Property Tax Relief Refund Nj

Many New Jersey homeowners are entitled to a rebate or credit thats a percentage of the first 10000 in property tax that they paid last year. There are two separate and distinct property tax relief programs available to New Jersey homeowners.

My Nj Tax Return Not Picking Property Tax Deductio

My Nj Tax Return Not Picking Property Tax Deductio

The point of the Freeze is to limit your property tax.

Property tax relief refund nj. You will get the difference between your base year first year of eligibility property tax amount and the current year property tax amount as long as the current year is higher than the base year and you met all other eligibility. The Homestead credit is a popular property tax relief program for about 580000 seniors disabled or low-income homeowners. Description STAR or Property Tax Relief credit year.

The state treasurer said in a news release the state will not fund. NJ Division of Taxation. Department of the Treasury Division of Taxation PO Box 281 Trenton NJ 08695-0281.

If a reimbursement has been issued the system will tell you the amount of the reimbursement and the date it was issued. All relief programs require applicants to be New Jersey residents for a least one year prior to October 1 st and ownoccupy their home as of October 1 st of the pretax year. Before checking on your refund wait four weeks from the day you filed an electronic online return.

If you itemize your deductions to claim property taxes you reduce your property taxes by the amounts of these two checks. Before you begin youll need. All Property Tax Relief Benefits are Subject to Change NJ FY 2019 Budget Passed July 1 2018.

Senior Freeze Property Tax Reimbursement Program. Check the status of your New Jersey Senior Freeze Property Tax Reimbursement. In addition if the program has specific requirements there are legal definitions on the application forms that you should read to confirm you meet the requirements.

Claim for Refund of Estimated Gross Income Tax Payment Required on the Sale of Real Property Located in New Jersey under the provisions of C55 PL 2004 GITREP-1 Nonresident Sellers Tax. If you do not itemize your deductions you do not have to report these two checks. The deadline for senior homeowners to apply for the Senior Freeze property tax relief program has been extended from December 31 2020 to February 1 2021.

June 7 2019 412 PM The property tax relief and property tax freeze checks are reductions of your property taxes. The percentage depends on the owners annual income. Senior Freeze Property Tax Reimbursement Inquiry.

Senior Freeze Property Tax Relief. Local Tax Office Refunds the State Apply with Local Tax Office. The homestead rebate also reduces the amount of property tax paid.

Your prior-year New York State income tax return Form IT-201. Forms are sent out by the State in late Februaryearly March. New Jerseys Property Tax Relief Programs Joyce Olshansky Team Leader.

Phil Murphys proposed 324 billion spending plan includes 275 million for the property tax relief program which lowers tax bills for about 580000 seniors disabled or low-income. To use this service you will need the Social Security number that was listed first on your Senior Freeze application Form. This is not an issue if you dont itemize.

You can view and print the following information regarding your 2017 2018 2019 and 2020 property tax credit checks that have been issued. The State of NJ site may contain optional links information services andor content from other websites operated by third parties that are provided as a convenience such as Google Translate. You may claim only one of the benefits.

You can only deduct property taxes paid. To follow the progress of your refund enter your Social Security number and the amount of the refund as listed on your tax return. The program reimburses eligible senior citizens and disabled persons for property tax or mobile home park site fee increases on their principal residence.

Wait 12 weeks to. In the old days when it was also mailed many New Jerseyans would deduct it anyway so now it goes straight to the tax collector. This property tax relief program does not actually freeze your taxes but will reimburse you for any property tax increases you have once youre in the program.

The Garden State is home to the highest levies on property in the nation with a mean effective property tax rate of 221 according to the Tax. Residents of New Jersey that pay property tax on the home they own or rent may qualify for a refundable tax credit or a deduction on their return. If your annual income exceeds 250000 you will not qualify for any rebate or credit.

Local Property Tax Relief Programs. Then select the appropriate tax year. Department of the Treasury Division of Taxation PO Box 281 Trenton NJ 08695-0281.

The higher your income the lower the percentage.

Senior Freeze Hazlet Township Nj

Tell Gov Murphy Don T Cut The Senior Freeze Or Homestead Tax Relief Programs Senatenj Com

Tell Gov Murphy Don T Cut The Senior Freeze Or Homestead Tax Relief Programs Senatenj Com

Disabled Veterans Property Tax Exemptions By State

Disabled Veterans Property Tax Exemptions By State

Nj Division Of Taxation Nj Division Of Taxation Senior Freeze Property Tax Reimbursement

Nj Division Of Taxation Nj Division Of Taxation Senior Freeze Property Tax Reimbursement

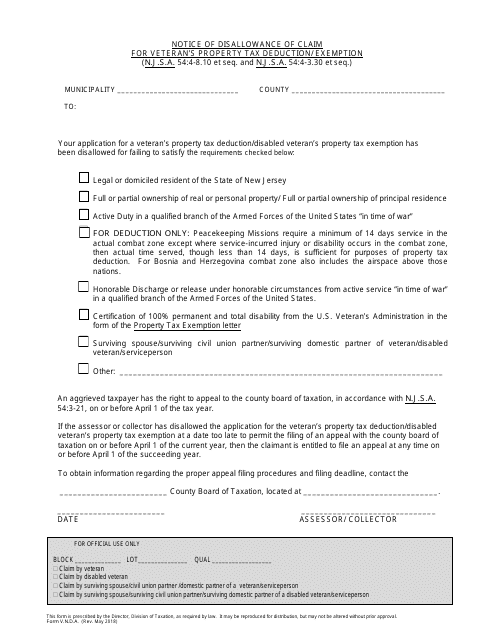

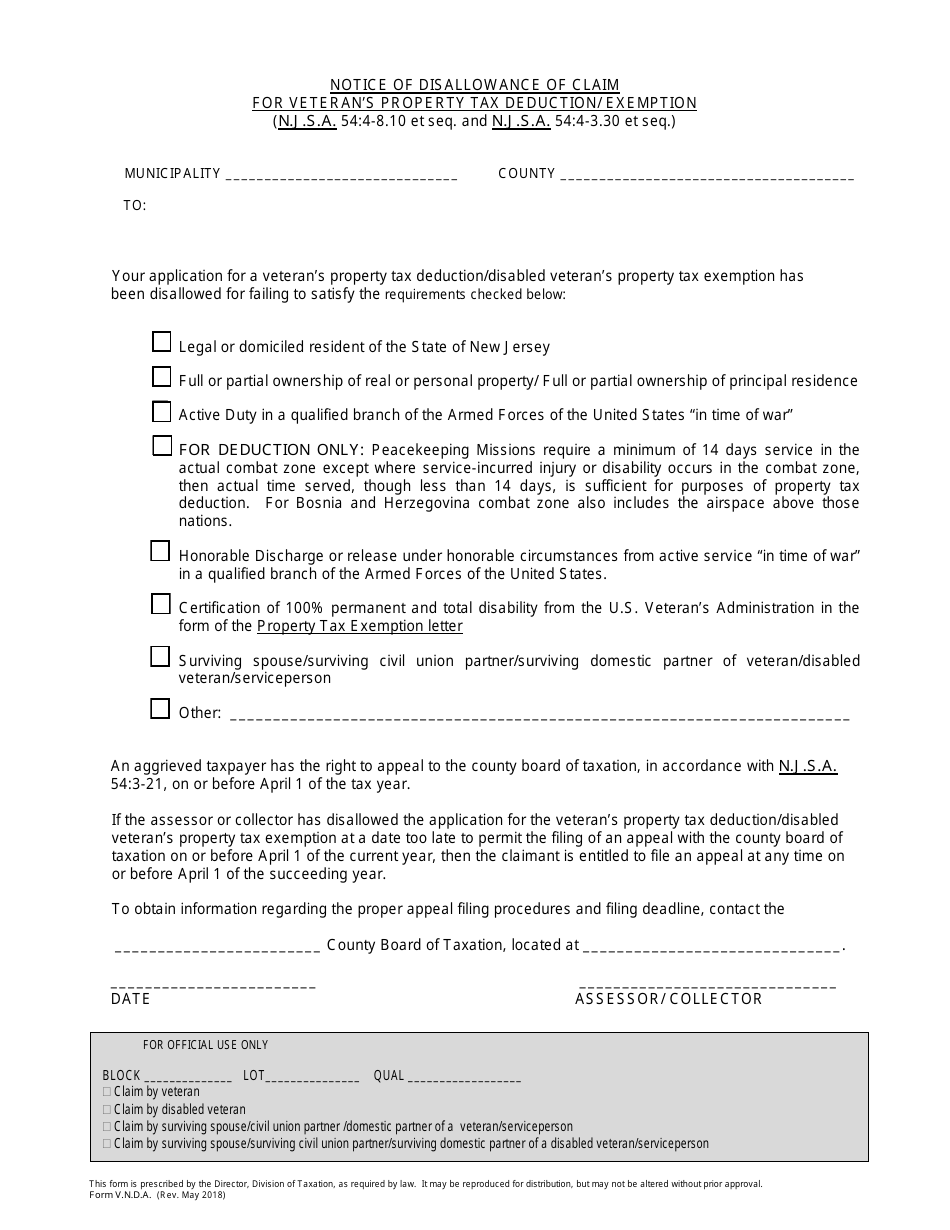

Form V N D A Download Fillable Pdf Or Fill Online Notice Of Disallowance Of Claim For Veteran S Property Tax Deduction Exemption New Jersey Templateroller

Form V N D A Download Fillable Pdf Or Fill Online Notice Of Disallowance Of Claim For Veteran S Property Tax Deduction Exemption New Jersey Templateroller

What Is The Disability Property Tax Exemption Millionacres

What Is The Disability Property Tax Exemption Millionacres

Senior Freeze Hazlet Township Nj

Will You Get A Break On Your N J Property Taxes During Coronavirus Crisis Nj Com

Nj Division Of Taxation Nj Division Of Taxation Senior Freeze Property Tax Reimbursement

Nj Division Of Taxation Nj Division Of Taxation Senior Freeze Property Tax Reimbursement

Property Tax Relief Takes Big Hit As N J Freezes Nearly 1b In Spending Coronavirus Phillytrib Com

Property Tax Relief Takes Big Hit As N J Freezes Nearly 1b In Spending Coronavirus Phillytrib Com

Shortchanging Homestead Benefit A Nj Tradition Nj Spotlight News

Shortchanging Homestead Benefit A Nj Tradition Nj Spotlight News

Https Www Rockawaytownship Org 218 Property Tax Relief

Nj Property Tax Relief Program Updates Access Wealth

Nj Property Tax Relief Program Updates Access Wealth

Another Instance Of The Law Being Properly Upheld The Buoyant Reader Of Cracking The Code Who Received The Refund Displayed Below Was Required By New Jersey To Explain Why He Was Amending His Original Return And Claiming The Refund His Succinct

Another Instance Of The Law Being Properly Upheld The Buoyant Reader Of Cracking The Code Who Received The Refund Displayed Below Was Required By New Jersey To Explain Why He Was Amending His Original Return And Claiming The Refund His Succinct

Nj Property Tax Relief Program Updates Access Wealth

Nj Property Tax Relief Program Updates Access Wealth

Deducting Property Taxes H R Block

Deducting Property Taxes H R Block

Form V N D A Download Fillable Pdf Or Fill Online Notice Of Disallowance Of Claim For Veteran S Property Tax Deduction Exemption New Jersey Templateroller

Form V N D A Download Fillable Pdf Or Fill Online Notice Of Disallowance Of Claim For Veteran S Property Tax Deduction Exemption New Jersey Templateroller

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home