Property Tax Assessment Vs List Price

The assessed property value can help you determine your property taxes but its not useful during the offer and negotiating stage. Appraised Tax Value vs.

Real Estate Assessed Value Vs Fair Market Value

Real Estate Assessed Value Vs Fair Market Value

The sellers list or asking price is simply a number attached to the house -- it may or may not reflect current real estate conditions.

Property tax assessment vs list price. The property-tax value is different from the actual value though. Assume a municipality has an average assessment ration of 030. Property taxes are charged by the county in which you live.

It is important to keep in mind the county tax assessment of value is just that an assessment for the purpose of calculating taxes. To illustrate if the sales of a specific class of property in a specific area in a given year have a median sale price 30 higher than the assessed value then the ratio would be 07692 ie. Some states use 100 of the market value to determine how much a homeowner will pay in property taxes.

They will assess a value based on the comparable homes in your area. This assessed value will determine the amount of property tax you pay. Typically the assessed value of a home is less than the market value value.

The market value is usually what the home will sell for and is typically the price used for listing the property. In many counties throughout the US assessed value is a portion of the market value calculated as a percentage of the market value of the property. In Denver for instance assessed value is 29 percent of market value.

The IRS also offers the following example. Market value is the estimated price that a house will sell for within a projected period of time that is considered reasonable. The latest real estate tax assessment on the property was based on an assessed value of 160000 of which 136000 was for the house and 24000 was for the land.

Make sure you review your tax card and look at. The higher the assessed value the more you will typically pay in property taxes. Many real property sellers and buyers have gotten confused in trying to sort out a propertys true value.

You can appeal your tax bill if you feel the assessed value is too high. If we continue on this path of using the local assessors opinion of the propertys land value we can use their percentages to come up with the right depreciable amount. Assessed value on the other hand takes the market value and puts it in the context of your property taxes.

Property taxes are calculated by multiplying your municipalitys effective tax rate by the most recent assessment of your property. The property taxes are calculated based on the county assessment of tax value. Throw in bank owned homes foreclosed properties and listing prices may be all over the place without a logical explanation due to an asset manager.

Normally real property is valued according to its. Other states use an assessment rate that is a percentage of the market value. Then that number is multiplied by an assessment rate also known as assessment ratio a uniform percentage that each tax jurisdiction sets that is typically 80 to 90 to arrive at the.

Yeah the tax man. If your house is worth 100000 the value for property taxes is 29000. Ryan bought an office building for 100000.

In theory your property taxes are based on the fair market value of. For example in a state with an assessment rate of 80 a home with a market value of 182000 would have an assessed value of 145600. What is market value.

The county assessment is not an appraisal. A homeowner with a 100000 home determines assessed value by multiplying 03 times 100000 for tax. In other areas such as California property-tax assessment values begin with your purchase price and typically increase about 2 percent annually regardless of the actual value of your.

In Minnesota assessors are to aim for ratios within 90 of the sales. Once the assessed value is determined property taxes are charged back to the current property owner based on a percentage rate. Your basis in the house is 170000 85 of 200000 and your basis in the land is 30000 15 of 200000.

1000000 EMV 1300000 Sale Price or 77. However The property tax statement shows. 60000 75 Land.

Think of assessed value as the tax value. If this property is listed at 400000 but there are no recent comps that have sold for more than 300000 buyers might consider the price of this property to. Market value is based on current averages and on the typical buyer for a property.

IRS the assessed value of a property is not necessarily what the home will sell for but is the rate it will be taxed. Property values are the primary revenue source for many cities counties and school boards. Extra low prices are generally the result of an extra motivated seller that has to sell and move in a rush so theyll list their property below market comps in order to be the most competitive.

Rental Property Roi And Cap Rate Calculator And Comparison Etsy In 2021 Rental Property Management Rental Property Real Estate Investing

Rental Property Roi And Cap Rate Calculator And Comparison Etsy In 2021 Rental Property Management Rental Property Real Estate Investing

Rental Property Tax Preparation Worksheet In 2021 Income Tax Income Tax Preparation Tax Preparation

Rental Property Tax Preparation Worksheet In 2021 Income Tax Income Tax Preparation Tax Preparation

Real Estate Assessed Value Vs Fair Market Value

Real Estate Assessed Value Vs Fair Market Value

Thinking Of Selling Your Home Las Vegas Real Estate Summerlin Some Important Tips To Look At Real Estate Myths Real Estate Infographic Real Estate Advice

Thinking Of Selling Your Home Las Vegas Real Estate Summerlin Some Important Tips To Look At Real Estate Myths Real Estate Infographic Real Estate Advice

Real Estate Appraiser Vs Home Inspector What S The Difference Real Estate Articles Worth Reading Real Estate Articles Home Inspector Home Appraisal

Real Estate Appraiser Vs Home Inspector What S The Difference Real Estate Articles Worth Reading Real Estate Articles Home Inspector Home Appraisal

Secured Property Taxes Treasurer Tax Collector

Secured Property Taxes Treasurer Tax Collector

Secured Property Taxes Treasurer Tax Collector

Secured Property Taxes Treasurer Tax Collector

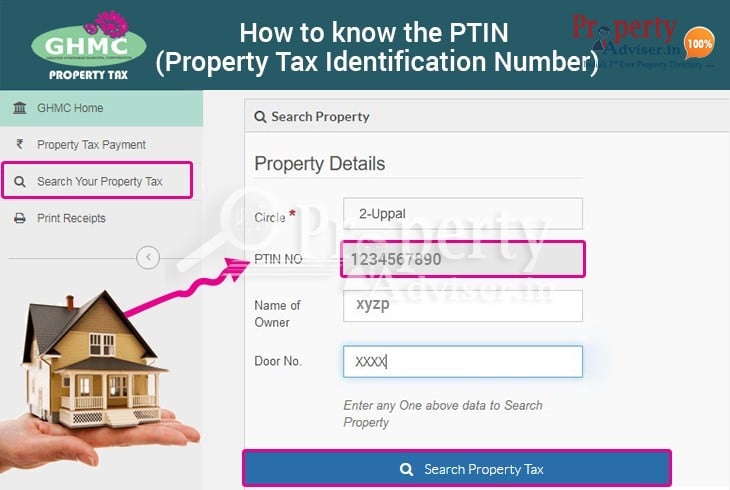

Now Get Your Ghmc Property Tax Search Details By Door Number In Hyderabad

Now Get Your Ghmc Property Tax Search Details By Door Number In Hyderabad

Real Estate Beginner Vocabulary Real Estate Real Estate Terms Vocabulary

Real Estate Beginner Vocabulary Real Estate Real Estate Terms Vocabulary

Pin By Bobbie Persky Realtor On Finance Real Estate Property Tax Tax Attorney Debt Relief Programs

Pin By Bobbie Persky Realtor On Finance Real Estate Property Tax Tax Attorney Debt Relief Programs

People Are Not Always Satisfied With Their Property Assessment Most Of The Time Property Assessed By Computerized Syst Tax Protest Property Tax Tax Reduction

People Are Not Always Satisfied With Their Property Assessment Most Of The Time Property Assessed By Computerized Syst Tax Protest Property Tax Tax Reduction

Assessed Value Vs Market Value Top 5 Differences With Infographics Market Value Marketing Assessment

Assessed Value Vs Market Value Top 5 Differences With Infographics Market Value Marketing Assessment

Assessed Value Vs Market Value In 2021 Market Value Real Estate Articles Real Estate Prices

Assessed Value Vs Market Value In 2021 Market Value Real Estate Articles Real Estate Prices

10 Steps To Buying A Home Infographic Home Buying Process Home Buying Real Estate Buyers

10 Steps To Buying A Home Infographic Home Buying Process Home Buying Real Estate Buyers

Real Estate Assessed Value Vs Fair Market Value

Real Estate Assessed Value Vs Fair Market Value

:max_bytes(150000):strip_icc()/GettyImages-1042505068-d5c7b095f4704a5286a5cabcc25f4495.jpg) Your Property Tax Assessment What Does It Mean

Your Property Tax Assessment What Does It Mean

How I Won A Property Tax Appeal And Details On How You Can Do The Same When Was The Last Time You Checked Your Property Tax Assessm Property Tax Appealing Tax

How I Won A Property Tax Appeal And Details On How You Can Do The Same When Was The Last Time You Checked Your Property Tax Assessm Property Tax Appealing Tax

Appraisal Vs Assessment Do You Know What The Difference Between The Assessed Value And Appraised Value Of A Home Door Cost Architecture Model Flipping Houses

Appraisal Vs Assessment Do You Know What The Difference Between The Assessed Value And Appraised Value Of A Home Door Cost Architecture Model Flipping Houses

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home