Property Tax Exemption Alameda County

The exemption shall apply in the same proportion that is exempted from ad valorem property tax. REV13 5-20 California property tax laws provide two alternatives by which the Homeowners Exemption up to a maximum of 7000 of assessed value may be granted.

What Is A Homestead Exemption California Property Taxes

What Is A Homestead Exemption California Property Taxes

Ownership Statement Cooperative Housing Corporation.

Property tax exemption alameda county. Assessor La encourages Alameda County homeowners to apply for the Homeowners Property Tax Exemption that can save owners of residential property 70 off their property tax bill each year. The claim form BOE-260-B Claim for Exemption from Property Taxes of Aircraft of Historical Significance is available from the county assessor. Per thousand on full value.

Back to Forms Center. No fee for an electronic check from your checking or savings account. A senior property tax exemption reduces the amount seniors have to pay in taxes on properties they own.

The claim must be filed with the assessor on or before February 15 for the preceding January 1 lien date to receive 100 percent of the exemption. The deadline to file foran exemption from the Alameda Unified School Districts Measure Aparcel tax is June 30 2015. COUNTY OF ALAMEDA PHONG LA ASSESSOR.

Per thousand on full value. Press Release The Alameda County Treasurer-Tax Collector Announces Policies and Procedures for COVID-19 Related Deliquent Property Tax Penalty Interest Waiver. Once a homeowner submits an application and qualifies for the exemption the propertys assessed value is reduced by 7000 thereby lowering the property tax bill by.

19 rows The exemption application has been approved for Measures D Q only. The Parcel Viewer is the property of Alameda County and shall be used only for conducting the official business of Alameda County. Transfer Tax Exemptions List.

If the conveyance is exempt the RT Code of the exemption and a brief explanation must be included. This generally occurs Sunday morning from 700 to 900 AM and weeknights from 100 to 200 AM. Transferring property from parent to child is exempt from transfer tax in California.

The system may be temporarily unavailable due to system maintenance and nightly processing. Back to Alameda County. Parent to Child Exclusion Form Download this form fill in.

Once you file for the homeowners exemption and receive it you do not need to file it again unless you move from the residence. Form Name Form Source. 1 to 20 of 73.

The County of Alameda explicitly disclaims any representation and warranties including without limitation the implied warranties of merchantability and fitness for a particular purpose. The exemption is available to an eligible owner of a dwelling which is occupied as the owners principal place of. Per thousand on full value 1500000 and less Ordinance No.

Back to Forms Center. Press Release For past announcements click here. Look Up Prior Year Delinquent Tax.

For Measures Q and Z. You can pay online by credit card or by electronic check from your checking or savings account. Forms Center - Form Listing.

These pages list exemption codes and their respective explanations. Watch Video Messages from the Alameda County Treasurer-Tax Collector. Download this file to view the exemptions.

The Disabled Veterans Exemption reduces the property tax liability on the principal place of residence of qualified veterans who due to a service-connected injury or disease have been rated 100 disabled or are being compensated at the 100 rate due to unemployability. A convenience fee of 25 will be charged for a credit card transaction. We accept Visa MasterCard Discover and American Express.

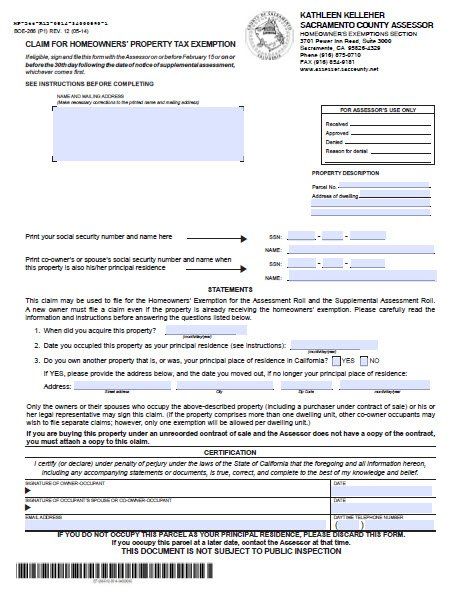

1221 Oak St Rm 145. Per thousand on full value. Claim For Homeowners Property Tax Exemption BOE-266-E.

Forms Center - Form Listing. Under the terms of the ballot. Property taxes are quite possibly the most widely unpopular taxes in the US.

Form Name Form Source. Claim For Homeowners Property Tax Exemption. You will get up to a 7000 reduction of your propertys full cash value.

This is how it works. Look Up Unsecured Property Tax. Per thousand on full value 1500001 and above Ordinance No.

Pay Your Property Taxes Online. 41 to 60 of 73. The Alameda County Treasurer-Tax Collector Continues to Encourage Online Payment for 2020-2021 Property Taxes.

Property owned by an entity organized and operating exclusively for religious purposes that was granted a Property Tax Exemption from the Alameda County Assessors Office according to California Law. To qualify for the Alameda County Homeowners exemption you need to own and live in a home that is your principal place of residence. This form is for a property reassessment exclusion in Alameda County and could prevent an increase in property taxes.

Infographic Preparing Your Home For A Natural Disaster Natural Disasters Infographic Disasters

Infographic Preparing Your Home For A Natural Disaster Natural Disasters Infographic Disasters

Understanding California S Property Taxes

Understanding California S Property Taxes

Property Tax Exemption For Live Aboards

Property Tax Exemption For Live Aboards

Railpictures Net Photo Mrl 264 Montana Rail Link Emd Sd40 2xr At Toston Montana By Mike Danneman Rail Link Railroad Photos Train Photography

Railpictures Net Photo Mrl 264 Montana Rail Link Emd Sd40 2xr At Toston Montana By Mike Danneman Rail Link Railroad Photos Train Photography

Supplemental Property Tax Bill

California Public Records Public Records California Public

California Public Records Public Records California Public

Http Www Acgov Org Forms Assessor4 Input Pdf

Http Www Acgov Org Forms Assessor 262ah Rev07 05 12 Pdf

Customary Closing Costs In Northern California Caliliving Calilifestyle Carealestate Realestate Homebuying Closing Costs California Real Estate Escrow

Customary Closing Costs In Northern California Caliliving Calilifestyle Carealestate Realestate Homebuying Closing Costs California Real Estate Escrow

How To Calculate Property Tax Everything You Need To Know New Venture Escrow

How To Calculate Property Tax Everything You Need To Know New Venture Escrow

What Is The Disability Property Tax Exemption Millionacres

What Is The Disability Property Tax Exemption Millionacres

Prop 19 Ahead Would Change Residential Property Tax Transfer

Prop 19 Ahead Would Change Residential Property Tax Transfer

Alameda County Assessor Encourages Homeowners To Apply For Exemption News Pleasantonweekly Com

Alameda County Assessor Encourages Homeowners To Apply For Exemption News Pleasantonweekly Com

Http Www Acgov Org Forms Claim Seismic Safety Pdf

Https Www Cityofberkeley Info Uploadedfiles Finance Home Files Propertytaxesfaqs Pdf

Https Treasurer Acgov Org Treasurer Assets Docs Covid 19 20penalty 20 20interest 20waiver 20policy Pdf

Https Www Titleadvantage Com Mdocs Homeowners 20prop 20tax 20exemption 20all Pdf

Http Www Acgov Org News Pressreleases Ac Property Taxes Due 2020 2021 Pdf

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home