Houston Property Tax Over 65 Exemption

This can be in the form of a letter email or signature on a check. Age 65 or older and disabled exemptions.

Texas Property Taxes Homestead Exemption Explained Carlisle Title

Texas Property Taxes Homestead Exemption Explained Carlisle Title

If the county grants an optional exemption for homeowners age 65 or older or disabled the owners will receive only the local-option exemption.

Houston property tax over 65 exemption. Over 65 Exemption. Annual property taxes may be spread over a year and paid in four installments without penalty or interest. If you have an over 65 or disabled exemption or are the surviving spouse of a disabled veteran you may request to pay your property taxes in 4 equal payments without penalty and interest.

To apply you must provide. A homeowner may receive the Over 65 exemption immediately upon qualification of the exemption by filing an application with the county appraisal district office. The homestead exemption is typically 20 percent of market value for the city of Houston and Harris County.

You may file for a homestead exemption up to one year after the delinquency dateusually February 1. The homeowner must apply before the first anniversary of their qualification date to receive the exemption in that year. If they are the surviving spouse of someone who received the Over 65 exemption they can continue the.

If you are 65 or older or disabled you must apply for the exemption no later than one year from your 65th birthday or one year after the delinquency date whichever is later. If the owner qualifies for both the 10000 exemption for age 65 or older homeowners and the 10000 exemption. The main address of the Harris County Tax Office is 1001 Preston Houston Texas 77002.

12 rows You do NOT need to be 65 years old at the first of the year to qualify. If you have received an over 65 tax ceiling limitation certificate from the Harris County Appraisal District please forward original certificate to the Harris County Tax Office or contact HCTO at 713-274-8000 and ask for the over 65 department. So if your home is worth 150000 and you receive the homestead exemption the school district tax rate will only apply to 125000 of you home value.

Individuals age 65 or older or disabled residence homestead owners qualify for a 10000 homestead exemption for school district taxes in addition to the 25000 exemption for all homeowners. Payment in the amount of at least one-fourth 25 of the total amount of current taxes due. The over-65 exemptions for Houston and Harris County are.

Over 65 deductions on. For persons age 65 or older or disabled Tax Code Section 1113c requires school districts to offer an additional 10000 residence homestead exemption and Tax Code Section 1113d allows any taxing unit the option to decide locally to offer a separate residence homestead exemption. Its the same as if one homeowner was 65 and their spouse was 50.

New Yorks Senior Citizen Exemption is 50 of your homes appraised value but you must be age 65 or older and have an annual income of no more than 29000 as of 2020. Harris County Commissioners Court. Only one person in the household has to be over 65 to claim the over 65 exemption and freeze.

In order to qualify for any type of residential homestead exemption including the over- 65 exemption the. Like the homestead exemption only school districts are required to offer this exemption. Persons who are at least 65 or who are disabled can claim an additional exemption of 10000.

You may apply to your local appraisal district for up to one year after the date you become age 65 or up to one year after the taxes are due. Disability exemption the over-55 surviving spouse exemption or the 100 disabled veteran exemption. If they own it jointly they exemption applies.

A written request to pay in installments. Harris County homeowners who are age 65 or older or who have disabilities can expect property tax relief this year in the form of expanded property tax exemptions. New York Anchorage Honolulu and Houston are among the kindest.

In addition to the 25000 exemption that all homestead owners receive those age 65 or older qualify for a 10000 homestead exemption for school taxes.

Why Are Texas Property Taxes So High Home Tax Solutions

Why Are Texas Property Taxes So High Home Tax Solutions

Property Tax Information City Of Meadows Place

Property Tax Information City Of Meadows Place

Getting To Know Georgia Property Taxes Wch Homes

Getting To Know Georgia Property Taxes Wch Homes

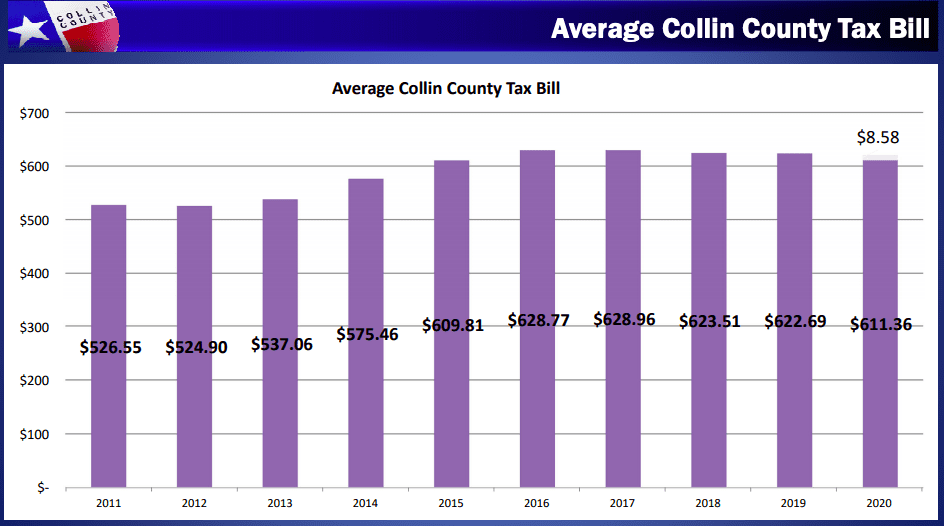

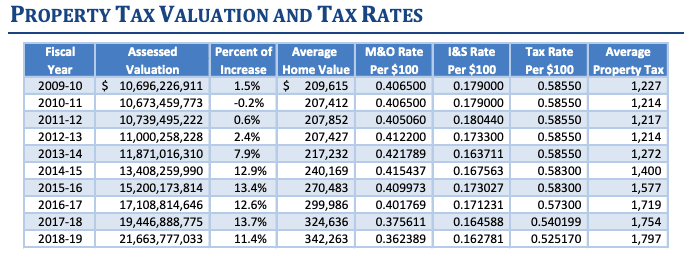

North Texas Counties Plan Pro Taxpayer Budgets Texas Scorecard

North Texas Counties Plan Pro Taxpayer Budgets Texas Scorecard

Which Texas Mega City Has Adopted The Highest Property Tax Rate

Which Texas Mega City Has Adopted The Highest Property Tax Rate

Guide To Central Pennsylvania Property Taxes Century 21 Core Partners

Guide To Central Pennsylvania Property Taxes Century 21 Core Partners

Property Tax Protests On The Rise As Home Values Increase Community Impact Newspaper

Property Tax Protests On The Rise As Home Values Increase Community Impact Newspaper

Pay Property Taxes Online County Of Harris Papergov

Pay Property Taxes Online County Of Harris Papergov

Keller City Council Approves Increase To Property Tax Homestead Exemption Community Impact Newspaper

Keller City Council Approves Increase To Property Tax Homestead Exemption Community Impact Newspaper

Types Of Property Tax Exemptions Millionacres

Types Of Property Tax Exemptions Millionacres

Property Tax Exemption Who Is Exempt From Paying Property Taxes

Property Tax Exemption Who Is Exempt From Paying Property Taxes

2021 Update Houston Homestead Home Exemptions Step By Step Guide

2021 Update Houston Homestead Home Exemptions Step By Step Guide

Mckinney Set To Raise Property Taxes Texas Scorecard

Mckinney Set To Raise Property Taxes Texas Scorecard

Montgomery County Approves 10 Percent Homestead Exemption Community Impact Newspaper

Montgomery County Approves 10 Percent Homestead Exemption Community Impact Newspaper

Are There Any States With No Property Tax In 2021 Free Investor Guide

Are There Any States With No Property Tax In 2021 Free Investor Guide

Property Taxes Big Burden For Seniors

Property Taxes Big Burden For Seniors

Are There Any States With No Property Tax In 2021 Free Investor Guide

Are There Any States With No Property Tax In 2021 Free Investor Guide

Texas Homestead Tax Disabled Veteran Home Exemption Information

Texas Homestead Tax Disabled Veteran Home Exemption Information

Texas Homestead Application O Connor Property Tax Reduction Experts

Texas Homestead Application O Connor Property Tax Reduction Experts

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home