What Is Local Property Tax Used For

Local governments then use the money. The pensions of public safety workers as well as legal payouts for misconduct personal injury etc are also covered by property taxes.

7 States Without An Income Tax And An 8th State Is Repealing Its Tax Income Tax Dividend Income Income

7 States Without An Income Tax And An 8th State Is Repealing Its Tax Income Tax Dividend Income Income

311 As a primary source of revenue property tax plays an important role in decentralisation and the autonomy of local government.

What is local property tax used for. Schools can impose this tax to help fund school operating costs. Local taxes come in. Use SmartAssets tools to better understand the average cost of property taxes in your state and county.

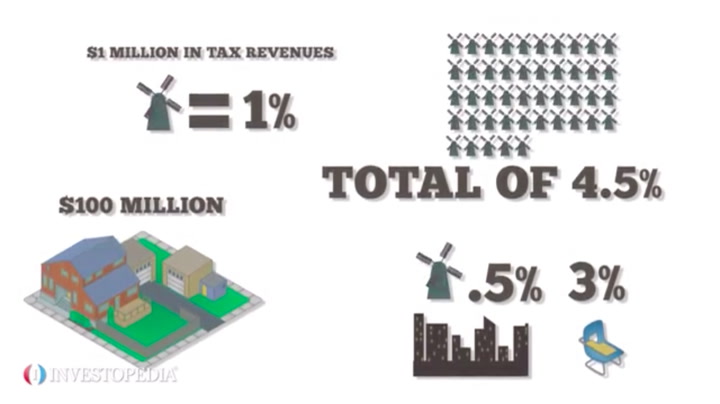

Or if the local income tax is an employer tax you must pay it. State governments once used the tax as an important source of revenue but few states now get more than a small percentage of their revenue from this source. Use tax of 1 percent which totals 1000 is paid.

If you end up paying personal property taxes to your local government the IRS allows you to claim a deduction for it on your federal tax return. Property taxes pay for road construction and maintenance local governments staff salaries and municipal public service employees such as police firefighters. Property taxes in America are collected by local governments and are usually based on the value of a property.

The LPT is collected by Revenue. Its also called an ad valorem tax. Local income taxes are typically used to fund local programs such as education parks and community improvement.

A local tax is an assessment by a state county or municipality to fund public services ranging from education to garbage collection and sewer maintenance. A property owner will receive a property tax bill each year. While property taxes are a significant source of local government revenue they are a very small revenue source for most states table 1.

This includes local authorities and social housing organisations. Cities municipalities counties and school districts rely on property taxes to raise money for their budgets. Property taxes are a major source of income for local and state governments and are used to fund services such as education transportation emergency parks recreation and libraries.

Updated February 26 2021 A personal property tax is imposed by state or local tax authorities based on the value of an item of qualifying property. An annual Local Property Tax LPT charged on all residential properties in the State came into effect in 2013. If you own a residential property in the State you must pay the tax.

To claim the deduction the tax must only apply to personal property you own be based on its value and be charged on an annual basis irrespective of. Learn how to pay your state taxes and find out about resources in your area that can help you through the process. The money collected is generally used to support community safety schools infrastructure and other public projects.

A grocer removes 1000 worth of food from his shelves for donation to a local charity. However the IRS requires you to satisfy certain requirements regardless of how your government classifies the tax. School district tax is a specific kind of local tax.

Or property owned by federal state or local governments are exempt from property tax. Own-source revenue excludes intergovernmental transfers. State and Local Taxes.

Property taxes also pay for the salaries and supplies of police officers firefighters and emergency medical technicians or EMTs. The property tax in the United States is the chief source of revenue for local governments. Taxpayers must pay personal income tax to the federal government 43 states and many local municipalities.

State governments levied property taxes in 36 states in 2017 collecting 16 billion in revenue or 1 percent of their own-source general revenue. In many cases however property tax is the main source of revenue and even when local income taxes exist it may be easier for a local government to modify the property tax rate than to adjust the income tax rate. The school district tax might be an income or property tax.

One hundred percent of this amount is deposited into the State and Local Sales Tax Reform Fund for distribution. Upon qualification properties that are owned and used by religious charitable or educational organizations. The tax is imposed on movable property such as automobiles or boats and its assessed annually.

Use tax on qualifying food drugs and medical appliances is 1 percent.

Average Property Tax As A Share Of Home Price Five Year Average 2007 2011 Property Tax Real Estate Infographic Real Estate Articles

Average Property Tax As A Share Of Home Price Five Year Average 2007 2011 Property Tax Real Estate Infographic Real Estate Articles

What You Need To Know About Property Taxes Property Tax Tax Deductions Refinancing Mortgage

What You Need To Know About Property Taxes Property Tax Tax Deductions Refinancing Mortgage

Usa County Of Orange California Property Tax Bill Template In Word Format Bill Template Property Tax Bills

Usa County Of Orange California Property Tax Bill Template In Word Format Bill Template Property Tax Bills

Online Tds Payment On Property Tax Payment Tax Refund Online Taxes

Online Tds Payment On Property Tax Payment Tax Refund Online Taxes

Pin By Bobbie Persky Realtor On Finance Real Estate Property Tax Tax Attorney Debt Relief Programs

Pin By Bobbie Persky Realtor On Finance Real Estate Property Tax Tax Attorney Debt Relief Programs

Find Out If There Are Any States With No Property Tax In 2020 Which States Have The Lowest Property Taxes States With Special Property Tax Property States

Find Out If There Are Any States With No Property Tax In 2020 Which States Have The Lowest Property Taxes States With Special Property Tax Property States

Property Tax Relief Portal In 2020 Property Tax How To Apply Homeowner

Property Tax Relief Portal In 2020 Property Tax How To Apply Homeowner

A Guide About How To Filing Mcd Property Tax Online Property Tax Public Private Partnership Tax Payment

A Guide About How To Filing Mcd Property Tax Online Property Tax Public Private Partnership Tax Payment

Long Island Index Infographic Property Tax Investment Property

Long Island Index Infographic Property Tax Investment Property

Normal Remember All Those Property Tax Increases Property Tax The Borrowers Pension Fund

Normal Remember All Those Property Tax Increases Property Tax The Borrowers Pension Fund

India S Aurangabad Municipal Corporation Amc On 3 June 2018 Announced It Will Conduct A Survey Of All Properties Within Its Munic Surveys Property Aurangabad

India S Aurangabad Municipal Corporation Amc On 3 June 2018 Announced It Will Conduct A Survey Of All Properties Within Its Munic Surveys Property Aurangabad

The Importance Of Preserving Homeownership S Tax Incentives Home Ownership Incentive Real Estate Infographic

The Importance Of Preserving Homeownership S Tax Incentives Home Ownership Incentive Real Estate Infographic

Deducting Property Taxes H R Block

Deducting Property Taxes H R Block

Monday Map State Local Property Tax Collections Per Capita Property Tax Map Best Places To Retire

Monday Map State Local Property Tax Collections Per Capita Property Tax Map Best Places To Retire

What Is Property Tax Equalization Factor For Cre Investor Commercial Real Estate Investing What Is Property Real Estate Investing

What Is Property Tax Equalization Factor For Cre Investor Commercial Real Estate Investing What Is Property Real Estate Investing

Kootenai County Homeowners Tax Exemption Tax Exemption Property Tax Kootenai County

Kootenai County Homeowners Tax Exemption Tax Exemption Property Tax Kootenai County

How Property Taxes Are Calculated

How Property Taxes Are Calculated

How Does The Deduction For State And Local Taxes Work Tax Policy Center

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Secured Property Taxes Treasurer Tax Collector

Secured Property Taxes Treasurer Tax Collector

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home