Can I Claim Tax Relief For Working From Home During Coronavirus

So instead you can in simple terms claim a rate of 6 a week. After tax reform became law at the end of 2017 employees lost the ability to deduct expenses related to maintaining a home office.

Get Your Free Small Business Tax Organizer For 2018 Income Tax Prep Organizer Includes Tax Tips Small Business Tax Business Tax Small Business Tax Deductions

Get Your Free Small Business Tax Organizer For 2018 Income Tax Prep Organizer Includes Tax Tips Small Business Tax Business Tax Small Business Tax Deductions

You cannot claim tax relief if you choose to work from home.

Can i claim tax relief for working from home during coronavirus. Demand for this working from home tax relief shot up last year 54800 claims were submitted in the first 10 days of October 2020 for example. 2 days agoPeople working from home during the coronavirus lockdown could each be owed 280. If you have been working from home you may have expenses you can claim a deduction for at tax time.

For example if an employed worker pays the 20 basic rate of tax and claims tax relief on 6 a week they would. Working from home due to coronavirus even for a day. You may be able to claim tax relief for.

Neither work nor live. HM Revenue Customs HMRC has specifically confirmed that claims from employees working at home due to coronavirus measures if their usual workplace is closed count. If people are working from home because of Covid-19 then they can claim said a spokesperson.

You cannot claim a tax relief if your employer. 2 Claim tax relief on the exact amount you spend per week on coronavirus working from home expenses. 2 days agoCan salaried workers now also claim home office tax relief.

Im currently on maternity leave. There are two ways to do this. Can I still claim for the tax relief for that time.

We understand that due to COVID-19 your working arrangements may have changed. You can then also claim any additional days you worked at. Previously employees could claim an.

During the pandemic the government launched a new microservice which let people claim a whole years tax relief. I worked from home from 1703 to 1007. This includes if you have to work from home because of coronavirus COVID-19.

Can I still claim for the tax relief for that time. The Guardian - You can claim if you were told by your employer to work from home either full or part time Coronavirus latest updates See all our coronavirus coverage If you are one of the millions of people who has been working at home over the last 12 months because of Covid either full or part-time have. But apportioning extra costs such as heating and electricity is tough.

The Coronavirus Aid Relief and Economic Security Act CARES Act allows federal-income-tax-free treatment for payments made by your employers Section 127 educational assistance plan towards your. We use cookies to make the site easier to use. If you worked more than 50 of the time from home for a period of at least four consecutive weeks in 2020 due to the COVID-19 pandemic you can claim 2 for each day you worked from home during that period.

Permission for this tax during the pandemic was part of a. By Elizabete Da Silva 17 Apr 2021 0052. You may need to keep all your receipts and bills as evidence.

You can claim 2 for each day you worked from home during that period plus any additional days you worked at home in 2020 due to the COVID-19 pandemic. Working from home during COVID-19. Eligible taxpayers can claim tax relief based on the rate at which they pay tax.

The maximum you can claim using the new temporary flat rate method is 400 200 working days per individual. Tracking these expenses can be challenging so we have introduced a temporary shortcut method. Due to Covid-19 the work environment was forced to make certain changes more rapidly.

RITA income tax filers can claim a refund for working at home during coronavirus but might not get the money.

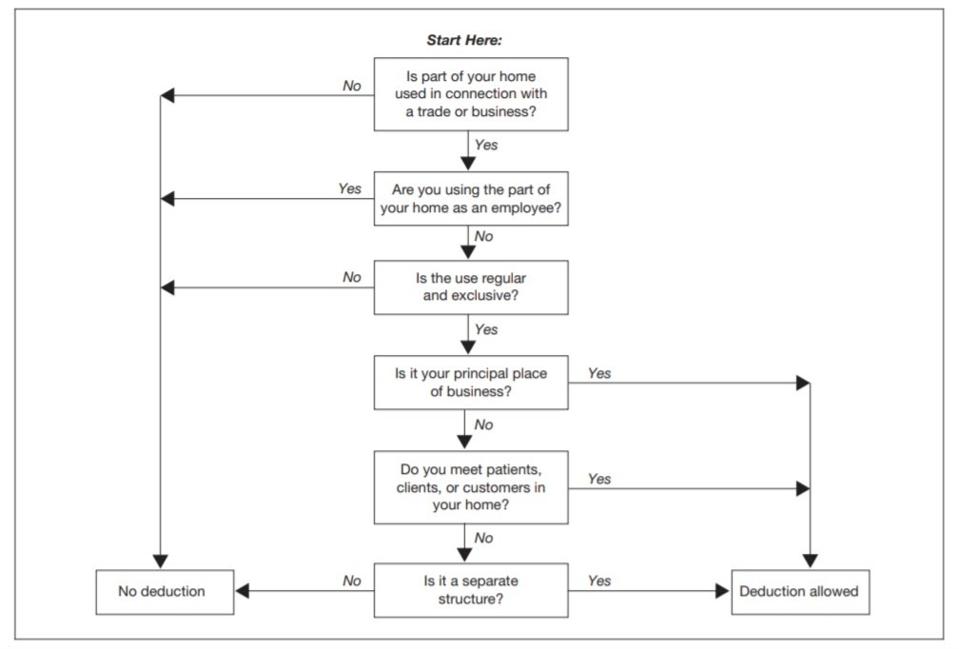

.png) Quiz Do I Qualify For The Home Office Deduction

Quiz Do I Qualify For The Home Office Deduction

How To Keep Up With Income And Expenses For Business The Right Way Atkins E Corp Small Business Tax Business Tax Deductions Business Tax

How To Keep Up With Income And Expenses For Business The Right Way Atkins E Corp Small Business Tax Business Tax Deductions Business Tax

Home Business Tax Deductions Keep What You Earn Legal Book Nolo

Home Business Tax Deductions Keep What You Earn Legal Book Nolo

A Charitable Donation Tax Deduction Can Lower Your Tax Liability Whether You Donate Money Or Physical Donation Tax Deduction Charitable Donations Charitable

A Charitable Donation Tax Deduction Can Lower Your Tax Liability Whether You Donate Money Or Physical Donation Tax Deduction Charitable Donations Charitable

These Popular Tax Deductions Have Been Extended Through 2020 Home Insurance Home And Auto Insurance Student Loans

These Popular Tax Deductions Have Been Extended Through 2020 Home Insurance Home And Auto Insurance Student Loans

Working From Home Your Home Offices Expenses Are Probably Not Tax Deductible

Working From Home Your Home Offices Expenses Are Probably Not Tax Deductible

How People Working From Home Can Claim A Home Office Tax Deduction

How People Working From Home Can Claim A Home Office Tax Deduction

In Case You Were Wondering Workfromhome Taxes Https Www Marketwatch Com Story Ive Been Working At Home Dur Leadership Coaching Working From Home Workplace

In Case You Were Wondering Workfromhome Taxes Https Www Marketwatch Com Story Ive Been Working At Home Dur Leadership Coaching Working From Home Workplace

How People Working From Home Can Claim A Home Office Tax Deduction

How People Working From Home Can Claim A Home Office Tax Deduction

Working From Home By The Numbers Working From Home Digital Trends Virtual Private Network

Working From Home By The Numbers Working From Home Digital Trends Virtual Private Network

Quiz Do I Qualify For The Home Office Deduction

Quiz Do I Qualify For The Home Office Deduction

Four Reasons Why You Should File Your Tax Return Early Filing Taxes Tax Return Tax Prep

Four Reasons Why You Should File Your Tax Return Early Filing Taxes Tax Return Tax Prep

Home Office Deductions In The Covid 19 Era Mlr

Home Office Deductions In The Covid 19 Era Mlr

How Working From Home In Pandemic Impacts Taxes What You Can Deduct

How Working From Home In Pandemic Impacts Taxes What You Can Deduct

Get My Payment The New Irs Stimulus Bank Details Tool A Guide For Expats Irs Expat Tax Expat

Get My Payment The New Irs Stimulus Bank Details Tool A Guide For Expats Irs Expat Tax Expat

How Does Working From Home Change Tax Deductions In 2020

How Does Working From Home Change Tax Deductions In 2020

Get Paid Missing Stimulus Money On Your 2020 Taxes How To File Before The May 17 Deadline In 2021 Filing Taxes Tax Refund Tax Credits

Get Paid Missing Stimulus Money On Your 2020 Taxes How To File Before The May 17 Deadline In 2021 Filing Taxes Tax Refund Tax Credits

Working From Home Your Home Offices Expenses Are Probably Not Tax Deductible

Working From Home Your Home Offices Expenses Are Probably Not Tax Deductible

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home