How Is Tax Calculated In Japan

The basic calculation is based on your Annual Salary minus the Employment Income Deduction minus any deductions you can claim have a look at the official Guide to Metropolitan Taxes for those. A Japanese company structured as a cost-center with no revenue other than funds transferred from its non-resident foreign parent will be subject to a corporate income tax charge based on a notional profit calculated as 5 of its total expenses plus the tax charge on any directors bonuses.

Japan Not Keen On Cryptocurrency Futures Just Yet Cryptocurrency Keen Futures Contract

Japan Not Keen On Cryptocurrency Futures Just Yet Cryptocurrency Keen Futures Contract

The calculation is pretty straightforward and very similar to living at home.

How is tax calculated in japan. If the full value of your items is over 10000 JPY the import tax on a shipment will be 10. 31 July and 30 November following Monday if these payment dates fall on Saturday Sunday and National holiday. The Japanese Tax Calculator is a diverse tool and we may refer to it as the wage calculator salary calculator or after tax calculator it.

Taxation of retained earnings is calculated by multiplying the taxable amount of retained earnings obtained by subtracting the retained earnings deductible from the amount of retained earnings in each business year by the special tax rate. Both the government and municipal taxes can be calculated by this Japan income tax calculator. You actually only need to pay the resident tax if you were a resident of Japan on the first of January of that year.

Remove Tax Tax Amount Original Cost - Original Cost 100 100 VAT Net Price Original Cost - Tax Amount Example Find the VAT price and net price in Japan. In Japan there is a minimum tax rate of 5 to a maximum of 45 depending on your income. Local Consumption Tax rate.

22 2278 of National Consumption Tax 176 2278 of National Consumption Tax. Calculate your take home pay thats your salary after tax with the Japan Salary Calculator. For tax calculation purposes in Japan youll need to report income from your salary along with any benefits or bonus payments that you receive.

Below is the list of income and tax rates. That is you will pay monthly starting in June for taxes calculated based on the previous years salary. Altogether your tax bill for the year will be 97500 330000 150000 577500 yen.

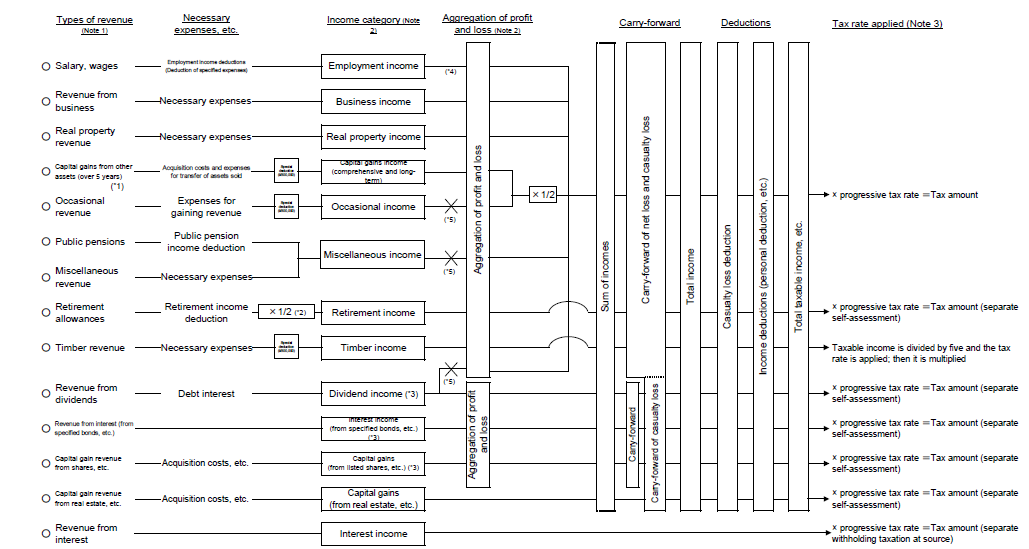

Income tax in Japan is based on a self-assessment system a person determines the tax amount himself or herself by filing a tax return in combination with a withholding tax system taxes are subtracted from salaries and wages and submitted by the employer. 30 rows National tax due. Take 10 of this amount.

You will be required to pay from the next January the amount calculated on the basis of your annual gross income of the previous year. If you leave Japan you will be required to pay the rest as a lump sum. Assuming the non-resident does not have a permanent establishment PE in Japan a non-residents income from Japan-source interest dividends rental income and royalties is generally subject to tax at a rate of 2042 15315 in the case of interest on bank deposits andor certain designated financial instruments or lower treaty rates through WHT at source.

Note Consumption Tax National Consumption Tax and Local Consumption Tax rate. Net Income Salary - Insurance - Income Tax - Residence Tax Income Tax Salary - Insurance - Residence Tax - Net Income The Japan tax calculator is a useful tool to find the taxes. Tax rate Standard tax rate Reduced tax rate.

Provisional national tax payments are determined based on the prior years tax liability. For example if the declared value of your items is 10000 JPY in order for the recipient to receive a package an additional amount of 100000 JPY in taxes will be required to. It will be calculated on the basis of your previous years income in Japan.

National Consumption Tax rate. Dont let Japans foreign tax code get you down. A quick and efficient way to compare salaries in Japan review income tax deductions for income in Japan and estimate your tax returns for your Salary in Japan.

By using this guide you should get a very good idea of how much youll owe in taxes. You will not be required to pay for the first year if you lived abroad the previous year. If you get non-monetary benefits as part of your job for example if your employer provides you a house to live in this will also be treated as taxable income.

Income tax rate deduction amount income tax amount The tax rate on domestic income for non-residents is uniformly 2042. In general provisional tax is calculated as two-thirds of the preceding years tax liability and is payable in two equal installments. This tax is 10 of your taxable income earned in Japan during the previous calendar year from January 1st until December 31st and is applied in June of the current year.

Simple Tax Guide For Americans In Japan

Simple Tax Guide For Americans In Japan

2019 Advertising Expenditures In Japan Press Releases News Dentsu Inc

Investors Pile Pressure On Yield Curve Pioneers Japan Australia In 2021 Yield Curve Investors Japan

Investors Pile Pressure On Yield Curve Pioneers Japan Australia In 2021 Yield Curve Investors Japan

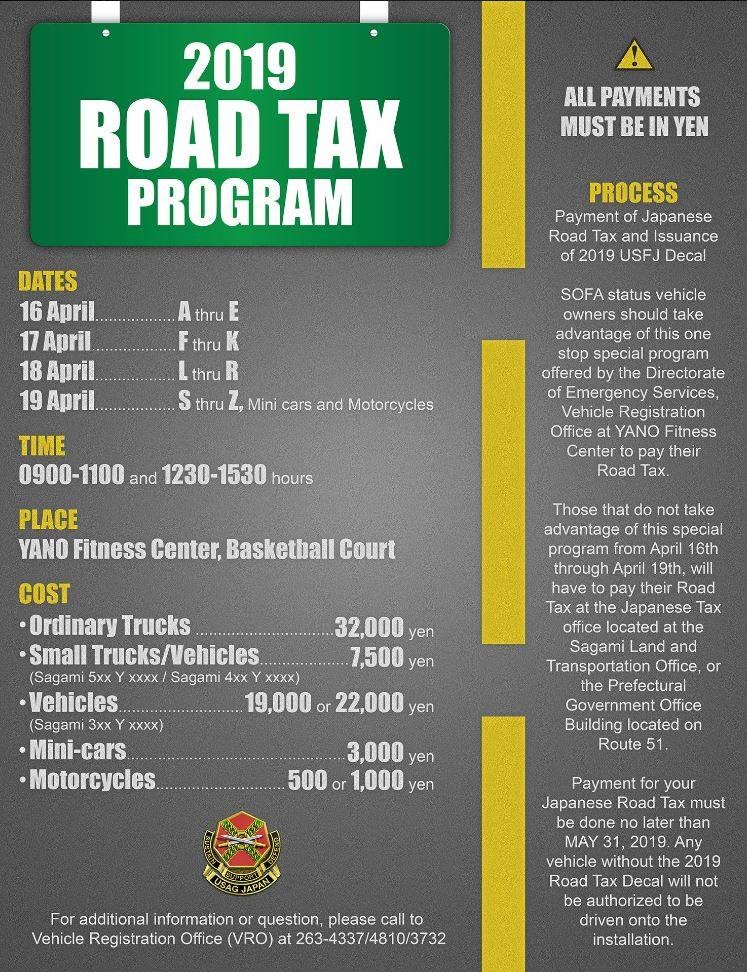

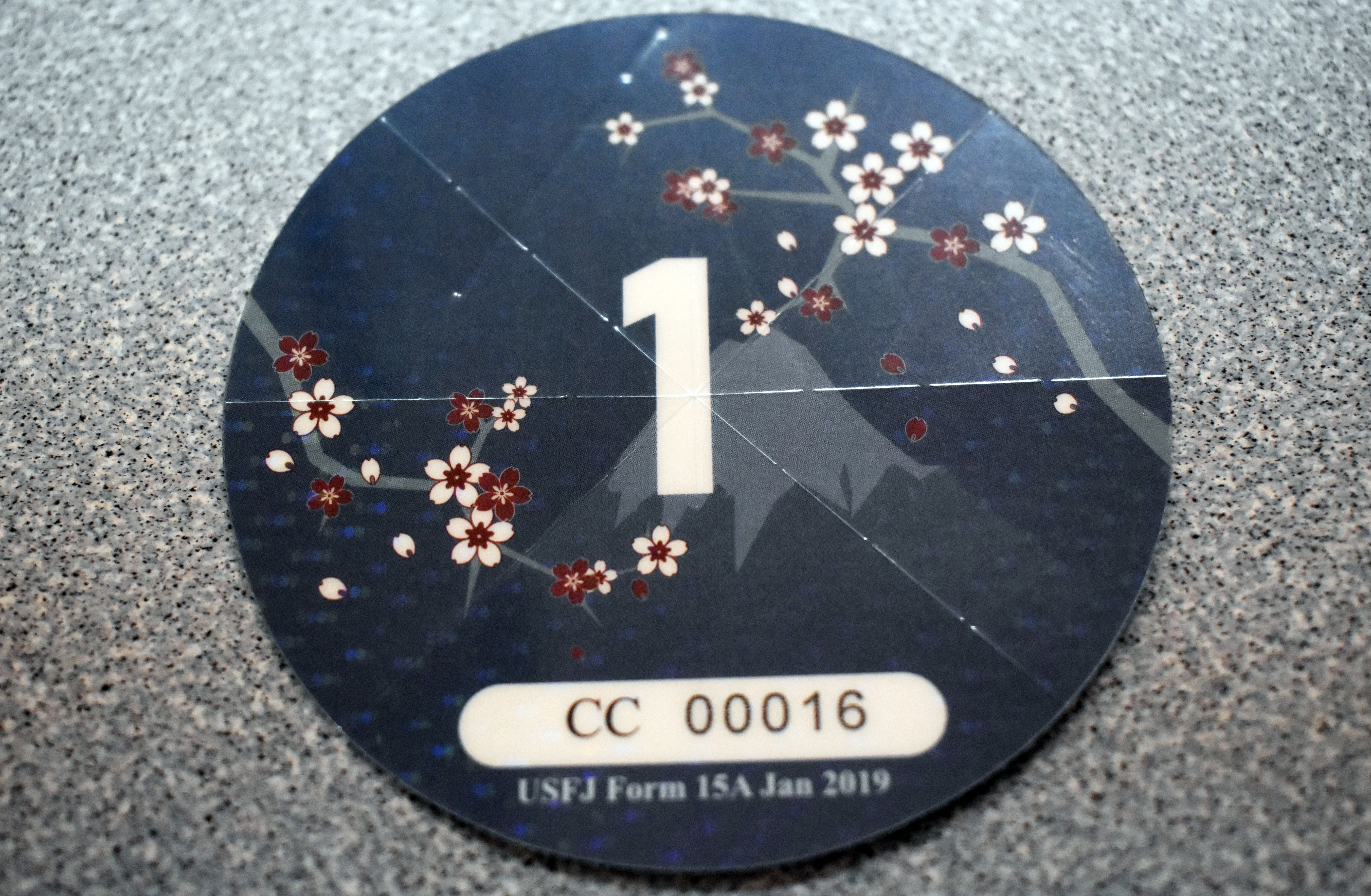

Sofa Drivers In Japan Prepare To Pay Annual Road Tax Article The United States Army

Sofa Drivers In Japan Prepare To Pay Annual Road Tax Article The United States Army

Understanding Your Gas Bill In Japan With Kanji Cheat Sheet Blog

Japanese Tax That Foreign Workers In Japan Want To Keep In Mind G Talent Blog

Japanese Tax That Foreign Workers In Japan Want To Keep In Mind G Talent Blog

Japan Salary Calculator 2021 22

Japan Salary Calculator 2021 22

Japan Consolidated Fiscal Balance Of Gdp 1996 2021 Data

A Quick Guide To Taxes In Japan Gaijinpot

A Quick Guide To Taxes In Japan Gaijinpot

Sofa Drivers In Japan Prepare To Pay Annual Road Tax Article The United States Army

Sofa Drivers In Japan Prepare To Pay Annual Road Tax Article The United States Army

Japanese Tax That Foreign Workers In Japan Want To Keep In Mind G Talent Blog

Japanese Tax That Foreign Workers In Japan Want To Keep In Mind G Talent Blog

Profit Sharing Calculator For A Startup Business Plan Projections How To Plan Startup Business Plan Start Up Business

Profit Sharing Calculator For A Startup Business Plan Projections How To Plan Startup Business Plan Start Up Business

Permanent Resident Visa In Japan How To Apply Guide And Explanation Of Highly Skilled Foreign Professional Point System

Permanent Resident Visa In Japan How To Apply Guide And Explanation Of Highly Skilled Foreign Professional Point System

668 Twitter Brazil News Philippines Singapore

668 Twitter Brazil News Philippines Singapore

Material On Individual Income Taxation Ministry Of Finance

Material On Individual Income Taxation Ministry Of Finance

Japanese Tax That Foreign Workers In Japan Want To Keep In Mind G Talent Blog

Japanese Tax That Foreign Workers In Japan Want To Keep In Mind G Talent Blog

Real Estate Related Taxes And Fees In Japan

Labels: calculated, property

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home