Gaston County Nc Real Estate Tax Bill Search

The Randolph County Tax Department is committed to keeping our community safe while maintaining excellent service to our citizens. Open Property Tax Bill Search in new window If you have questions on your tax bill please call 311 or dial 704-336-7600 if outside Mecklenburg County limits For questions regarding the Streamside Subdivision assessment Matthews jurisdiction only please call the Town of Matthews at 704-847-4411.

Property Tax Information Using the tax bill search you can browse billing and payment information for real estate personal business and motor vehicle accounts and select accounts to pay online.

Gaston county nc real estate tax bill search. See what the tax bill is for any Gaston County NC property by simply typing its address into a search bar. Gaston County NC Property Tax Search by Address. Visit our Collections website to search for current year taxes as well as previous years payments.

Dear Gaston County Residents In an attempt to reduce mortgage and lien fraud Gaston County Register of Deeds has partnered with our countys land records software provider to offer a new free service to our residents. Gaston Countys last Reappraisal was conducted in 2019. Payment Options To learn more about ways to pay please visit our Payment Options.

Social distancing and temperatures checks will be required for access into the building. Click the green Pay Taxes button and follow the prompts to complete your online payment. Information regarding Property Check service.

This data is subject to change daily. Reappraisal North Carolina law requires each County to reappraise all real estate at least once every 8 years. 2020 Property Tax Bills Correction.

Median Property Taxes No Mortgage 1110. Union County taxpayers recently received their 2020 property tax bills. 2021 BusinessPersonal Property Tax Listing Announcement Due to the current situation with Covid-19 there will be a limited availability for.

Box 368 Smithfield NC 27577. Russell Ave High Point North Carolina 27260. House Number Low House Number High Street Name.

The GIS data provided by Gaston County for this web site is made available on the condition that. All data is compiled from recorded deeds plats and other public records and data. Box 451 Smithfield NC 27577 Administration Mailing Address.

Johnston County Tax Administration Office. These assessments or appraisal values are generated as of January 1 of the last county wide reappraisal. Box 1578 Gastonia NC.

Welcome to Gaston County NC. Gaston County Property Tax Inquiry. Users of this data are hereby notified that the aforementioned public information sources.

Our office will be open with safety procedures in place. In-depth Property Tax Information. Gaston County Property Records are real estate documents that contain information related to real property in Gaston County North Carolina.

Historically a footnote and chart included on the tax bill have provided a categorical breakdown of only general fund expenditures. Statements of vehicle property taxes paid to the NC DMV at the time of registration are not available on the Countys web site. The Tax Parcel information contained within is updated by the Gaston County Tax GIS-Mapping staff.

To Pay by Mail Payments may be mailed to. See Gaston County NC tax rates tax exemptions for any property the tax assessment history for the past years and more. To Pay by Phone Call.

While the maps and data provided on these web pages are believed to be accurate and true they should not be considered or used as a legal document. Median Property Taxes Mortgage 1546. The next countywide reappraisal is scheduled for 2023.

Land Value Min Land Value Max Total Taxable Min Total Taxable Max Acreage Min Acreage Max Sales Criteria. The Billing Collections records provided herein represent information as it currently exists in the Guilford County tax system. Enter your Property KeyParcel ID Name or Address to access your Tax Bill.

Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a. All information on this site is prepared for the inventory of real property found within Cabarrus County. 1-855-976-3866 You will need to enter your property key number which can be found in the top right hand corner of your tax bill.

Gaston County Property Tax Payments Annual Gaston County North Carolina. SESSION LAW 2020-3 SB704COVID-19 Tag and Tax Information. Johnston Street Smithfield NC 27577 Collections Mailing Address.

400 West Market St Greensboro North Carolina 27401 325 E. The chart on the 2020 tax bills addresses all categories of expenditures included in the FY21 adopted budget. Gaston County Tax Collector PO.

Email the Tax Director.

Tax Administrator Warren County Nc

Cheap Homes For Sale In Beaufort County Nc 13 Listings

Cheap Homes For Sale In Beaufort County Nc 13 Listings

Gaston County Nc Recently Sold Homes Realtor Com

Gaston County Nc Recently Sold Homes Realtor Com

Gaston County Nc Recently Sold Homes Realtor Com

Gaston County Nc Recently Sold Homes Realtor Com

Forsyth County 2021 Property Tax Revaluation What You Need To Know Bell Davis Pitt

Forsyth County 2021 Property Tax Revaluation What You Need To Know Bell Davis Pitt

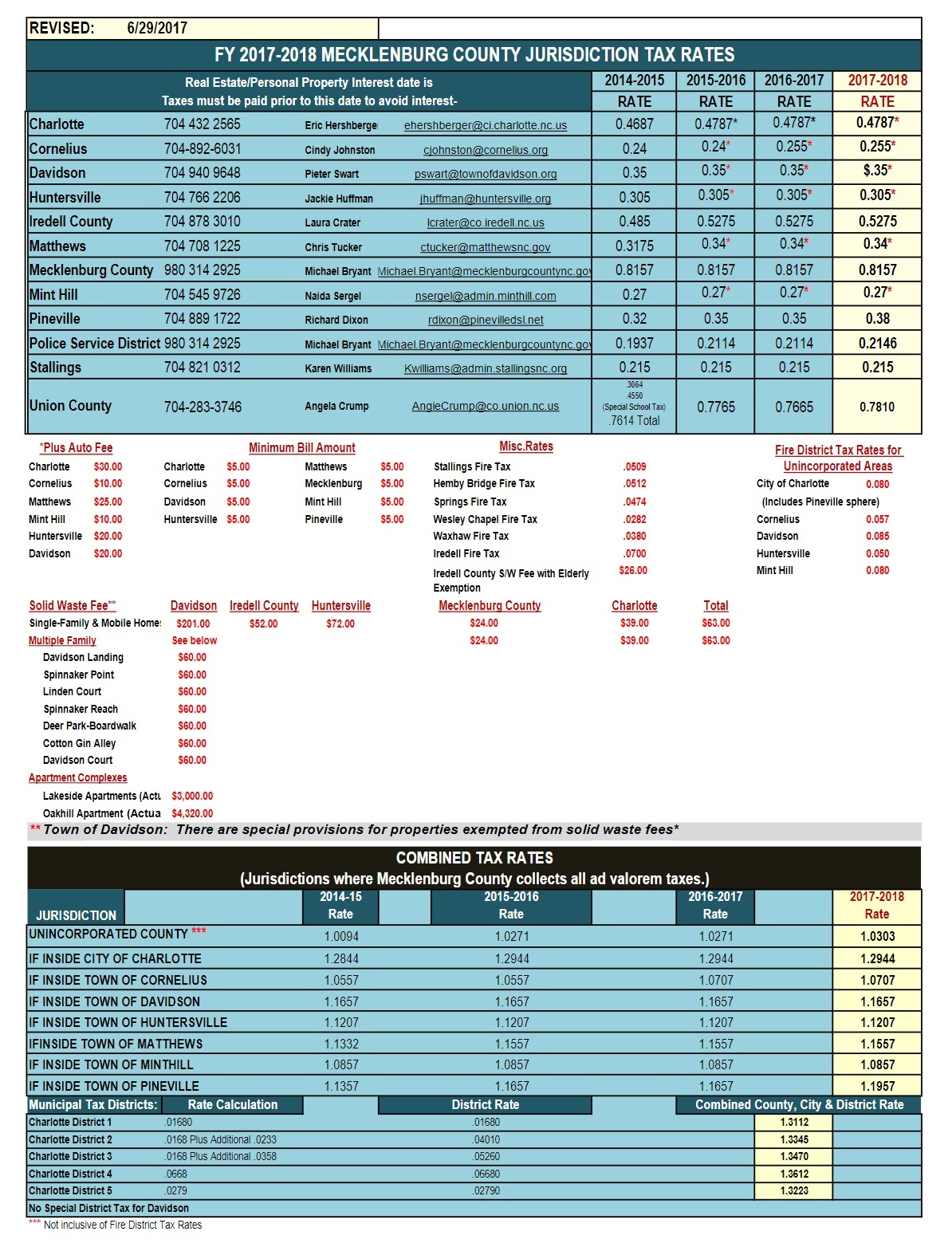

2018 Property Tax Rates Mecklenburg Union Counties

2018 Property Tax Rates Mecklenburg Union Counties

Gaston County Nc Recently Sold Homes Realtor Com

Gaston County Nc Recently Sold Homes Realtor Com

Mappy Monday Catawba County Nc And The Widener Homestead Catawba County Lincoln County

Mappy Monday Catawba County Nc And The Widener Homestead Catawba County Lincoln County

Gaston County Property Tax Inquiry

Gaston County Property Tax Inquiry

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home