Property Taxes In Franklin County Ohio

Convenience fees for credit card transactions are processed and collected by the Treasurers payment processor Point and Pay. This fee does not come back to the county in.

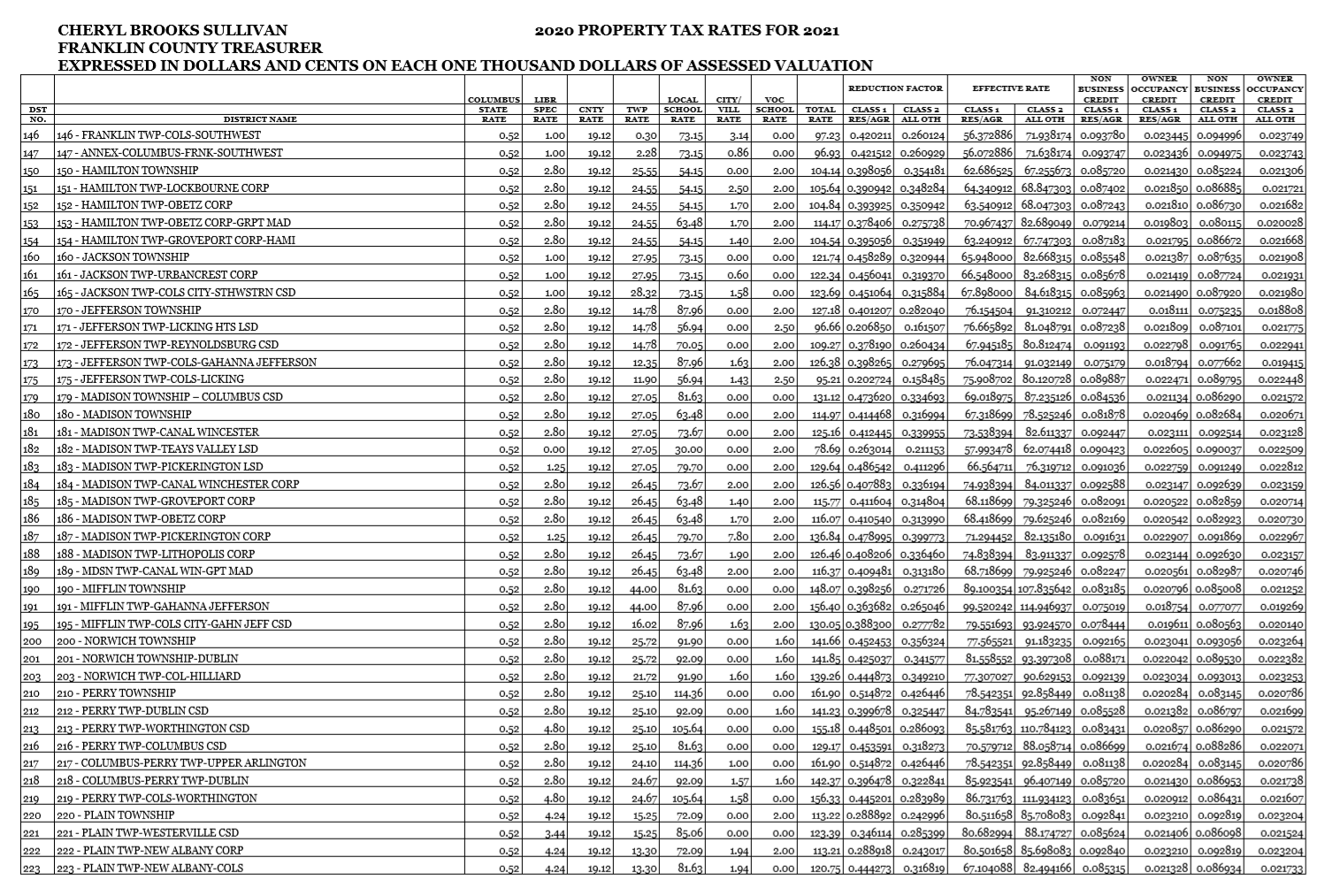

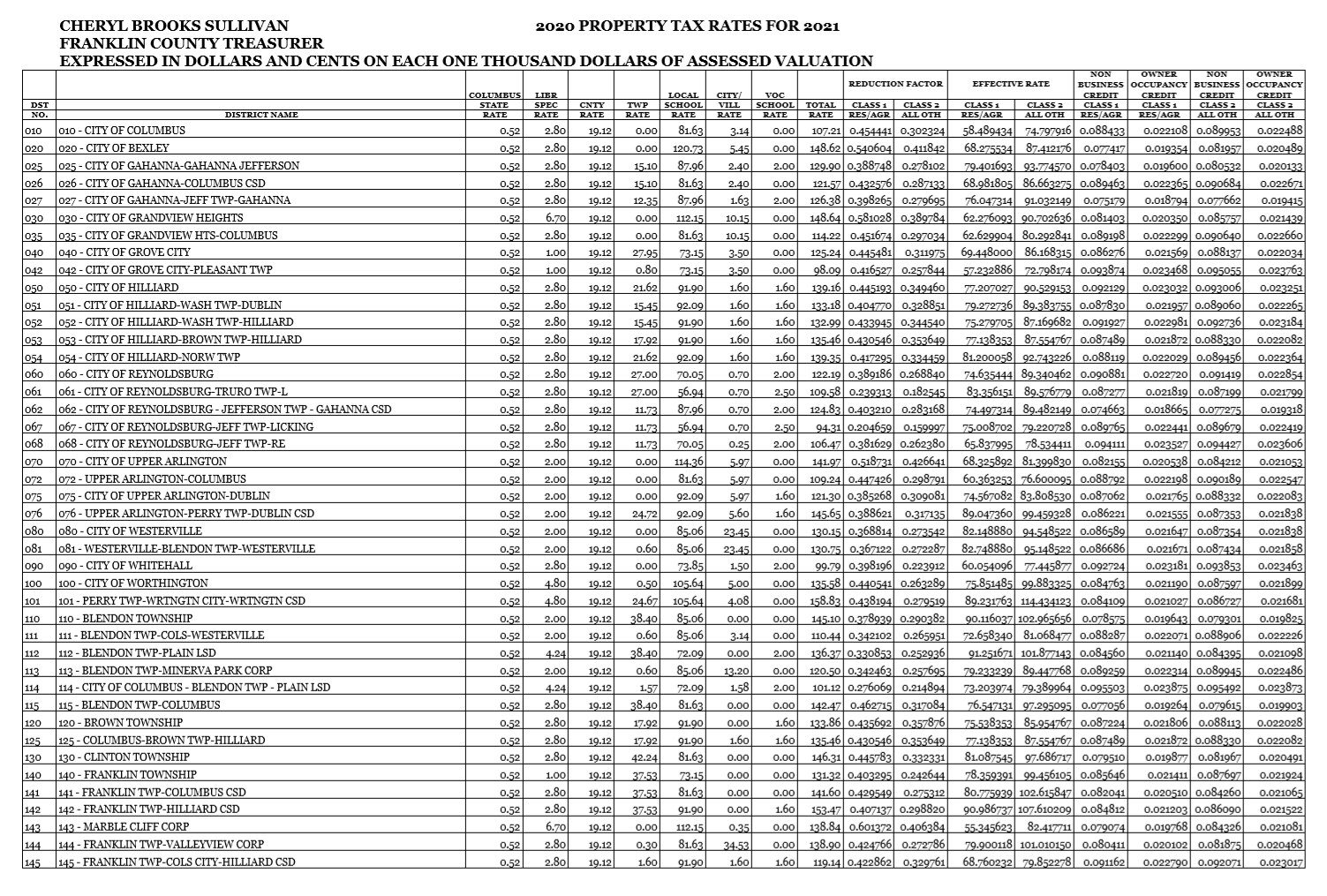

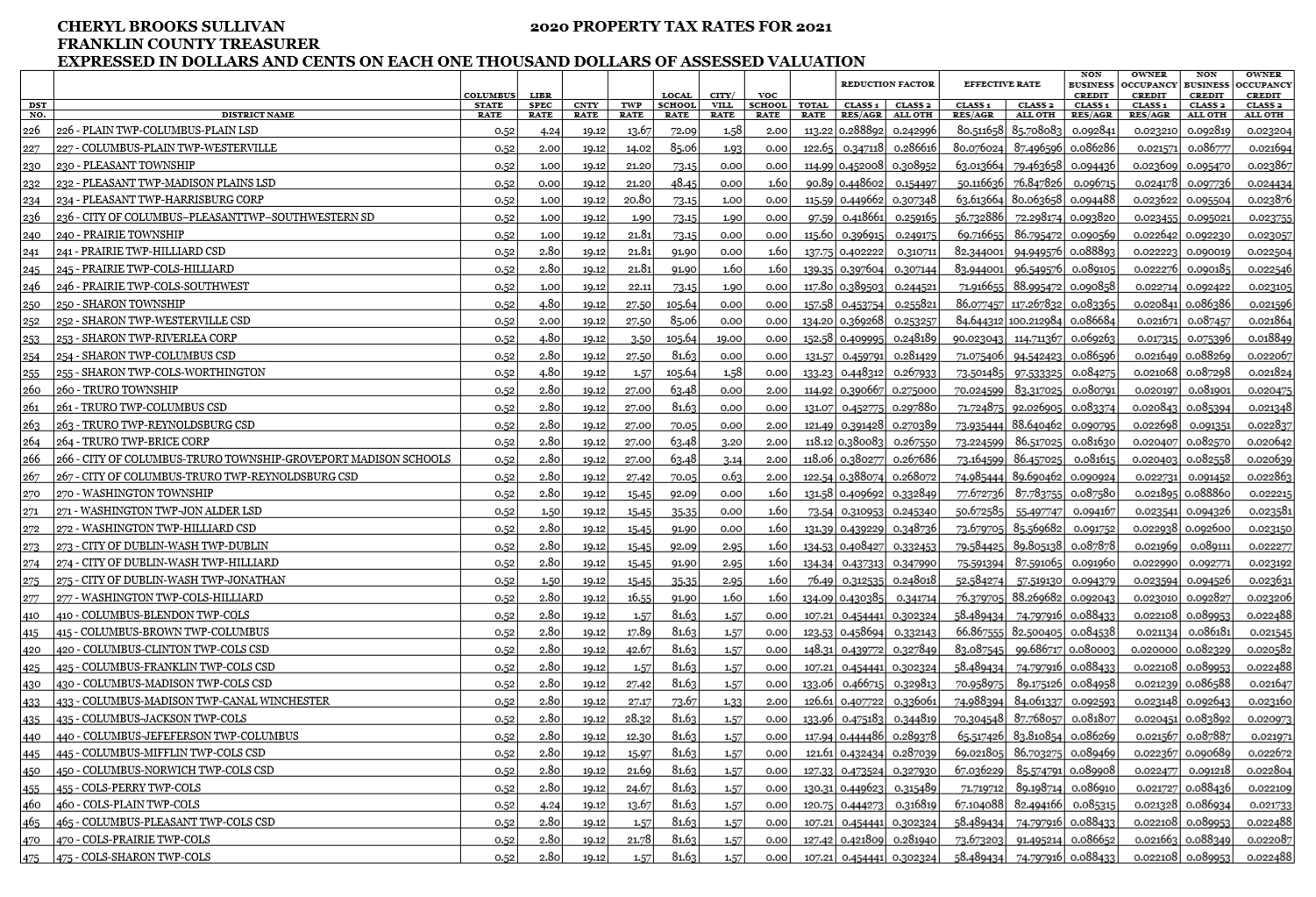

Franklin County Treasurer Tax Rates

Franklin County Treasurer Tax Rates

The following provides you with information on property tax payments.

Property taxes in franklin county ohio. Wednesday January 20 2021. The median property tax on a 15530000 house is 259351 in Franklin County. Proposed Ohio law would allow counties to test fuel quality.

123 Main Parcel ID Ex. Search for a Property Search by. Tax bills are mailed each year in mid-December with payment due on or before January 20th or the first following business day if the 20th falls on a weekend or holiday.

Monday June 21 2021. Real Estate property taxes are due semi-annually each January 20th and June 20th. Please note you cannot use home equity line of credit checks or money market account to make an online payment.

The median property tax on a 15530000 house is 211208. Users of this data are notified that the primary information source should be consulted for verification of the information contained on this site. If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact the Franklin County Tax Appraisers office.

The Franklin County Board of Revision hears complaints against the valuations of manufactured or mobile home taxed like real property. Fees are 230 of total transaction for all credit cards Visa MasterCard Discover and American Express or 200 minimum. 7071 7076 7081 7086 7091 7096 7101 tax assessments.

Franklin County moving ahead with property reappraisal despite coronavirus. Debit card Visa will be a flat fee of 350. The Franklin County Treasurers Office wants to make paying your taxes as easy as possible.

The real estate tax collection begins with the assessment of the real estate parcels in Franklin County. The information on this web site is prepared from the real property inventory maintained by the Franklin County Auditors Office. If either January 20th or June 20th occurs on a weekend the due date will be changed to the next business day following the 20th.

Taxation of Real Property is Ohios oldest tax established in 1825 and is an ad valorem tax based on the value of the full market value of each property. Auditor Stinziano Announces Updated Ballot. The State Department of Taxation Division of Tax Equalization helps ensure uniformity and fairness in property taxation through its oversight of the appraisal work.

Franklin County auditor seeks delay on property value updates. The County assumes no responsibility for errors in the information and does not guarantee that the. The median property tax in Franklin County Ohio is 2592 per year for a home worth the median value of 155300.

Ohio law requires counties to revalue all real property every six years with an update at the three year midpoint as ordered by the Tax Commissioner of the State of Ohio. Franklin County collects on average 167. The Treasurers Office collects real estate taxes for the previous year during the current year.

Office Closed in Observance of Juneteenth. A state lawmaker announced legislation to cap annual property tax increases at five percent for households at or below their countys median income. The Auditors office handles a wide variety of important responsibilities that affect all of Franklin Countys residents and businesses.

Property valuation of Wichita Court Dublin OH. Please note that the Franklin County Treasurers Office collects real estate taxes for the previous year during the current year. Second-Half Real Estate Tax Payments Due.

Real Estate Tax. The Franklin County Auditors Office is a leader in public service and provides quality cost-effective information. The office licenses our dogs as required by.

FILE - A home in Franklin County Ohio. Residential property owners will also need the Residential Data Sheet to accompany the above complaint form. Office Closed in Observance of Memorial Day.

John Smith Street Address Ex. Get information on a Franklin County property and view your tax bill. And services to all Franklin County residents.

The Franklin County Treasurer makes every effort to produce and publish the most current and accurate information possible.

Franklin County Treasurer Tax Rates

Franklin County Treasurer Tax Rates

Find Out Where Your City Or Township Ranks For Property Tax Rates In Greater Cleveland Akron Area Cleveland Com

Franklin County Treasurer Property Search Property Search Franklin County Tax Reduction

Franklin County Treasurer Property Search Property Search Franklin County Tax Reduction

Franklin County Property Tax Records Franklin County Property Taxes Oh

Franklin County Property Tax Records Franklin County Property Taxes Oh

Map Of Warren County Ohio School Districts Google Search Warren County Warren Ohio Ohio

Map Of Warren County Ohio School Districts Google Search Warren County Warren Ohio Ohio

Equestrian Estate For Sale In Clermont County Ohio Gorgeous 7500 Sq Ft Sprawling Custom Log Cedar Estate On 15 Bluestone Patio Horse Property Gunite Pool

Equestrian Estate For Sale In Clermont County Ohio Gorgeous 7500 Sq Ft Sprawling Custom Log Cedar Estate On 15 Bluestone Patio Horse Property Gunite Pool

Horse Properties For Sale In Medina County Ohio This Extraordinary Horse Property Is Set Up For The Active Animal Love Horse Property Medina County Property

Horse Properties For Sale In Medina County Ohio This Extraordinary Horse Property Is Set Up For The Active Animal Love Horse Property Medina County Property

Franklin County Treasurer Tax Rates

Franklin County Treasurer Tax Rates

10 Things You Need To Know About Your Property Tax Bill Entertainment Life The Columbus Dispatch Columbus Oh

10 Things You Need To Know About Your Property Tax Bill Entertainment Life The Columbus Dispatch Columbus Oh

Franklin County Property Tax Records Franklin County Property Taxes Oh

Franklin County Property Tax Records Franklin County Property Taxes Oh

Franklin County Ohio Treasurer Payments

Franklin County Ohio Treasurer Payments

The Property Tax On My Eaton Ohio Home Is Increasing 14 Percent In 2018 I Knew The Rate Was Abnormal It S Roughly Twi Property Tax Preble County How To Plan

The Property Tax On My Eaton Ohio Home Is Increasing 14 Percent In 2018 I Knew The Rate Was Abnormal It S Roughly Twi Property Tax Preble County How To Plan

Find Out Where Your City Or Township Ranks For Property Tax Rates In Greater Cleveland Akron Area Cleveland Com

10 Things You Need To Know About Your Property Tax Bill Entertainment Life The Columbus Dispatch Columbus Oh

10 Things You Need To Know About Your Property Tax Bill Entertainment Life The Columbus Dispatch Columbus Oh

File Tn Williamson County Boundary Map Jpg Genealogy Williamson County Franklin Tennessee County

File Tn Williamson County Boundary Map Jpg Genealogy Williamson County Franklin Tennessee County

Stuff You Should Know Real Property Taxes In Ohio Waller Financial Planning Group

Stuff You Should Know Real Property Taxes In Ohio Waller Financial Planning Group

Equestrian Estate For Sale In Preble County Ohio This Property Offers A Casual Yet Stylish 9 000 Square Foot Estate W Property Country Estate Horse Property

Equestrian Estate For Sale In Preble County Ohio This Property Offers A Casual Yet Stylish 9 000 Square Foot Estate W Property Country Estate Horse Property

Ohio Homestead Exemption For Disabled Veterans Disabled Veterans Va Mortgage Loans Mortgage Loan Officer

Ohio Homestead Exemption For Disabled Veterans Disabled Veterans Va Mortgage Loans Mortgage Loan Officer

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home