Johnson County Property Tax Texas

Transactions are processed through our secured server and deliver immediate responses. Johnson County Texas Home Home Property Search Property Search Tax Information Tax Information Tax Office Tax Office Map Map News News Board.

Property Tax Information Mansfield Tx

Passport Application andor Photo or file an Assumed Name Certificate DBA.

Johnson county property tax texas. Cleburne Texas 76033 Phone. Tax Year 2020. Constables Sale Tax Sale is conducted at the same time and location by the Constables Office.

Enter owners last name followed by a space and the first name or letter. Located at 247 Elk Dr. The Property Tax Code also requires property to be appraised at 100 market value.

In keeping with that requirement the capitalization rate that will be used to derive an estimate of market value for exempt low and moderate-income housing for tax year 2021 will be between 65 - 125. Once you find your property in the online search just click on the account number and then select the e-payment button. No-New-Revenue Maintenance and Operations Rate.

Tax AssessorCollector Last Updated. If you do not know the account number try searching by owner name address or property location. - Payments can be made in person at the West Chambersoffice Monday Friday 700 am 500 pm payable by money order cashiers checks credit cards and cash.

0001007 S MAIN ST. Please indicate name and cause number. Whether youre looking for help with one residential home a number of.

Were a boutique property tax consulting firm located in the heart of Johnson County Texas. Pay my Property Taxes. This is the owners mailing address.

Place a checkbox inside the boxboxes you want to pay. The median property tax in Johnson County Texas is 1867 per year for a home worth the median value of 111800. Hours 800 AM-12 noon 100 PM - 430 Monday through Friday except on Court Approved Holidays.

There is a flat 150. Box 75 Cleburne Texas 76033-0075 Street Address 2 N. Add Money to Inmate Accounts.

My Property Tax Accounts. The location for foreclosure sale is outside the West doors of the Johnson County Historic Courthouse at 2 N. Tax estimation tool to use for calculating property taxes.

Main Street in Cleburne exterior steps to the main floor facing Main Street. Enter the street number followed by a space and the street name. ECheck electronic check is an online only transaction Credit Card accepted online at the counter or by phone at 800-884-6091 Tax certificates are cash only transactions.

Delinquent Tax Data products must be purchased over the phone. Search and pay property taxes online with eCheck or by credit card. Tax Sales are posted and conducted by the Constables Office.

Account numbers can be found on your Johnson County Tax Statement. BUSINESS 126280023420 G M JA. Johnson County collects on average 167 of a propertys assessed fair market value as property tax.

Our expertise encompasses commercial residential agricultural real estate as well as minerals and business personal property. To begin the payment process please select accounts you want to pay below or click here to Search for My Property Tax Accounts. Cleburne Texas 76033 Collecting Unit Johnson County.

OME ON L GORE LAND AB 26 10. Maintenance Operations Rate. Room 103 in Burleson this office is able to provide assistance to qualified applicants who wish to obtain a Marriage License Texas Birth Certificate Johnson County Death Certificate US.

Hand-carried Recording accepted in the Deed Room B15 located in the South hallway at basement level. Texas Property Tax Code Section 2616. Yearly median tax in Johnson County.

ECheck offers the option of paying property taxes online by writing a check electronically from your checking account. How Payments Can Be Made. Johnson County Tax Office.

Johnson County has one of the highest median property taxes in the United States and is ranked 531st of the 3143 counties in order of median. Pay my Probation Fees. TaxNetUSA offers solutions to companies that need Delinquent Property Tax Data in one or more counties including Johnson County TX and want the data in a standard form.

We are happy to help you with anything from your personal home to your large commercial business. Real Property Documents are recorded at the Historic Courthouse Downtown Cleburne 817-202-4000 x 1625. - Payments can be mailed to 425 West Chambers Cleburne Texas 76033Please DO NOT mail Cash.

Juvenile Services Johnson County Tx

Hamm Creek Park Johnson County Tx

Tax Information For New Homeowners Republic Title

Tax Information For New Homeowners Republic Title

Agriculture Taxes In Texas Texas A M Agrilife Extension Service

Agriculture Taxes In Texas Texas A M Agrilife Extension Service

Http Www Galvestoncountytx Gov To Propertytaxinformation 2018 20city 20of 20friendswood 20public 20notice Pdf

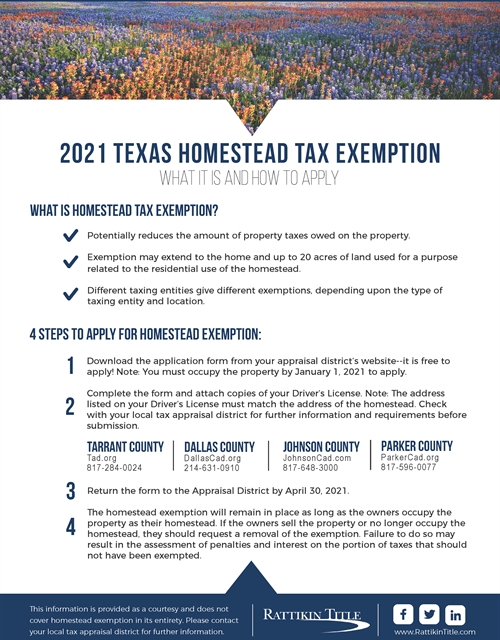

2021 Texas Homestead Tax Exemption

2021 Texas Homestead Tax Exemption

Bexar County Property Tax Records Bexar County Property Taxes Tx

Bexar County Property Tax Records Bexar County Property Taxes Tx

County Treasurer Johnson County Tx

Rockwall County Property Tax Records Rockwall County Property Taxes Tx

Rockwall County Property Tax Records Rockwall County Property Taxes Tx

Johnson County Texas Property Search And Interactive Gis Map

Johnson County Texas Property Search And Interactive Gis Map

Comal And Guadalupe Counties Approve Discretionary Tax Increase Measures Community Impact Newspaper

Comal And Guadalupe Counties Approve Discretionary Tax Increase Measures Community Impact Newspaper

Property Taxes In Texas Useful Information O Connor Associates

Property Taxes In Texas Useful Information O Connor Associates

Where Do Texas Homeowners Pay The Highest Property Taxes Texas Scorecard

Where Do Texas Homeowners Pay The Highest Property Taxes Texas Scorecard

Public Information Johnson County Tx

Http Www Galvestoncountytx Gov To Propertytaxinformation 2018 20hitchcock 20notice 20of 20proposed 20tax 20rate Pdf

Bexar County Property Tax Records Bexar County Property Taxes Tx

Bexar County Property Tax Records Bexar County Property Taxes Tx

Texas Property Taxes Homestead Exemption Explained Carlisle Title

Texas Property Taxes Homestead Exemption Explained Carlisle Title

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home