Property Tax Relief Bill Nebraska

Unlike other state incentive programs Nebraskas tax incentives are performance-based. Money for legislation pending this year of 211 million.

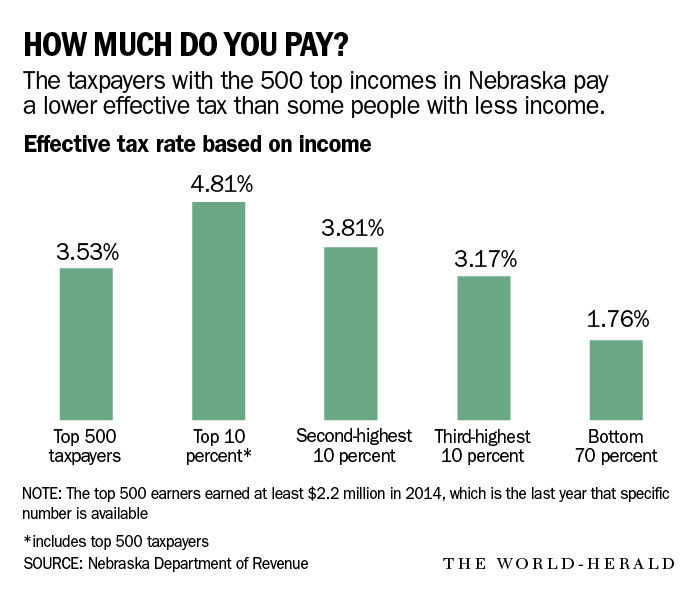

Hansen Want Lower Nebraska Property Taxes We Need To Have A Chat About Income Taxes Archives Omaha Com

Hansen Want Lower Nebraska Property Taxes We Need To Have A Chat About Income Taxes Archives Omaha Com

State senator Lou An Linehan added up what that would mean in.

Property tax relief bill nebraska. LB 974 is the main property tax bill under consideration in the Legislature. Property tax relief the committee included an increase in the Property Tax Credit of 63 million over the next two years. Nebraskas farmers ranchers and homeowners are counting on Senators to pass meaningful property tax relief before the session ends.

The Legislatures Revenue Committee on Tuesday introduced a new plan to reduce local. Voices rose in disagreement more than once before the Legislatures Revenue Committee voted 6-0 with two senators abstaining to advance Legislative Bill 289 which aims to. Under the relief portion of LB 1107 Nebraska property taxpayers will receive a piecemeal income tax credit based on the amount of property taxes theyve paid toward funding K-12 education.

776701 to 776705 provides a refundable income tax credit credit or credit against franchise tax imposed on financial institutions for any taxpayer who pays school district property taxes. Under the relief portion of LB 1107 Nebraska property tax payers will receive a piecemeal income tax credit based on the amount of property taxes theyve paid toward funding K-12 education. KOLN - After trying and failing several times over the last few years Nebraska lawmakers voted overwhelmingly to approve a property tax relief bill 41-4.

Senators will begin the budget debate Thursday April 8. Also money to help replenish the cash reserve fund the. The Nebraska Property Tax Incentive Act Laws 2020 LB 1107 and Neb.

LB 1107 also reforms and renews Nebraskas business tax incentives. This credit was a result of LB 1107 passed by the Legislature and signed into law by Governor Pete Ricketts on August 17 2020. February 15 2021 by Kellan Heavican.

Persons over age 65 see page 4. With the passage of LB 1107 direct property tax relief from the state to property taxpayers will increase to 650 million annually a four-fold increase during Governor Ricketts time in office. Lou Ann Linehan one of the major backers of LB 1107 said that property tax relief is what Nebraskans have been seeking for years.

The states governor praised the passage of LB. For the first time in 13 years property tax relief is a done deal in Nebraska. Tax benefits arent given in the hopes of future.

New Nebraska property tax relief plan placed on fast track. Lawmakers approved LB 1107 the first new property tax relief measure since 2007. The new tax credit would be frontloaded with 125 million and grow to 375 million annually after five years.

Some of the highlights from the Appropriations Committee proposed FY 2021-22FY2022-23 biennial budget are. Overview The Nebraska homestead exemption program is a property tax relief program for six categories of homeowners. While its details are still being finalized I support the bills general framework.

After three to five years she said the bill. Nebraska Farm Bureau is urging state lawmakers to make dollars for property tax relief school funding reform and expanded broadband top priorities during state budget negotiations. Nebraska taxpayers who are eligible for a property tax credit credit are reminded to claim this new tax credit that will provide property tax relief for Nebraskans.

Nebraska Property Tax Incentive Act LB1107 sets a minimum allocation for Nebraskas existing Property Tax Credit Cash Fund and establishes a new refundable income tax credit for property taxes paid such that even property owners who owe no income taxes could receive a. The new tax credit would be frontloaded with 125. The new program expected to be signed into law is called the Nebraska Property Tax Incentive Act which will join the list of other state programs that attempt to offset the cost of property taxes with your state tax dollars including the Property Tax Credit Act and the homestead exemption.

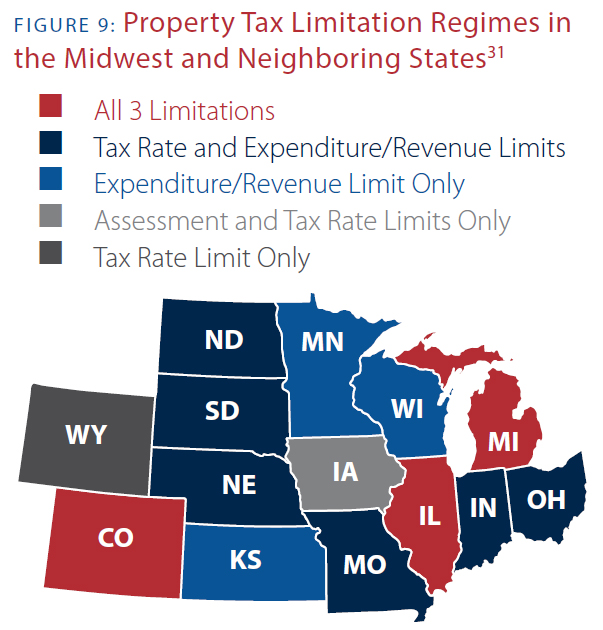

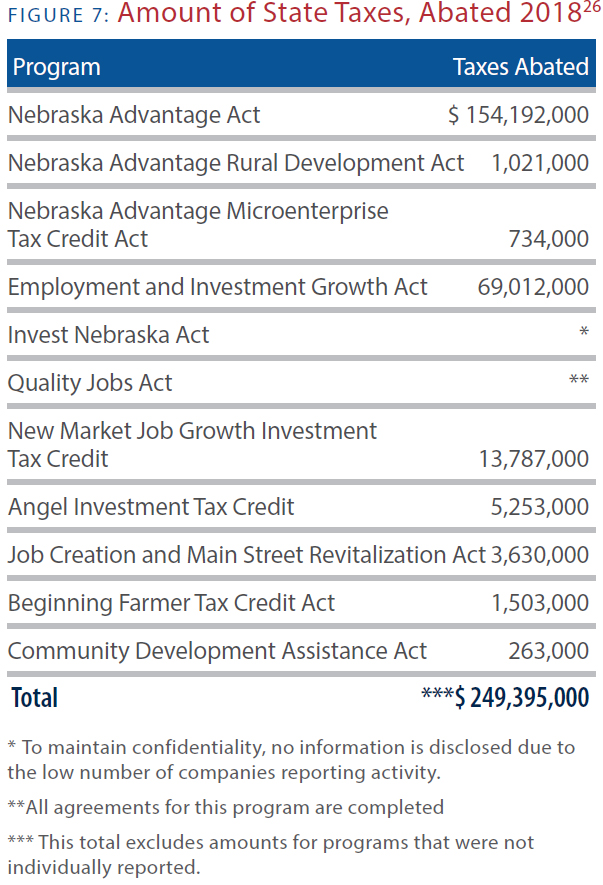

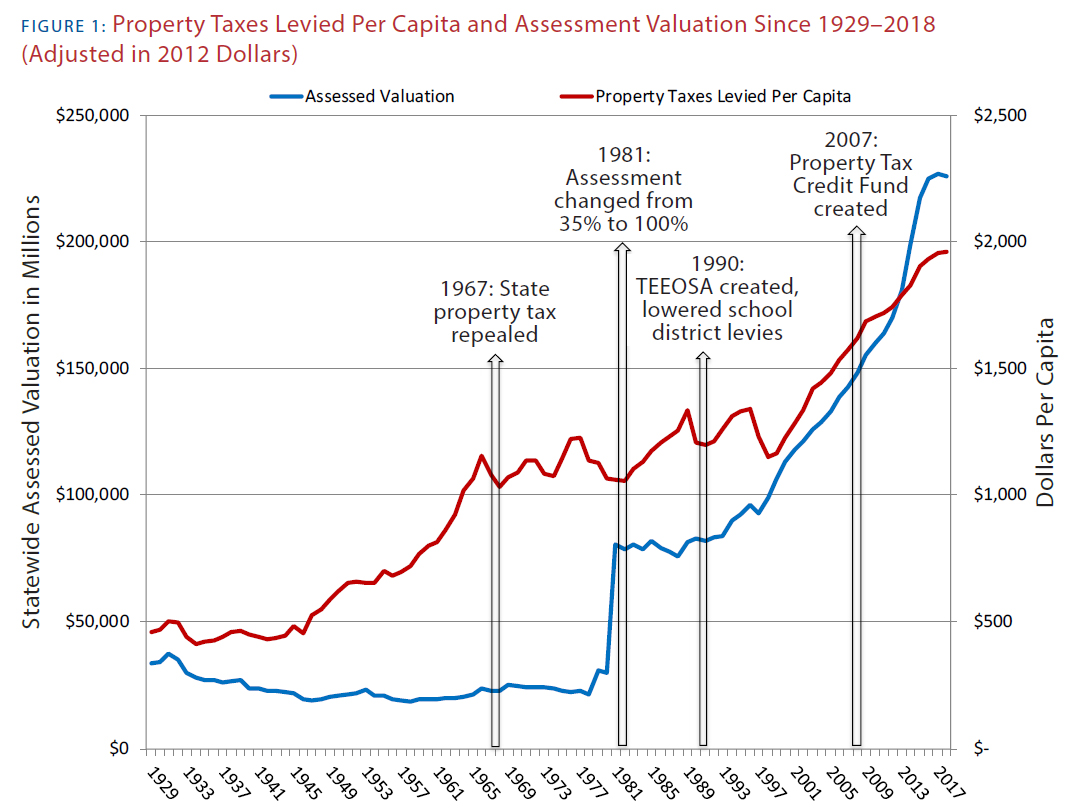

Get Real About Property Taxes 2nd Edition

Get Real About Property Taxes 2nd Edition

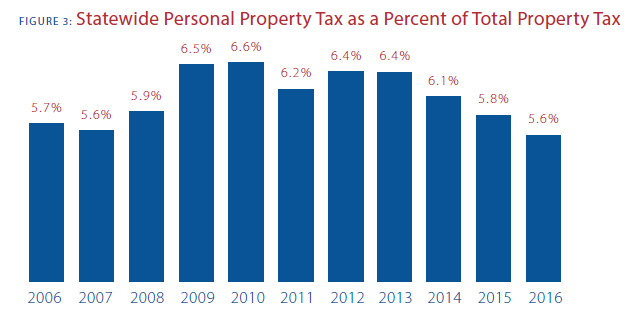

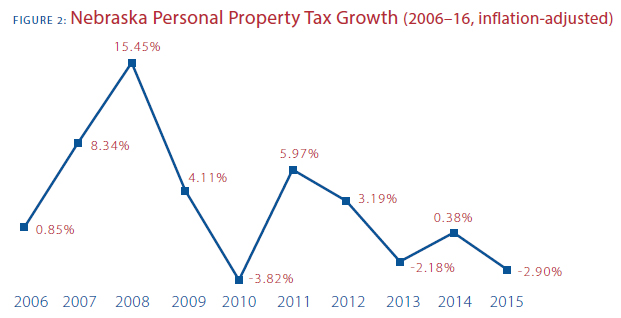

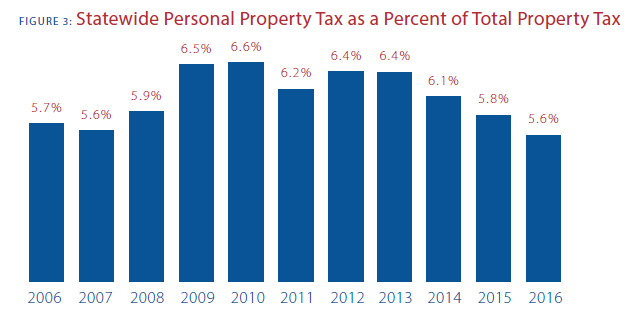

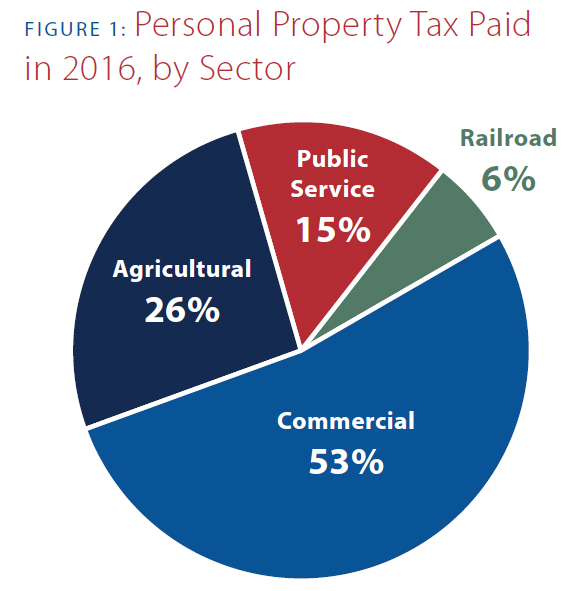

This Time It S Personal Nebraska S Personal Property Tax

This Time It S Personal Nebraska S Personal Property Tax

This Time It S Personal Nebraska S Personal Property Tax

This Time It S Personal Nebraska S Personal Property Tax

A Major Property Tax Relief Measure Passed The First Since 2007 Khgi

A Major Property Tax Relief Measure Passed The First Since 2007 Khgi

New Budget Analysis Highlighted Facebook Invests In Nebraska Office Of Governor Pete Ricketts

New Budget Analysis Highlighted Facebook Invests In Nebraska Office Of Governor Pete Ricketts

Get Real About Property Taxes 2nd Edition

Get Real About Property Taxes 2nd Edition

Gov Ricketts Dept Of Revenue Invite Nebraskans To Claim New Property Tax Credit Office Of Governor Pete Ricketts

Gov Ricketts Dept Of Revenue Invite Nebraskans To Claim New Property Tax Credit Office Of Governor Pete Ricketts

This Time It S Personal Nebraska S Personal Property Tax

This Time It S Personal Nebraska S Personal Property Tax

Https Www Nefb Org Images Federation Pdfs Talking Points 021220 Pdf

Https Nebraskalegislature Gov Pdf Reports Research Propertytax2020 Pdf

Gov Pete Ricketts A Golden Opportunity For Property Tax Relief Hastingstribune Com

Gov Pete Ricketts A Golden Opportunity For Property Tax Relief Hastingstribune Com

2020 Nebraska Property Tax Issues Agricultural Economics

2020 Nebraska Property Tax Issues Agricultural Economics

Get Real About Property Taxes 2nd Edition

Get Real About Property Taxes 2nd Edition

Legislative Update 3 15 2021 Covid 19 Relief Package Nebraska Prioritized Legislation Children S Hospital Medical Center

Legislative Update 3 15 2021 Covid 19 Relief Package Nebraska Prioritized Legislation Children S Hospital Medical Center

Under New Nebraska Law Property Tax Relief Will Come Via Credit On Income Taxes Csg Knowledge Center

Under New Nebraska Law Property Tax Relief Will Come Via Credit On Income Taxes Csg Knowledge Center

Get Real About Property Taxes 2nd Edition

Get Real About Property Taxes 2nd Edition

This Time It S Personal Nebraska S Personal Property Tax

This Time It S Personal Nebraska S Personal Property Tax

Property Tax Relief Remains Ricketts No 1 Priority Washington County Enterprise

Property Tax Relief Remains Ricketts No 1 Priority Washington County Enterprise

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home