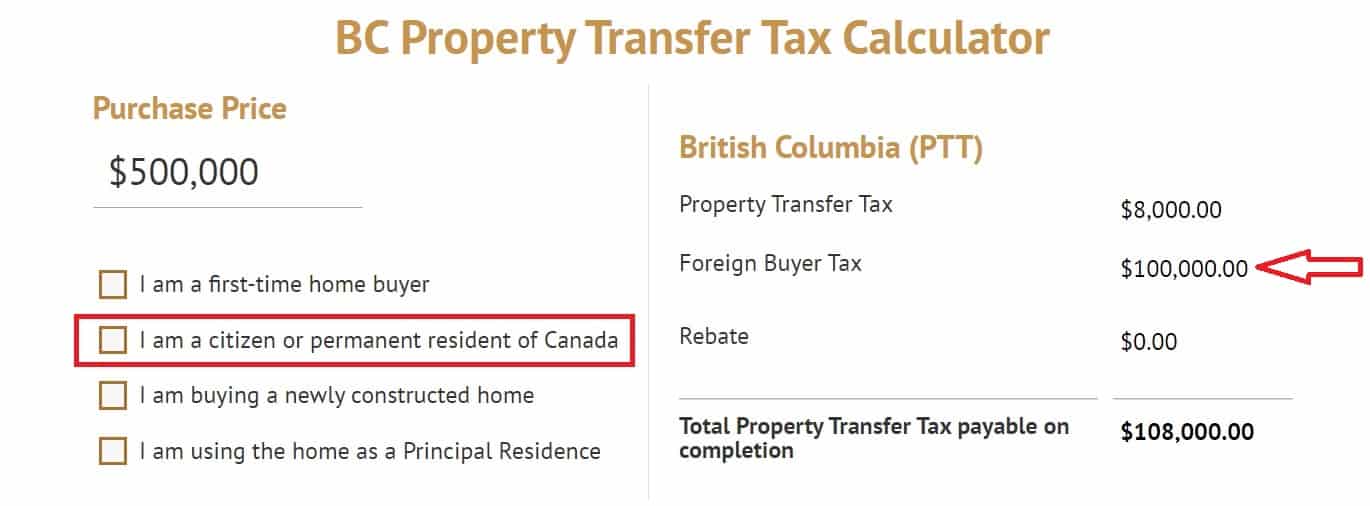

Since its inception BC Assessment has provided uniform fair and independent service to the people of British Columbia. Property assessments in BC are conducted annually and must be based on the value of the property on July 1st of the previous year. When you purchase or gain an interest in property that is registered at the Land Title Office you or your legal professional must file a property transfer tax return and you must pay property transfer tax unless you qualify for an exemption.

Contact the Tax Collector directly. If you disagree with the assessment value applied to your property you have a limited time to appeal your assessment. BC Assessment develops and maintains real property assessments throughout British Columbia in addition to providing real property information.

This is called the Valuation Date. City property appraisers will be conducting inspections on building and other permits and owner requested inspections. For example a 2020 property assessment will be based on the value of the property on July 1st 2019.

BC Assessment develops and maintains real property assessments throughout British Columbia in addition to providing real property information. BC Assessment provides current actual value assessments for tax purposes on all properties in British Columbia and provides expertise in real estate data mass appraisal systems and management. BC Assessment mails Assessment Notices to every homeowner in the first week of January each year.

Access current assessment information 2021 property information was released on January 4 2021 and is based on market values as of July 1 2020. Beaufort County government exists to serve the people of Beaufort County in a cost-effective manner so all our citizens may enjoy and appreciate a protected quality of life natural and developed resources in a coastal environment a diverse heritage and economic well-being. Another important date is the Condition.

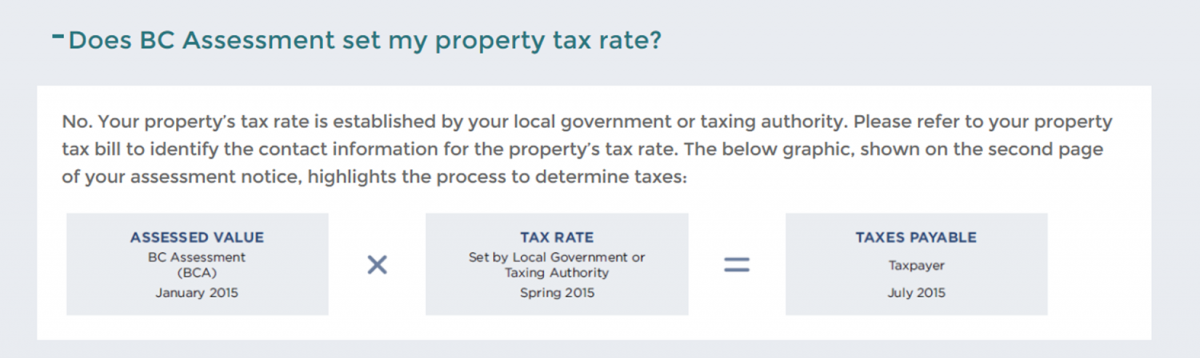

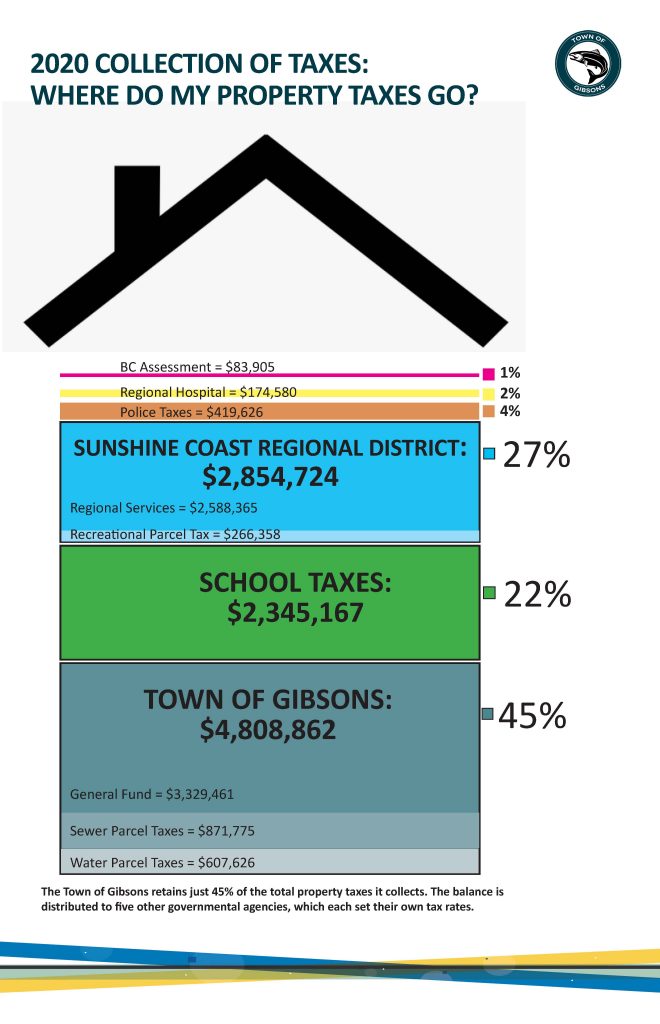

You will receive your property assessment notice from BC Assessment each year in January. The City is also responsible for the collection of taxes for the Province school taxes Regional District Hospital District BC Assessment and Municipal Finance Authority although it has no control over the amount of taxes collected for these other agencies and it retains none of these funds for its own use.

Supervisor Of Assessments Bureau County Government Princeton Il

Supervisor Of Assessments Bureau County Government Princeton Il

2020 Bc Assessment Property Values Now Available Online On E Valuebc Urbanyvr

2020 Bc Assessment Property Values Now Available Online On E Valuebc Urbanyvr

Https Royalbcmuseum Bc Ca Assets Land Records Quick Guide Pdf

Lower Mainland 2020 Property Assessments In The Mail

The Ultimate Guide To Vancouver Bc Foreign Buyer Tax

The Ultimate Guide To Vancouver Bc Foreign Buyer Tax

Property Assessments City Of Terrace

Property Assessments City Of Terrace

Https Www Oipc Bc Ca Investigation Reports 1258

Property Assessment The City Of Colwood

Property Assessment The City Of Colwood

Property Taxes Town Of Gibsons

Property Taxes Town Of Gibsons

Bc Assessments 2020 Vs What Your Home Is Truly Worth

Property Taxes By State Why We Should All Embrace Higher Property Taxes

Property Taxes By State Why We Should All Embrace Higher Property Taxes

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home