Franklin County Wa Property Tax Exemption

Senior Citizens and Disabled Person Tax Relief. Combined service-connected evaluation rating of 80 or higher.

Https Www Dnr Wa Gov Publications Rp Burn Cwpp Franklin Co Appendix Pdf

Franklin County recognizes the many financial and personal impacts of the current COVID-19 emergency and we are committed to helping every tax payer in Franklin County during this.

Franklin county wa property tax exemption. Your family automobile household goods and personal effects are not subject to personal property tax unless they are used in a. Retired from regular gainful employment due to a disability. Upper columbia corporation of sda 3715 s grove rd spokane wa 99224.

A proportionate amount of land value is also granted exemption. It consists of 1242 square miles or 795000 acres. Franklin County Assessors Office John Rosenau - Assessor Contact.

The person must be the owner or a lessee with an ownership interest in the. Transfer of real property means and includes every grant sale exchange assignment quitclaim contract for sale or other conveyance of ownership in title to real property. Appealing your Property Valuation.

Local 598 plumbing pipefitting 1328 rd 28. Visit the Office of the Franklin County Assessors website or call 509 545-3506 for more information. APPRAISAL - PERSONAL.

There are several tax relief opportunities provided by state law including property tax exemptions or deferrals for senior citizens and disabled persons. In 2014 the population of Franklin County was 87809 - a 78 increase since 2000 making us one of. SINCE 75 OR MORE.

Property tax exemption program for senior citizens and people with disabilities. Franklin County was formed in 1883 and is named after Benjamin Franklin. If you are 61 years old disabled or a disabled veteran you may be entitled for a property tax deduction.

THE DETERMINATION IS BASED ON 147 INCOME QUALIFIED UNITS OUT OF 194 UNITS OCCUPIED AS OF JANUARY 1 2019 REPRESENTING 76 OF THE UNITS QUALIFYING BY INCOME. During this challenging time there may be questions regarding how the COVID event may impact the assessed value of your property. There are several tax relief opportunities provided by state law including.

Transfer tax is imposed on each transfer of real property located within Washington County. APPRAISAL - REAL PROPERTY. The improvment lies upon parcel 119-370-299 as well and the improvement exemption applies to both parcels.

The surviving spouse or joint property owner is required to reapply for the exclusion if qualified. PROPERTY TAX INFORMATION NEW. This annual exemption is available for single-family residential property that is occupied as the principal residence of a person who is 65 years of age or older during the assessment year.

FRANKLIN COUNTY TREASURERS OFFICE. The divisions duties include the collection of delinquent taxes and working with property owners account holders tax lien purchasers and other interested parties with tax related issues. Business inventories are exempt from property tax unless available for rent but supplies consumed in the operation of a business are taxable.

If the person receiving the exclusion last year deceased prior to January 1 the person required by law to list the property must notify the Franklin County Tax Assessors Office. It includes machinery equipment furniture and fixtures associated with commercial industrial or agricultural enterprises. Homestead Exemption The Homestead Exemption program assists senior and disabled citizens in Franklin County by providing a substantial tax savings on the real estate or.

Designated Forestland Classification for timberland parcels 20 acres or more. Historical Restoration Exemption for historical significant property undergoing restoration. THE PROPERTY IS APPROVED FOR EXEMPTION IN TOTAL AS A VERY LOW INCOME HOUSING FACILITY FOR THE 2020 TAX YEAR UNDER RCW 8436560.

For information and the application please contact the Franklin County Assessors office at 509 545-3506. The Franklin County Assessors Office is mailing Real Property Change of Value Notices on July 23 2021. The tax is one dollar per thousand dollars or fraction thereof of the.

Delinquent tax refers to a tax that is unpaid after the payment due date. It is located in beautiful Eastern Washington. 21 rows leasehold interest this applicant would be exempt from property tax if they owned the.

At least 61 years of age or older. A total of 26700 sqft of the improvement is granted exemption. Tri-city junior academy 4115 w henry pasco franklin.

The remainder of the parcel is taxable. 1 1 f3 p l 106 sw14 nw14 ne14 less n 425 exc w 181 thereof tog with ease over nly 5 of w 181 26 9 26 265 acres.

Franklin County Treasurer Tax Relief Information

Franklin County Treasurer Tax Relief Information

Franklin County Assessor Important Dates

Franklin County Assessor Important Dates

Franklin County Assessor Frequently Asked Questions Personal Property

Franklin County Assessor Frequently Asked Questions Personal Property

Franklin County Assessor Personal Property

Franklin County Assessor Personal Property

Franklin County Treasurer Tax Relief Information

Franklin County Treasurer Tax Relief Information

Franklin County Treasurer Tax Relief Information

Franklin County Treasurer Tax Relief Information

Assessor Anticipates Decrease In Property Tax Bills

Assessor Anticipates Decrease In Property Tax Bills

10 Things You Need To Know About Your Property Tax Bill Entertainment Life The Columbus Dispatch Columbus Oh

10 Things You Need To Know About Your Property Tax Bill Entertainment Life The Columbus Dispatch Columbus Oh

Fcatb Fill Online Printable Fillable Blank Pdffiller

Fcatb Fill Online Printable Fillable Blank Pdffiller

Auto Title Manual Franklin County Ohio

Auto Title Manual Franklin County Ohio

Https Www Co Franklin Wa Us Auditor Myuploads File Auditor Accounting Documents 2020 Franklin County Budget Book Pdf

Franklin County Assessor Tax Information

Franklin County Assessor Tax Information

Franklin County Treasurer Property Tax Information

Human Services Benton County Wa

Human Services Benton County Wa

County Launches New App For Property Tax Payments Local News Emissourian Com

County Launches New App For Property Tax Payments Local News Emissourian Com

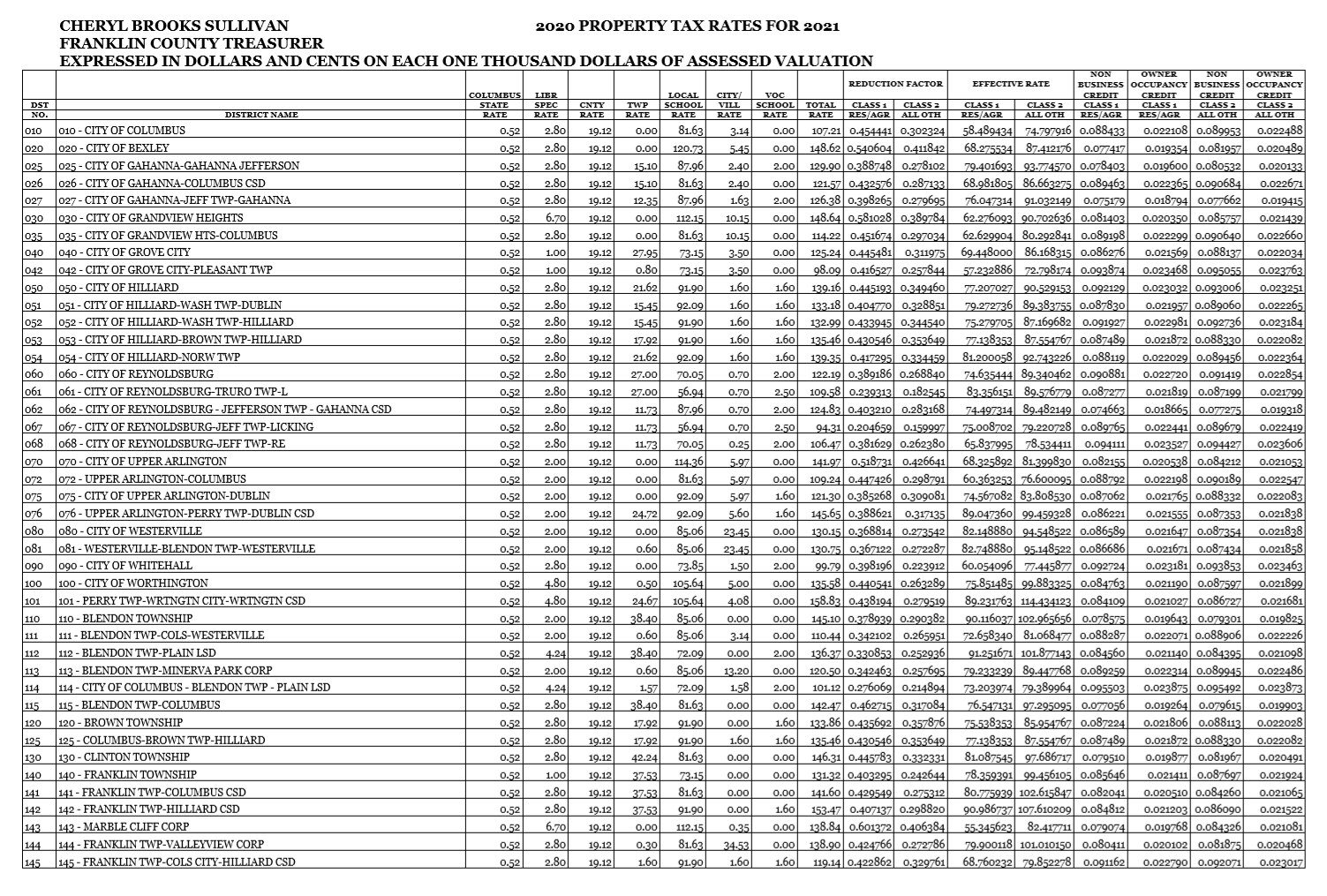

Franklin County Treasurer Tax Rates

Franklin County Treasurer Tax Rates

Https Www Co Franklin Wa Us Auditor Myuploads File Auditor Accounting Documents 2020 Franklin County Budget Book Pdf

Franklin County Assessor Appeal Of Valuation

Franklin County Assessor Appeal Of Valuation

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home