Property Tax Lookup Clark County

Property account numbers PAN contain nine numbers. Please review our Contact Us page for more detailed contact information.

Clark County Property Tax Inquiry.

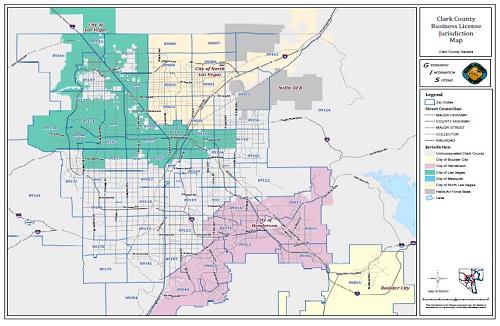

Property tax lookup clark county. Property Information Center which will take you to the Clark County Assessors area for property information including property taxes. Rather it will direct connect to the new Ascent tax and land records system. The Clark County Assessors Office makes every effort to produce and publish the most current and accurate information possibleNo warranties expressed or implied are provided for the data herein its use or its interpretation.

Research Your Property Using The Internet. Inmate Search CCDC Marriage License. Sale Price Min Sale Price Max.

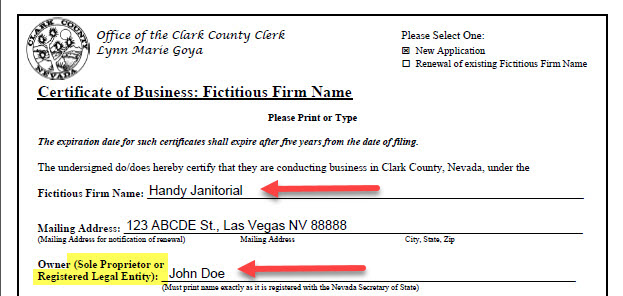

Please enter your property account number PAN OR property address in the appropriate field. Apply for Business License. Please examine your tax bill and notify the Clark County Treasurers Office at 937-521-1832 of any error or questions your may have regarding your tax bill.

PST The Clark County Government Center including the County. Clark County Detention Center Inmate Accounts. In addition to online service.

The Treasurers office mails out real property tax bills ONLY ONE TIME each fiscal year. Business Opportunities Procurement Find My Commission District. In fact you will likely have better results with less criteria.

Gov Tech Tax Services provides tax information to professionals researching tax information in Clark County. Pay Property Taxes Online Clark County Official Site The Clark County Treasurer provides an online payment portal for you to pay your property taxes. If you are a new visitor to our site please scroll down this page for important information regarding the Assessor transactions.

Find Clark County Tax Records Clark County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Clark County Nevada. In an effort to assist you in locating the desired parcel we have provided for a number of search criteria options. The Clark County website will be unavailable on Sunday April 18 2021 from 800 AM.

Post all payments collected by local treasurer in December and January and do tax settlements by. The document has moved here. If you do not receive your tax bill by August 1st each year please use the automated telephone system to request a copy.

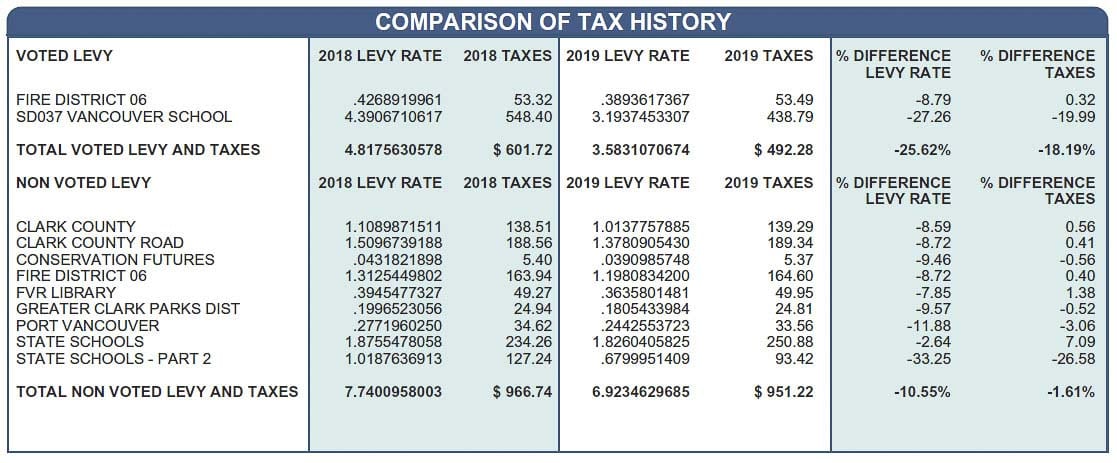

In Clark County property taxes are collected by the Treasurers Office and distributed to the various taxing districts that provide services to the property. While our Joint Lobby in-person services are closed. If you are a new visitor to our site please scroll down this page for important information regarding the Assessor transactions.

Purchasing and Contracts. Make changes to parcel records for all property transfers recorded with the Register of Deeds office as well as parcel and description changes due to recorded plats and certified survey maps. Clark County Treasurer Alishia Topper today announced she is accepting property tax deferral applications from business owners of real property who were financially impacted by COVID-19 in 2020.

Although multiple criteria can be entered to narrow your search results you are not required to complete each criteria. These records can include Clark County property tax assessments and assessment challenges appraisals and income taxes. Assessors Office services are provided in a virtual format to help slow the spread of COVID-19 in the community until further notice.

All tax bills are mailed 28 to 30 days before the due date. Household goods and personal effects. TAX RESEARCH ON CLARK COUNTY PROPERTY.

Keep accurate listings of all real estate parcels in the county of which there are approximately 33000. House Number Low House Number High Street Name. Click on the title link above to visit Gov Tech Tax Services website.

Gov Tech Tax Services are used primarily for escrow payers title companies and real estate agents. All Assessors Office services may be accessed through this website. Clark County Parcel Search.

2019 Transcendent Technologies. For questions about parcel lineworkmapping please call the Land Information Office 715-743-5130. This program is a result of ESHB 1332 which provides for a deferral of 2021 property taxes through a payment agreement.

In Washington State all real and personal property is subject to tax unless specifically exempted by law eg. The tax is levied by the governing authority of the jurisdiction in which the property is located. For inquiries on land recordstax information please call the TreasurerReal Property Lister 715-743-5155.

The Clark County Assessors Office makes every effort to produce and publish the most current and accurate information possibleNo warranties expressed or implied are provided for the data herein its use or its interpretation. Governor Inslee on Friday morning signed the bill into law. Home Government Elected Officials County Treasurer Real Property Tax Information.

County Assessor Treasurer Hold Q A On 2020 Property Tax Changes Clarkcountytoday Com

County Assessor Treasurer Hold Q A On 2020 Property Tax Changes Clarkcountytoday Com

Clark County Property Tax A Secure Online Service Of Arkansas Gov

Clark County Property Tax A Secure Online Service Of Arkansas Gov

The Cook County Property Tax System Cook County Assessor S Office

Clark County Tax Collector Record Search Arcountydata Com Arcountydata Com

Clark County Tax Collector Record Search Arcountydata Com Arcountydata Com

Navigation Assessor Image To Use This Search Page Select Owner S Name Or Assessor Parcel Number Apn From The Drop Down Menu Type The Owner S Name Or The Parcel Number In The Adjacent Box And Click On The Search Directory Button Or You Can

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home