How To Find My Property Tax Bill Online

The information provided in these databases is public record and available through public information requests. You can always pay your taxes online without your bill.

Most likely payment of your real property tax is handled through your mortgage lender but you can view local property tax rates on SDATs Web site.

How to find my property tax bill online. Access the 20-Year Property Tax History. To do so we need the parcel ID for your property. The Department of Local Government Finance has compiled this information in an easy-to-use format to assist Hoosiers in obtaining information about property taxes.

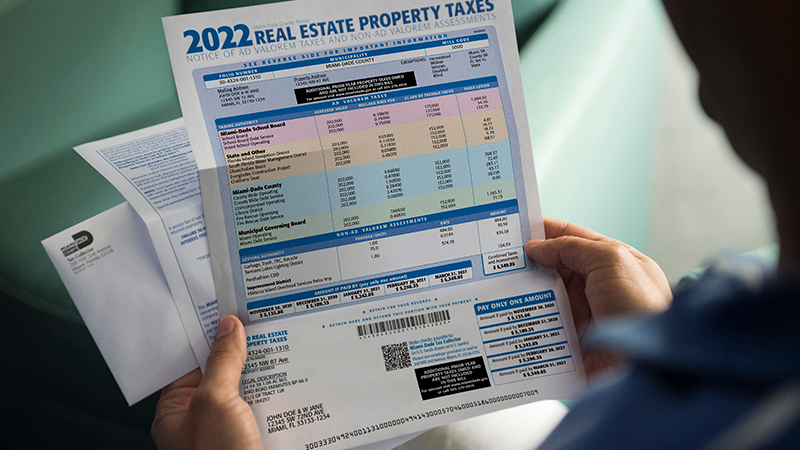

Beyond the amount of taxes you owe the bills indicate where your taxes are going and how much more is being collected by your local governments each year. Your Secured Property Tax Bill contains your Assessors Identification Number AIN and Personal Identification Number PIN which you will need to complete the transaction. Get help if you need it.

The only exception is that a property tax collector may wait to send a bill until the total taxes due for all taxing units the collector serves is 15 or more. The tax statement provided by this website has been prepared from Tax Office data current as of the date printed on the statement and is subject to changes or corrections. Current year is available between October 1 and June 30 only.

If a bank or mortgage company pays your property taxes they will receive your property tax bill. To locate the amount of your Secured Property Taxes click the following link How much are my property taxes. Enter your parcel number name or street name to view your invoice.

Search MyTaxDCgov and go to Make a Real Property Payment Enter your square and lot or your address. And enter your Assessors Identification Number. If you have trouble searching by Name please use your Property Tax Account Number or your Property Address.

Using the tax bill search you can browse billing and payment information for real estate personal business and motor vehicle accounts and select accounts to pay online. Payments may not be scheduled for a later date. Choose from the options below.

You can also reprint your bill online and attach it to your payment if you wish to use a physical check or money order. Our services are available online by phone by email or by mail. Mobile Homes and Personal Property Commercial Property Tax 206-263-2844.

You also can check and update key information about your property such as. You can always download and print a copy of your Property Tax Bill on this web site. Then click on the payment type.

Read The Pappas Study. Statements of vehicle property taxes paid to the NC DMV at the time of registration are not available on the Countys web site. To use the MyTaxDCgov online payment system.

Search to see a 5-year history of the original tax amounts billed for a PIN. Use an e-Check or credit card to make a payment. Download a copy of your tax bill.

Begin by entering your account number or bill number or street address for the bill you want to pay in the box below. To pay by phone call 240-777-8898. If you lost your bill we can mail you a new one.

Contact SDAT or visit one of their local assessment offices. Property tax bills and receipts contain a lot of helpful information for taxpayers. Online or phone payments can be made from your home.

After you make an online payment it can take up to five business days for your tax bill to be updated with your new balance. Once you search by PIN you can pay your current bill online or learn additional ways to pay by clicking More Tax Bill Information on the next page. We do accept partial payments.

The information on the bill can also help you determine whether your assessment is accurate. Real Property Tax Real Estate 206-263-2890. You can also view Local Tax Billing Collection Offices information.

This website provides current year and delinquent secured tax information. Sign up to receive tax bills by email. Property Tax Installment Due Dates are May 10 and November 10.

There is no cost to you for electronic check eCheck payments. A property owner may file a written request with the collector that a tax bill not be sent until the total amount of taxes due on the property is 15 or more. If you have further questions please contact our office at 951955-3900 or e-mail your questions to.

Property Tax Portal The Property Tax Portal will assist you in finding the most frequently requested information about your property taxes. Click on your property to retrieve your account information. You will receive a Property Tax Bill if you pay the taxes yourself and have a balance.

See local governments debt and pensions. Bills are generally mailed and posted on our website about a month before your taxes are due. Pay or view your account online do a property search or sign up for e-Reminder Notices via text or email.

The Cook County Treasurers Office provides payment status for current tax years and the ability to pay online. Find out if your delinquent taxes have been sold. Since the information displayed appears exactly as it is reported from each county some formatting.

Click Get Started button above or use one of the other payment options below. You do not need to request a duplicate bill. To obtain a statement of the property taxes paid for your vehicles visit NC.

If you lost the original bill and are making a payment you can pay electronically or print out and send in the online copy with your tax payment.

Understanding Property Tax In California Property Tax Tax Understanding

Understanding Property Tax In California Property Tax Tax Understanding

Secured Property Taxes Treasurer Tax Collector

Secured Property Taxes Treasurer Tax Collector

What S My Property S Tax Identification Number

What S My Property S Tax Identification Number

Entrepreneurshiptipoftheday Pay Taxes Tax Refund Tax Time Small Business Accounting

Entrepreneurshiptipoftheday Pay Taxes Tax Refund Tax Time Small Business Accounting

Property Tax Chennai Online Calculator And Payment Guide

Property Tax Chennai Online Calculator And Payment Guide

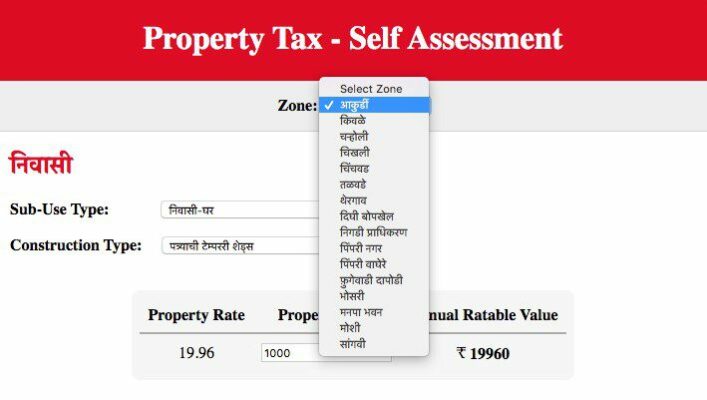

Pay Pcmc Property Tax Online A Step By Step Guide

Pay Pcmc Property Tax Online A Step By Step Guide

How To Read Your Property Tax Bill O Connor Property Tax Reduction Experts Property Tax Tax Reduction Tax

How To Read Your Property Tax Bill O Connor Property Tax Reduction Experts Property Tax Tax Reduction Tax

What S My Property S Tax Identification Number

What S My Property S Tax Identification Number

What S My Property S Tax Identification Number

What S My Property S Tax Identification Number

Current Payment Status Lake County Il

Pay Your Property Tax Bill Online

Pay Your Property Tax Bill Online

Secured Property Taxes Treasurer Tax Collector

Secured Property Taxes Treasurer Tax Collector

Supplemental Property Tax Information Property Tax Mortgage Companies Property

Supplemental Property Tax Information Property Tax Mortgage Companies Property

Appealing Property Taxes How To Challenge Your Tax Assessment Property Tax Assessment Real Estate Advice

Appealing Property Taxes How To Challenge Your Tax Assessment Property Tax Assessment Real Estate Advice

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home