Property Tax Bill Harford County Md

Recent payments may not be reflected. Recent payments may not be reflected.

Frisian First Names Names Person Genealogy Research

Frisian First Names Names Person Genealogy Research

While we have confidence in the accuracy of these records Harford County Government makes no warranties.

Property tax bill harford county md. -Select one- ALLEGANY COUNTY ANNE ARUNDEL COUNTY BALTIMORE CITY BALTIMORE COUNTY CALVERT COUNTY CAROLINE COUNTY CARROLL COUNTY CECIL COUNTY CHARLES COUNTY DORCHESTER COUNTY FREDERICK COUNTY GARRETT COUNTY HARFORD COUNTY HOWARD COUNTY KENT COUNTY MONTGOMERY COUNTY PRINCE GEORGES COUNTY QUEEN ANNES COUNTY. Harford County collects on average 086 of a propertys assessed fair market value as property tax. Create an Account - Increase your productivity customize your experience and engage in information you care about.

Do I have to pay property tax in Harford County. Search by Street Address. The County provides several ways for you to make payment.

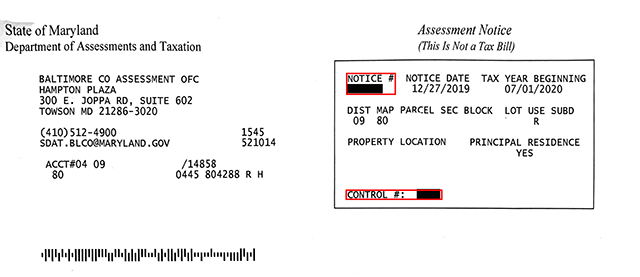

The Maryland Department of Assessments and Taxation administers and enforces the property assessment and property tax laws of Maryland. Select the county in which to search. While we have confidence in the accuracy of these records Harford County Government makes no warranties.

You may also mail your payment to Bureau of Revenue Collections PO. Box 609 Bel Air MD 21014 In Person. The property owner is responsible for payment of property taxes.

Search by Street Address. You will receive a property tax bill each year. Your Property Number is listed on your bill you receive from Harford County.

The tax roll is prepared from the assessment. Council President Parrott at the request of the County Executive 91-4 Date February 7 1995 AN ACT to add new Subsections F and G to Section 123-42 Business Tax Credits of Article II Real Property Tax Credits of Chapter 123 Finance and Taxation of the Harford County Code as. Do I have to pay property tax in Harford County.

Harford County Property Records are real estate documents that contain information related to real property in Harford County Maryland. Real Estate Tax Information. At the end of February of each year a delinquent notice is mailed to the owner of the property if any amount of taxes are still unpaid.

MD Assessment and Taxation - Real Property Data. I lost my property tax bill how can I get a new property tax bill. Real Estate Tax Information.

COUNTY COUNCIL OF HARFORD COUNTY MARYLAND BILL NO. Q 1- 7 Introduced by Legislative Day No. Also on October 1 a one-time 6 penalty is assessed on the County property tax portion.

Yearly median tax in Harford County The median property tax in Harford County Maryland is 2582 per year for a home worth the median value of 298800. By Mail Enclosed with each tax bill is a return envelope for mailing your payment. For example if the Property Number on your bill is.

State law provides that all real property is subject to a property tax. I am new to the county and have purchased a home. When searching by Property Tax ID DO NOT enter spaces or dashes.

Marylands 23 counties Baltimore City and 155 incorporated cities issue property tax bills during July and August each year. Return to Bill Search. Real Estate Tax Information.

What do I need to do. Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents. You must enter all 8 numeric digits to continue.

While we have confidence in the accuracy of these records Harford County Government makes no warranties. The address on the envelope is our mail payment processing address located in Baltimore. MD Assessment and Taxation - Real Property Data.

Do not enter street directions North South East West etc. Recent payments may not be reflected. I did not receive a property tax bill for my property.

MD Assessment and Taxation - Real Property Data. Do not enter street name suffixes Avenue Street Lane etc. The county mails the property tax bill to the owner of record on the tax roll.

Bel Air MD 21014 Phone. 410-638-3000 Hours Monday through Friday 8 am. Return to the Harford County Website.

This property is subject to City of Aberdeen property taxes. Beginning April 1 additional charges are added to the property tax bill for the cost of preparing the property for Tax Sale. Return to the Harford County Website.

The tax levies are based on property assessments determined by the Maryland Department of Assessments and. When searching omit dashes and spaces.

State Roundup New Covid Variant Found In Maryland As State Launches Govax Campaign Marylandreporter Com

State Roundup New Covid Variant Found In Maryland As State Launches Govax Campaign Marylandreporter Com

Https Mdgfoa Org Wp Content Uploads 2018 01 01192018 Elderly Resident And Retired Veterans Property Tax Credit Pdf

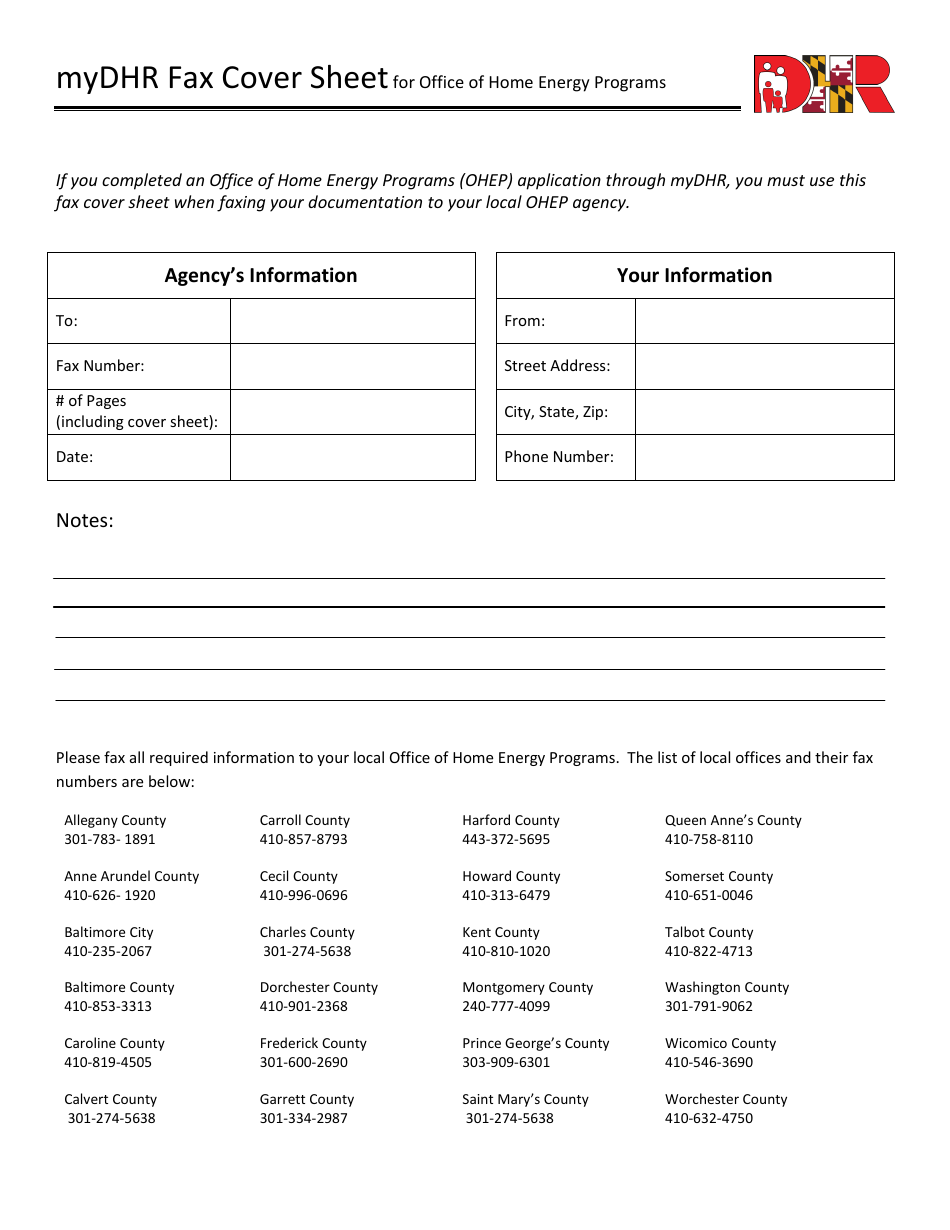

Maryland Mydhr Fax Cover Sheet For Office Of Home Energy Programs Download Printable Pdf Templateroller

Maryland Mydhr Fax Cover Sheet For Office Of Home Energy Programs Download Printable Pdf Templateroller

Harford County Maryland 2017 2018 By Atlantic Communications Group Inc Issuu

Harford County Maryland 2017 2018 By Atlantic Communications Group Inc Issuu

Http Hcgweb01 Harfordcountymd Gov Weblink 0 Edoc 7113113 Legislativedoc Pdf

Http Hcgweb01 Harfordcountymd Gov Weblink 0 Edoc 7858187 Legislativedoc Pdf 22

Http Hcgweb01 Harfordcountymd Gov Weblink 0 Edoc 8026942 Legislativedoc Pdf 22

Coalition To Protect Maryland Burial Sites Home

Coalition To Protect Maryland Burial Sites Home

Https Mdgfoa Org Wp Content Uploads 2018 01 01192018 Elderly Resident And Retired Veterans Property Tax Credit Pdf

Virginia New Homes For Sale In Toll Brothers Luxury Communities Toll Brothers House Exterior New Homes

Virginia New Homes For Sale In Toll Brothers Luxury Communities Toll Brothers House Exterior New Homes

List Of The Original 30 Anglican Parishes In The Province Of Maryland Wikipedia The Province Maryland Anglican

List Of The Original 30 Anglican Parishes In The Province Of Maryland Wikipedia The Province Maryland Anglican

How To Appeal Your Maryland Property Tax Assessment

How To Appeal Your Maryland Property Tax Assessment

Woodstock Berkshire Model At Laurel Ridge The Glen In Abingdon Md Abingdon New Home Communities Mansions

Woodstock Berkshire Model At Laurel Ridge The Glen In Abingdon Md Abingdon New Home Communities Mansions

Ouzo Bay Baltimore Md Greek Restaurants Greek Restaurant

Ouzo Bay Baltimore Md Greek Restaurants Greek Restaurant

Https Mdgfoa Org Wp Content Uploads 2018 01 01192018 Elderly Resident And Retired Veterans Property Tax Credit Pdf

Https Mdgfoa Org Wp Content Uploads 2018 01 01192018 Elderly Resident And Retired Veterans Property Tax Credit Pdf

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home