Nassau County Property Tax Questions

The sale or donation of a conservation easement may provide substantial tax benefits through the reduction of federal income and estate taxes and possible property tax relief. Data is available for all non-voted property tax levies of city and county governments in the state.

Nassau County Reassessment Plan Leaves Many In A Tailspin Wshu

Nassau County Reassessment Plan Leaves Many In A Tailspin Wshu

Laura Curran a county executive states that the reassessment.

Nassau county property tax questions. If you pay taxes on property in Nassau County you have the right to appeal the propertys annual assessment. Property Assessments Assessment Lookup How to Challenge Your Assessment Assessment Challenge Forms Instructions Assessment Review Calendar Rules of Procedure PDF Information for Property Owners. ASK US A QUESTION.

Mike is a native of Nassau County who prior to being elected spent the past 35 years as a State Certified Appraiser and Real Estate Broker. After a county-wide reassessment with more than half of homeowners taxes. County and Municipal Property Tax Data Pursuant to Section 195052 FS.

County Nassau County Department of Assessment 516 571-1500 General Information Provides information from the Department of Assessment on rules procedures exemptions and general information. Personnel cuts in the prior administration left the Department unable to dedicate adequate staff to handle a high volume of phone calls. State Certified in 1992 he has personally appraised over 10000 properties throughout Nassau County.

For your convenience copies of tax maps can be purchased at the Tax Map Division. Property Taxes-Assessment How is My Property Tax Determined. 45401 Mickler Street Callahan FL 32011 Hours.

The time to appeal a new assessment ends before the taxes based on that assessment are billed. Since 2011 Nassau Countys tax rolls have been frozen and the town has recently decided to pursue a property reassessment for its current residents. 830 430 Wednesday Closed for lunch 100 200.

What the RPIA Does. County Executive Laura Curran is committed to making it easier for seniors and disabled residents to receive the property tax relief they deserve throughout the pandemic and beyond. The Assessment Review Commission ARC will review your application.

Can I call the Department of Assessment with questions. Your share of the taxes that will be raised for school and general municipal purposes in your community is based on an annual property assessment. If you have any questions regarding this update or these exemptions please contact one of our dedicated customer service representatives at 516 571-1500 or by email at NCexemptionsnassaucountynygov.

Per Florida Statute 194 during the hearing both you and the Property Appraisers staff will present relevant. The Nassau County Department of Assessment establishes values for land and improvements as the basis for property taxes. The county has therefore borrowed hundreds of millions of dollars.

Our mission is to ensure that our clients pay the lowest amount of property tax as required by law. The RPIA provides a five-year phase in for changes to a homeowners assessed value for the 202021 tax year caused by the countywide reassessment. Nassau County makes no warranties expressed or implied concerning the accuracy completeness reliability or suitability for the use of this information.

In the absence of owner input we will be forced to estimate a value based on the best available information. The Property Appraisers office is required to place an assessed value on all tangible personal property regardless of whether or not a tax return is filed FLORIDA STATUTE 193073. On March 23 2020 the Nassau County Legislature passed the Reassessment Phase-In Act of 2020 RPIA formerly known as the Taxpayer Protection Plan.

Nassau County Tax Collector Nassau County Clerk of Courts 76347 Veterans Way Suite 456 Yulee Florida 32097 Phone 904 548-4600 Toll free 800 958-3496 Hours of Operation are 830am to 500pm Monday Through Friday. Furthermore Nassau County assumes no liability associated with the use or misuse of such information. With many residents still struggling from the devastating repercussions of the COVID-19 pandemic at my.

As requested by s195052 FS the Department of Revenue has posted information on its website regarding local government property tax levies. People have been taking advantage of challenging their property taxes and the county is having trouble keeping up with the payouts. Based on the budgets provided to them property tax rates are determined by the Nassau County Legislature as well as the towns.

The Nassau County Department of Assessment determines a tentative assessment for every property as of January 4 2021. Property Tax Reduction Consultants 255 Executive Drive Suite 210 Plainview NY 11803. The petition must be filed with the VAB Clerk at the Clerk of Courts office at the Nassau County Judicial Annex 76347 Veterans Way Yulee Florida 32097.

Property Search Search for Properties located within Nassau County. NASSAU COUNTY NY Nassau County Executive Laura Curran announced today that the Assessment Review Commission ARC will extend the property assessment grievance deadline from March 1 2021 to Friday April 30 2021 by providing an additional 60-day grace period. CBSNewYork Property taxes are front and center in Nassau County.

Nassau County Tax Lien Sale Annual Tax Lien Sale Public Notice. There is a new assessment for each year.

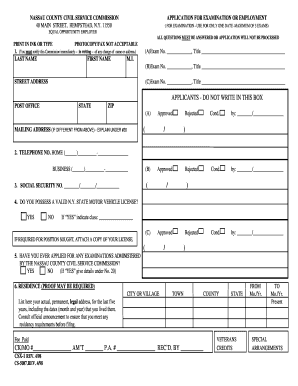

Nassau County Civil Service Exams Fill Out And Sign Printable Pdf Template Signnow

Nassau County Civil Service Exams Fill Out And Sign Printable Pdf Template Signnow

Ask The County Assessor Nassau County Ny Official Website

Consumer Affairs Nassau County Ny Official Website

Http Oysterbaytown Com Wp Content Uploads 2015 12 Tax Bill Brochure1 2016 Pdf

Nassau County Ny Official Website Official Website

How To File For A Nassau County Property Tax Grievance Your Online Property Tax Grievance Center For Nassau County Long Island

Property Tax Assessment Grievance Workshop Herald Community Newspapers Liherald Com

Property Tax Assessment Grievance Workshop Herald Community Newspapers Liherald Com

014 Nassau County Mh Pdf New York Eastern Probation U S

014 Nassau County Mh Pdf New York Eastern Probation U S

Https Www Nassaucountyny Gov Documentcenter View 22437

How To File For A Nassau County Property Tax Grievance Your Online Property Tax Grievance Center For Nassau County Long Island

Nassau Taxpayers Get Extra 30 Days Until March 12 To Pay First Half Taxes Newsday

Nassau Taxpayers Get Extra 30 Days Until March 12 To Pay First Half Taxes Newsday

Nassau County Ny Official Website

Nassau County Ny Property Tax Payment Property Walls

Nassau County Ny Property Tax Payment Property Walls

It S Official The Investors Are Back Real Estate Investor We Buy Houses Mortgage Loan Originator

It S Official The Investors Are Back Real Estate Investor We Buy Houses Mortgage Loan Originator

Nassau County 2020 21 Reassessment Tax Impact Notice Property Tax Grievance Heller Consultants Tax Grievance

Nassau County 2020 21 Reassessment Tax Impact Notice Property Tax Grievance Heller Consultants Tax Grievance

Certificate Of Residence Nassau County Ny Official Website

District 3 Carrie Solages Nassau County Ny Official Website

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home