Denver Property Tax Homestead Exemption

Property Tax Exemption Available Opportunities Currently there are two types of property tax exemptions available certain residents of Adams County. The exemption which takes the form of a credit on property tax bills allows qualifying homeowners to exempt up to 25000 of the market value of their homes from all local property taxes.

Http Www Co Teller Co Us Assessor Seniorpropexemptionshortform1 Pdf

Owned their home for at least 10 consecutive years prior to January 1 and.

Denver property tax homestead exemption. Colorado Senior Property Tax Exemption Disabled Veterans Property Tax Exemption. 1 the qualifying senior must be at least 65 years old on January 1 of the year of application. Occupied it as their primary residence for at least 10 consecutive years prior to January 1.

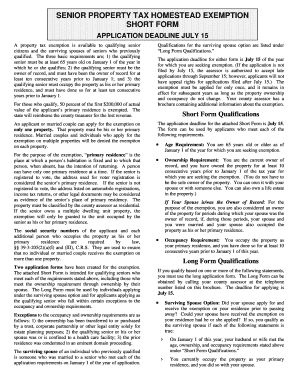

The three basic requirements are. Your property tax bill would equal 2000. SENIOR PROPERTY TAX HOMESTEAD EXEMPTION A property tax exemption is available to qualifying senior citizens and the surviving spouses of those who previously qualified.

1 the qualifying senior must be at least 65 years old on January 1 of the year in which he or she qualifies. A property tax exemption is available to qualifying senior citizens and the surviving spouses of seniors who previously qualified. 1 the qualifying senior must be at least 65 years old on January 1 of the year in which he or she qualifies.

Property Tax Exemption A property tax exemption is available to qualifying senior citizens and the surviving spouses of seniors who previously qualified. The homestead exemption is 105000 if the homeowner his or her spouse or dependent is disabled or 60 years of age or older. Additional exemptions might be available for farmland green space veterans or others.

PROPERTY TAX EXEMPTION FOR SENIORS City County of Denver Assessment Division CONFIDENTIAL 201 W Colfax Ave Dept 406 15-DPT-AR Denver CO 80202 1. 2 he or she must be. 1 of the year you apply are age 65 or older and have owned and lived in your home as your primary residence for 10 consecutive years or more.

For example through the homestead exemption a home with a market. The three basic requirements are. Senior Property Tax Homestead Exemption.

A property tax exemption is available to qualifying senior citizens and the surviving spouses of seniors who previously qualified. The three basic requirements are. Homestead Exemptions The Denver County Tax Assessor can provide you with an application form for the Denver County homestead exemption which can provide a modest property tax break for properties which are used as the primary residence of their owners.

1 The qualifying senior must be at least 65 years old on January 1 of the year in which he or. Complete the form and email mail or fax to the Assessment Division. There are three basic requirements to qualify.

Identification of Applicant and Property 2. The Colorado legislature controls the amount of the exemption. The three basic requirements are.

1 the qualifying senior must be at least 65 years old on January 1 of the year in which he or she qualifies. Under the Colorado exemption system homeowners can exempt up to 75000 of their home or other property covered by the homestead exemption. A property tax exemption is available for Colorado residents who by Jan.

201 W Colfax Ave Dept 406. To change the mailing address of the owner for real property owned in Denver. 2 the qualifying senior must be the.

To keep things simple lets say the assessed value of your home is 200000 and your property tax rate is 1. This exemption is limited to the fair cash value up to an annual maximum of 75000 or 25000 in assessed value which is 33 13 percent of fair cash value that was added to homestead property by any new improvement eg remodeling adding a new room or rebuilding after a catastrophic event and continues for four years from the date the improvement or rebuilding is completed and occupied. Applicants First Name Middle Initial and Last Name Social Security Number Date of Birth.

PROPERTY TAX EXEMPTION FOR SENIORS City County of DenverAssessment Division CONFIDENTIAL. For those who qualify 50 percent of the first 200000 of the actual value of the property is exempted. All taxable business personal and real estate property within Denver is subject to 74195 mills for 2020 taxes due in 2021.

For qualified seniors to claim senior property tax homestead exemption. SENIOR PROPERTY TAX HOMESTEAD EXEMPTION A property tax exemption is available to qualifying senior citizens and the surviving spouses of seniors who previously qualified. If the property is located within a special district local maintenance district or business improvement district additional taxes are levied upon the property.

But if you were eligible for a homestead tax exemption of 50000 the taxable value of your home would drop to 150000 meaning your tax bill would drop to 1500. Age and Occupancy Requirements One of the following statements must be true SE-001-0717 Phone. Identification of Applicant and Property.

Inequities In Colorado S Senior Homestead Property Tax Exemption Colorado Fiscal Institute

Inequities In Colorado S Senior Homestead Property Tax Exemption Colorado Fiscal Institute

Inequities In Colorado S Senior Homestead Property Tax Exemption Colorado Fiscal Institute

Inequities In Colorado S Senior Homestead Property Tax Exemption Colorado Fiscal Institute

Senior Property Tax Exemption Event Resources Colorado Senior Lobby

Senior Property Tax Exemption Event Resources Colorado Senior Lobby

Https Www Jeffco Us Documentcenter View 616 Senior Property Tax Exemption Long Form Pdf

Colorado May Be Losing Millions In Bogus Senior Property Tax Breaks The Denver Post

Colorado May Be Losing Millions In Bogus Senior Property Tax Breaks The Denver Post

Inequities In Colorado S Senior Homestead Property Tax Exemption Colorado Fiscal Institute

Inequities In Colorado S Senior Homestead Property Tax Exemption Colorado Fiscal Institute

Https Www Jeffco Us Documentcenter View 617 Senior Property Tax Exemption Short Form Pdf

Inequities In Colorado S Senior Homestead Property Tax Exemption Colorado Fiscal Institute

Inequities In Colorado S Senior Homestead Property Tax Exemption Colorado Fiscal Institute

Assessor Denvergov Org Fill Online Printable Fillable Blank Pdffiller

Assessor Denvergov Org Fill Online Printable Fillable Blank Pdffiller

Inequities In Colorado S Senior Homestead Property Tax Exemption Colorado Fiscal Institute

Inequities In Colorado S Senior Homestead Property Tax Exemption Colorado Fiscal Institute

Homestead Exemption In Colorado Colorado Real Estate

Homestead Exemption In Colorado Colorado Real Estate

Https Www Denvergov Org Content Dam Denvergov Portals 344 Documents Financial Reports Property Tax Dist Info Pdf

Inequities In Colorado S Senior Homestead Property Tax Exemption Colorado Fiscal Institute

Inequities In Colorado S Senior Homestead Property Tax Exemption Colorado Fiscal Institute

Https Www Colorado Gov Pacific Sites Default Files Instructions 20for 20senior 20property 20tax 20homestead 20exemption 20long 20form Pdf

Http Www Co Teller Co Us Assessor Seniorpropexemptionshortform1 Pdf

Colorado S Low Property Taxes Colorado Fiscal Institute

Colorado S Low Property Taxes Colorado Fiscal Institute

Homestead Exemption In Colorado Colorado Real Estate

Homestead Exemption In Colorado Colorado Real Estate

Inequities In Colorado S Senior Homestead Property Tax Exemption Colorado Fiscal Institute

Inequities In Colorado S Senior Homestead Property Tax Exemption Colorado Fiscal Institute

Colorado S Low Property Taxes Colorado Fiscal Institute

Colorado S Low Property Taxes Colorado Fiscal Institute

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home