How Does Property Tax Lien Work

If the homeowner cant pay. A tax lien prohibits a property from being sold or refinanced until the taxes are paid and the lien is removed.

A levy actually takes the property to pay the tax debt.

How does property tax lien work. A tax lien sale is often win-win for the purchaser. When you bid for properties you are bidding on the interest you will receive while you hold the tax lien. According to Florida law the Tax Collector must conduct a sale of tax certificates beginning on June 1 for the preceding year of delinquent real estate taxes.

If youre delinquent on your property. Also property tax liens themselves can be sold to investors who then attempt to. A tax lien sale is when the liens are auctioned off to the highest bidder.

To apply for a PT AID payment agreement download and complete the application below or call 311 for assistance. A lien secures the governments interest in your property when you dont pay your tax debt. A tax lien certificate or tax certificate is not a purchase of property.

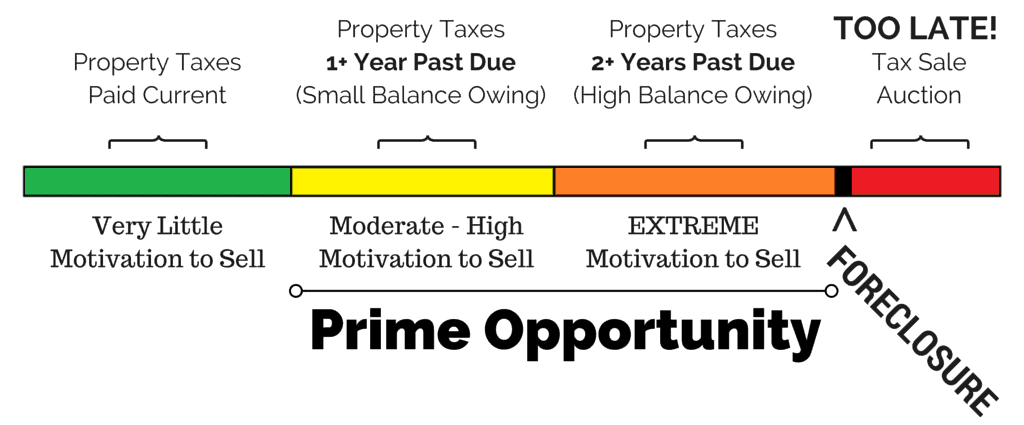

When a local government forecloses a property for taxes due it conducts a property tax lien sale or auction. Property owners have a set time frame in which to pay outstanding property taxes before a tax lien certificate holder can initiate a foreclosure proceeding. If the taxes are not paid within the statutory time limit the taxes become delinquent.

If the property owner does not pay their taxes by the due date set by the treasurer the lien holder is awarded a Treasurers Deed to the property. The lien is the amount owed and must be paid in. A lien is placed on a property when the homeowner fails to pay annual property taxes to the state or local government.

By winning a tax lien certificate bidders pay off the tax debt for the property owner. Bidding starts at the statutory maximum rate of 18 percent and goes. By law you must pay the total taxes penalties and interest owed for each property.

The tax collector places the property on the delinquent tax role and issues a tax lien. A lien effectively makes the property act as collateral for the debt. If you dont pay or make arrangements to settle your tax debt the IRS can levy seize and sell any type of.

A lien is a legal claim or a right against a property. Rather it is a lien imposed on the property by payment of the delinquent taxes. Tax liens can be costly to property owners though they can yield returns to investors.

The property owner then becomes responsible for paying back that debt plus interest to the purchaser. A tax lien certificate represents a debt associated with unpaid property taxes. The tax lien amount includes the past due taxes and monthly interest.

The highest bidder now has the right to collect the liens plus interest from the homeowner. The Property Tax and Interest Deferral program removes properties from the tax lien sale once an application is complete. When the lien is issued the county or town that is owed property taxes creates a.

The owner of the property is notified and given numerous opportunities to catch up their back taxes and pay the lien holder their investment plus interest. When homeowners dont pay their property taxes the overdue amount becomes a lien on the property. A tax lien is a legal claim against the property of an individual or business that fails to pay taxes owed to the government.

Each year the county tax collector sends out property tax bills to the owners. This lien is a public claim for the outstanding delinquent tax meaning the property. In certain municipalities the treasurers office will eventually place a property tax lien on the property.

If the delinquent taxpayer pays off their debts the purchaser earns back their initial investment plus interest. Learn about your options to avoid a tax sale if you cant keep up with the property taxes How Tax Foreclosures Work in New York. Liens are often part of the public record informing potential creditors and others about existing debts.

1 Liens provide security allowing a person or organization to take property or take other legal action to satisfy debts and obligations.

Tax Certificates Does A Homebuyer Need One With Images Home Buying Estate Lawyer Estate Tax

Tax Certificates Does A Homebuyer Need One With Images Home Buying Estate Lawyer Estate Tax

Tax Lien Wealth Builders The Best Real Estate Investment Training Institute Real Estate Training Best Real Estate Investments Investing

Tax Lien Wealth Builders The Best Real Estate Investment Training Institute Real Estate Training Best Real Estate Investments Investing

Progress And Deterioration Buy Gazebo Work Skills Gazebo

Progress And Deterioration Buy Gazebo Work Skills Gazebo

Tony Martinez Asks If You Have Considered The Possibility Of Purchasing An Investment Property With An Existing Tenant Discover Investing Mortgage Payoff Tax

Tony Martinez Asks If You Have Considered The Possibility Of Purchasing An Investment Property With An Existing Tenant Discover Investing Mortgage Payoff Tax

5 17 2 Federal Tax Liens Internal Revenue Service

5 17 2 Federal Tax Liens Internal Revenue Service

Buy Tax Liens From Home Tax Lien Investing Tips Investing Tips Real Estate Investing

Buy Tax Liens From Home Tax Lien Investing Tips Investing Tips Real Estate Investing

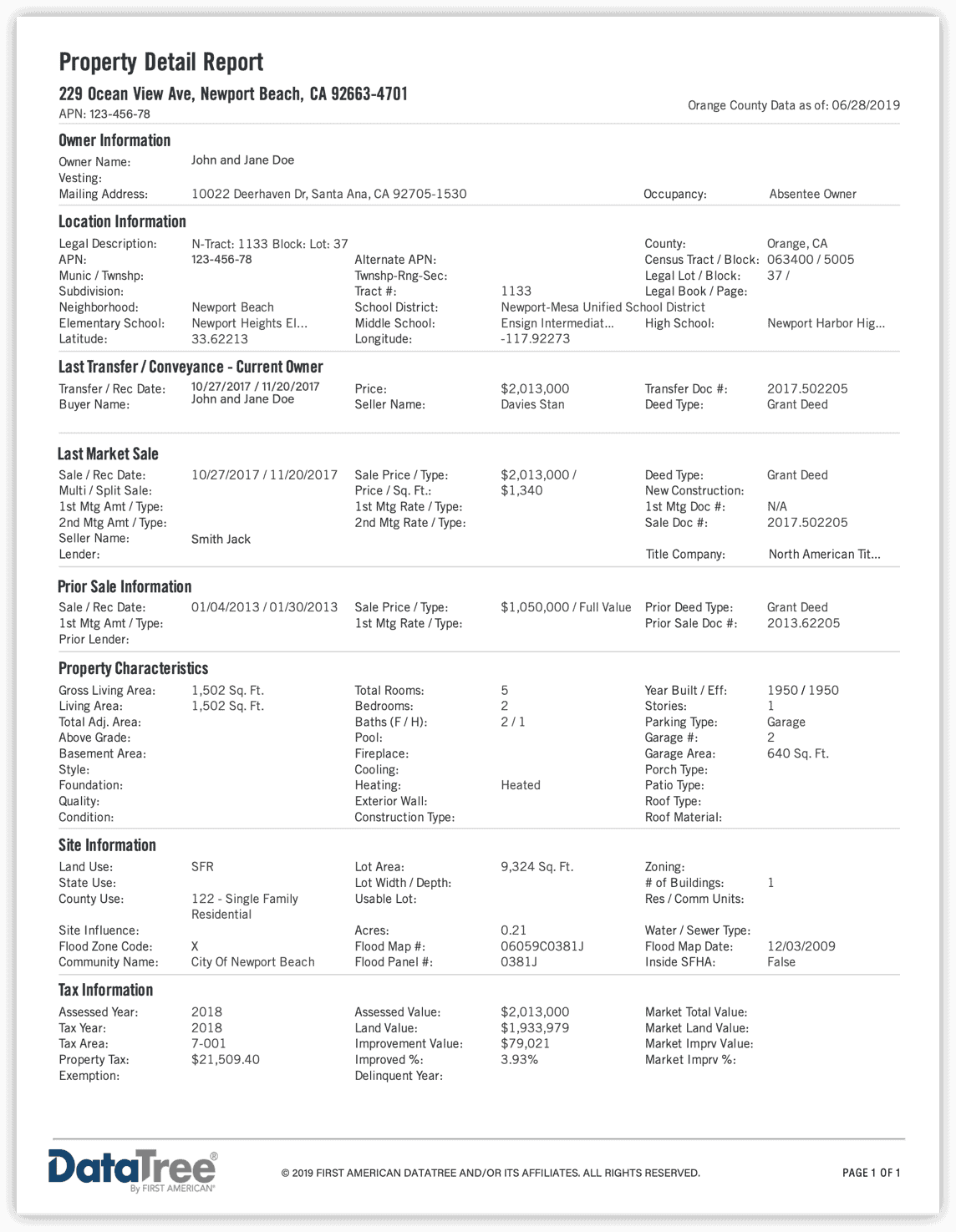

Everything You Need To Know About Getting Your County S Delinquent Tax List Retipster

Everything You Need To Know About Getting Your County S Delinquent Tax List Retipster

Tax Lien Certificate Way To Investing In A Profitable Way Infographics Investing Real Estate Investing Budgeting Finances

Tax Lien Certificate Way To Investing In A Profitable Way Infographics Investing Real Estate Investing Budgeting Finances

Tax Lien Investing Pros And Cons Youtube

Tax Lien Investing Pros And Cons Youtube

Irs Tax Liens Irs Taxes Business Funding Irs

Irs Tax Liens Irs Taxes Business Funding Irs

Secrets Of Tax Lien Investing Tax Sale Investment Type Tax Lien States Tax Deed States And Redemption Deed States Tax Help Tax Prep Investing

Secrets Of Tax Lien Investing Tax Sale Investment Type Tax Lien States Tax Deed States And Redemption Deed States Tax Help Tax Prep Investing

Learn How You Can Buy Tax Liens From Home And Have Someone Else Do All The Work For You Real Estate Investing Investing Stock Market

Learn How You Can Buy Tax Liens From Home And Have Someone Else Do All The Work For You Real Estate Investing Investing Stock Market

Tax Sale Investing The Auction Process Tutorial Training Tax Liens Deeds Foreclosures Investing Auction Tutorial

Tax Sale Investing The Auction Process Tutorial Training Tax Liens Deeds Foreclosures Investing Auction Tutorial

Everything You Need To Know About Getting Your County S Delinquent Tax List Retipster

Everything You Need To Know About Getting Your County S Delinquent Tax List Retipster

Buying A Tax Lien Or Tax Deed How To Simplify The Research Process Investment Quotes Investing Real Estate Investing

Buying A Tax Lien Or Tax Deed How To Simplify The Research Process Investment Quotes Investing Real Estate Investing

Free Tax Lien Training W Danielle Pierce Youtube Tax Free Investing Wholesale Real Estate

Free Tax Lien Training W Danielle Pierce Youtube Tax Free Investing Wholesale Real Estate

Auctionmydeal Allows Listing Of Your Property In Houston S Online Real Estate Auction To Buy Or Sell You Property Tax Lawyer Real Estate Auction Foreclosures

Auctionmydeal Allows Listing Of Your Property In Houston S Online Real Estate Auction To Buy Or Sell You Property Tax Lawyer Real Estate Auction Foreclosures

Tax Lien Investing Simple Diy Investing For 18 Returns Diy Investing Real Estate Investing Investing

Tax Lien Investing Simple Diy Investing For 18 Returns Diy Investing Real Estate Investing Investing

What Is A Lien Types Of Property Liens Explained

What Is A Lien Types Of Property Liens Explained

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home