Property Tax Assessment San Francisco

3rd Street 4th 4th Avenue. 4th Avenue 4th Street 5th Avenue 5th Street 6th Avenue.

Some of these measures include an exemption for seniors living on the property provided they meet certain criteria.

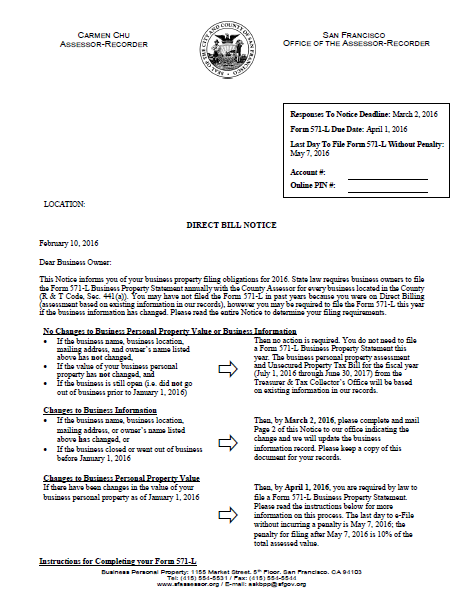

Property tax assessment san francisco. The City County of San Francisco open filing period for a formal appeal of your 20202021 assessed property value is now closed. San Francisco CA property tax assessment. In order to determine the tax bill your local tax assessors office takes into account the propertys assessed value the current assessment rate as well as any tax exemptions or abatements for that property.

This List will be part of a special Business of Pride edition of the San Francisco Business Times publishing June 11. 0001-002 or property location Search For best search results enter your bill number or blocklot as shown on your bill. In-depth San Francisco County CA Property Tax Information.

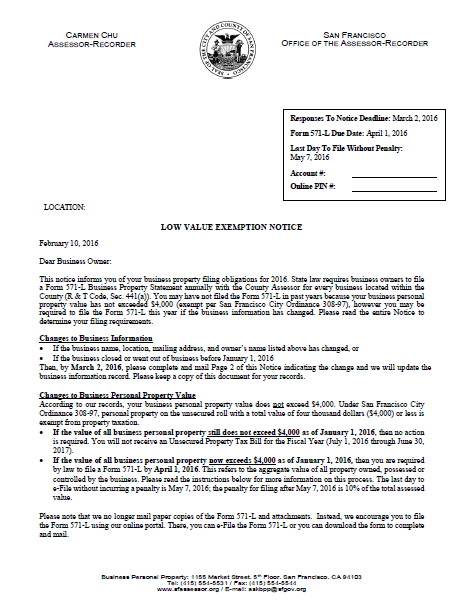

Secured property taxes are calculated based on real propertys assessed value as determined annually by the Office of the Assessor-Recorder. Assessor Chu To Answer Questions on Proposition 19 2020. 2nd Avenue 2nd Street 3rd 3rd Avenue 3rd Street.

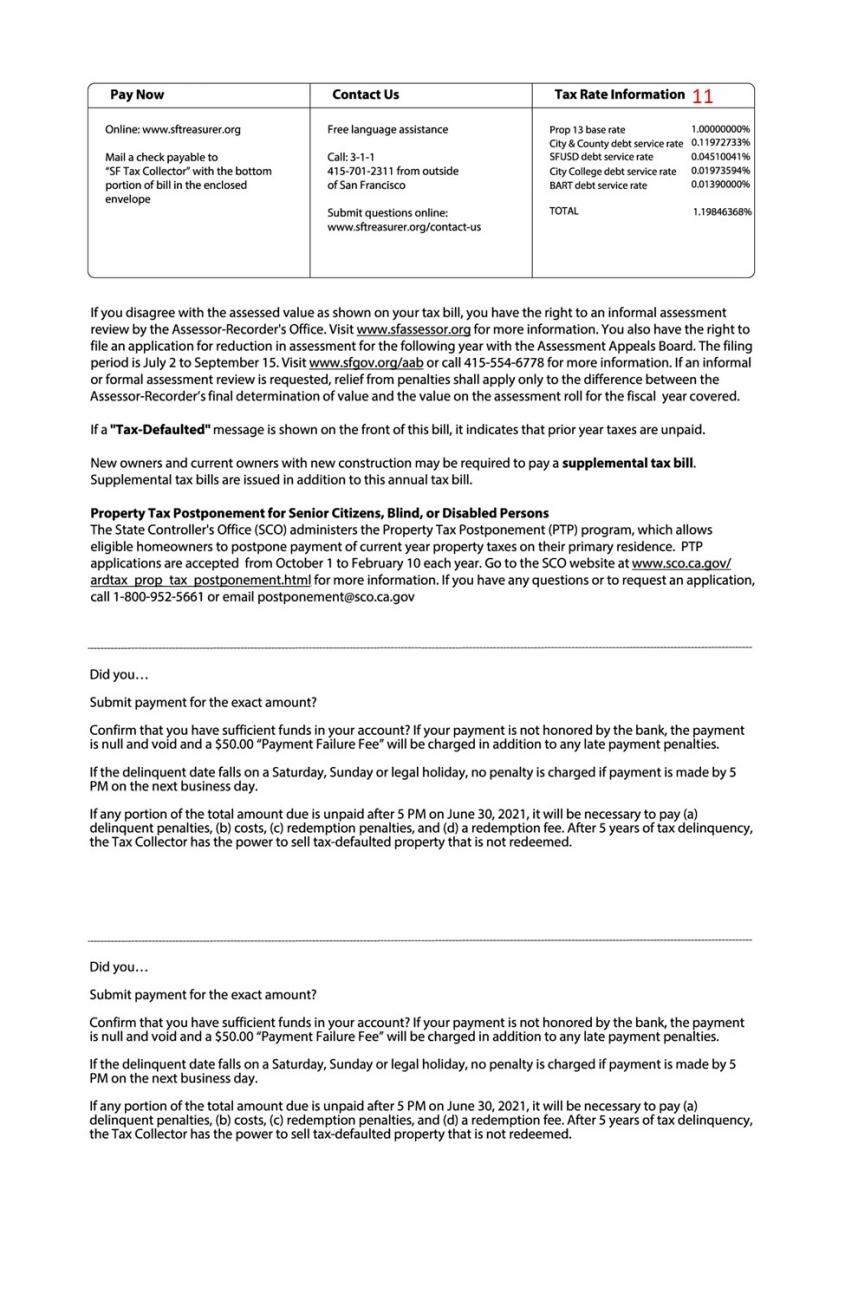

The secured property tax rate for Fiscal Year 2020-21 is 119846368. View and pay a property tax bill online. Link is external.

One of the primary responsibilities of the Assessor-Recorder Office is the assessment of real property - that is determining the proper taxable value for all properties subject to taxation. Property valuation of Diamond Heights Bl San Francisco CA. City and County of San Francisco.

Unlike real property business personal property is appraised annually. The assessor must annually assess all taxable property in the county to the person business or legal entity owning claiming possessing or controlling the property on January 1st. You may either pay the entire tax when the first installment is due or pay in two installments.

A completed Application for Changed Assessment form together with a non-refundable 60 administrative processing fee must be submitted or postmarked to the Assessment. COVID-19 Tax Relief for Businesses The Board of Supervisors recently passed legislation that provides pandemic business tax relief to certain businesses that have gross receipts of. 12 04th Avenue 12 Quesada Avenue 1st Street 2nd Avenue.

Enter only the values. The secured property tax amount is based on the assessed value of the property as established annually by the Citys AssessorRecorder. Access and view your bill online learn about the different payment options and how to get assistance form the Citys Treasurer Tax Collector Office.

Property owners pay secured property tax annually. 5290 5300 5320 101 5320 101 5320 102 5320 102 5320 103 5320 103 5320 104 5320 104 tax assessments. Secured Property Tax bills are mailed in October.

San Francisco may lower property tax assessments because of Covid. Bill block-lot ex. Learn about the Citys property taxes.

6th Avenue 6th Street 7th Avenue 7th Street. After clicking on Access Tool above type in the address or Assessors Parcel Number APN into the search box on the left then Search and then view all the different tabs on the right to get more information for each propertyThe San Francisco Property Information Map is maintained by the San Francisco Planning Department. San Francisco CA 94120-7426 Postmarks are imprints on letters flats and parcels that show the name of the United States Postal Service USPS office that accepted custody of the mail along with the state the zip code and the date of mailing.

The citizens of San Francisco approved measures to provide funding to the San Francisco Unified School District and City College of San Francisco. For questions about billing and refunds contact the Treasurer Tax Collectors Property Tax Division at 415 701-2311. The Office of the Treasurer Tax Collector serves as the banker tax collector collection agent and investment officer for the City and County of San Francisco.

Joaquín Torres Sworn In As San Franciscos Assessor-Recorder. In 2020 California voters passed Proposition 19 which makes changes to property tax benefits for families seniors severely disabled persons and victims of natural disaster. Supplemental and Roll Correction assessmen appeals are accepted within 60 days of the notice and Escape assessment appeals is accepted within 60 days of the tax bill.

Labels: assessment, francisco, property

.png)

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home