Property Tax Statement San Diego

Filings must be postmarked on or before May 7th to avoid a 10 percent late filing penalty. The Business Property Statement is used for reporting all business equipment supplies and fixtures for each business location along with other important information.

Info About The Property Tax Bill For San Diego County Property Tax San Diego County Informative

Info About The Property Tax Bill For San Diego County Property Tax San Diego County Informative

To accomplish this the Assessors Office mails out approximately 60000 Business.

Property tax statement san diego. San Diego County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in San Diego County California. The unsecured property tax bills are issued based on the statements filed. Property tax bills may be paid in person at any of the County Tax Collectors branch offices by mail or online.

On January 1 tax lien date. You can search for any account whose property taxes are collected by the Duval County Tax Office. For the first time San Diego County Treasurer-Tax Collectors office is mailing over 1 million property tax bills to local property owners.

Secured property is any property that cant be moved like homes or land. BUSINESS PROPERTY STATEMENT FORM 571L. Do I need a Business Tax Certificate.

Personal Property Statements and Important Assessment Notices to all San Diego County businesses. After locating the account you can pay online by credit card or eCheck. 1-877-829-4732 Operators do not accept payments email - taxmansdcountycagov.

Jon Baker - Manager Auditor Controller 5530 Overland Avenue Suite 410 San Diego CA 92123. Treasurer-Tax Collector Hits 1 Million Property Tax Bill Record. Change of Address Forms.

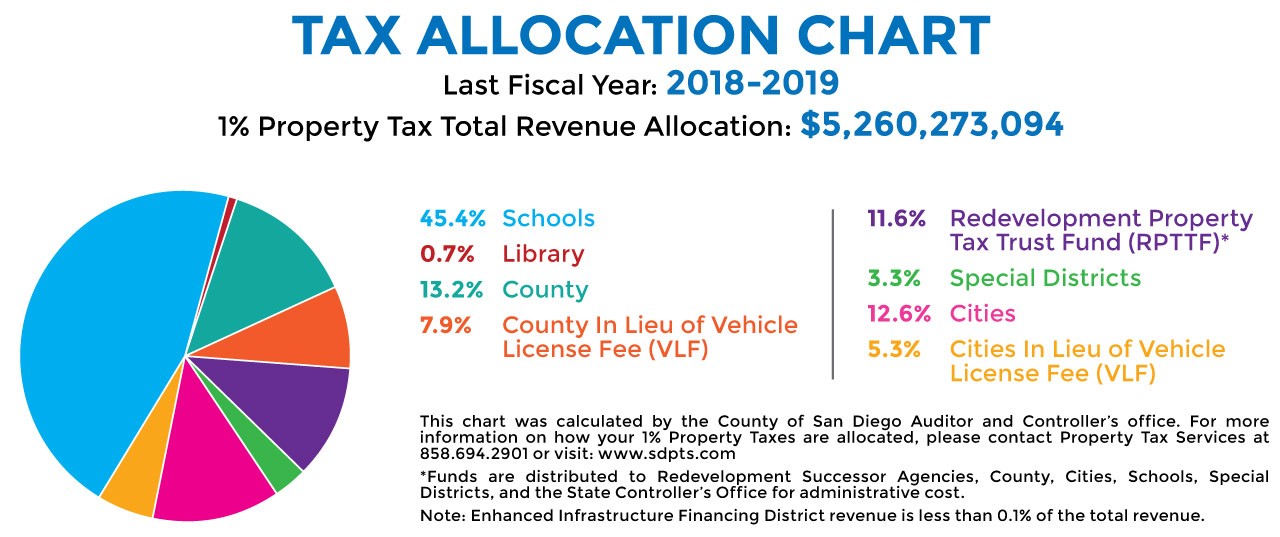

Center 1600 Pacific Hwy Room 162 San Diego CA 92101. Mandated deadline for filing unsecured business personal property statements. Proposition 13 limits the tax rate to 1 of a propertys current assessed value plus any voter-approved bonds and assessments.

City of San Diego Municipal Code Section 310121 states that no person shall engage in any business trade calling or occupation until a certificate of payment is obtained. Search Property Tax Information This page allows you to search for San Diego County secured unsecured and defaulted properties. San Diego County is now home to 1001029 separate parcels Treasurer-Tax Collector Dan McAllister announced today and in the coming week their owners will receive the 2019-2020 tax bills.

Proposition 13 limits the tax rate to 1 of a propertys current assessed value plus any voter-approved bonds and assessments. This form constitutes an official request that you declare all assessable business property situated in this county which you owned claimed possessed controlled or managed on the tax lien date and that you sign under penalty of perjury and return the statement. You can view and print your current property tax statements or view past payment history by visiting the Property Tax Payment Portal.

These records can include San Diego County property tax assessments and assessment challenges appraisals and. DUVAL COUNTY TAX OFFICE PO BOX 337 SAN DIEGO TX 78384-0337 361. The proposition also states that property values cannot increase more than 2 annually based on the California Consumer Price Index.

Please choose to search by either Assessor Parcel Number Supplemental Bill Number Escape Bill Number Mailing Address or Unsecured Bill Number to display a list of matching or related records. Dan McAllister Treasurer-Tax Collector San Diego County Admin. The owner also reports the acquisition costs of new business equipment supplies and fixtures that were owned on lien date at the.

Center 1600 Pacific Hwy Room 162 San Diego CA 92101. Taxpayers who are unable to pay their property taxes by April 12 2021 because of the COVID-19 crisis are encouraged to submit a request for a penalty waiver online. For more information on these statements call the Assessors Office at 858 505-6100.

Gavin Newsoms May 6 2020 executive order certain property owners directly affected by COVID-19 have until May 6 2021 to file a special COVID-19 penalty. The San Diego County Treasurer-Tax Collectors Office is now accepting penalty cancellation requests for those who have been directly impacted by the coronavirus pandemic. Property Tax Payment Portal.

This page provides prior-year secured property tax data for information purposes only. You may be trying to access this site from a secured browser on the server. The proposition also states that property values cant increase more than 2 annually based on the California Consumer Price Index.

Treasurer-Tax Collector San Diego County Admin. All accounts with statements requested by fiduciary number 586590 Washington Mutual 586590 then. The information provided on the statement is used to assess and tax property in accordance with California State Law.

Unsecured and defaulted tax property tax information is not included. Property Tax Exemption and Exclusion Forms Fill-In Homeowners Property Tax Exemption Claim electronic submittal. Annual property tax bills which include property taxes and.

Self-employed persons and independent contractors are also required to pay the Business Tax. The property tax bills and the County Tax Collectors website provide detailed information on the various options available for payment. There may have been changes in the financial condition or affairs of the County of San Diego since then the County of San Diego has not undertaken to update the financial statements or such other documents.

Please enable scripts and reload this page. California law prescribes a yearly ad valorem tax based on property as it exists at 1201 am.

Property Tax Prorations Case Escrow

Property Tax Prorations Case Escrow

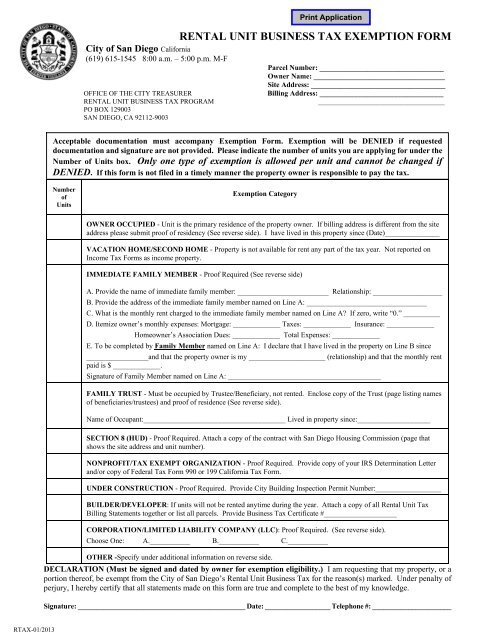

Rental Unit Business Tax Exemption Form City Of San Diego

Rental Unit Business Tax Exemption Form City Of San Diego

San Diego County Property Tax Records San Diego County Property Taxes Ca

San Diego County Property Tax Records San Diego County Property Taxes Ca

Property Tax Frequently Asked Questions

Property Tax Frequently Asked Questions

Understanding California S Property Taxes

Understanding California S Property Taxes

County Of San Diego Treasurer Tax Collector

County Of San Diego Treasurer Tax Collector

Understanding California S Property Taxes

Understanding California S Property Taxes

What Is Real Estate Tax Bill In 2021 Estate Tax Real Estate Checklist Listing Presentation Real Estate

What Is Real Estate Tax Bill In 2021 Estate Tax Real Estate Checklist Listing Presentation Real Estate

San Diego Property Tax Rate San Diego Real Estate Taxes Welcome To San Diego

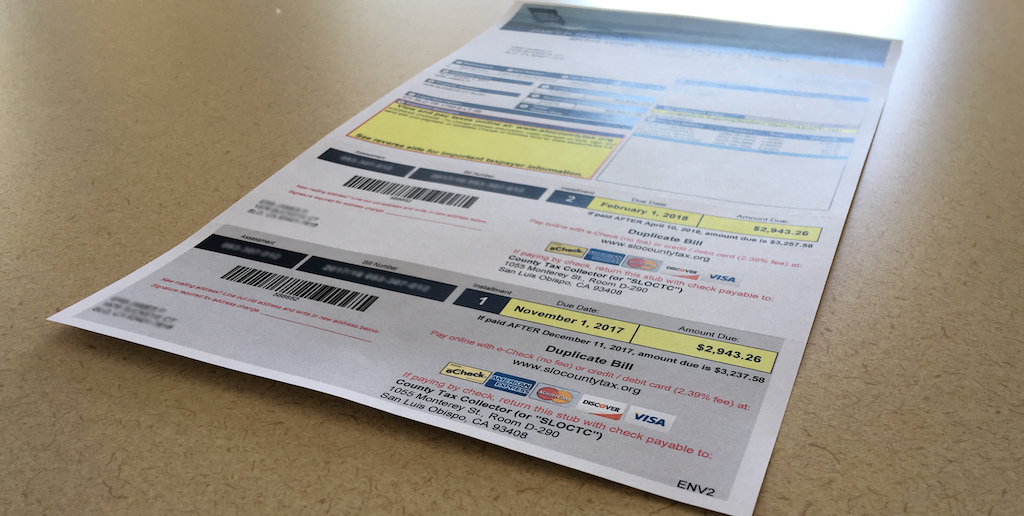

New Program Allows Taxpayers Pay Annual Property Taxes In Monthly Installments County Of San Luis Obispo

New Program Allows Taxpayers Pay Annual Property Taxes In Monthly Installments County Of San Luis Obispo

Property Tax Calculation For San Diego Real Estate Tips For Homeowners

Property Tax Calculation For San Diego Real Estate Tips For Homeowners

County Of San Diego Treasurer Tax Collector

County Of San Diego Treasurer Tax Collector

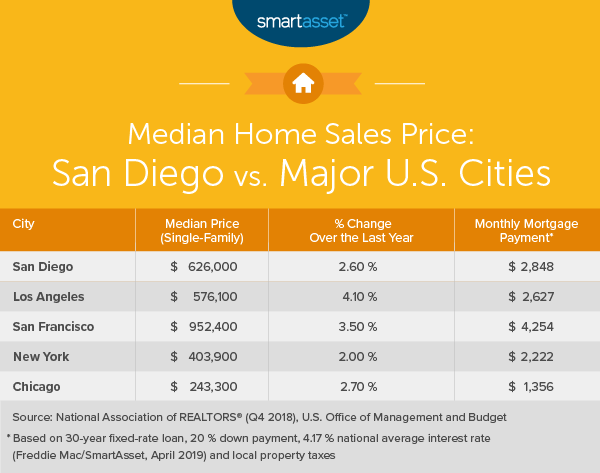

The Cost Of Living In San Diego Smartasset

The Cost Of Living In San Diego Smartasset

Https Www Sandiego Gov Sites Default Files Tr Rtax Exemption Form Pdf

2019 Property Tax Bills Mailed

2019 Property Tax Bills Mailed

San Diego County Ca Property Tax Faq S In 2021

San Diego County Ca Property Tax Faq S In 2021

San Diego County Public Records Public Records San Diego Records

San Diego County Public Records Public Records San Diego Records

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home