Property Transfer Tax In Quebec

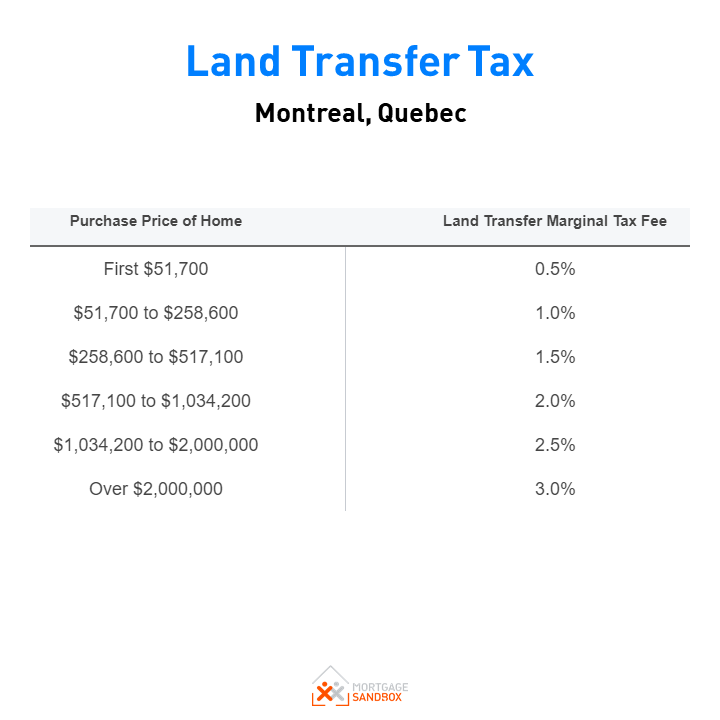

Using the chart below you can begin to see how the Québec land transfer tax is calculated. The first 51700 at the rate of 05 would cost 2585.

The Cost Of Buying A House In Toronto Canada By Neighbourhood The Neighbourhood Toronto Neighbourhoods Moving To Toronto

The Cost Of Buying A House In Toronto Canada By Neighbourhood The Neighbourhood Toronto Neighbourhoods Moving To Toronto

It is used to pay for city services such as police the fire department and public transit as well as elementary and secondary education.

Property transfer tax in quebec. And the remaining 91400 350000 258600 is another 1371. It also adds two exemptions to modernize the regime. Property tax is a tax on land and property.

Each portion of your homes value is taxed at its own unique marginal tax rate. When a property is transferred the City of Pointe-Claire does not automatically re-issue property tax bills. Enter the amount of this transfer on line 454 of your Québec income tax.

Property transfer duties commonly called the welcome tax are a sum of money that all buyers must pay the town or city after buying property. The real estate transfer tax exists in Quebec since 1992. The next 206900 258600 51700 is another 2069.

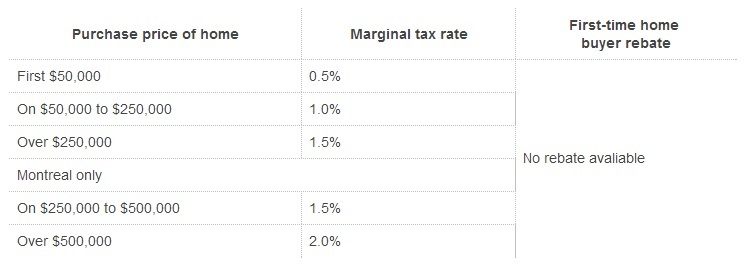

The New Quebec Land Transfer Tax Act. Furthermore you should never ignore the application of Land Transfer taxes on any transaction. 15 on amounts exceeding 250001.

It was the minister Jean Bienvenue who recommended its application. The general property transfer tax rate is. It is a tax applied to home buyers during the purchase of a property and is also known as taxe de bienvenue in French or welcome tax.

In a Gifting situation Then the tax is calculated as follows. The amount of the consideration stipulated in the act of sale if different from the price paid e. Commonly known as the Welcome Tax theGovernment of Québecs Land Transfer Taxsystem came to effect in 1992.

In the event of a separation or divorce only the transferee the person to whom the property is transferred will have to pay income tax on. The transferable portion of the source deductions for another province can reach 45 of the income tax withheld for this province. Québec Land Transfer Tax In Québec the LTT calculation is based on three different home price ranges and marginal tax rates.

For a purchase costing 100000000 the tax thus comes to 13500. It is based on the assessed value of a property. For example if you sell a property to your daughter for 5000 and the fair market value of the property is 400000 and the cost of the property is 5000 you will have deemed proceeds of 400000.

When gifting real estate to family members if you transfer a property to a related person for consideration less than the fair market value it may result in double taxation. Property Tax in Québec. 15 on the amount from 250000 to 500000.

It was named after Jean Bienvenue who was the Minister of Municipal Affairs responsible for instituting this tax. The general property transfer tax applies for all taxable transactions. Under provincial law all Québec municipalities must charge property transfer duties when buildings within their city or town limits are sold.

Quebecs 2016-17 budget seeks to eliminate the most common techniques used to avoid the Quebec land transfer tax the so-called welcome tax. These proposed amendments to the Act Respecting Duties on Transfers of Immovables are effective for transfers occurring after budget day March 17. Land Transfer taxes are imposed under the Act Respecting Duties on Transfers of Immoveables the Act and are invoiced to the purchaser by the relevant municipality after the registration of the deed of transfer.

Transfer tax is only payable once at the time of acquisition. The income from the transferred property or property substituted for the. You can transfer to the Province of Quebec up to 45 of the income tax shown on information slips issued to you by payers outside Quebec.

To be entitled to this credit you must have requested a tax transfer on your federal income tax return. This tax requires the new owner of property to pay a certain percentage of the value of the property to the municipality with the value of the property being determined as the. Quebecs Land Transfer TaxLTT is a percentage of your homes purchase price and has a marginal tax rate ranging from 05 to 15.

05 on the first 50000. It is payable in a single instalment. Province of Quebec outside Montreal.

Land Transfer Tax also commonly referred to as the Property Transfer Tax Real Property Transfer Tax or Welcome Tax depending upon where you reside within Canada was introduced in most provinces during the 1970s Ontario and Quebec and 1980s British Columbia. For a purchase costing 3000000 it comes to 43500. The property transfer tax is charged when a property is purchased.

1 on the amount from 50000 to 250000. Enter on line 43800 of your federal return the transfer amount up to the maximum and claim the same amount on line 454 of your provincial income tax return for Quebec. To calculate the Québec LTT you simply run the purchase price through the marginal tax rates for each range.

So the total Québec land transfer tax for this home would be. Its a non-recurring property tax applied only once and helps finance the citys expenses. The rates range from 05 to 15 but Montreals highest rate is 2 applying on transfers of more than.

If you and your spouse live in Canada and one of you transfers property to the other directly or indirectly one of you may have to pay income tax with regard to the property. 2585 2069 1371 369850T. Based on this formula.

1 of the fair market value up to and including 200000 2 of the fair market value greater than 200000 and up to and including 2000000. If you own a property you will have to pay property tax.

Unclaimed Financial Assets In Canada Financial Asset Financial Savings Bonds

Unclaimed Financial Assets In Canada Financial Asset Financial Savings Bonds

Live Coin Watch Cryptocurrency Prices Market Cap List Cryptocurrency Coin Market Coins

Live Coin Watch Cryptocurrency Prices Market Cap List Cryptocurrency Coin Market Coins

Ryan Wiley Business Card Burlington On Mortgage Brokers Mortgage Mortgage Brokers Home Mortgage

Ryan Wiley Business Card Burlington On Mortgage Brokers Mortgage Mortgage Brokers Home Mortgage

Como Ja Diz Um Velho Ditado Mais Vale Uma Vida Segura Do Que Mil Seguros De Vida Www Mundi Construcao Civil Treinamento De Seguranca Seguro De Vida

Como Ja Diz Um Velho Ditado Mais Vale Uma Vida Segura Do Que Mil Seguros De Vida Www Mundi Construcao Civil Treinamento De Seguranca Seguro De Vida

Canadian Mortgage Broker Needs A Creative Logo By Sevim Creative Logo Logo Branding Identity Fashion Logo Branding

Canadian Mortgage Broker Needs A Creative Logo By Sevim Creative Logo Logo Branding Identity Fashion Logo Branding

Substantiate Substantiate Substantiate A Friendly Reminder For Not For Profit Organizations And Their Donors Article Financial Services Reminder Coding

Substantiate Substantiate Substantiate A Friendly Reminder For Not For Profit Organizations And Their Donors Article Financial Services Reminder Coding

Ontario Parliament Building Toronto Ontario Canada Incredible Places Toronto Photos The Places Youll Go

Ontario Parliament Building Toronto Ontario Canada Incredible Places Toronto Photos The Places Youll Go

We Are The Best Auto Financing Business In Canada When You Apply For A Car Titl Car Finance Car Title How To Apply

We Are The Best Auto Financing Business In Canada When You Apply For A Car Titl Car Finance Car Title How To Apply

Effective Ways To Get Rid Of Ladybug Infestation In Your House Ladybug Ladybug House How To Get

Effective Ways To Get Rid Of Ladybug Infestation In Your House Ladybug Ladybug House How To Get

Https Ca Rbcwealthmanagement Com Delegate Services File 869670 Content

Myriad Manhattan Residences Of The Vanderbilt Cousins Part 2 The Children Of William K Vanderbilt And Florence Vanderbilt Twombly American Mansions Manhattan Residence Vanderbilt Mansions

Myriad Manhattan Residences Of The Vanderbilt Cousins Part 2 The Children Of William K Vanderbilt And Florence Vanderbilt Twombly American Mansions Manhattan Residence Vanderbilt Mansions

Got A Ladybug Infestation Here S What To Do If Ladybugs Are Invading Your Home Infestations Asian Beetle Ladybug House

Got A Ladybug Infestation Here S What To Do If Ladybugs Are Invading Your Home Infestations Asian Beetle Ladybug House

Online Mortgage Payment Calculator Calculate Your Mortgage Payment Online Easy And Quick You Ne Mortgage Payment Calculator Mortgage Payment Online Mortgage

Online Mortgage Payment Calculator Calculate Your Mortgage Payment Online Easy And Quick You Ne Mortgage Payment Calculator Mortgage Payment Online Mortgage

Land Transfer Tax In Quebec Ratehub Ca

Land Transfer Tax In Quebec Ratehub Ca

Un Travail Bien Fait Magazine La Coulisse Law Firm This Or That Questions Personal Injury Attorney

Un Travail Bien Fait Magazine La Coulisse Law Firm This Or That Questions Personal Injury Attorney

New Landlord Introduction Ez Landlord Forms Being A Landlord Introduction Letter Landlord Tenant

New Landlord Introduction Ez Landlord Forms Being A Landlord Introduction Letter Landlord Tenant

Pin By Julie Hemphill Hansen On Ottawa Real Estate Newsletter Molly Claude Team Realtors Christmas Trivia Fun Facts Fun

Pin By Julie Hemphill Hansen On Ottawa Real Estate Newsletter Molly Claude Team Realtors Christmas Trivia Fun Facts Fun

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home