Kern County Ca Property Tax Bill Search

The information provided on and obtained from this site does not constitute the official record of Kern County Superior Court. To begin your search for information please select Accept below.

![]() Social Archives Fractracker Alliance

Social Archives Fractracker Alliance

Visit MyTurncagov or call 833 422-4255 to get notified when its your turn to make an appointment to get vaccinated against COVID-19.

Kern county ca property tax bill search. Mailed payments must be postmarked no later than April 10 2021. Kern County property taxes are based on the assessed value of a given property as determined by the County Assessor. Please enable cookies for this site.

Supplemental Tax Bill Info. The Kern County Treasurer-Tax Collector maintains a useful tool for estimating supplemental tax bills. Before making a formal appeal you are advised to contact the County Assessor at 661-868-3485 to verify the propertys assessed value.

If you disagree with the value assigned to your property by the Assessors office you may appeal that value to the Assessment Appeals Board. Kern County CA Property Tax information. In-depth Property Tax Information.

Kern County is actively responding to COVID-19. Penalty Cancellation Form New Requirements for COVID-19 Related Penalty Cancellations. See Kern County CA tax rates tax exemptions for any property the tax assessment history for the past years and more.

Revenue Taxation Codes. Kern County CA Property Tax Search by Address. See what the tax bill is for any Kern County CA property by simply typing its address into a search bar.

This information is provided as a service to the general public. Avoid Penalties by Understanding Postmarks. Visit the dashboard for updated information.

The Assessor is committed to producing a correct assessment roll for all Kern County property owners. Any user of this information is hereby advised that it is being provided as is. On July 1 1983 California State law was changed to require the reassessment of property following a change of ownership or the completion of new construction.

This reassessment may result in one or more supplemental tax bills being mailed to the assessed owner in addition to the annual property tax bill. Why Are My Taxes So High. If your Notice of Supplemental Assessment indicates a net increase and the resulting bill exceeds 450 a Supplemental Tax Bill.

This Executive Order mandated that tax collectors cancel late penalties on delinquent property taxes if the delinquency is due to the impacts of COVID-19 and if the property meets certain criteria. Please select your browser below to view instructions. Visit MyTurncagov or call 833 422-4255 to get notified when its your turn to make an appointment to get vaccinated against COVID-19.

If you have the bill number you can search for it directly. Kern County Treasurer-Tax Collector Tax Records Report Link httpwwwkcttccokerncauspaymentmainsearchaspx Search Kern County Treasurer-Tax Collector tax bills by assessor tax number file number bill number or address. The maps available through this search were prepared for Assessment purposes only and do not indicate either parcel legality or a valid building site.

The Parcel Map Search and Recent Sales Search services are provided by a third party and is not maintained or warranted by the County of Kern. COVID-19 Impact to Property Taxes FAQs. Request a Mobile Home Tax Clearance Certificate Online.

Tax Collection and Licensing. The Kern County Treasurer-Tax Collector has a helpful tool for calculating your potential bill or refund resulting from a property transfer or new construction. Secured Tax Collection Statistics.

Kern County is actively responding to COVID-19. You are not required to enter the check digit 12th digit of the bill number for the search to work. Finance 700 H Street Room 1710 First Floor Sacramento CA 95814 916-874-6622 or e-mail.

The offices of the Assessor-Recorder Treasurer-Tax Collector Auditor-Controller-County Clerk and the Clerk of the Board have prepared this property tax information site to provide tax payers with an overview of the property tax process in Kern County. On May 6 2020 the Governor of the State of California issued Executive Order N-61-20. Lake County Tax Collector 255 N Forbes Street Rm 215 Lakeport CA 95453.

Visit the dashboard for updated information. When will I receive my supplemental bill. Cookies need to be enabled to alert you of status changes on this website.

Below is a link to the Kern County COVID-19 Penalty Waiver Request Form with instructions. View the E-Prop-Tax page for more information. If a match is found you are presented with the Bill Summary page that displays information about this bill.

This does not include personal unsecured property tax bills issued for boats business equipment aircraft etc. You must enter at least the first 11 digits of the bill number.

Kern County Treasurer And Tax Collector

Kern County Treasurer And Tax Collector

San Diego County Property Tax Records San Diego County Property Taxes Ca

San Diego County Property Tax Records San Diego County Property Taxes Ca

Antelope Valley 056 736 W Rancho Vista Blvd Palmdale Ca 93551 661 224 1988 Dunn Edwards Paint Storing Paint Shopping Mall Design

Antelope Valley 056 736 W Rancho Vista Blvd Palmdale Ca 93551 661 224 1988 Dunn Edwards Paint Storing Paint Shopping Mall Design

California Property Taxes Explained Big Block Realty

California Property Taxes Explained Big Block Realty

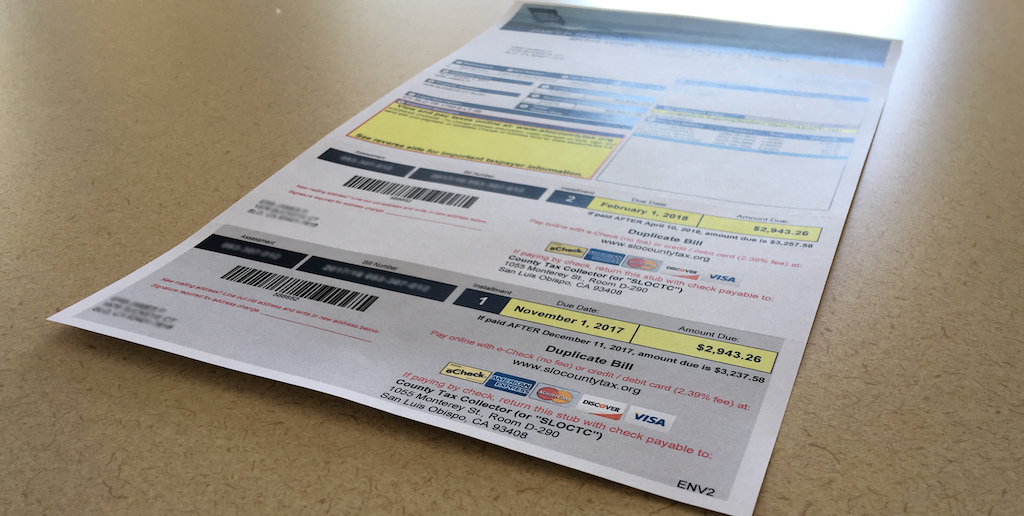

New Program Allows Taxpayers Pay Annual Property Taxes In Monthly Installments County Of San Luis Obispo

New Program Allows Taxpayers Pay Annual Property Taxes In Monthly Installments County Of San Luis Obispo

6100 Frank J Fletcher St Bakersfield Ca 93304 Realtor Com

6100 Frank J Fletcher St Bakersfield Ca 93304 Realtor Com

6313 Baguette Ave Bakersfield Ca 93313 Realtor Com

6313 Baguette Ave Bakersfield Ca 93313 Realtor Com

Kern County Property Tax Records Kern County Property Taxes Ca

Kern County Property Tax Records Kern County Property Taxes Ca

6313 Declaration Way Bakersfield Ca 93313 Realtor Com

6313 Declaration Way Bakersfield Ca 93313 Realtor Com

Riverside County Property Tax Records Riverside County Property Taxes Ca

Riverside County Property Tax Records Riverside County Property Taxes Ca

Santa Barbara County Property Tax Records Santa Barbara County Property Taxes Ca

Santa Barbara County Property Tax Records Santa Barbara County Property Taxes Ca

Kern County Property Tax Records Kern County Property Taxes Ca

Kern County Property Tax Records Kern County Property Taxes Ca

1602 Spanke St Bakersfield Ca 93312 Realtor Com

1602 Spanke St Bakersfield Ca 93312 Realtor Com

Kern County Property Tax Records Kern County Property Taxes Ca

Kern County Property Tax Records Kern County Property Taxes Ca

416 Bill Ave Bakersfield Ca 93304 Realtor Com

416 Bill Ave Bakersfield Ca 93304 Realtor Com

Santa Barbara County Property Tax Records Santa Barbara County Property Taxes Ca

Santa Barbara County Property Tax Records Santa Barbara County Property Taxes Ca

San Diego County Property Tax Records San Diego County Property Taxes Ca

San Diego County Property Tax Records San Diego County Property Taxes Ca

Sonoma County Property Tax Records Sonoma County Property Taxes Ca

Sonoma County Property Tax Records Sonoma County Property Taxes Ca

San Diego County Property Tax Records San Diego County Property Taxes Ca

San Diego County Property Tax Records San Diego County Property Taxes Ca

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home