Jackson County Ky Property Tax Bills

Payments may be made to the county tax collector or treasurer instead of the assessor. Last day for timely filing of abstracts listing forms extension requests and.

Https Www Ferc Gov Sites Default Files 2020 08 Cp15 88 000 Ea Pdf

Collect taxes provide security for local events issue summons responsible for maintaining order throughout the County.

Jackson county ky property tax bills. January 6 2021 - Unpaid 2020 property tax bills become delinquent 2 interest accrues additional 34 each month thereafter. Jackson County has one of the lowest median property tax rates in the country with only two thousand six hundred. Explanation of the Property Tax Process.

You may pay your bill by check money order or by cash if paying in person. Taxes are due for the entire amount assessed and billed regardless if property is no longer owned or has been moved from Jackson County. The courthouse will be closed until further notice starting 03182020.

Tax bills are mailed once a year with both installments remittance slips included Spring and Fall. However this material may be slightly dated which would have an impact on its accuracy. Taxes not paid in full on or before December 31 will accrue interest penalties and fees.

The 2020 Jackson County property tax due dates are May 10 2021 and November 10 2021. 058 of home value. Taxes Jackson County - GA makes every effort to produce and publish the most accurate information possible.

Paying Your Property Tax The Jackson County Tax Assessor can provide you with a copy of your property tax assessment show you your property tax bill help you pay your property taxes or arrange a payment plan. Henderson County Sheriffs Office 20 N Main St. If a tax bill is not received by December 10 contact the Collectors Office at 816-881-3232.

About the Taxes Taxes are a lien against the real estate and remains with. The Jackson County Treasurer has compiled the following resources to assist you with questions and inquiries related to tax information. Failure to receive a tax bill does not relieve the obligation to pay taxes and applicable late fees.

The Jackson County Tax Collector is responsible for collecting property tax from property owners. Current Tax Cycle PDF Delinquent Tax Collection PDF Hardship Guidelines and Application. No warranties expressed or implied are provided for the data herein its use or its.

No Reminder billing will be submitted for the Fall installment. Our office hours are Monday through Friday 800 am. Box 175 McKee Ky 40447 Office - 606 287-8562 Fax - 606 287-7190.

Payments must be received or federally postmarked by the deadline to avoid penalties. Taxes are assessed on personal property owned on January 1 but taxes are not billed until November of the same year. Yearly median tax in Jackson County.

They issue yearly tax bills to all property owners in Jackson County and work with the sheriffs office to foreclose on properties with delinquent taxes. These records can include Jackson County property tax assessments and. The Tax Collector may use enforced collections to secure payment of 2020 property tax bills.

Contact Information Local Government PO. Please contact the Johnson County Clerk at 606-789-2557 to request a payoff amount for delinquent real property tax bills or the Johnson County Attorneys Office at 606-789-8232 to request a payoff amount for delinquent tangible and intangible tax bills. 3 rows Jackson County Property Tax Payments Annual Jackson County Kentucky.

Property Valuation Administrator PVA Paul Rose PO. The address to the Sheriffs Office is listed below. Box 249 McKee KY 40447 606 287-7634 Office 606 287-7079 Fax.

Lafayette St Suite 107 PO Box 697Marianna FL 32447 850-482-9653 FAX850-526-3821 Monday - Friday 800am-400pm CST Map It. January 5 2021 Last day to pay 2020 property tax bills. January 31 2021 - Last day of the 2021 listing period.

Jackson County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Jackson County Kentucky. Suite 112 Henderson KY 42420. The median property tax in Jackson County Kentucky is 377 per year for a home worth the median value of 64700.

In an effort to assist property owners understand the administration of the property tax in Kentucky this website will provide you with information that explains the various components of the property tax system. Jackson County collects on average 058 of a propertys assessed fair market value as property tax. If you have taxes that need to be paid we recommend you mail them to the Sheriffs Office.

Any errors or omissions should be reported for investigation. We are closed New Years Day Memorial Day Independence Day. The Tax Commissioners Office in Jefferson is the only location in Jackson County for handling motor vehicle transactions and the billing and collecting of mobile home timber and property taxes for the County.

Mississippi Property Tax Calculator Smartasset

Mississippi Property Tax Calculator Smartasset

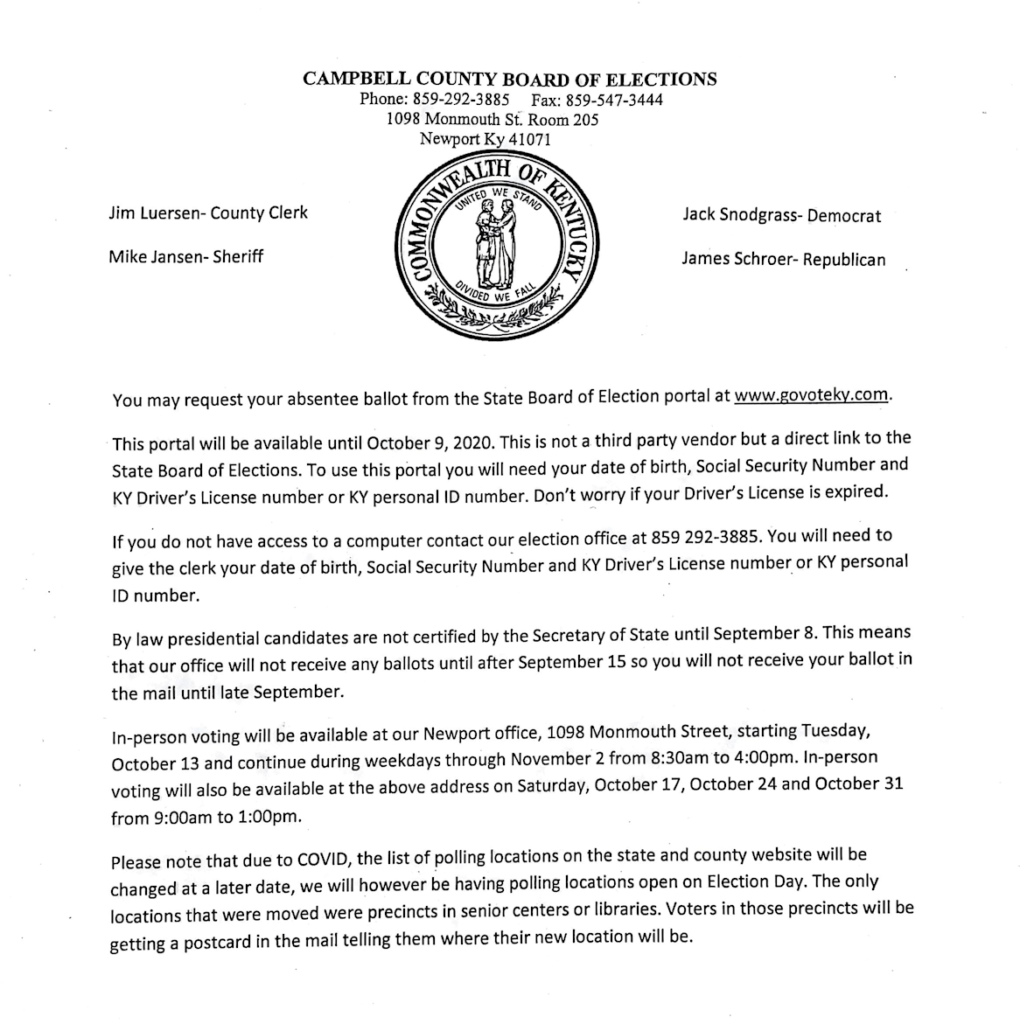

Mike Jansen Campbell County Sheriff S Office

Mike Jansen Campbell County Sheriff S Office

Mike Jansen Campbell County Sheriff S Office

Mike Jansen Campbell County Sheriff S Office

Mike Jansen Campbell County Sheriff S Office

Mike Jansen Campbell County Sheriff S Office

Https Www Kybar Org Resource Resmgr Klu Materials Klu 2012 Book Basic Pdf

Holton Kansas Ks 66436 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Mike Jansen Campbell County Sheriff S Office

Mike Jansen Campbell County Sheriff S Office

Https Www Ok Gov Tax Documents Tes 14 Pdf

Double Shooting Under Investigation In Fairplain Wv Metronews

Double Shooting Under Investigation In Fairplain Wv Metronews

Mississippi Property Tax Calculator Smartasset

Mississippi Property Tax Calculator Smartasset

Three Newly Confirmed Covid 19 Cases In Jackson County Today July 01 2020 Covid19 Nolangroupmedia Com

Three Newly Confirmed Covid 19 Cases In Jackson County Today July 01 2020 Covid19 Nolangroupmedia Com

Holton Kansas Ks 66436 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Https Www Ferc Gov Sites Default Files 2020 08 Cp15 88 000 Ea Pdf

Https Chfs Ky Gov Agencies Dcbs Dfs Documents Omvoliva Pdf

/images/logo.gif)

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home