Property Tax Bill Riverside County

A supplemental tax bill is an additional property tax bill based on the difference between the prior assessed value and the new assessed value of real property. You will need your assessment number which you can find on a previous years tax bill or the address of the property.

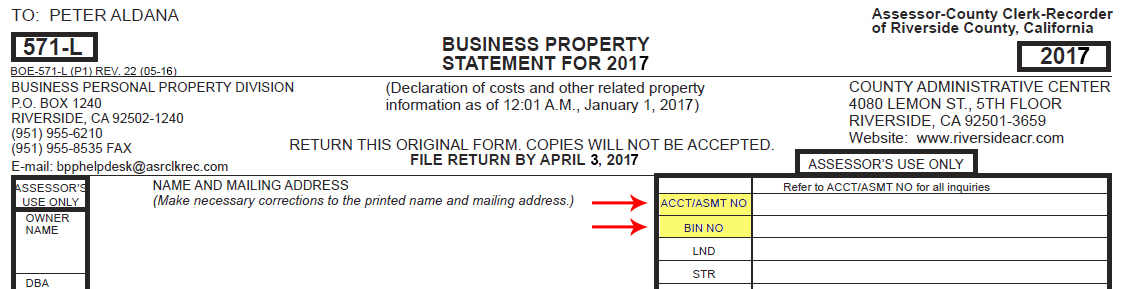

Riverside County Assessor County Clerk Recorder File Your Business Property Statement Online

Riverside County Assessor County Clerk Recorder File Your Business Property Statement Online

We accept the following forms of payment.

Property tax bill riverside county. The rate charged in a specific area 10. The combined office is led by Jon Christensen a countywide publicly elected official serving the fourth largest county in California by landmass and. Riverside County Assessor-County Clerk-Recorder Vision Statement To uphold and protect public trust through extraordinary.

For further information or claim forms please contact the Office of the Assessor at 951 955-6200 or 1 800 746-1544 within the 951 and 760 area codes. Searches and payment options are available for the following. The Treasurer-Tax Collector collects the taxes and invests the proceeds in the Treasurers Pooled Investment Fund for later distribution by the Auditor-Controller to taxing entities throughout Riverside County.

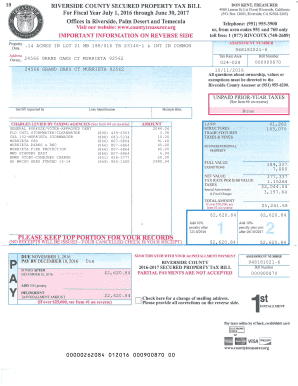

The Riverside County Treasurer-Tax Collector is responsible for the billing and collection of property taxes and for the receiving processing investing and most importantly safeguarding of public funds as mandated by the laws of the state of California. Riverside County Annual Property tax bills are mailed each year on or before November 1. The Riverside County Treasurer - Tax Collector is proud to offer online payment services.

All tax bills paid online or by the automated phone system are due by midnight on the delinquent date. A supplemental tax bill is in addition to the regular tax bill which is based on the assessed value as of January 1st. The Riverside County Tax Collector is a state mandated function that is governed by the California Revenue Taxation Code Government Code and the Code of Civil Procedures.

Registration fees are collected separately by the Department of Motor Vehicles DMV. The supplemental tax bill is sent directly to you by the Treasurer Tax Collector rather than to your mortgage company as may be the case with the regular property tax bill. If you do not receive your annual tax bill by November 1 you should request one by contacting the Treasurer- Tax Collectors Office.

10 digit number used to identify real property 8. Unique tax bill number assigned to your property each year 7. We STRONGLY encourage taxpayers to make their tax payments using either our online payment system make.

Bill Posted Date 9. The mailing address where tax bill is mailed according to the records with the County Assessors office 5. The Riverside County Treasurer - Tax Collector is proud to offer online payment services.

These annual property-tax bills cover the period from July 1 to June 30 and reflect the assessed value of the property as of January 1st. Boats vessels and jet skis. Add your property taxes.

OFFICE OF THE TREASURER-TAX COLLECTOR. OFFICE OF THE TREASURER-TAX COLLECTOR RIVERSIDE COUNTY CALIFORNIA. An escaped assessmenttax bill may be the result of a reappraisable event that has not been reported to the Assessors Office.

For information on property tax bills please see. Receives the extended assessment roll prints and mails the property tax bills to the name and address of record. DROP BOXES are available in front of the Dare County Justice Center and the Dare County Water Departments.

Regular Property Tax Bills. Property Property Tax Bills Escaped Tax Bills. If you own a boat in Riverside County on lien date January 1 of each year you are responsible for the full property tax bill even if you sell the boat after January 1.

All tax bills paid online or by the automated phone system are due by midnight on the delinquent date. To be eligible the property sold must be within the State of California and the property purchased must be within Riverside County. Each year the Treasurer-Tax Collector s Office mails in excess of 700000 property-tax bills and informational copies to owners of property in Riverside County.

Yes all property is taxed unless exempt by law Article XIII Taxation Section 14. Effective March 22 2021 the Treasurer-Tax Collectors downtown Riverside office located on the 1st floor of the County Administrative Center will be open by appointment only. The Tax Collector is responsible for the billing and collection of secured unsecured supplemental transient occupancy tax as well as various other special assessments for the county school and community colleges and.

Search for your property tax. The Assessor does not set tax amounts or collect taxes. Property tax bills are mailed out in late Septemberearly October and are payable in two equal.

An example of such an event would be construction done without a building permit or an unrecorded transfer of ownership. The Treasurer Tax Collector is committed to offering payment options to the public in the safest way possible. HAGHIGHI KAYVON LEAHY JAN 2385 RIVERSIDE TER MANASQUAN NJ 08736.

Please be advised that if for any reason you are unable to make your tax payment in an automated fashion over the phone or. Property Tax Portal Property Tax Payments - Search.

How To Appeal Your Cook County Property Taxes The Details Property Tax Tax Debt Tax Services

How To Appeal Your Cook County Property Taxes The Details Property Tax Tax Debt Tax Services

Winning 421 Million Powerball Ticket Sold In Tennessee Mega Millions Jackpot Powerball Lottery Strategy

Winning 421 Million Powerball Ticket Sold In Tennessee Mega Millions Jackpot Powerball Lottery Strategy

Understanding California S Property Taxes

Understanding California S Property Taxes

Help Taxsys Broward County Records Taxes Treasury Div

Help Taxsys Broward County Records Taxes Treasury Div

Tarrant County Tx Property Tax Calculator Smartasset

Tarrant County Tx Property Tax Calculator Smartasset

Understanding California S Sales Tax

Understanding California S Sales Tax

Riverside County Property Tax Records Riverside County Property Taxes Ca

Riverside County Property Tax Records Riverside County Property Taxes Ca

Sierra County Government Assessor

Sierra County Government Assessor

Https Www Cacttc Org Assets Documents Ebilling 20 20matt 20jennings 20 20thursday 202019 Pdf

Property Taxes Waterford Wi Official Website

The Myth Of Donor States Gonzoecon Myths Poor People States

The Myth Of Donor States Gonzoecon Myths Poor People States

Riverside County Property Tax Bill Fill Online Printable Fillable Blank Pdffiller

Riverside County Property Tax Bill Fill Online Printable Fillable Blank Pdffiller

California Public Records Public Records California Public

California Public Records Public Records California Public

Understanding California S Sales Tax

Understanding California S Sales Tax

Property Taxes Waterford Wi Official Website

New Program Allows Taxpayers Pay Annual Property Taxes In Monthly Installments County Of San Luis Obispo

New Program Allows Taxpayers Pay Annual Property Taxes In Monthly Installments County Of San Luis Obispo

Just In Time For O C Property Taxes A New App For That Property Tax Sign Company Free Sign

Just In Time For O C Property Taxes A New App For That Property Tax Sign Company Free Sign

Understanding California S Property Taxes

Understanding California S Property Taxes

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home