How To Find Comps For Property Tax Appeal

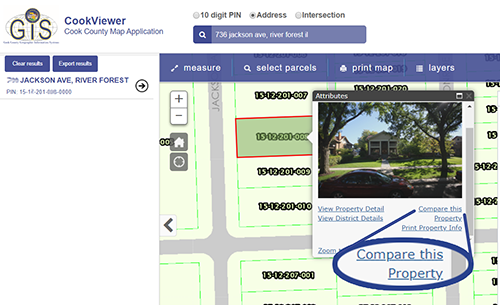

Click on Compare properties Find properties that are comparable to yours. How to Find House Values to Appeal My Property Taxes.

How To Avoid Overpaying For A House Residential Real Estate Real Estate Tampa Real Estate

How To Avoid Overpaying For A House Residential Real Estate Real Estate Tampa Real Estate

If the comps show a serious discrepancy between the sale prices of similar homes and the appraised value of your home -- and the potential tax savings are high -- hire a professional appraiser.

How to find comps for property tax appeal. You have two options. Click on My Filings. Simply enter your home address to view recent sales.

You can then take the average PPSF of all the comps on your list and using that dollar value multiply it by the number of square feet in your home. Note that assessed value does NOT equal market value. Effective July 1 2017 the previous process for conducting an appeal was repealed and replaced with a.

The list of steps is broadly previewed below but you can also read step-by-step instructions with images. Heres how I knocked 13000 off my property tax appraisal in 30 minutes This process was so easy Im vowing to protest every year. If you have the time and are effective you may get a reduction to your assessed value which will reduce your propertys future property tax bills.

Equity appeals will quench some of the dissatisfaction on property tax. The comp has to be dated within a specific time period has. The Indiana General Assembly passed legislation in 2017 Senate Enrolled Act 386 2017 that significantly changed the appeal process which subsequently resulted in a change in the forms used in the appeal process.

Keep in mind that if you do choose to file a property tax appeal the worst thing that can happen is that you dont get your taxes reduced. These are 3 Main Steps Necessary in Making a Property Tax Appeal. Simply enter your home address to view recent sales.

Filter for Recently Solds so youre only seeing the yellow dots. One of the most common errors in making a tax appeal is using the wrong comparable sales. You need to get comps for the sales not just the list.

Your tax bill cant climb as a result of your appeal. If you believe the value is lower. Start your search for comps on Zillow by typing your city and state into the search bar.

Zillow Zoom in on your area then your neighborhood and finally your house to use as a reference point. If you feel like youre paying too much in property taxes and who doesnt you can submit a property tax appeal to the assessors office and in the case of Cook County also to the Board of Review. Your property taxes are based on the assessed value of your home.

Ask a real estate agent to find comps which are the recent sale prices of properties similar to your own in terms of size facilities condition and location. Any changes in assessment from the previous year and all exemptions appear on second installment bills sent in the summer. No one wants to pay high property taxes but owners bitterly resent being assessed unfairly and unequally.

How To Find Comparables Comps To Contest Property TaxesAccess Comps Now httpbitly2TFCzwJ Get access to real time property information like never. However most appraisal districts in the recent past have declined to discuss the level of assessment for neighboring properties at appeal hearings. Then enter your propertys address or PIN.

You can narrow the results based on the ones that are most similar to your home and then well calculate a home value for you. All first installment bills are by law 55 of the total taxes paid the previous year. Try this pricing tool to find comps in your area.

To attach comparable properties with your appeal requires some specific steps. You will be able to review your appeal information. Dividing the assessed value by the sales ratio could also be called the equalization rate or a variety of other similar names to find the actual value the town has place on your property.

Cool Property Tax Appeals To Lower Property Taxes Find Your Reason To Appeal Property Tax Homeowners Guide Homeowner

Cool Property Tax Appeals To Lower Property Taxes Find Your Reason To Appeal Property Tax Homeowners Guide Homeowner

Property Tax Appeal Tips To Reduce Your Property Tax Bill

Property Tax Appeal Tips To Reduce Your Property Tax Bill

N Carolina Hwy Denver Nc 28037 Commercial Property For Sale On Loopnet Com Commercial Property For Sale Commercial Real Estate N Carolina

N Carolina Hwy Denver Nc 28037 Commercial Property For Sale On Loopnet Com Commercial Property For Sale Commercial Real Estate N Carolina

Tax Appeal Deadline Is April 1 We Tell You How To File Montclair Local News

Tax Appeal Deadline Is April 1 We Tell You How To File Montclair Local News

Find Comparable Properties Cook County Assessor S Office

How To Lower Your Property Taxes In 4 Easy Steps Clark Howard

How To Lower Your Property Taxes In 4 Easy Steps Clark Howard

Find Comparable Properties Cook County Assessor S Office

Find Comparable Properties Cook County Assessor S Office

Real Estate Checklist Listing Real Estate Forms Realtor Etsy Real Estate Checklist Real Estate Forms Real Estate Advice

Real Estate Checklist Listing Real Estate Forms Realtor Etsy Real Estate Checklist Real Estate Forms Real Estate Advice

How To Lower Your Property Taxes In 4 Easy Steps Clark Howard

How To Lower Your Property Taxes In 4 Easy Steps Clark Howard

How To Challenge A Low Appraisal And Tips For Agents And Appraisers Appraisal Sample Resume What Is Property

How To Challenge A Low Appraisal And Tips For Agents And Appraisers Appraisal Sample Resume What Is Property

Buying A Foreclosed Home How To Buy A Foreclosure Buying A Foreclosure Buying Foreclosed Homes Foreclosures

Buying A Foreclosed Home How To Buy A Foreclosure Buying A Foreclosure Buying Foreclosed Homes Foreclosures

Do Your Own Comps To Gauge Home Value Nerdwallet

Do Your Own Comps To Gauge Home Value Nerdwallet

How To Find Comparables Comps To Appeal Property Taxes Youtube

How To Find Comparables Comps To Appeal Property Taxes Youtube

Property Tax Appeal Tips To Reduce Your Property Tax Bill

Property Tax Appeal Tips To Reduce Your Property Tax Bill

Get Download Property Tax Appeals Property Tax Reduction Bonus Http Inoii Com G Learn Affiliate Marketing Marketing Checklist Email Marketing Examples

Get Download Property Tax Appeals Property Tax Reduction Bonus Http Inoii Com G Learn Affiliate Marketing Marketing Checklist Email Marketing Examples

Property Tax Appeal Tips To Reduce Your Property Tax Bill

Property Tax Appeal Tips To Reduce Your Property Tax Bill

How To Lower Your Property Taxes In 4 Easy Steps Clark Howard

How To Lower Your Property Taxes In 4 Easy Steps Clark Howard

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home