Property Tax Appeal Attorney Cook County Il

Taxpayers may challenge an assessment by the county board of tax assessors by appealing to the county board of equalization or to an arbitrator or arbitrators within 45 days or 30 days in some counties from the date of the change of assessment notice that is mailed by the board of tax assessors. Our service is guaranteed its simple we will appeal until we win.

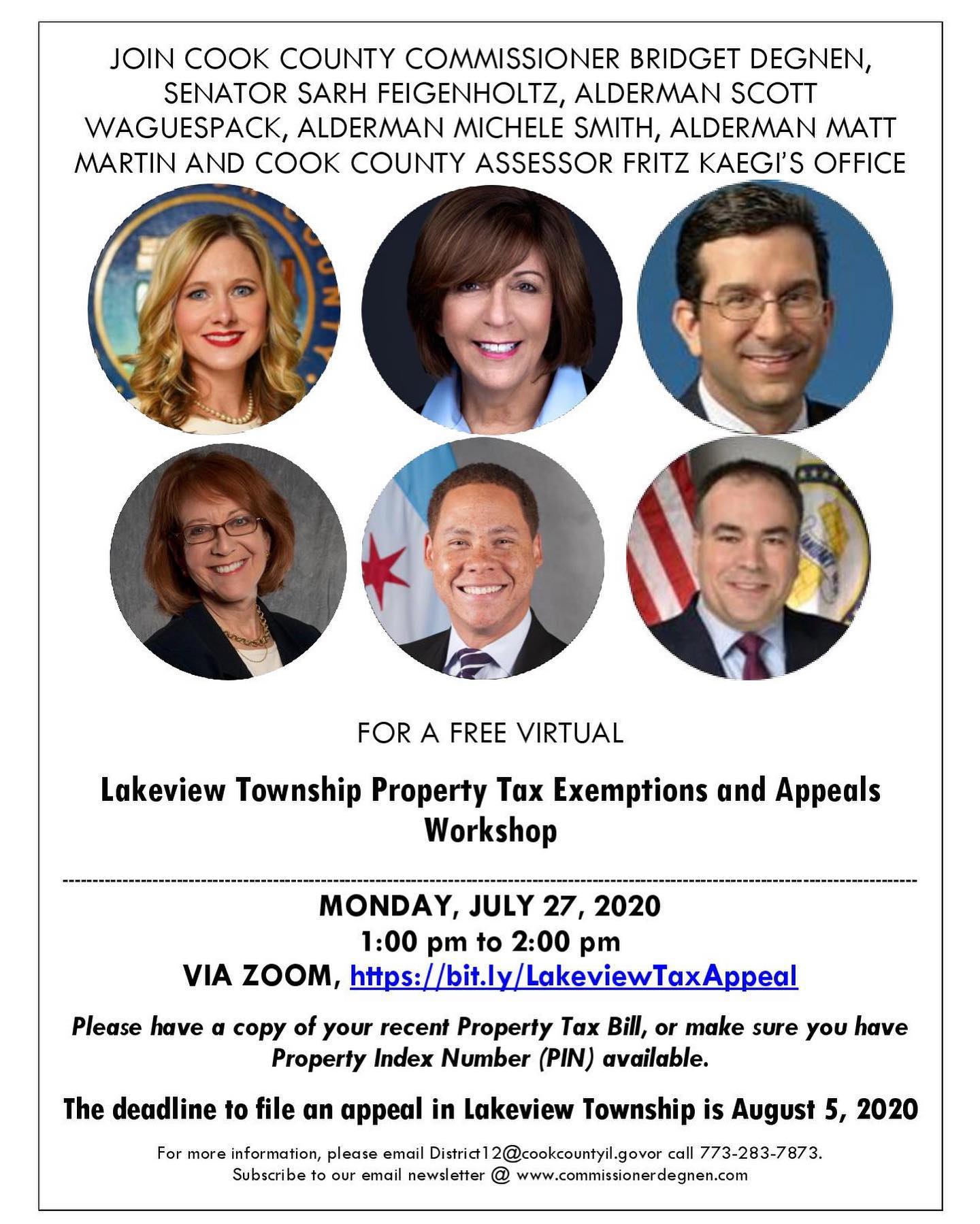

Lake View Township Property Tax Exemptions And Appeals Workshop Cook County Assessor S Office

Lake View Township Property Tax Exemptions And Appeals Workshop Cook County Assessor S Office

ABBB Rating and a Guarantee.

Property tax appeal attorney cook county il. DIY Tax Appeals LLC is the highest rated property tax appeal service in Cook County. Were attorneys and property owners. Lead Counsel independently verifies Property Tax attorneys in Cook County by conferring with Illinois bar associations and conducting annual reviews to confirm that an attorney practices in their advertised practice areas and possesses a valid bar license for the appropriate jurisdictions.

Raila Associates PC. Attorneys and staff have assisted thousands of property owners in achieving tax relief. It is my profession and I will fight to lower your property taxes.

Filers must read and adhere to these rules. Residential properties are all single-family homes townhomes condominiums cooperatives multi-family residential buildings and mixed-use property residential and commercial with no more than six units. For example appeals on over 400000 parcels were filed with the Cook County Board of Review in 2016.

Fishbein is a Property Tax Attorney serving property owners in Cook County and Lake County Illinois. Property Tax Appeal Board Refunds. When the subject of an appeal is an income-producing property in whole or in part it is also required to file the Real Property Income Expense RPIE statement.

There are 2 chances to appeal your Cook County property taxes every year do not miss your next opportunity. The equalization factor is established for Cook County to bring property tax assessments in line with other parts of Illinois. The Cook County Treasurers Office website was designed to meet the Illinois Information Technology Accessibility Act and the Americans with Disabilities Act.

The Official Appeal Rules of the Cook County Assessor apply to the entire appeal process. We will take care of everything for one flat rate. How do I appeal my property taxes in Georgia.

A Rated Better Business Bureau Accredited Business Illinois Corporation Cook County Assessor Registered Property Tax Appeal Representative. Low flat fee 125 year. They are classified as Class 2 properties.

The main drives for property tax increases are the tax rate and equalization factor. Appeal Cook County property tax up to 4 x a year every year. The equalization factor is determined by the Illinois Department of Revenue.

Only a taxpayer or his or her attorney can file an appeal with the County Board of Review the State Property Tax Appeal Board and the Circuit Courttax consultants cannot file appeals. You do not need to hire an attorney to file an appeal and filing is free at our office. Every day our property tax appeal lawyers work diligently to lower property taxes for homeowners and businesses.

And were on a mission to help you mitigate frustratingly high property taxes with a clear plan to minimize your tax bill. Never Pay a Percentage. I have won 95 of my appeals and hope to have the opportunity to work with you.

But taxes are complicated and most appeals plans are outdated on auto-pilot or yield the same lack luster results. 203 N LaSalle St 2100 Chicago IL 60601. Find a Property Tax Attorney near Cook County.

It can feel like the whole systems rigged against you. Services for Seniors. Is a law firm providing property tax appeal services in Chicago Cook County and Illinois with representation of clients at government administrative agencies.

Take the guesswork out of appealing your property taxes. Free Property Tax Assessment Most Cook County property owners are overpaying in. There are different kinds of appeal filings.

Schmidt Salzman Moran Ltd Property Tax Appeal Attorneys Schmidt Salzman Moran Ltd

Say Goodbye To Disproportionately High Property Tax Bills Property Tax Property Residential

Say Goodbye To Disproportionately High Property Tax Bills Property Tax Property Residential

Property Tax Assistance Cook County Assessor S Office

Property Tax Appeals Saving You Money On Your Property Taxes

Property Tax Appeals Saving You Money On Your Property Taxes

Cook County Property Tax Appeal Attorneys

Cook County Property Tax Appeal Attorneys

Pin By Roy Paeth On Dupage County Businesses Estate Tax Naperville Real

Pin By Roy Paeth On Dupage County Businesses Estate Tax Naperville Real

How To Appeal Property Taxes Youtube

How To Appeal Property Taxes Youtube

Attorney Gary H Smith Chicago Property Tax Appeal Lawyer

Attorney Gary H Smith Chicago Property Tax Appeal Lawyer

Illinois Three Level Of Property Tax Appeals Ryan Law

Illinois Three Level Of Property Tax Appeals Ryan Law

Taxattorney Taxlawyer We Mainly Represent Individuals And Businesses Throughout Chicago And All Points Along The Lake To Kn Tax Lawyer Tax Attorney Lake

Taxattorney Taxlawyer We Mainly Represent Individuals And Businesses Throughout Chicago And All Points Along The Lake To Kn Tax Lawyer Tax Attorney Lake

The Cook County Property Tax System Cook County Assessor S Office

Contact Today With Chicago Property Tax Attorney Today And Reduce Your Property Taxes By Filing A Cook County Property Tax Property Tax Tax Attorney Tax Lawyer

Contact Today With Chicago Property Tax Attorney Today And Reduce Your Property Taxes By Filing A Cook County Property Tax Property Tax Tax Attorney Tax Lawyer

The Basics Fitzgerald Law Group P C

The Basics Fitzgerald Law Group P C

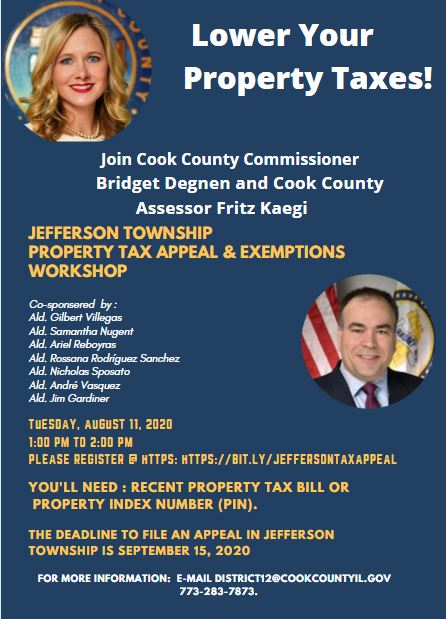

Jefferson Township Property Assessment Appeal Exemption Workshop Cook County Assessor S Office

Jefferson Township Property Assessment Appeal Exemption Workshop Cook County Assessor S Office

Cook County Property Tax Appeal Attorneys

Cook County Property Tax Appeal Attorneys

Why Hire An Attorney To Appeal My Cook County Property Taxes

Why Hire An Attorney To Appeal My Cook County Property Taxes

Appeals Process In Chicago Park Longstreet P C

Appeals Process In Chicago Park Longstreet P C

How To Appeal Your Cook County Property Taxes The Details Property Tax Tax Debt Tax Services

How To Appeal Your Cook County Property Taxes The Details Property Tax Tax Debt Tax Services

Northfield Township How To File A Property Assessment Appeal Cook County Assessor S Office

Northfield Township How To File A Property Assessment Appeal Cook County Assessor S Office

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home