Personal Property Tax Per State

A personal property tax is imposed by state or local tax authorities based on the value of an item of qualifying property. For instance as of 2015 in Missouri the personal property tax rate is 335 for most types of person property except mobile homes which are taxed at a rate of 19.

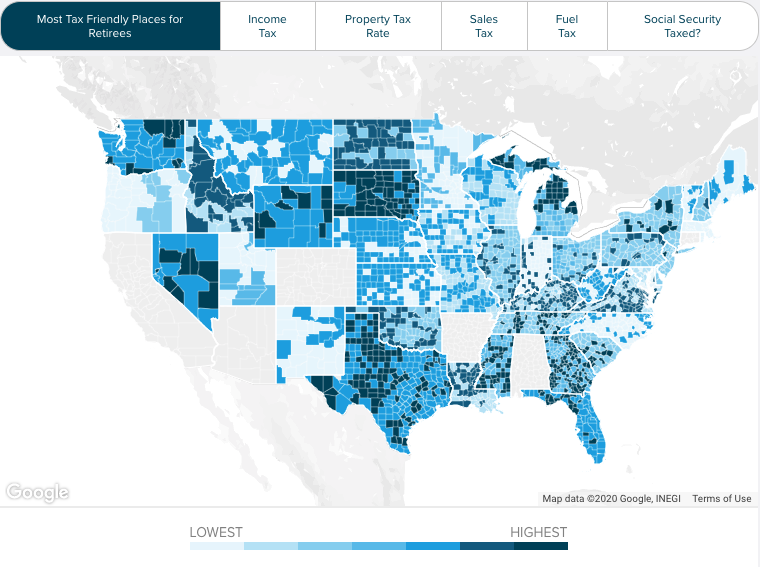

Utah Retirement Tax Friendliness Smartasset

Utah Retirement Tax Friendliness Smartasset

Payment of the Personal Property Tax is normally due each year by October 5 see Tax Bill for due date.

Personal property tax per state. Tax per 1000. 13 rows A property tax is a municipal tax levied by counties cities or special tax districts on most. In the most expensive states.

The refundable credit is in addition to any real property tax credit you claim on Form IT-214. Personal Property Tax Most people know that property Bytax applies to real property however some may not know that property tax also applies to personal property. Per diems gratuities train travel taxis and parking.

State tax levels indicate both the tax burden and the services a state can afford to provide residents. New York State Department of Taxation and Finance Office of Tax Policy Analysis. Sales and excise taxes.

Its also called an ad valorem tax. In some states homes are cheap property tax rates are less than half of 1 and the average property tax payment is just a few hundred bucks per year. Tax per 1000.

If payment is late a 10 late payment penalty is assessed on the unpaid original tax balance. Tax per 1000. 45 rows Depending on where you live property taxes can be a small inconvenience or a major burden.

52 rows Its effective property tax rate is 247 not much higher than the 23 in Illinois. Total Tax Burden Property Tax Burden Individual Income Tax Burden Total. This table includes the per capita tax collected at the state.

Ad valorem taxation of TPP has become a smaller portion of state revenues for a number of reasons. Interest at a rate of 10 per annum is added beginning the 1st day of. Failure to Pay Personal Property Tax.

State grants 30 day filing extension upon mfg. New York City enhanced real property tax credit For tax years 2014 through 2019 an enhanced real property tax credit is available for homeowners and renters residing in New York City with household gross incomes of less than 200000 annually. For example household goods and personal effects are not subject to property tax.

States use a different combination of sales income excise taxes and user feesSome are levied directly from residents and others are levied indirectly. Beginning in 2018 deductions for state and local taxes including personal property taxes are capped at 10000 per tax return. Prior to 2018 there is not a cap for these deductions although large amounts of these deductions can cause you to be subject to the Alternative Minimum.

Personal Property Date Events Notes. State and local sales taxes pursuant to section 1105c7 of the Tax Law. Most personal property owned by individuals is exempt.

Landmark Event Services Inc. Tax revenues from tangible personal property comprised just 225 of own-source state and local tax revenue state and local tax revenue excluding federal and state aid in 2009 a 29 decrease in TPP tax levies over the previous ten years. The tax is imposed on movable property such as automobiles or boats and its assessed annually.

Equipment Transportation refers to charges for transporting the equipment to the. Only available to State assessed manufacturers. It is also common for the personal property tax rate to vary depending on the type of property and local jurisdiction.

Individuals can deduct personal property taxes paid during the year as an itemized deduction on Schedule A of their federal tax returns at least up to.

Monday Map State Local Property Tax Collections Per Capita Property Tax Map Best Places To Retire

Monday Map State Local Property Tax Collections Per Capita Property Tax Map Best Places To Retire

Taxes From A To Z 2015 M Is For Municipal Bonds Property Tax Business Tax Personal Property

Taxes From A To Z 2015 M Is For Municipal Bonds Property Tax Business Tax Personal Property

Visualizing Unequal State Tax Burdens Across America Visualizing Unequal State Tax Burdens Across America What Percentage Of State Tax Infographic America

Visualizing Unequal State Tax Burdens Across America Visualizing Unequal State Tax Burdens Across America What Percentage Of State Tax Infographic America

How School Funding S Reliance On Property Taxes Fails Children Npr

New Hampshire Property Tax Calculator Smartasset

New Hampshire Property Tax Calculator Smartasset

These 7 U S States Have No Income Tax The Motley Fool Income Tax Map Tax Free States

These 7 U S States Have No Income Tax The Motley Fool Income Tax Map Tax Free States

Map How Much 100 Is Really Worth In Every State Map States Cost Of Living

Map How Much 100 Is Really Worth In Every State Map States Cost Of Living

The Hidden Costs Of Owning A Home

The Hidden Costs Of Owning A Home

25 Illinois Counties With The Highest Median Property Taxes Property Tax Illinois Property

25 Illinois Counties With The Highest Median Property Taxes Property Tax Illinois Property

Property Tax Map Tax Foundation

Property Tax Map Tax Foundation

Monday Map State Income And Sales Tax Deductions Data Map Map Diagram Tax Deductions

Monday Map State Income And Sales Tax Deductions Data Map Map Diagram Tax Deductions

How Is Tax Liability Calculated Common Tax Questions Answered

How Is Tax Liability Calculated Common Tax Questions Answered

How Much Tax Do Small Businesses Pay A Simple Guide Freshbooks Resource Hub

How Much Tax Do Small Businesses Pay A Simple Guide Freshbooks Resource Hub

State Diesel Tax Rates 2013 Safest Places To Travel Infographic Map Safe Cities

State Diesel Tax Rates 2013 Safest Places To Travel Infographic Map Safe Cities

States With The Highest And Lowest Property Taxes Property Tax Social Studies Worksheets States

States With The Highest And Lowest Property Taxes Property Tax Social Studies Worksheets States

Sin Taxes Are Excise Taxes That The Government Applies To Certain Goods Or Services In Addition To Standard Sales Taxes Regardles Tax Sales Tax Filing Taxes

Sin Taxes Are Excise Taxes That The Government Applies To Certain Goods Or Services In Addition To Standard Sales Taxes Regardles Tax Sales Tax Filing Taxes

P The Chicago Tribune Has A Map That Outlines Areas Of Chicago That Appear To Be Hardest Hit By A Average 13 Percent Property Property Tax Chicago Tribune Tax

P The Chicago Tribune Has A Map That Outlines Areas Of Chicago That Appear To Be Hardest Hit By A Average 13 Percent Property Property Tax Chicago Tribune Tax

Improving Lives Through Smart Tax Policy Income Tax Local Marketing Tax Lawyer

Improving Lives Through Smart Tax Policy Income Tax Local Marketing Tax Lawyer

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home