Are California State Taxes Delayed This Year

This year paper returns are taking even longer and refunds are seriously delayed. But theres extra time the deadline for federal and California income taxes is delayed until May 17.

Https Www Ftb Ca Gov Tax Pros Procedures Collection Procedure Manual Cpm Glossary Pdf

We recognize what a challenging year this has been for Californians statewide said State Controller Betty T.

Are california state taxes delayed this year. Doing business means that a corporation has sufficient connections to California so that the corporation has availed itself of the benefits provided by the state that it. You must file by October 15 2021. If none leave blank.

Even if you e-file early the IRS wont start processing your tax return until February 12 2021. 2021 State Tax Filing Guidance for Coronavirus Pandemic updated. State of California Franchise Tax Board Corporate Logo.

Sacramento The Franchise Tax Board FTB today announced updated special tax relief for all California taxpayers due to the COVID-19 pandemic. California State Taxes for Tax Year 2020 January 1 - Dec. The AICPA has compiled the below latest developments on state tax filings related to coronavirus.

If you cant afford your tax bill and owe less than 25000 California offers payment plans. 31 2020 can be prepared and e-Filed now together with an IRS or Federal Income Tax Return or learn how to only prepare and eFile a CA state return. This extension is generally granted to.

No form is required. 12921 10 am et also see 2020 State Tax Filing Guidance for Coronavirus Pandemic US. 2020 first and second quarter estimated payments.

2019 tax return payments. Yee who serves as chair of FTB. Generally taxpayers reporting less than 1 million in tax on a return originally due during this time frame are not required to seek an extension from CDTFA.

The old adage that if you are expecting a refund you should file early seems to be coming under fire a bit in recent years but none so much as the 2019 tax season. States are providing tax filing and payment due date relief for individuals and businesses. Relief will be provided automatically.

If you cant pay your California state tax bill on time you can request a one-time 30-day delay. And in 2021 there is another reason your tax refund will be delayed. But the start of this years tax season was delayed to allow the agency to update and test its systems to reflect tax changes approved by Congress late last year.

The sad part is though that many honest people may see their tax returns delayed by several weeks. Find IRS or Federal Tax Return deadline details. The State of California has also postponed until July 15 2020 the filing and payment deadlines for all individuals and business entities for.

Paper returns usually take longer than e-filed returns to be processed. State of California Franchise Tax Board Corporate Logo. Sacramento The Franchise Tax Board FTB today announced that consistent with the Internal Revenue Service it has postponed the state tax filing and payment deadline for individual taxpayers to May 17 2021.

Numbers in Mailing Address Up to 6 numbers. Yes its that late this year. California grants you an automatic extension to file your state tax return.

Here are some articles to get you on track. Check Your Refund Status. The Covid-19 and Coronavirus pandemic.

Returns due between December 15 2020 and April 30 2021 for all but the largest taxpayers will be extended. FTB is postponing until July 15 the filing and payment deadlines for all individuals and business entities for. And there are new benefits to be gained.

Check Your 2020 Refund Status Required Field Required Field Social Security Number 9 numbers no dashes. Your payment is still due by May 17 2021. The State Controllers Property Tax Postponement Program allows homeowners who are seniors are blind or have a disability to defer current-year property taxes on their principal residence if they meet certain criteria including at least 40 percent equity in the home and an annual household income of 45000 or less among other requirements.

As we get deeper into the 2019 tax season some taxpayers are experiencing a delay in receiving their tax refunds. Taxpayers will have until May 17 2021 to file and pay income taxes. The California tax filing and tax payment deadline is April 15 2021 May 17 2021.

For California franchise tax purposes corporations are required to file a tax return and are subject to the minimum franchise tax if they are doing business in California. The due date to file and pay taxes and fees owed to the California Department of Tax and Fee Administration CDTFA originally due between December 15 2020 and April 30 2021 has been extended by three months.

![]() Understanding And Avoiding California State Taxes

Understanding And Avoiding California State Taxes

12 Irs Non Stimulus Tax Rules You Ll Need This Year Tax Rules Irs Tax Questions

12 Irs Non Stimulus Tax Rules You Ll Need This Year Tax Rules Irs Tax Questions

California Taxes A Guide To The California State Tax Rates

California Taxes A Guide To The California State Tax Rates

Your Guide To State Tax Deadlines For Filing Returns Making Estimated Payments During Covid 19

Your Guide To State Tax Deadlines For Filing Returns Making Estimated Payments During Covid 19

California Taxes A Guide To The California State Tax Rates

California Taxes A Guide To The California State Tax Rates

Where S My Refund California H R Block

Where S My Refund California H R Block

California Income Tax Returns Can Be E Filed Now Start Free

California Income Tax Returns Can Be E Filed Now Start Free

Federal And California Announce Filing And Payment Deadline Tax Day For Individuals Has Been Extended To May 17 2021 Sierra Wave Eastern Sierra Newssierra Wave Eastern Sierra News

Federal And California Announce Filing And Payment Deadline Tax Day For Individuals Has Been Extended To May 17 2021 Sierra Wave Eastern Sierra Newssierra Wave Eastern Sierra News

We Are Open And Taking Appointments Earlier Filing Is Highly Recommended Again This Year The Irs Is Already Anticipating Refund De Income Tax Tax Credits Tax

We Are Open And Taking Appointments Earlier Filing Is Highly Recommended Again This Year The Irs Is Already Anticipating Refund De Income Tax Tax Credits Tax

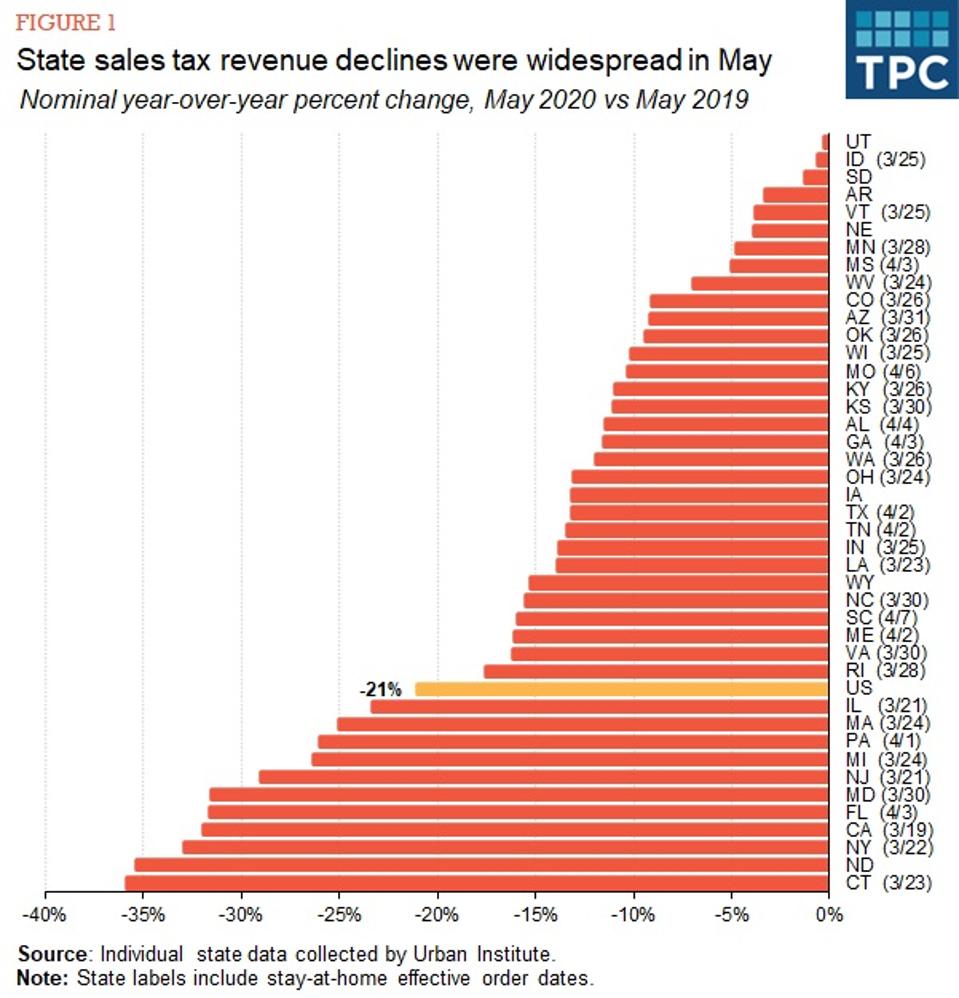

The Covid 19 Effect State Sales Tax Receipts Shrank 6 Billion In May

The Covid 19 Effect State Sales Tax Receipts Shrank 6 Billion In May

Tax Deadlines Pushed Back Federal And California Measures To Help Taxpayers Through Covid 19 Pandemic

Tax Deadlines Pushed Back Federal And California Measures To Help Taxpayers Through Covid 19 Pandemic

What Is Casdi Employer Guide To California State Disability Insurance Gusto

What Is Casdi Employer Guide To California State Disability Insurance Gusto

California S 15 Day Rule For Corporations And Llcs Lawinc

Pin On San Diego California Usa

Pin On San Diego California Usa

California Llc Annual Franchise Tax 800 Llc University

California Llc Annual Franchise Tax 800 Llc University

Is Your Inheritance Taxable Smartasset Inheritance Tax Tax Payment Inheritance

Is Your Inheritance Taxable Smartasset Inheritance Tax Tax Payment Inheritance

Labels: california, property, state, taxes

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home