Do 100 Disabled Veterans Pay Property Tax In Tennessee

Property Tax Relief Property tax relief for combat related 100 totally disabled veterans andor their surviving spouses. Disabled veterans with qualifying VA-rated conditions and certain surviving spouses may be eligible for a property tax break up to 100000 for primary residences only.

Any disabled Veteran who has a 100 percent permanent total disability from a service connected cause or any former prisoner-of-war as determined by the US.

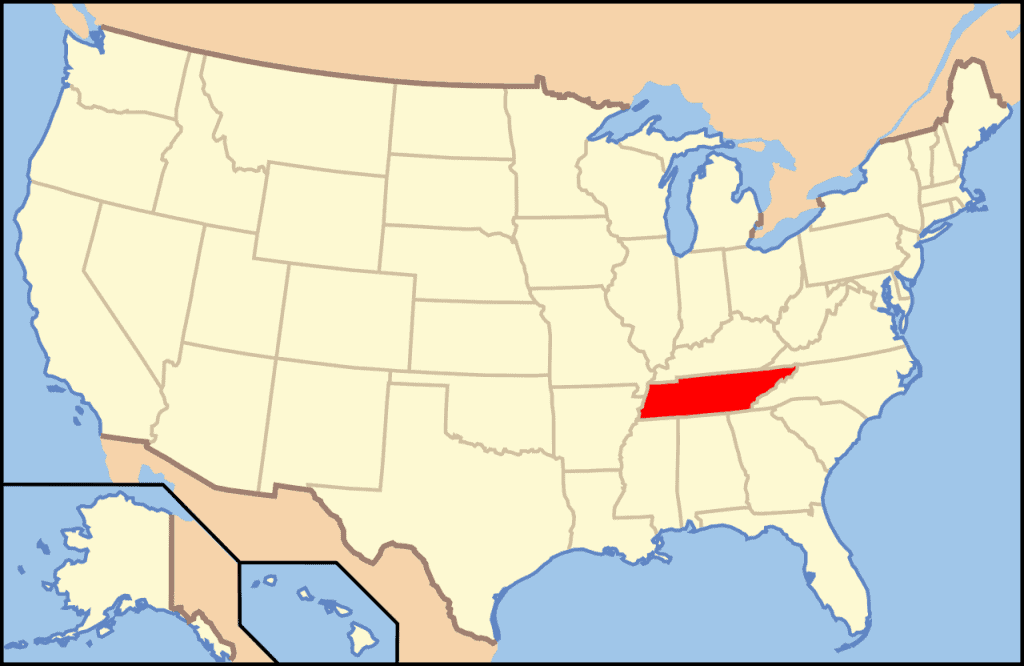

Do 100 disabled veterans pay property tax in tennessee. As a result of their service some Veterans are wounded or disabled in the line of duty. For more information on the changes to the Property Tax Relief Program read Public Chapter No. May 7 2018.

Veterans Disability must meet one of the following categories. A 100 total and permanent disability rating from being a prisoner of war. Likewise veterans are not current service members in a branch of the United States military so they are not eligible for the exemption.

Tennessee State Property Tax Relief For Qualified Disabled Veterans. 6 Property tax relief shall also be extended to the surviving spouse of a disabled veteran who at the time of the disabled veterans death was eligible for disabled veterans property tax relief. Surviving spouses are not eligible for the job preference if they remarry.

If a subsequent amendment to the law would have made the. The combat-disabled veteran applying for and being granted Combat-Related Special Compensation after an award for Concurrent Retirement and Disability. Code Ann 67-6-303 a 1 in order to purchase a motor vehicle tax exempt one of the requirements is the military member must be stationed in Tennessee or a military reservation located partially within Tennessee.

The qualifying conditions for this property tax exemption include but may not be limited to one or more of the following. Individual Income Tax Return to correct a previously filed Form 1040 1040A or 1040EZ. To do so the disabled veteran will need to file the amended return Form 1040X Amended US.

Deservedly the state and federal government provide special discounts or assistance to our disabled warriors one such benefit being a property tax exemption for veterans who are considered 100 disabled. The tax due for that tax year is the amount due for the portion of the year before the exemption started. Those over the age of 65 may also qualify for additional property tax exemption programs.

Do military members pay sales taxes. Disabled Veteran Homeowner A 100 total and permanent disability rating from being a prisoner of war. A service-connected disability that resulted in.

Paraplegia OR Permanent paralysis of both legs and lower part of the body resulting from traumatic. Military veterans and their families sacrifice a great deal for our nation. Department of Veterans Affairs shall be exempt from the motor vehicle privilege tax upon submission of evidence of such disability to the officer in the county.

See all Texas Veterans Benefits. The maximum market value on which tax relief is calculated is 175000. Property Tax Exemption for Disabled Veterans.

Military retirement pay based on age or length of service is considered taxable income for Federal income taxes and most state income taxes. The exemption may start immediately when the 100 percent disabled veteran qualifies the new residence homestead. This is a state program funded by appropriations authorized by the General Assembly.

Tennessee County Motor Vehicle Privilege Tax Disabled Veteran Exemption. Those rated 10 percent disabled will receive at least 14005 a month depending on their marital and dependent status while 100 percent disabled veterans get. The veteran was permanently and totally disabled or was 100 disabled due to service-connected disabilities or.

Texas veterans with VA disability ratings between 10 and 100 may qualify for property tax exemptions starting at 5000 for 10-29 disability and ending at a full exemption for those VA-rated as 100 disabled. Property Tax Relief Tennessee state law provides for property tax relief for low-income elderly and disabled homeowners as well as disabled veteran homeowners or their surviving spouses. The veteran died while on active duty.

However disabled veterans may be eligible for the automotive adaptive equipment exemption or the Veterans Affairs Automobile Grant. Tennessee law outlines the requirements for military service based tax exemptions. Must own and use property as primary residence.

Tax Breaks for Disabled Veterans.

Disabled Veterans Property Tax Exemptions By State Hadit Com For Veterans Who Ve Had It With The Va

Disabled Veterans Property Tax Exemptions By State Hadit Com For Veterans Who Ve Had It With The Va

States That Offer Free Tuition For Vets Military Benefits

States That Offer Free Tuition For Vets Military Benefits

Army Veteranowned Taxbusiness Mobile Tax Associates Tax Consulting Veteran Owned Business Tax Preparation

Army Veteranowned Taxbusiness Mobile Tax Associates Tax Consulting Veteran Owned Business Tax Preparation

Disabled Veterans Los Angeles County Office Of The Assessor

Disabled Veterans Los Angeles County Office Of The Assessor

Tennessee Military And Veterans Benefits The Official Army Benefits Website

Tennessee Military And Veterans Benefits The Official Army Benefits Website

Va Loan Funding Fee Closing Cost Calculator

Va Loan Funding Fee Closing Cost Calculator

Tennessee Military And Veterans Benefits The Official Army Benefits Website

Tennessee Military And Veterans Benefits The Official Army Benefits Website

Disabled Veterans Property Tax Exemptions By State Hadit Com For Veterans Who Ve Had It With The Va

Disabled Veterans Property Tax Exemptions By State Hadit Com For Veterans Who Ve Had It With The Va

100 Percent Va Disability And Working Cck Law

100 Percent Va Disability And Working Cck Law

Disabled Veterans Property Tax Exemptions By State

Disabled Veterans Property Tax Exemptions By State

Free Space A Travel And Other Additional Benefits For 100 Va Rated Vets

Free Space A Travel And Other Additional Benefits For 100 Va Rated Vets

Va Loan The Complete Guide From Veterans United Home Loans Va Loan Loan Mortgage Loan Originator

Va Loan The Complete Guide From Veterans United Home Loans Va Loan Loan Mortgage Loan Originator

Tennessee Veterans Boost Lobbying Efforts And Secure Property Tax Relief

Disabled Veterans Property Tax Exemptions By State Hadit Com For Veterans Who Ve Had It With The Va

Disabled Veterans Property Tax Exemptions By State Hadit Com For Veterans Who Ve Had It With The Va

Tennessee Veterans Benefits The Insider S Guide Va Claims Insider

Tennessee Veterans Benefits The Insider S Guide Va Claims Insider

Disabled Veterans Property Tax Exemptions By State Hadit Com For Veterans Who Ve Had It With The Va

Disabled Veterans Property Tax Exemptions By State Hadit Com For Veterans Who Ve Had It With The Va

Tennessee Veterans Benefits The Insider S Guide Va Claims Insider

Tennessee Veterans Benefits The Insider S Guide Va Claims Insider

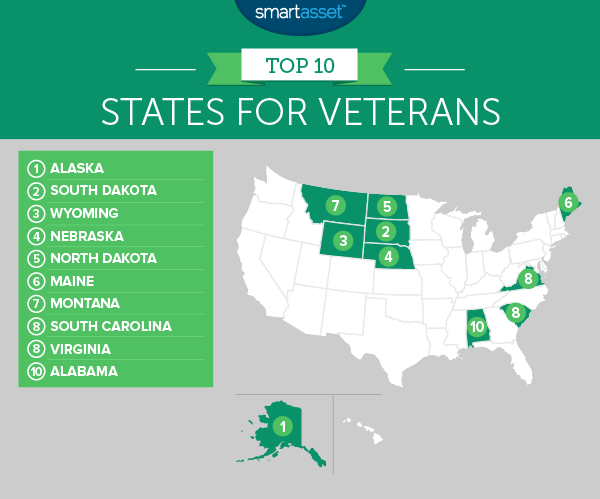

The Best States For Veterans Smartasset

The Best States For Veterans Smartasset

Veteran Id Cards What Your Options Are Now And In The Future Vantage Point

Veteran Id Cards What Your Options Are Now And In The Future Vantage Point

Labels: property

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home