Property Lien Search Franklin County Ohio

Why do I have to pay the Franklin County Clerk of Courts for a State of Ohio Tax lien. The following is a list of the services and duties of the Delinquent Tax Division at the Franklin County Treasurers Office.

Bfp Affidavit Individual Real Words Individuality

Bfp Affidavit Individual Real Words Individuality

The Recorders office does not have their own e-recording platform but there are a number of private companies that provide e-recording services that are then consolidated and sent to the Recorder.

Property lien search franklin county ohio. It is recommended you obtain a case number from the reporting agency. Nowadays many local county recorders and county clerks of court records can be viewed on the Internet by simply visiting these agency websites. Payment Plans Ask how to set up a payment plan to pay delinquent taxes.

The Mission of the Franklin County Recorders Office is to record preserve protect and retrieve real estate personal property and other records for the public so their property interests are safeguarded and so those records can be efficiently retrieved. Any documents that transfer real estate should still start the transfer process with the Franklin County Auditor. The AGs Office has a hotline for such inquiries.

Search Clerk of Courts. Enjoy the pride of homeownership for less than it costs to rent before its too late. Legal counsel for county officials and their offices.

Ohio Franklin County 369 South High Street Columbus OH 43215 Number. Search for a Property Search by. Users of this data are notified that the primary information source should be consulted for verification of the information contained on this site.

These fees are set by the External link Ohio. In Ohio you can find out if your property has a lien on it by simply checking the records of the local county recorder and the local clerk of courts. External link Franklin County Treasurer.

The information on this web site is prepared from the real property inventory maintained by the Franklin County Auditors Office. External link Franklin County Prosecutor. These tax foreclosed homes are available for pennies on the dollar - as much as 75 percent off full market price and more.

Users can create profiles for any individual or business name and receive an alert when a document is recorded in our office with that name. Tax Lien Sale Find out about our annual tax lien sale and access. You may enter multiple terms.

Unpaid State of Ohio Income Tax Liens may require you to contact another agency. The External link State of Ohio uses the offices of the 88 county clerks to record file and maintain tax liens. Costs are incurred with filing paperwork computerization etc.

Users of this data are notified that the primary information source should be consulted for verification of the information contained on this site. There are currently 987 red-hot tax lien listings in Franklin County OH. John Smith Street Address Ex.

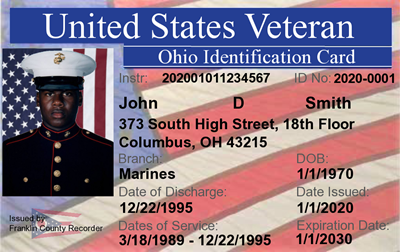

DD214s and Mechanics liens filed here. Results are ranked by most relevant pages first. 123 Main Parcel ID Ex.

All eligible tax lien certificates are bundled together and sold as part of a single portfolio. Certain property tax liens are handled by the Franklin County Treasurer others are the result of filings with the Clerk of Courts. Buyer Information Overview of the Sale Ohio Revised Code sections 572130 to 572143 permit the Franklin County Treasurer to collect delinquent real property taxes by selling tax lien certificates in exchange for payment of the entire delinquency.

If you HAVE received such a document from the AG there is a process to follow. Unless a taxpayer responds to the initial 60-day notice letter informing him or her that taxes are past due the Ohio Department of Taxation will contact the Attorney Generals Office who will file a certification of the tax assessment with the Clerk of the Common Pleas Court where the taxpayer resides. The County assumes no responsibility for errors in the information and does not guarantee that the.

If you havent received a notice of satisfaction from the party with the lien usually the Ohio Attorney Generals office then you should contact them first to get more information about obtaining the satisfaction. FraudSleuth is a tool to help detect possible fraudulent activity on your name that can affect your property by automatically searching documents filed at the Franklin County Recorders Office. The Franklin County Treasurer makes every effort to produce and publish the most current and accurate information possible.

Please enter your search terms in the Search box. The existence of Ohio tax liens also called judgment liens can come as a surprise. Real estate tax billings and Foreclosure prevention services.

373 South High Street 26th Floor County Courthouse Columbus OH 43215-4591 Phone. The information on this web site is prepared from the real property inventory maintained by the Franklin County Auditors Office. Determine if county records are accessible online.

Ohio Secretary of State. Property tax assessments and Dog Licenses.

Ohio Release Of Lien Form Free Template Download

Ohio Release Of Lien Form Free Template Download

Search Ohio Public Property Records Online Courthousedirect Com

Search Ohio Public Property Records Online Courthousedirect Com

Http Www Columbuscityattorney Org Pdf Press Amg Complaint Pdf

Https Www Ccao Org Wp Content Uploads Hbkchap081 207 16 15 Pdf

Http Www Columbuscityattorney Org Pdf Press Amg Complaint Pdf

Http Www Columbuscityattorney Org Pdf Press Amg Complaint Pdf

Http Www Columbuscityattorney Org Pdf Press Amg Complaint Pdf

New Court Order Instructions Franklin County Ohio

New Court Order Instructions Franklin County Ohio

Https Www Columbus Gov Workarea Downloadasset Aspx Id 2147502772

Ohio Request For Notice Of Commencement Form Free Template

Ohio Request For Notice Of Commencement Form Free Template

Auto Title Manual Coverf Pub Franklin County Ohio

Auto Title Manual Coverf Pub Franklin County Ohio

Http Www Columbuscityattorney Org Pdf Press Amg Complaint Pdf

Auto Title Manual Franklin County Ohio

Auto Title Manual Franklin County Ohio

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home