Jarrell Texas Property Tax Rate

Office Closure April 2 2021. 113 Ammonite Ln is a 2 Full Baths property in Jarrell TX 76537.

Jarrell Texas Tx 78626 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

59 rows Property Tax Rate.

Jarrell texas property tax rate. 2020 City of Jarrell Notice of Tax Rates. The total tax rate is the sum of the rates of all applicable taxing units including cities counties schools and special districts. 2020 Property Tax Information.

Four states impose gross receipt taxes Nevada Ohio Texas and Washington. Use our free directory to instantly connect with verified Property Tax attorneys. View photos map tax nearby homes for sale home values school info.

Our property tax rates are very competitive making Jarrell a very attractive location on Interstate 35 for property ownership. The median property tax in Texas is 227500 per year for a home worth the median value of 12580000. 119 rows The Williamson County property tax rates for each tax jurisdiction for 2020 2019 2018.

The statistics from this question refer to the total amount of all real estate taxes on the entire property land and buildings payable to all taxing jurisdictions including special assessments school taxes county taxes and so forth. The average yearly property tax paid by Terrell County residents amounts to about 079 of their yearly income. 254 rows Property taxes in Texas are the seventh-highest in the US as the average effective.

This years no-new-revenue tax rate. Compare the best Property Tax lawyers near Jarrell TX today. Tax Roll Information and Open Records.

Governor Greg Abbott issues Executive Order GA-34 lifting the mask mandate in Texas effective March 102021. Texas has one of the highest average property tax rates in the country with only thirteen states levying higher property taxes. Estimated Monthly Property Tax Based on Tax Assessment 2020 439.

The City of Jarrell property tax rates are very competitive making Jarrell a very attractive location for property ownership. Additionally there is no corporate income tax. The delinquency date is Monday February 1.

Search Property. City of Jarrell Notice of Tax Rates 2020. Texas is one of only a handful of states with no individual income tax.

Counties in Texas collect an average of 181 of a propertys assesed fair market value as property tax per year. The median property tax in Terrell County Texas is 285 per year for a home worth the median value of 42600. Who we are A growing community centrally located on IH 35 in Texas.

On August 25 2020 the City of Jarrell adopted a tax rate that will raise more taxes for maintenance and operations than last years tax rate. 2020 Property tax statements will be mailed the week of October 12th. Unclaimed Property-Tax Assessor Collector.

2020 property taxes must be paid in full on or before Sunday January 31 2021 to avoid penalty and interest. All property is appraised at full market value and taxes are assessed by local county assessors on 100 of appraised value. - Single standard deduction one exemption - Sales Tax includes food and services where applicable - Real tax taxes are based on the local median home price - Car taxes.

Wait Times Appointments Motor Vehicle. Posted on August 5 2020. Terrell County collects on average 067 of a propertys assessed fair market value as property tax.

The rates are given per 100 of property value. Property Taxes The following data sample includes all owner-occupied housing units in Jarrell Texas. This tax rate will effectively be raised by 6723 percent and will raise taxes for maintenance and operations on.

Property owners who have their taxes escrowed by their lender may view their billing information using our Search My Property program. Last years adjusted taxes after subtracting taxes on lost property 874264 This years adjusted taxable value after subtracting value of new property 208325638 This years no-new-revenue tax rate 0419662100 This years adjustments to the no-new-revenue tax rate 0 100 This years adjusted no-new-revenue tax rate. Texas has no state property tax.

Jarrell Tx New Home Builders Communities Realtor Com

Jarrell Tx New Home Builders Communities Realtor Com

Jarrell Texas Tx 78626 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Jarrell Texas Tx 78626 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Jarrell Texas Tx 78626 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

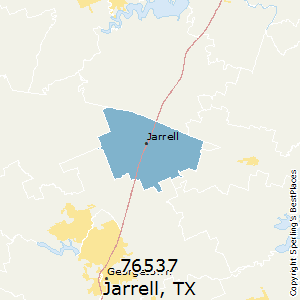

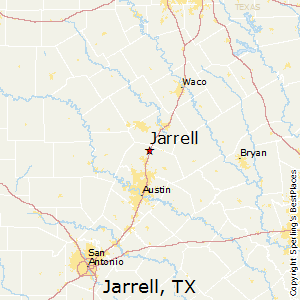

Best Places To Live In Jarrell Zip 76537 Texas

Best Places To Live In Jarrell Zip 76537 Texas

Sonterra By Centex Homes In Jarrell Tx Zillow

Sonterra By Centex Homes In Jarrell Tx Zillow

Https Storage Googleapis Com Proudcity Jarrelltx Uploads 2020 09 Ordinance No 2020 0825 05 Adopting Tax Rate For 2021 Pdf

Jarrell Texas Tx 78626 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

New Homes In Jarrell Tx Century Communities

New Homes In Jarrell Tx Century Communities

An Illusion Of Property Ownership The Castle Report Illusions Castle Property Tax

An Illusion Of Property Ownership The Castle Report Illusions Castle Property Tax

Jarrell Texas Tx 78626 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Jarrell Texas Tx 78626 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Jarrell Texas Tx 78626 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

300 Serpentine Ln Jarrell Tx 76537 Realtor Com

300 Serpentine Ln Jarrell Tx 76537 Realtor Com

532 Seabiscuit Dr Jarrell Tx 76537 Realtor Com

532 Seabiscuit Dr Jarrell Tx 76537 Realtor Com

200 Plata Ln Jarrell Tx 76537 Realtor Com

200 Plata Ln Jarrell Tx 76537 Realtor Com

133 Ammonite Ln Jarrell Tx 76537 Realtor Com

133 Ammonite Ln Jarrell Tx 76537 Realtor Com

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home