Property Tax Flathead County Montana

The median property tax in Montana is 146500 per year for a home worth the median value of 17630000. The median property tax on a 23180000 house is 192394.

Coolest Homes For Sale In Bozeman Montana Bozeman Montana Bozemanmontana Home Realestate Beautifulhomes Bozemanreales Montana Homes Bozeman Real Estate

Coolest Homes For Sale In Bozeman Montana Bozeman Montana Bozemanmontana Home Realestate Beautifulhomes Bozemanreales Montana Homes Bozeman Real Estate

Find and pay taxes online.

Property tax flathead county montana. Montana Department of Revenue. Historic Aerials 480 967 - 6752. If any of the links or phone numbers provided no longer work please let us know and we will update this page.

State Mapping GIS. Tax amount varies by county. Flathead Tax Department 406 758 - 5680.

These records can include Flathead County property tax assessments and assessment challenges appraisals and income taxes. Flathead Recorder 406 758 - 5534. Flathead County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Flathead County Montana.

Go to Data Online. Once you have found your record simply follow the instructions on each screen. The median property tax in Flathead County Montana is 177700 All of the Flathead County information on this page has been verified and checked for accuracy.

To use the county property tax system you must inquire on an assessor number or go directly and inquire on a taxbill. Flathead Assessor 406 758 - 5700. Payments may be made to the county tax collector or treasurer instead of.

Counties in Montana collect an average of 083 of a propertys assesed fair market value as property tax per year. Go to Data Online. Flathead County collects relatively high property taxes and is ranked in the top half of all counties in the United States by property tax collections.

Flathead County has one of the highest median property taxes in the United States and is ranked 585th of the 3143 counties in order of median property taxes. Flathead County Property Records are real estate documents that contain information related to real property in Flathead County Montana. Property values may be rising in Missoula and other places but here in the Flathead they are slow and stagnant.

This Web site was coded to comply with both the. Flathead County recognizes the importance of making its digital government services available to the largest possible audience and has attempted to design the Web site to be accessible by everyone. The Flathead County Tax Assessor can provide you with a copy of your property tax assessment show you your property tax bill help you pay your property taxes or arrange a payment plan.

The median property tax on a 23180000 house is 178486 in Flathead County. To access your property information enter a property number assessment code name or address in the search box above. 083 of home value.

Montana needs to fully overhaul the tax structure and if that involves a sales tax. Flathead Treasurer 406 758 - 5684. If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact the Flathead County Tax Appraisers office.

Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents. Click here to review our Web Payment Policies. Flathead County collects on average 077 of a propertys assessed fair market value as property tax.

The median property tax also known as real estate tax in Flathead County is 177700 per year based on a median home value of 23180000 and a median effective property tax rate of 077 of property value. Go to Data Online. Flathead County Property Tax Payment By Check.

After entering a search term select a county to improve search speed. We strive to work harmoniously together as tax collectors of Flathead County and endeavor to serve the taxpayers in a courteous professional and friendly environment while maximizing returns on investments in a safe and prudent manner. Go to Data Online.

The median property tax in Flathead County Montana is 1777 per year for a home worth the median value of 231800. Property Tax Department MISSION STATEMENT.

Chinook Blaine County Montana Land For Sale 238 Acres Blaine County Land For Sale Montana

Chinook Blaine County Montana Land For Sale 238 Acres Blaine County Land For Sale Montana

560 Wolf Creek Drive Bigfork Mt 59911 Mls 21906795 Bigfork Real Estate Bigfork Real Estate Mls

560 Wolf Creek Drive Bigfork Mt 59911 Mls 21906795 Bigfork Real Estate Bigfork Real Estate Mls

Visiting Garnet Ghost Town Destination Missoula Garnet Ghost Town Ghost Towns Missoula

Visiting Garnet Ghost Town Destination Missoula Garnet Ghost Town Ghost Towns Missoula

Flathead County Gis Department

Flathead County Gis Department

560 Wolf Creek Drive Bigfork Mt 59911 Mls 21906795 Bigfork Real Estate Bigfork Real Estate Wolf Creek

560 Wolf Creek Drive Bigfork Mt 59911 Mls 21906795 Bigfork Real Estate Bigfork Real Estate Wolf Creek

Private Ponds Real Estate For Sale Columbia Falls Montana 7450 Hwy 2 East Mls 21911945 Columbia Falls Waterfront Homes For Sale Montana

Private Ponds Real Estate For Sale Columbia Falls Montana 7450 Hwy 2 East Mls 21911945 Columbia Falls Waterfront Homes For Sale Montana

Cultural History Town Profiles

Swan River Real Estate For Sale Bigfork Montana 1260 Swan Horseshoe Road Mls 21901358 Waterfront Homes For Sale Bigfork Swan River

Swan River Real Estate For Sale Bigfork Montana 1260 Swan Horseshoe Road Mls 21901358 Waterfront Homes For Sale Bigfork Swan River

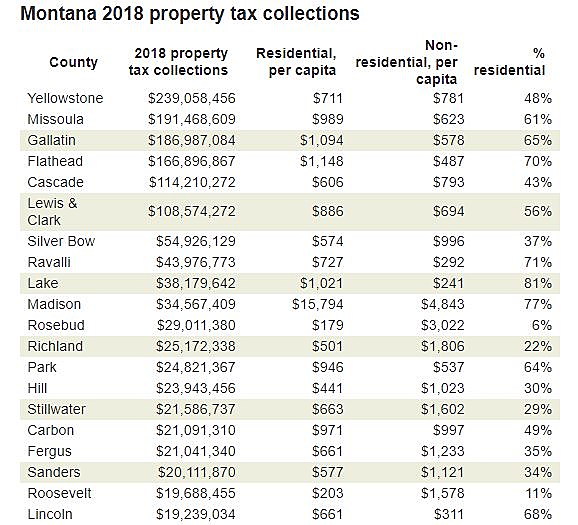

Montana Property Taxes Keep Rising But Missoula Isn T At The Top Missoula Current

Montana Property Taxes Keep Rising But Missoula Isn T At The Top Missoula Current

Flathead County Property Tax Department Delinquent Tax List

Flathead County Property Tax Department Delinquent Tax List

Flathead Lake Real Estate For Sale Bigfork Montana 14958 Romain Drive Mls 21911071 Flathead Lake Bigfork Montana

Flathead Lake Real Estate For Sale Bigfork Montana 14958 Romain Drive Mls 21911071 Flathead Lake Bigfork Montana

River Living Bigfork Wolf Creek Bigfork Montana

River Living Bigfork Wolf Creek Bigfork Montana

4 Bedroom 3 Bathroom Waterfront Home For Sale In Bigfork Montana On Swan River Listed For 150 Days At 3 750 00 In 2020 Swan River Glacier National Park Flathead Lake

4 Bedroom 3 Bathroom Waterfront Home For Sale In Bigfork Montana On Swan River Listed For 150 Days At 3 750 00 In 2020 Swan River Glacier National Park Flathead Lake

Swan River Real Estate For Sale Bigfork Montana 1260 Swan Horseshoe Road Mls 21901358 Waterfront Homes For Sale Bigfork Bigfork Montana

Swan River Real Estate For Sale Bigfork Montana 1260 Swan Horseshoe Road Mls 21901358 Waterfront Homes For Sale Bigfork Bigfork Montana

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home