How To Find My Personal Property Tax Receipt Virginia

Steps to viewprint property tax payment information. There is no service fee for e-check payment.

However a service fee is charged for the use of a creditdebit card.

How to find my personal property tax receipt virginia. Select Yes I accept. Declare Your Personal Property Declare your personal property online by mail or in person by April 1st and avoid a 10 assessment penalty. This is an annual tax routinely payable on June 5 of each year in any of the City Treasurers four offices.

Personal Property Tax also known as a car tax is a tax on tangible property - ie property that can be touched and moved such as a car or piece of equipment. Personal Property Tax Bills. Pay personal property taxes by e-Check or credit carddebit card using our online payment vendor NIC Virginia.

Barbour Berkeley Boone Braxton Brooke Cabell Calhoun Clay Doddridge Fayette Gilmer Grant Greenbrier. Select the information requested from. Click on the Online Services tab at the top of the website.

Tax Waiver Statement of Non-Assessment How to obtain a Statement of Non-Assessment Tax Waiver. Personal property taxes and real estate taxes are local taxes which means theyre administered by cities counties and towns in Virginia. 2401 Courthouse Drive Virginia Beach VA 23456.

Find out how to pay your property taxes. Personal Property taxes are due on June 5th annually. Click on the link for Personal PropertyMVLT and Real Estate.

All property must first be registered with the Virginia Department of Motor Vehicles DMV. Property Tax Rulings When the owner of property and the county assessor disagree over the classification of property or the taxability of property the question may be submitted to the Tax Commissioner for ruling as provided in West Virginia Code 11-3-24a. The assessment on these vehicles is.

A vehicle has situs for taxation in the county or if it is registered to a county address with the Virginia Department of Motor Vehicles. When you use this method to pay taxes please make a separate payment per tax account number. The tax rate is 400 per hundred dollars of the assessed value.

The daily rental property tax is collected by businesses that derive at least 80 percent of their rental receipts excluding the rental of vehicles licensed by the state from rental of personal property for 92 consecutive days or less. You can pay your personal property tax through your online bank account. The current percentage reduction for personal property tax relief is 538 for the 2018 tax year.

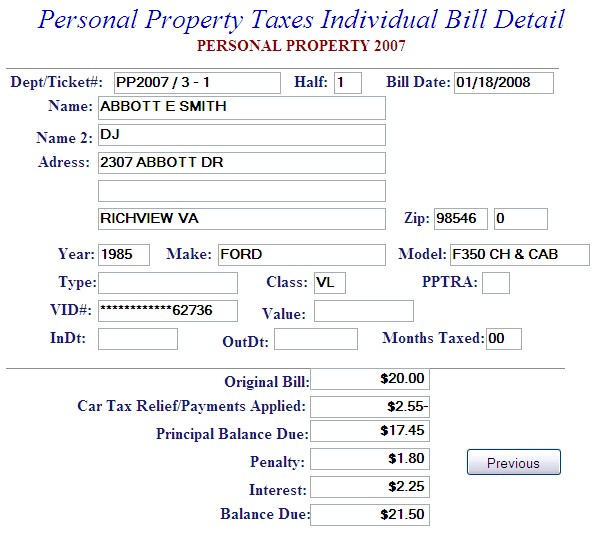

Chesterfield County levies a tax each calendar year on personal property with situs in the county. For an estimate of the tax on your vehicle contact the Personal Property Division of the Commissioners office. This bill will contain only the current year taxes due.

Use the map below to find your city or countys website to look up rates due dates payment information and. It is an ad valorem tax meaning the tax amount is set according to the value of the property. Select the Tax Bill Payment option which is the 6 th option.

Tax rates differ depending on where you live. Prorate of personal property tax began January 1 1991 on all vehicles with the exception of aircraft and boats. Personal property must then be registered with the.

Personal Property Tax Links. Personal Property Tax Rate. As of 1998 assessments are based on the loan value of.

Please use the convenie nt personal property calculator to estimate your tax due. The only exception to this is for boats which must be registered with the Virginia Department of Wildlife Resources DWR or the US. View personal property taxes currently due on your vehicles.

Providing efficient friendly service to the citizens of Bedford County is our highest priority offering customer service Monday through Friday 830 am. Personal Property taxes are assessed at the local tax rates by the Commissioner of the Revenue. West Virginia Code For more information please call 1-800-642-9066 West Virginia residents only.

The original witnessed or notarized document must be submitted to the Virginia Beach City Treasurer only at the following location. Passenger vehicles recreational vehicles boats heavy trucks and trailers are taxed. For additional information related to our third-party processor service fees please visit DTA Service Fees.

If you have any delinquent taxes due on that account the message shown below will appear on your bill. Division of Motor Vehicles Vehicles Registrations Personal Property Tax Links. The Tax Commissioner must issue a ruling by the end of February of the calendar tax year.

Also if it is a combination bill please include both the personal property tax amount and VLF amount as a grand total for each tax account number. Property Assessment Appeals Information on how to appeal your Property Assessment from the Assessors Office. Personal property taxes are due May 5 and October 5.

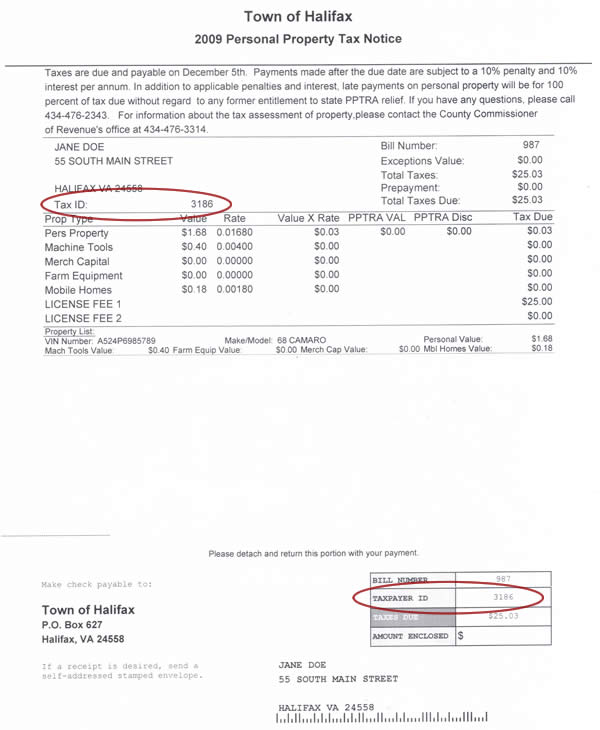

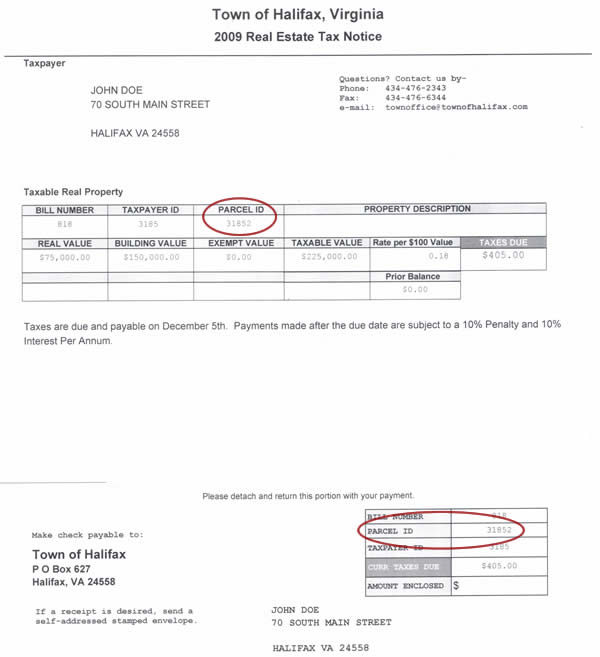

The County Treasurers is responsible for collecting all real estate and personal property taxes for the county school districts municipalities. Personal Property Tax bills are white in color with blue boxes and are mailed at least 30 days prior to the due date. The West Virginia Division of Motor Vehicles has enabled this service to allow you to Renewal Your Vehicle Registration Check Your Drivers License Status Search for.

If you have questions about personal property tax or real estate tax contact your local tax office. Refund checks if applicable will be mailed to the business address indicated by and on.

Pay Personal Property Tax Help

Pay Personal Property Tax Help

Understanding Your Property Tax Bill Department Of Taxes

Understanding Your Property Tax Bill Department Of Taxes

Other Payment Options Chesterfield County Va

Pay Personal Property Tax Help

Pay Personal Property Tax Help

Pay Personal Property Tax Help

Pay Personal Property Tax Help

Download Print Tax Receipt Clay County Missouri Tax

Download Print Tax Receipt Clay County Missouri Tax

Understanding Your Property Tax Bill Department Of Taxes

Understanding Your Property Tax Bill Department Of Taxes

Real Estate Tax Frequently Asked Questions Tax Administration

Real Estate Tax Frequently Asked Questions Tax Administration

How To Use The Property Tax Billing Portal Clay County Missouri Tax

How To Use The Property Tax Billing Portal Clay County Missouri Tax

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home