What Is A Tax Equalization Calculation

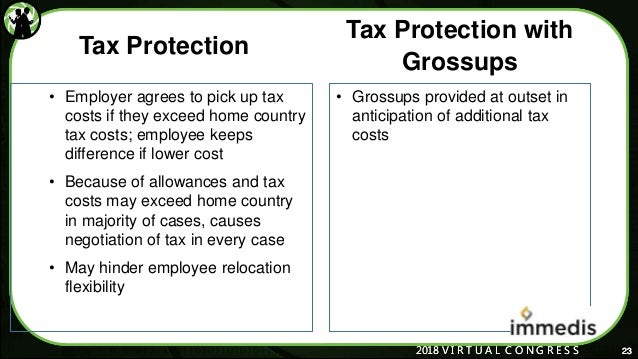

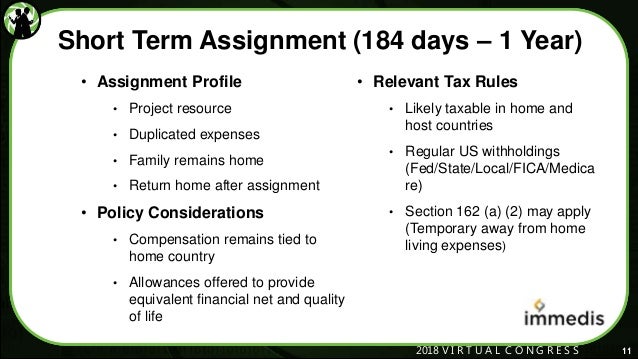

A Laissez Faire approach is considered a third option but this leaves the employee to calculate and deal with all of their own tax liabilities. Tax equalisation and tax protection.

Mobility Basics What Are Tax Equalisation And Tax Protection Eca International

Mobility Basics What Are Tax Equalisation And Tax Protection Eca International

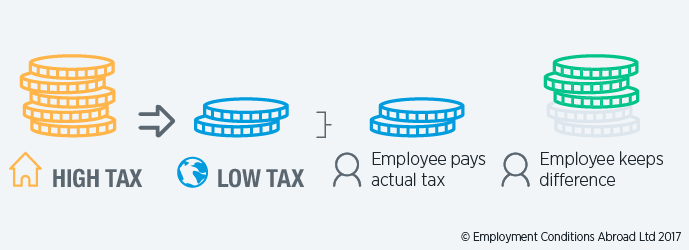

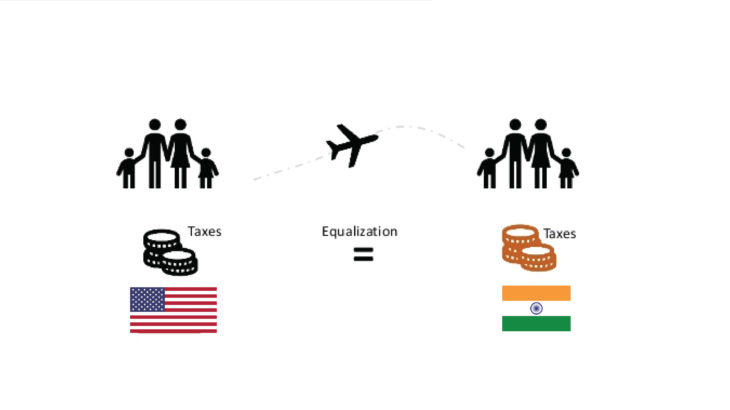

Tax equalisation allows for employees on assignment to effectively pay the same amount of tax they would have paid had they remained at home.

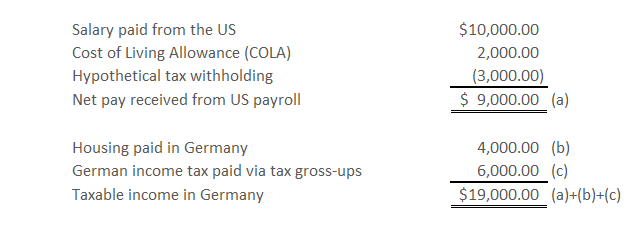

What is a tax equalization calculation. There are essentially two primary approaches to expatriate taxation. A calculation is made of what the home country tax liability would have been on the non-expatriate components of an individuals remuneration package in other words salary standard benefits in kind bonuses stock options etc. The 2018 to 2019 helpsheet has been added.

This is then compared to the hypo tax deduction being held by the company. Tax equalization calculations are done annually when the final income and deductions are known. The 2019 to 2020 helpsheet has been added.

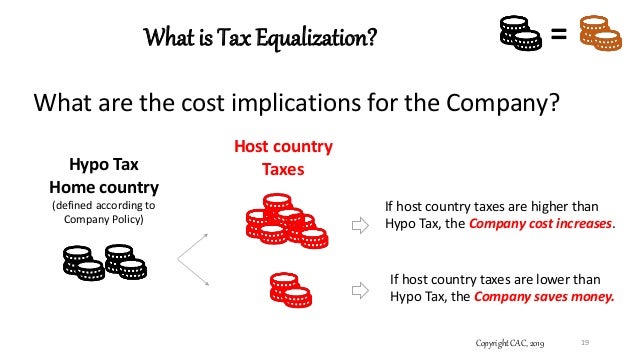

Under a tax equalization policy the employee is assured that he or she will pay neither more nor less taxes on foreign assignment than what would have been paid had the employee remained in the US. The company sometimes gains if the employee goes to low tax jurisdiction and may suffer additional charges if the assignee goes to a high tax jurisdiction. Facing this complexity without assistance may cause your expatriates head to spin.

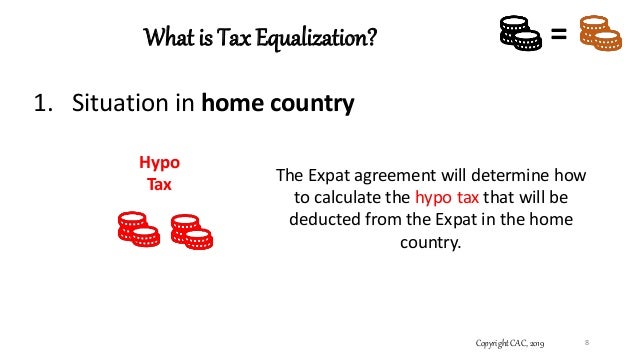

Tax equalisation are as follows. What is Tax Equalization. Situation in home country Hypo Tax The agreement will determine if personal deductions or familiar circumstances that are relevant according to the home country tax legislation are taken into account to calculate the hypo tax.

This is where tax equalization policy comes into play. At that point the expatriate settles the actual difference with their employer. An equalization ratio equals a propertys assessed value divided by its market value.

Tax Equalisation Tax Protection Calculations. Tax equalisation is widely used by multi-national companies or group moving employees from one country to another. Expatriate Payroll Tips 4 Tax Equalization.

Take a 225000 assessed property in this area Multiply 225000 X 125 270000 as the new assessed value Value Components in Real Estate. Determine what the tax liability on standard pay would have been had the individual remained in the home country. This is called the Tax Equalization Calculation.

Tax equalization policies generally provide that the expatriate employee pay to their employer his or her an estimated hypothetical tax liability during the tax year through hypothetical withholding from each paycheck. Guidance updated to include Tax equalisation 2021 HS212. The resulting figure will be the individuals hypothetical tax liability Deduct the hypothetical tax liability from the individuals standard pay.

TEQ policy fixes the employees tax obligation in many cases at roughly what it would have been had she remained at home. A municipality typically uses the assessed value to calculate property taxes whereas the market value is the amount for which the property would likely sell on the open market. Assuming an area that the tax authorities believe is under-assessed in relation to surrounding areas they might apply an equalization factor multiplier of 125 or a 25 increase.

Tax equalisation remains the most common approach to tax management according to our latest Expatriate Salary Management Survey with 75 of companies applying it. The intent of tax equalization is to equalize the amount of tax paid so that the taxpayer who is living and working abroad pays what he or she would have paid in tax domestically. Tax Equalization is offered by most US multinational companies to offset the additional taxes faced by their employees working overseas.

In return the company will pay all the actual home and host country taxes owed during the foreign assignment. There are a number of differences between tax equalisation and tax protection. That is the goal of tax equalization is to level out the level of taxation so that it is similar to what the taxpayer would have been assessed should he or she stayed within the United States.

It is not a statutory concept. A hypothetical tax calculation is completed which represents. A propertys assessed value is typically lower than its market value.

Tax equalization is the process by which an employer seeks to leave the expat employee in a neither better nor worse financial position for having gone abroad by deducting the value of the US taxes that the employee would pay if they were working in the US from their paycheck and then paying the taxes due to both the US and the host country directly as applicable. The main point of tax equalization is to ensure that the employee is no worse off and no better off as a result of the secondment. Tax equalisation In simple terms tax equalisation means that an assignee pays no more and no less tax on assignment than they would have paid had they stayed at home.

Copyright CAC 2019 9 1. This stay at home tax figure is known as hypothetical tax or hypotax.

Mobility Basics What Are Tax Equalisation And Tax Protection The Forum For Expatriate Management

Mobility Basics What Are Tax Equalisation And Tax Protection The Forum For Expatriate Management

What S The Difference Between Tax Equalization And Tax Protection

What S The Difference Between Tax Equalization And Tax Protection

What Is Tax Equalization What Does Tax Equalization Mean Tax Equalization Meaning Explanation Youtube

What Is Tax Equalization What Does Tax Equalization Mean Tax Equalization Meaning Explanation Youtube

Tax Equalization For Payroll Professionals

Tax Equalization For Payroll Professionals

Mobility Basics What Are Tax Equalisation And Tax Protection The Forum For Expatriate Management

Mobility Basics What Are Tax Equalisation And Tax Protection The Forum For Expatriate Management

Tax Equalization For Payroll Professionals

Tax Equalization For Payroll Professionals

Mobility Basics What Are Tax Equalisation And Tax Protection Eca International

Mobility Basics What Are Tax Equalisation And Tax Protection Eca International

Tax Equalization For Expatriates Gkm Inc

Tax Equalization For Expatriates Gkm Inc

Mobility Basics What Are Tax Equalisation And Tax Protection Eca International

Mobility Basics What Are Tax Equalisation And Tax Protection Eca International

How To Calculate Hypotax Eca International

How To Calculate Hypotax Eca International

What S The Difference Between Tax Equalization And Tax Protection

What S The Difference Between Tax Equalization And Tax Protection

Tax Equalization For Expatriates Gkm Inc

Tax Equalization For Expatriates Gkm Inc

Beyond The Cost Projection Advanced Considerations For Budgeting And Accrual Of Tax Equalized Assignment Costs

Beyond The Cost Projection Advanced Considerations For Budgeting And Accrual Of Tax Equalized Assignment Costs

Labels: equalization, property, what

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home