How Do I Apply For Homestead Exemption In Lee County Florida

Start by gathering the required documents including a Florida drivers license or ID card vehicle registration if you drive social security card or a document with your number on it a copy of your deed tax bill and Notice of. Homestead Exemptions are handled by the Property Appraisers office Call 239-533-6100 for more information.

The property appraiser has a duty to put a tax lien on your property if you received a homestead exemption.

How do i apply for homestead exemption in lee county florida. Your application you may file a petition with the countys value adjustment board. Florida Voters ID if you vote Immigration documents if not a US. When applying the homeowner must present.

Can the Clerks Office provide legal advice. 3 Oversee property tax administration involving 109. The Department of Revenueswebsite has more information about property tax benefits for homestead properties.

The legal description of property. If you meet ALL of the criteria below. The first 25000 of this exemption applies to all taxing authorities.

1 Administer tax law for 36 taxes and fees processing nearly 375 billion and more than 10 million tax filings annually. See if you are eligible for and apply for portability of some or all of your benefit. Welcome to the Lee County Property Appraisers Office on-line filing for Homestead Exemption.

Card may be used in lieu of a drivers license if the homeowner does not have a drivers license. Contact your local property appraiser if you have questions about your exemption. Only new applicants or those who had a change of residence are required to apply.

Florida Department of Revenue - The Florida Department of Revenue has three primary lines of business. When qualifying for the Homestead Exemption you will need the following documents for all property owners applying. How do I file for Homestead Exemption.

A valid Florida drivers license. Florida Drivers License or Florida ID if you do not drive. Apply for Homestead and other exemptions.

Homeowners may claim up to a 50000 exemption on their primary residence. There are two ways to apply depending on certain criteria. First-time applications for homestead exemption and widow widower or disability exemptions must be filed with the Property Appraiser by March 1st of the tax year.

Property tax exemptions including homestead exemptions. It is granted to those applicants with legal or beneficial title in equity to real property as recorded in official records who are bona fide Florida residents living in a dwelling and making it their permanent home on January 1 of the taxable year. Signature property appraiser or deputy Date Entered by Date.

Documents should reflect the address of your homesteaded property. To better serve the residents of Lee County we are now accepting Homestead Exemption applications by mail. If you have any questions regarding Homestead Exemption applicationsfiling please contact us at 888 721-0510 or via email.

Homestead Exemption Application can now be made Online. Already a homeowner in Florida with a Homestead exemption. Filing for the Homestead Exemption can be done online.

Initial application should be made in person at the property appraisers office. The letter of instruction and application form may be obtained by visiting our website at. File the signed application for exemption with the county property appraiser.

Floridas constitution provides for a 25000 exemption which is deducted from a propertys assessed value if the owner qualifies. No the Clerks Office is expressly prevented from providing legal advice by. The second 25000 excludes school board taxes and applies to.

Homestead Exemption Application can also be made by mail. To be eligible for the exemption this tax year an owner must file an Application for Homestead and related documents with the County Property Appraiser no later than March 1 2015. Download the Portability Application form DR 501T Download the Homestead Exemption Removal Request form.

Generally initial application for property tax exemption must be made between January 1 and March 1 of the year for which the exemption is sought. PROPERTY TAX EXEMPTION FOR HOMESTEAD PROPERTY. Homestead exemption is a constitutional benefit of a 50000 exemption from the propertys assessed value.

If youre planning to claim a homestead exemption you must first apply for a Florida drivers license. Carefully review the requirements described below and select the application process that applies to you. Download the Request Benefit of Save Our Homes on Parcel Contiguous to Homestead Property form.

2 Enforce child support law on behalf of about 1025000 children with 126 billion collected in FY 0607. For more information see Petitions to the Value Adjustment Board. You can apply for a homestead exemption in Florida if the property is your official permanent residence and if you have legal or beneficial title in the property.

If you prefer to apply in person you may do so at our Main Office located at 2480 Thompson Street 4th floor Fort Myers Florida between the hours of 830 am. Sign up to receive mailings and notifications from the Property Appraiser.

Https Leepa Org Webforms Faq Foreclosure Listing Pdf

Inspector General Hotline Lee County Clerk Of Court Fl

Homestead Deadline Approaching For Lee County Landowners The Legal Scoop On Southwest Florida Real Estate

Homestead Deadline Approaching For Lee County Landowners The Legal Scoop On Southwest Florida Real Estate

Lee County Florida Property Search And Interactive Gis Map

Lee County Florida Property Search And Interactive Gis Map

Lee County Property Appraiser How To Check Your Property S Value

Lee County Property Appraiser How To Check Your Property S Value

Lee County Government Further Expands Closures Makes Adjustments To Help Mitigate Virus Spread And Reflect Governor S Order Village Of Estero Fl

Lee County Government Further Expands Closures Makes Adjustments To Help Mitigate Virus Spread And Reflect Governor S Order Village Of Estero Fl

Https Www Leepa Org Webforms Faq Trimguide Pdf

Lee County Florida Homestead Exemption Steelbridge Realty Llc

Lee County Florida Homestead Exemption Steelbridge Realty Llc

Lee County New Va Heathcare System In Cape Coral Realtor Ron W

Lee County New Va Heathcare System In Cape Coral Realtor Ron W

.jpg?sfvrsn=9281406a_4) News Important Information Lee County Tax Collector

News Important Information Lee County Tax Collector

Home Buyer Tip Research With Lee County Property Line Greater Fort Myers Real Estate

Florida Homestead Exemption Lee County Property Appraiser Fort Myers Real Estate Youtube

Florida Homestead Exemption Lee County Property Appraiser Fort Myers Real Estate Youtube

Lee County Chamber Florida Area Information Dmv Department Of Motor Vehicles Schools Courts

Lee County Chamber Florida Area Information Dmv Department Of Motor Vehicles Schools Courts

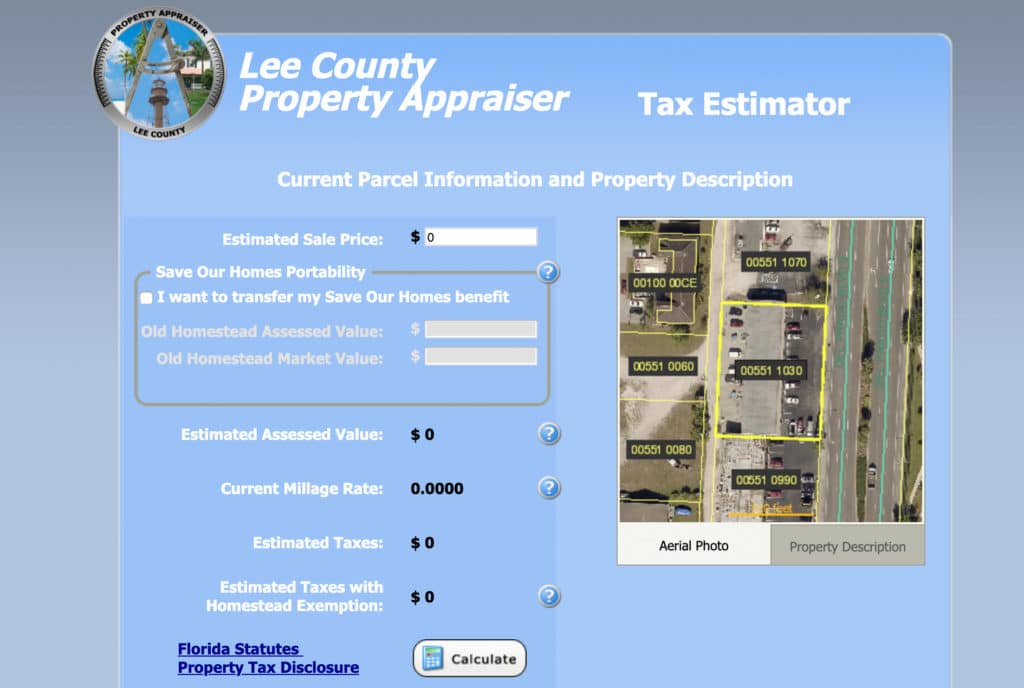

Lee County Florida Property Tax Estimator Property Walls

Lee County Florida Property Tax Estimator Property Walls

Https Www Leegov Com Dcd Documents Agendas Bcc 2017 06 Jun212017 Pdf

Https Leepa Org Docs Datamapservicesprices Pdf

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home