Gwinnett County Property Tax Bill Search

Steps to search for additional property information and sales in your neighborhood. Enter number and name do not put Street Road Drive Way etc.

Gwinnett County Ga Hallock Law Llc Property Tax Appeals

Gwinnett County Ga Hallock Law Llc Property Tax Appeals

The county board of tax assessors must send an annual notice of assessment which gives the taxpayer information on filing a property tax appeal on real property such as land and buildings affixed to the land.

Gwinnett county property tax bill search. Interest on unpaid tax bills will be applied in accordance with Georgia Code 48-2-40. Tax Summary request for multiple parcels - If you know the complete parcel IDs of the properties you are looking for this feature provides an efficient way of looking up your Tax Bills and Detailed Tax Summaries. Penalties on unpaid taxes will be.

R8001 001 or R8001 A 001 OR Property Owner Name OR Property Address. Gwinnett County GA Property Tax Search by Address. In-depth Property Tax Information.

Click on the. The new Economic Development tax is 03 mills. If the county board of tax assessors disagrees with the taxpayers return on personal property such as airplanes boats or business.

Enter as it appears on bill including spaces ex. If you are submitting your return by mail metered mail will not be accepted as proof of a timely property tax return. The tax commissioner is required to send a bill to whoever owned the property on January 1 and also to the new owner if the property was sold later that year.

To apply for the Senior Citizen Tax Abatement download the application and submit the required documentation to the GGA Tax Department. Search For a Tax Bill - This feature allows you to search for a tax bill or bills using a complete or partial parcel ID account number or physical address. If the taxes for the year in which the property was sold go unpaid a.

The tax commissioner does not prorate taxes between buyer and seller. Serving also as an agent for the state of Georgia the tax commissioner registers and titles motor vehicles and disburses associated revenue. Porter is a Constitutional Officer elected to bill collect and disburse personal and property taxes and to administer homestead exemptions.

Steeles office will begin mailing out tax bills on Thursday. Pay Water Bill Online. This should be handled at the closing as well.

Prevention and Enforcement Fire. Gwinnett County Tax Commissioner Richard Steele appears in a video to explain changes on this years property tax bill. For property details go to the Tax Assessor page and open the Property Information Map Search link.

This responsibility falls to the Tax Assessors office which answers to the Board of Tax Assessors and the Gwinnett County Board of Commissioners. Enter one of the following in the search box above. See Gwinnett GA tax rates tax exemptions for any property the tax assessment history for the past years and more.

In addition you can make a payment via creditdebit card or e-check on your property. Gwinnett County Tax Commissioner Tiffany P. Your Parcel Number example.

You can easily locate any street address or intersection in the county print or email your map or create a URL so others can easily go to the same data. In-depth Property Tax Information. The Tax Commissioner is authorized to bill collect and disburse taxes.

This tax funds the Development Authority of Gwinnett County according to the Board of Commissioners BOC. Tax Bills Property tax bills are mailed out September 15 of each year and due 60 days from the mailing of the bills which is November 15. Gwinnett GA Property Tax Search by Address.

Click on the Search box. 2 hours agoOne of the Gwinnett cities that was involved in a flap over proposed costs to have the county do its property tax billing has made the decision to bring that service in-house starting this fall. See what the tax bill is for any Gwinnett GA property by simply typing its address into a search bar.

Harrison County Courthouse 200 West Houston Suite 108 PO Box 967 Marshall Texas 75671 903-935-8411 903-935-5564 fax. See what the tax bill is for any Gwinnett County GA property by simply typing its address into a search bar. Gwinnett County GA Property Tax information.

This tool allows you to see the value you receive in services for the property taxes you pay to Gwinnett County government. Click on the name of the owner underlined in blue text from the returned search results to view comparable sales and additional information for the property. The Tax Commissioner does not determine property value for taxation purposes and has no authority over that process.

Select this option if you would like to search for a specific property within Gwinnett County to see how property taxes are used to fund. See Gwinnett County GA tax rates tax exemptions for any property the tax assessment history for the past years and more. For more information contact the BOC at 770-822-7000.

Gwinnett County Ga Hallock Law Llc Property Tax Appeals

Gwinnett County Ga Hallock Law Llc Property Tax Appeals

Gwinnett Sends Out Property Tax Bills News Gwinnettdailypost Com

Gwinnett Sends Out Property Tax Bills News Gwinnettdailypost Com

Horry County Property Tax Search Horry County Property Search

Horry County Property Tax Search Horry County Property Search

How To Redeem A Tax Deed In Georgia Gomez Golomb Law Officepersonal Injury Attorney In Atlanta Ga Gomez Golomb Law

How To Redeem A Tax Deed In Georgia Gomez Golomb Law Officepersonal Injury Attorney In Atlanta Ga Gomez Golomb Law

Douglas County Assessor Property Tax Search Douglas County Assessor Property Search

Douglas County Assessor Property Tax Search Douglas County Assessor Property Search

Gwinnett County Tax Commissioner Property Search Property Walls

Http Www Gwinnettassessor Manatron Com Linkclick Aspx Fileticket Fby6b8vijhc Tabid 464

San Diego County Public Records Public Records San Diego Records

San Diego County Public Records Public Records San Diego Records

How To Appeal Property Taxes Atlanta Georgia

How To Appeal Property Taxes Atlanta Georgia

Gwinnett County Tax Assessor Property Search By Address Gwinnett County Ga Tax Assessor Property Search

Gwinnett County Tax Assessor Property Search By Address Gwinnett County Ga Tax Assessor Property Search

Prince William County Property Search Will County Property Search

Prince William County Property Search Will County Property Search

Https Www Gwinnettcounty Com Static Departments Planning Pdf Gis Browser Parcel Location Guide Pdf

Hillsborough County Public Records Property Search Hillsborough County Fl Property Records Search

Hillsborough County Public Records Property Search Hillsborough County Fl Property Records Search

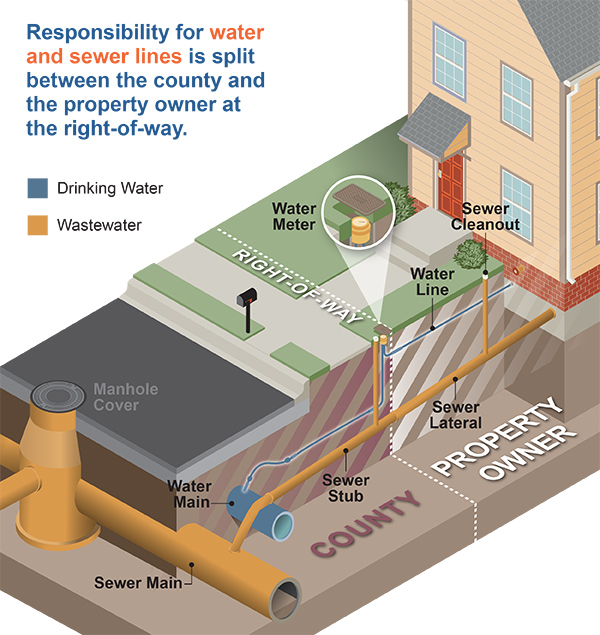

Resident Responsibility Gwinnett County

Resident Responsibility Gwinnett County

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home