Property Tax Search Johnson County Ks

JoCo Home AIMS Home Online Mapping myAIMS. You can find a property by tax ID number owner name or by address.

Johnson County Kansas Kansas Historical Society

Johnson County Kansas Kansas Historical Society

Enter the street number followed by a space and the street name.

Property tax search johnson county ks. The primary function of the County Collector is the collection of personal and real estate taxes for the various taxing entities of the county. Saturday April 17 2021 Search Map. Free Johnson County Property Tax Records Search.

Sale Tax Revenue Bonds STAR Economic Development - More Info. Search by Last Name or Company Name andor Tax Year. The first half real estate and personal property taxes are due on or before Monday Dec.

Johnson Treasurer 913 715 - 2600. This is the owners mailing address. Johnson Register of Deeds 913 715 - 0775.

Tax Search powered by. The Johnson County Collectors office strives to provide quality customer service to the citizens of Johnson County while being trustworthy stewards of public funds. See what the tax bill is for any Johnson County KS property by simply typing its address into a search bar.

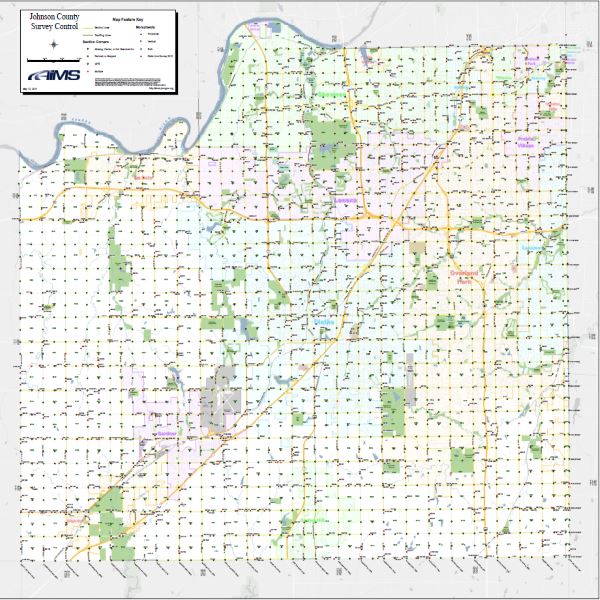

Amber Meadows in many of the layers. Johnson Appraiser 913 715 - 9000. As a public service we offer a land records search tool where you can look up the value of a parcel of Johnson County land by an Address Quick Reference Number KUP Number or Parcel Number.

If you do not know the account number try searching by owner name address or property location. Payments made online on the due dates ie. The search box will locate features by name eg.

If only the first half is paid a second half tax. Johnson County KS Property Tax Search by Address. 410 - - S - 2ND STREET - 67000.

Account numbers can be found on your Johnson County Tax Statement. This search tool provides you with a lot of valuable information including links to your current tax bill. Property Tax Forms Open Records Archives Records up to 5 years old including the current tax roll are available in the Johnson County Treasurers Office at 111 South Cherry Street Suite 1500 Olathe KS from 8 am.

You may also use the following search field to start your search directly from this page. Go to Data Online. Taxpayers have the option of paying the full or half amount taxes by December 20th.

Go to Data Online. 21 2020 and the second half taxes are due on or before Monday May 10 2021. Search by any combination of these.

Tax status prior year taxes and their status is available. Jackson County Tax Search. Personal property taxes include mobile homes boats trailers jet skis vehicles with non-highway titles etc.

Plat - Developed. In-depth Property Tax Information. Enter owners last name followed by a space and the first name or letter.

Registered Search - Do you need more information. The My Location text box will validate your address property id or Kansas uniform parcel number KUPN as you type. Enter your Address Property ID or Kansas Uniform Parcel Number in the My Location box at the upper left to view information for a specific location.

The Johnson County Treasury and Financial Management department will begin mailing 207814 real estate and 17428 personal property tax statements to Johnson County taxpayers on Friday Nov. Please allow 2-3 business days for the payment to show as posted on your online tax information page. Johnson County makes every effort to produce and publish the most current and accurate information possible.

Johnson County Treasurers Office 111 South Cherry Street Olathe KS 66061 913-715-2600 Directions. Johnson County Records Tax Administration 111 S Cherry Street Ste 1200 Olathe KS. Tax Searches can be performed on the County Appraisers page.

Go to Data Online. See Johnson County KS tax rates tax exemptions for any property the tax assessment history for the past years and more. Go to Data Online.

1220 and 510 are considered timely payments. Historic Aerials 480 967 - 6752. Perform a free Johnson County IN public tax records search including assessor treasurer tax office and collector records tax lookups tax departments property and real estate taxes.

Contact the Geary County Treasurers Office to become a registered user. Generally we record and index all land record documents create maintain and calculate the annual tax roll archive county records and provide customer service. The Johnson County Department of Records Tax Administration RTA is a consolidated office combining the duties of the Register of Deeds County Clerk and Archives and Record Management.

Real Estate Taxes Real estate tax statements are mailed in November of each year for that tax year. Johnson County Treasurer Tax Collector Office. Get Property Records from 1 Treasurer Tax Collector Office in Johnson County KS.

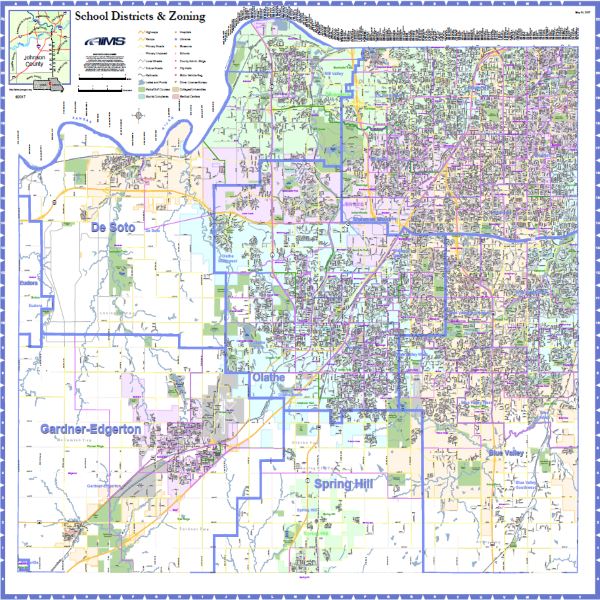

You can access their website for contact information and for more information regarding the tax roll and land records. Monday through Friday except holidays. Johnson Mapping GIS.

Johnson County Kansas Kansas Historical Society

Johnson County Kansas Kansas Historical Society

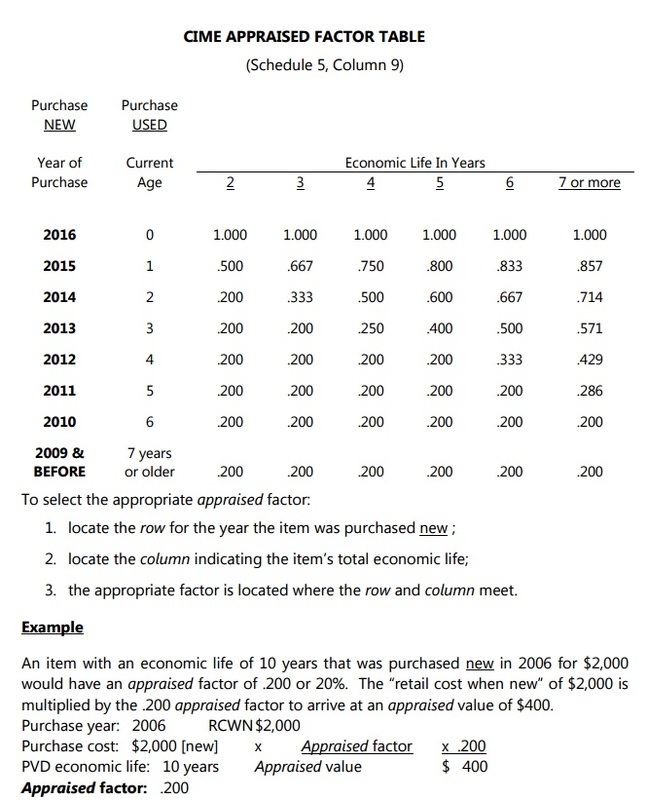

Faq S On Personal Property Crawford County Ks

Faq S On Personal Property Crawford County Ks

Real Estate And Personal Property Tax Johnson County Kansas

Real Estate And Personal Property Tax Johnson County Kansas

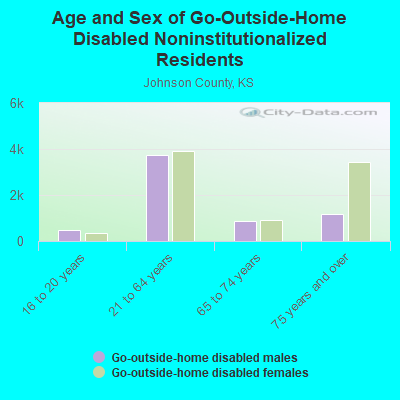

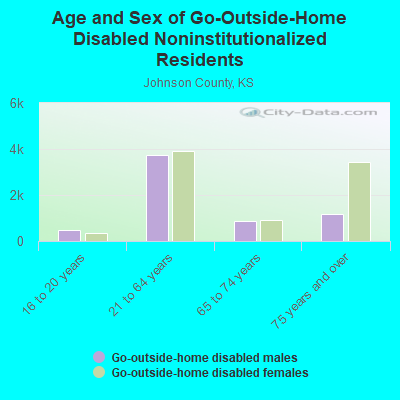

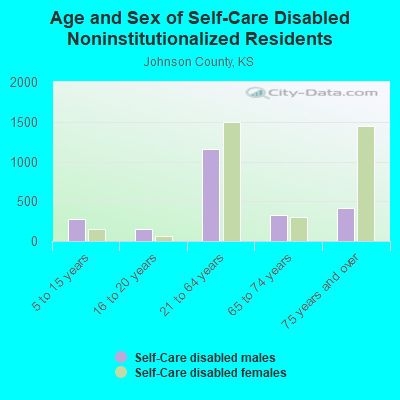

Johnson County Kansas Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Johnson County Kansas Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Board Of County Commissioners Update Johnson County Kansas

Board Of County Commissioners Update Johnson County Kansas

Oil And Ownership Map Of Johnson County Kansas Kansas Memory Kansas Historical Society

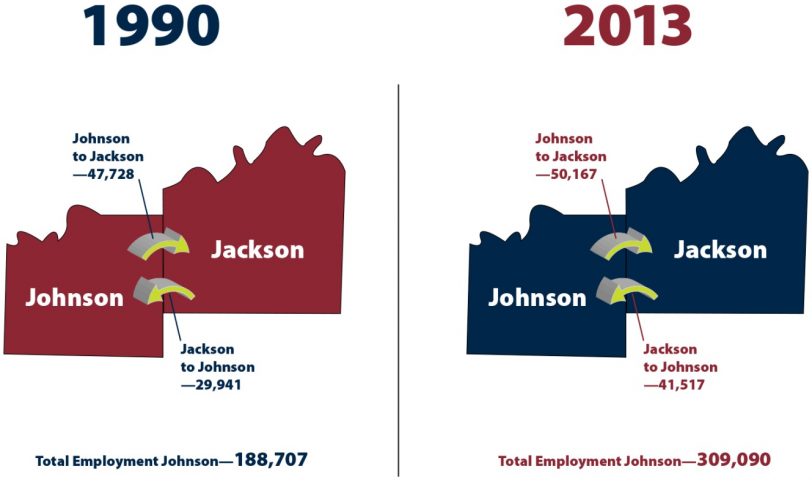

Working In Kansas City The Rise Of Johnson County Show Me Institute

Working In Kansas City The Rise Of Johnson County Show Me Institute

View Pay Tax Bill Johnson County Kansas

View Pay Tax Bill Johnson County Kansas

Kansas Gold Coast Generates More Than Third Of State S Property Tax Payments Kansas City Business Journal

Kansas Department Of Revenue Property Valuation Data By County

Kansas Department Of Revenue Property Valuation Data By County

2021 Best Places To Buy A House In Johnson County Ks Niche

2021 Best Places To Buy A House In Johnson County Ks Niche

Real Estate And Personal Property Tax Johnson County Kansas

Real Estate And Personal Property Tax Johnson County Kansas

Johnson County Kansas Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Johnson County Kansas Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Joco On The Go Johnson County Kansas

Joco On The Go Johnson County Kansas

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home