Senior Citizen Property Tax Exemption New York City

Maximum exemption amount by tax class. Apply online by March 15th for benefits to begin on July 1.

21600 for Classes 2 and 4.

Senior citizen property tax exemption new york city. Office of Real Property Tax Services Application for Partial Tax Exemption for Real Property of Senior Citizens For help completing this application see Form RP-467-I Instructions for Form RP-467. The NY senior citizen property tax exemption is essentially a tax reduction. Senior citizens exemption nys Verified Just Now.

It lowers the taxes of seniors who own one to three homes condos or coop apartments. To be eligible for SCHE you must be 65 or older earn no more than 58399 for the last calendar year and the property must be your primary residence. 14400 for Classes 2 and 4.

To qualify seniors generally must be 65 years of age or older and meet certain income limitations and other. STAR School Tax Relief Senior citizens exemption. Maximum of 2880 for Class 1.

130 rows Application for Partial Tax Exemption for Real Property of Senior Citizens. The Senior Citizen Homeowners Exemption SCHE provides a reduction of 5 to 50 on New York Citys real property tax to seniors age 65 and older. The property must be the primary residence for all senior owners and their spouses to be eligible for SCHE.

The person claiming the exemption must live in the home as their primary residence The minimum age requirement for senior property tax exemptions is generally between the ages of. These are some of the most common property tax exemptions. New Yorks Senior Citizen Exemption is 50 of your homes appraised value but you must be age 65 or older and have an annual income of no more than 29000 as of 2020.

You cannot receive the senior citizens exemption if the income of the owner or the combined income of all the owners exceeds the maximum income limit set by the locality. Local governments and school districts in New York State can opt to grant a reduction on the amount of property taxes paid by qualifying senior citizens. Senior Citizen Homeowners Exemption SCHE A property tax break for seniors who own one- two- or three-family homes condominiums or cooperative apartments.

Description Senior Citizen Real Estate Tax Exemption Nyc. If March 15 falls on a weekend or holiday the deadline is the next business day. Senior Citizen Homeowners Exemption SCHE The SCHE benefit is available to property owners who are 65 with an annual income of 58399 or less.

SCHE gives property tax help to senior homeowners. If March 15 falls on a weekend or holiday the deadline is the next business day. Exemptions for agricultural properties.

Exemption for persons with disabilities. Served during a specified period of conflict listed above 15. This is accomplished by reducing the taxable assessment of the seniors home by as much as 50.

Business investment instructions Persons with disabilities. Served in a combat zone Additional 10. Thanks to changes in city and state law the DHE and SCHE Senior Citizen Homeowners Exemption tax breaks are now available to homeowners with a combined annual income of 58399 or less.

However if you were mailed a renewal application for an exemption on your property thats addressed to a co-owner who isnt living there anymore you may still be eligible to renew the benefit. Reduction of propertys assessed value. New Yorks Senior Citizen Exemption is 50 of your homes appraised value but you must be age 65 or older and have an annual income of no more than 29000 as of 2020.

If you are married the income of your spouse must be included in the total unless your spouse is absent from the residence due to a legal separation or abandonment. Do not file this form with the Office of Real Property Tax Services. The exemption must be renewed every two years.

This form a New York City Senior Citizen Property Tax Exemption Application is easily completed or adapted to fit your circumstances. You must file this application with your local assessor by the taxable status date. Most exemptions are granted under Article four of the Real Property Tax law but others are authorized by a wide variety of statutes.

Available for download now. Senior citizens exemption. Certain local governments allow homeowners whose income exceeds the limit to receive the reduction but a much lower percentage.

Maximum of 1920 for Class 1. Full list of property tax exemptions. Your homes taxable assessment will get a 50 reduction if your income isnt higher than the set maximum income limit.

The Senior Citizen Homeowners Exemption SCHE provides a reduction of 5 to 50 on New York Citys real property tax to seniors age 65 and older. To be eligible for SCHE you must be 65 or older earn no more than 58399 for the last calendar year and the property must be your primary residence. Property Tax Exemptions for Seniors.

Thanks to changes in city and state law the SCHE and DHE Disabled Homeowners Exemption tax breaks are now available to homeowners with a combined annual income of 58399 or less. The deadline to apply for SCHE for the current tax year is March 15. If you live in a co-op you can apply online using the SCHE co-ops application.

A property tax break for disabled New Yorkers who own one- two- or three-family homes condominiums or cooperative apartments.

New Yorkers Get Relief And Protection With New Federal Funding And State Eviction Foreclosure Moratorium Ny State Senate

New Yorkers Get Relief And Protection With New Federal Funding And State Eviction Foreclosure Moratorium Ny State Senate

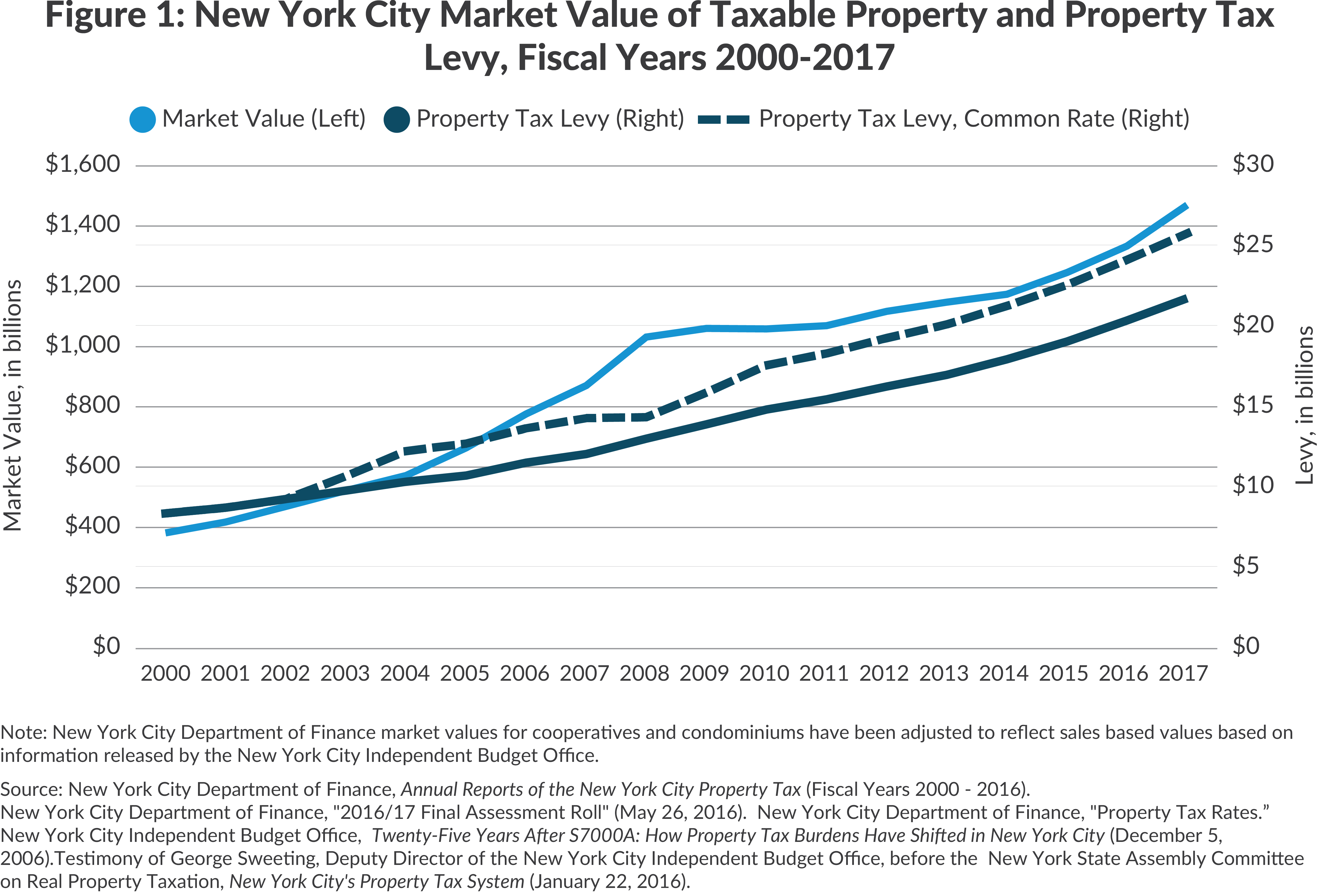

New York City Property Taxes Cbcny

New York City Property Taxes Cbcny

Ny Ended The Property Tax Relief Checks Why They May Not Come Back

Ny Ended The Property Tax Relief Checks Why They May Not Come Back

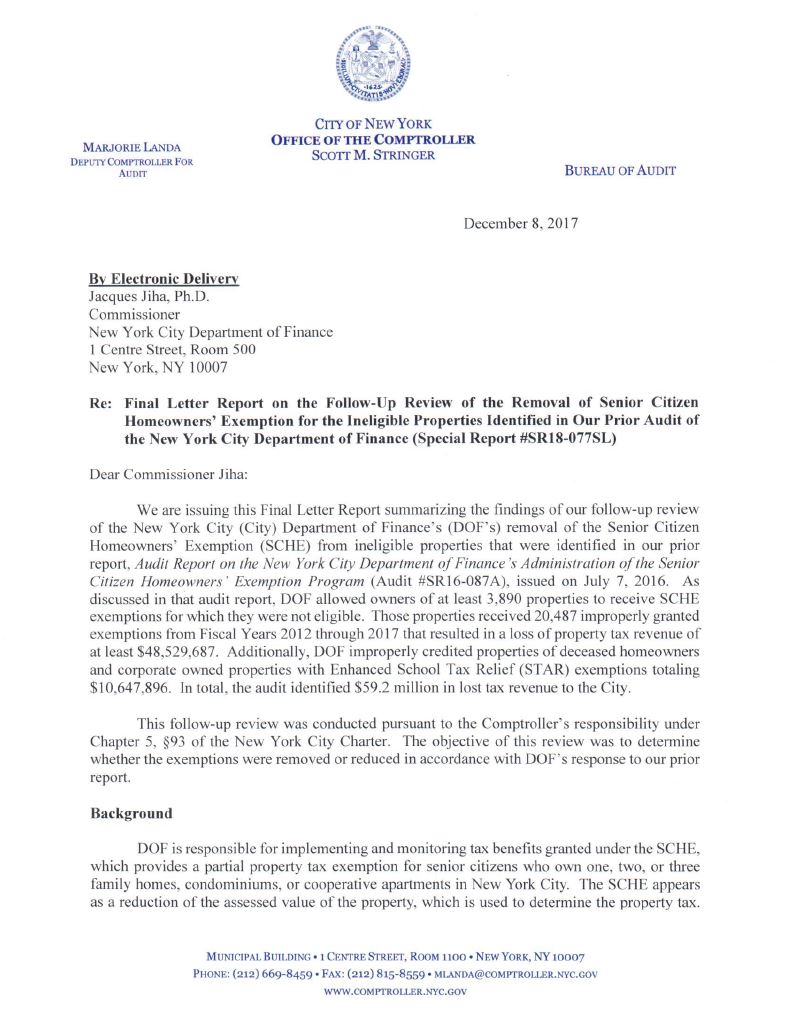

Final Letter Report On The Follow Up Review Of The Removal Of Senior Citizen Homeowners Exemption For The Ineligible Properties Identified In Our Prior Audit Of The New York City Department Of Finance

Final Letter Report On The Follow Up Review Of The Removal Of Senior Citizen Homeowners Exemption For The Ineligible Properties Identified In Our Prior Audit Of The New York City Department Of Finance

What Is The 421g Tax Abatement In Nyc Hauseit Nyc Lower Manhattan Tax

What Is The 421g Tax Abatement In Nyc Hauseit Nyc Lower Manhattan Tax

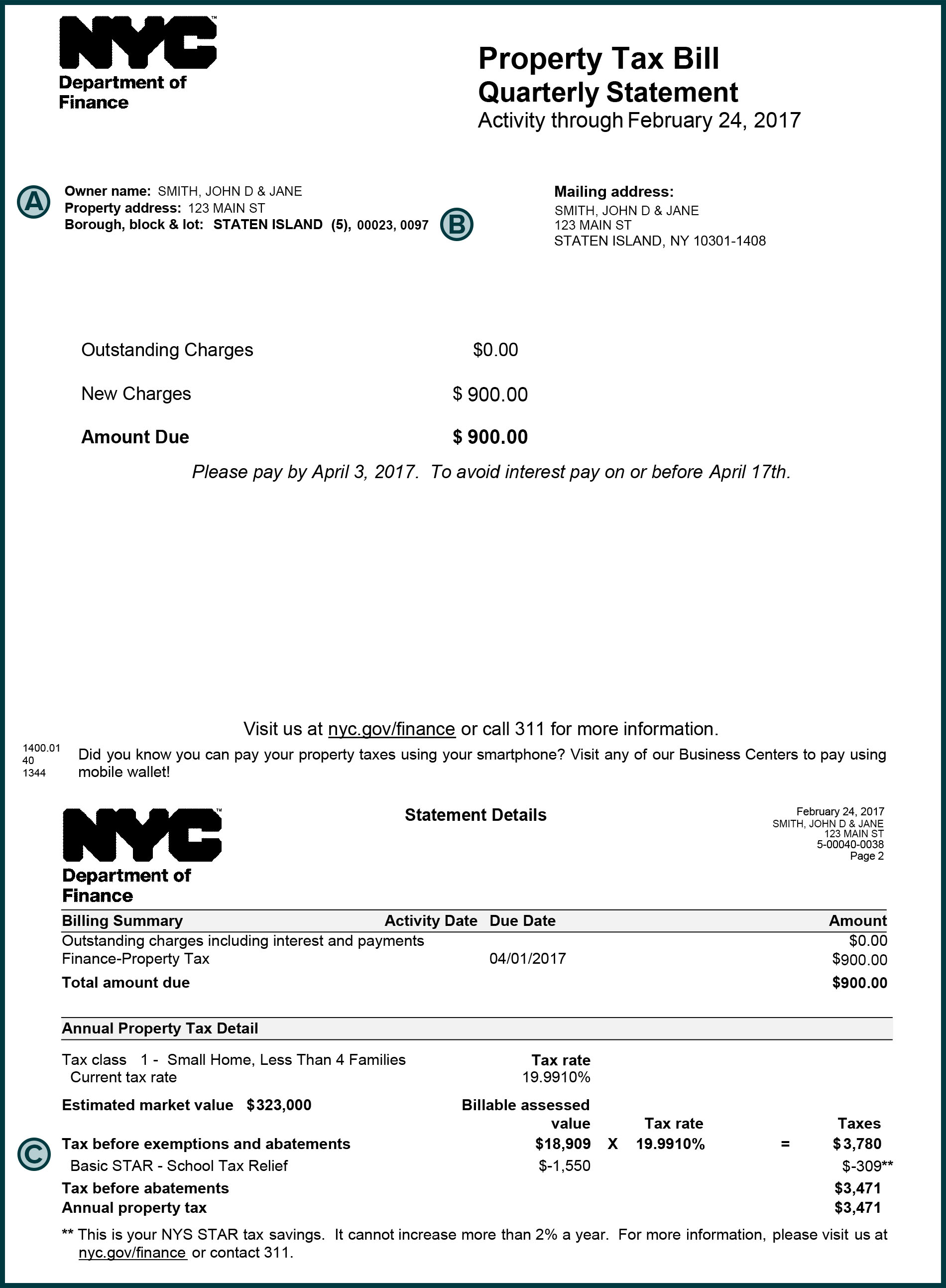

What Is The Basic Star Property Tax Credit In Nyc Hauseit

What Is The Basic Star Property Tax Credit In Nyc Hauseit

The School Tax Relief Star Program Faq Ny State Senate

The School Tax Relief Star Program Faq Ny State Senate

Https Www Osc State Ny Us Files Local Government Documents Pdf 2020 07 Property Tax Exemptions Pdf

Senator Brooks Proposes 1 7 Billion In Education Property Tax Relief Ny State Senate

Senator Brooks Proposes 1 7 Billion In Education Property Tax Relief Ny State Senate

What Is The Nyc Senior Citizen Homeowners Exemption Sche

What Is The Nyc Senior Citizen Homeowners Exemption Sche

Seniors In Ny Won T Have To Reapply For Local 2021 Property Tax Exemption If Towns Agree Syracuse Com

Seniors In Ny Won T Have To Reapply For Local 2021 Property Tax Exemption If Towns Agree Syracuse Com

Http Www Cityofrochester Gov Workarea Downloadasset Aspx Id 8589965745

What Is The Nyc Senior Citizen Homeowners Exemption Sche

What Is The Nyc Senior Citizen Homeowners Exemption Sche

Good News For Homeowners Who Have Illegal Properties In The Civic Body Area The Municipal Corporation Of Gurugram Ha Property Tax Commercial Property Property

Good News For Homeowners Who Have Illegal Properties In The Civic Body Area The Municipal Corporation Of Gurugram Ha Property Tax Commercial Property Property

Https Www1 Nyc Gov Assets Finance Downloads Pdf Reports Reports Property Tax Nyc Property Fy17 Pdf

Ny City Department Of Finance Property Taxes Financeviewer

Ny City Department Of Finance Property Taxes Financeviewer

What Is The Fair Market Value Of My Nyc Apartment Hauseit Nyc Nyc Apartment Nyc Market Value

What Is The Fair Market Value Of My Nyc Apartment Hauseit Nyc Nyc Apartment Nyc Market Value

What Is The Nyc Senior Citizen Homeowners Exemption Sche

What Is The Nyc Senior Citizen Homeowners Exemption Sche

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home