Can You Claim Property Taxes On Your Tax Return Ontario

As an Ontario resident you can claim your property taxes through the Ontario energy and property tax credit OEPTC by completing the ON-BEN. Usually owners can deduct property taxes from their.

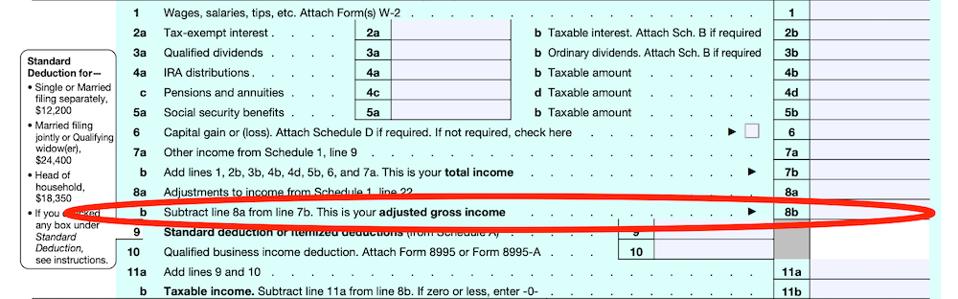

How To Fill Out Form 1040 Preparing Your Tax Return Oblivious Investor

How To Fill Out Form 1040 Preparing Your Tax Return Oblivious Investor

If you pay either type of property tax claiming the tax deduction is a simple matter of itemizing your personal.

Can you claim property taxes on your tax return ontario. Includes existing homes and homes under construction. Both the OTB and OSHPTG are designed to help low- to moderate-income Ontario residents with costs such as energy sales tax property tax and more. The tax cant be paid in exchanged for any special service or.

Review all deductions credits and expenses you may claim when completing your tax return to reduce your tax owed Report a problem or mistake on this page Please select all that apply. On the off chance that you and your companion both live there you can claim 500000 on a joint return. The credit is claimed on line 31270 on your income tax and benefits return previously line 369.

You can also claim part of your property taxes mortgage interest and capital cost allowance CCA. You can claim the property tax credit if all of the following conditions apply. Property taxes This is a no unless you work on commission in which case you can deduct a reasonable amount from the total costs with your T2200.

Though we technically are not claiming rent on our taxes the amount of rent property taxes or long term housing costs paid by you throughout the year is used to help calculate your benefit. You can claim expenses like mortgage interest property taxes insurance utilities and condo fees and you can claim these even when you have no tenant and your property is available to rent. You were 16 or older on December 31.

The IRS decide is that in the event that you live in your home in any event two of the five years before you sell you can prohibit up to 250000 of increase from charge. You were a resident of Ontario on December 31. To claim a refund the buyer must be a Canadian citizen or permanent resident be at least 18 years of age must not have owned a residential property or an interest in residential property anywhere in the world.

The revenues raised must benefit the community as a whole or the government. Rent or property tax on a principal residence was paid by or for you in the year. The 5000 can be split between the house owners as long as the total amount claimed on all tax returns doesnt exceed 5000.

Application for the Ontario Trillium Benefit and the Ontario Senior Homeowners Property Tax Grant form. Most state and local tax authorities calculate property taxes based on the value of the homes located within their areas and some agencies also tax personal property. You can claim the sales tax credit if all of the following conditions apply.

As for what to deduct you can claim part of your maintenance costs such as heating home insurance electricity and cleaning materials. Property tax is the annual tax paid by the owner of the property to the state local government or municipal corporation. You can claim a deduction for real property taxes if the tax is uniformthe same rate is applied to all real property in the tax jurisdiction.

If you rent out a room of your home then you can claim expenses related to the shared spaces such as. For example if your basement rental suite is ⅓ the square footage of your property then you can only claim ⅓ of the hydro mortgage interest property taxes etc. If you pay taxes on your personal property and owned real estate they may be deductible from your federal income tax bill.

If you live in Ontario you may qualify for the Ontario Energy and Property Tax Credit OEPTC which is a part of the Ontario Trillium Benefit. With all those tax deductions mentioned above remember that if youre renting a portion of the property you can only claim a percentage of those expenses. The credit is calculated based on your family income for the year.

Refundable tax credits can reduce the amount of tax that you owe but are also available even if you dont owe any tax such as the Ontario Energy and Property Tax Credit Benefits can help with various living expenses such as raising children housing loss of income and medical expenses. The ON-BEN form is used to claim the Ontario Trillium Benefit OTB and Ontario Senior Homeowners Property Tax Grant OSHPTG.

I Haven T Filed Taxes In 5 Years How Do I Start

I Haven T Filed Taxes In 5 Years How Do I Start

17 Things You Can T Claim In Your Tax Return Platinum Accounting Taxation

17 Things You Can T Claim In Your Tax Return Platinum Accounting Taxation

3 21 3 Individual Income Tax Returns Internal Revenue Service

3 21 3 Individual Income Tax Returns Internal Revenue Service

3 21 3 Individual Income Tax Returns Internal Revenue Service

3 21 3 Individual Income Tax Returns Internal Revenue Service

How Much Will Charity Help Your Tax Bill Csmonitor Com

How Much Will Charity Help Your Tax Bill Csmonitor Com

Foreign Tax Credit Form 1116 And How To File It Example For Us Expats

Foreign Tax Credit Form 1116 And How To File It Example For Us Expats

Free Tax Prep Checklist Jessica Moorhouse Tax Prep Checklist Tax Prep Tax Help

Free Tax Prep Checklist Jessica Moorhouse Tax Prep Checklist Tax Prep Tax Help

40 Years Ago And Now From 70 To 30 Peak I T Rate Tax Rules Inheritance Tax Income Tax

40 Years Ago And Now From 70 To 30 Peak I T Rate Tax Rules Inheritance Tax Income Tax

Why Is My Tax Return So Low 2020 Tax Year Edition Picnic S Blog

Why Is My Tax Return So Low 2020 Tax Year Edition Picnic S Blog

Gross Vs Net Income Financial Infographic From Accc Learn More About Personal Finances To Better Manage Your Net Income Debt Relief Programs Personal Finance

Gross Vs Net Income Financial Infographic From Accc Learn More About Personal Finances To Better Manage Your Net Income Debt Relief Programs Personal Finance

Best Tax Software For 2021 Turbotax H R Block Jackson Hewitt And More Compared Cnet

Best Tax Software For 2021 Turbotax H R Block Jackson Hewitt And More Compared Cnet

What To Bring To Your Tax Appointment Tax Appointment Business Tax Tax Organization

What To Bring To Your Tax Appointment Tax Appointment Business Tax Tax Organization

Mortgage Interest Statement Form 1098 What Is It Do You Need It

Mortgage Interest Statement Form 1098 What Is It Do You Need It

Irs Releases New Not Quite Postcard Sized Form 1040 For 2018 Plus New Schedules Tax Forms Irs Tax Forms Income Tax

Irs Releases New Not Quite Postcard Sized Form 1040 For 2018 Plus New Schedules Tax Forms Irs Tax Forms Income Tax

Should You Be Charging Sales Tax On Your Online Store Business Tax Small Business Tax Tax Deductions

Should You Be Charging Sales Tax On Your Online Store Business Tax Small Business Tax Tax Deductions

All You Wanted To Know About Those Tax Stimulus Checks But Were Afraid To Ask

All You Wanted To Know About Those Tax Stimulus Checks But Were Afraid To Ask

What Motor Vehicle Expenses Can You Claim On Income Tax In Canada Income Tax Motor Car Tax Prep

What Motor Vehicle Expenses Can You Claim On Income Tax In Canada Income Tax Motor Car Tax Prep

How To Fill Out Form 1040 Preparing Your Tax Return Oblivious Investor

How To Fill Out Form 1040 Preparing Your Tax Return Oblivious Investor

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home