Kalispell Montana Property Tax Rate

View a list of granted property tax exemptions in each county. Montana is ranked number twenty nine out of the fifty states in order of the average amount of property taxes collected.

Opportunity Zones Montana West Economic Development

Opportunity Zones Montana West Economic Development

The US average is.

Kalispell montana property tax rate. Federal income taxes are not included Property Tax Rate. Below are current and previous year tax bills. Median Property Taxes Mortgage 2158.

View market and taxable values by taxing jurisdiction and county. The tax rate for residential property is 135 percent in 2016. No endorsement is intended or made of any hypertext link product service or information either by its inclusion or exclusion from this page or site.

The tax rate for commercial and industrial property is 14 times the residential property tax rate or 189 percent in 2018. Search for personal property by assessment code. Flathead County collects on average 077 of a propertys assessed fair market value as property tax.

Tax Rates for Kalispell MT. The tax rate for residential property is 135 percent in 2018. 690 The total of all income taxes for an area including state county and local taxes.

Average which currently stands at 107. In part rates in Montana are low because the system is structured to reduce the burden on homeowners. The median property tax in Flathead County Montana is 1777 per year for a home worth the median value of 231800.

The tax rate for commercial and industrial property is 14 times the residential property tax rate or 189 percent in 2016. The states average effective property tax rate is 083 well below the US. The first 4 digits indicate the year.

Flathead County Property Tax Payments Annual Flathead County Montana. The median property tax also known as real estate tax in Flathead County is 177700 per year based on a median home value of 23180000 and a median effective property tax rate of 077 of property. If the tax rate is 1400 and the home value.

The taxable value for an owner-occupied residential property is only a small percentage of the propertys market value. 1098 The property tax rate shown here is the rate per 1000 of home value. Property values may be rising in Missoula and other places but here in the Flathead they are slow and stagnant.

Click on the tax bill number to view the bill. The median property value in Kalispell MT was 214100 in 2018 which is 0932 times smaller than the national average of 229700. Locate properties by browsing the statewide parcel map.

View listing photos review sales history and use our detailed real estate filters to find the perfect place. Enter a property number assessment code name or address in the search box to view property characteristics. 30 rows Tax Rates for Kalispell - The Sales Tax Rate for Kalispell is 00.

000 The total of all sales taxes for an area including state county and local taxes Income Taxes. Approximately 950 of levy districts paid an effective tax rate between 0581 and 4498. Between 2017 and 2018 the median property value increased from 205500 to 214100 a 418 increase.

The statewide effective tax rate for all property classes was estimated to be 1123 in TY 2019 with approximately 680 of levy districts paying an effective tax rate between 0765 and 1727. Flathead County has one of the highest median property taxes in the United States and is ranked 585th of the 3143 counties in order of median property taxes. Montana needs to fully overhaul the tax structure and if that involves a sales tax.

Counties in Montana collect an average of 083 of a propertys assesed fair market value as property tax per year. The median property tax in Montana is 146500 per year for a home worth the median value of 17630000. Median Property Taxes No Mortgage 1967.

The homeownership rate in Kalispell MT is 554 which is lower than the national average of 639. Zillow has 175 homes for sale in Kalispell MT.

Oharch Com Solar Solar House Eco House Passive Solar Homes

Oharch Com Solar Solar House Eco House Passive Solar Homes

108 Garland St Kalispell Mt 59901 Realtor Com

108 Garland St Kalispell Mt 59901 Realtor Com

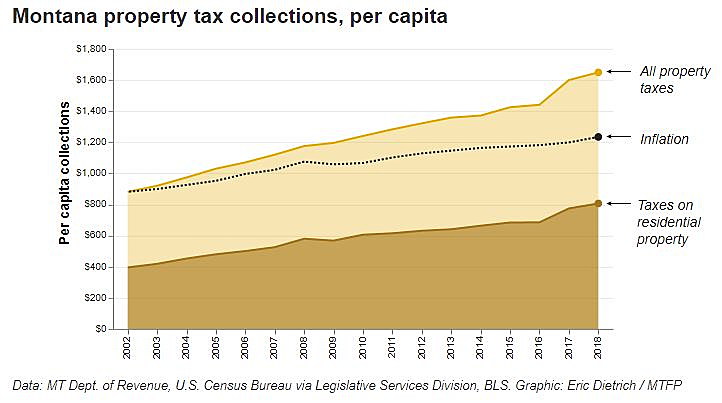

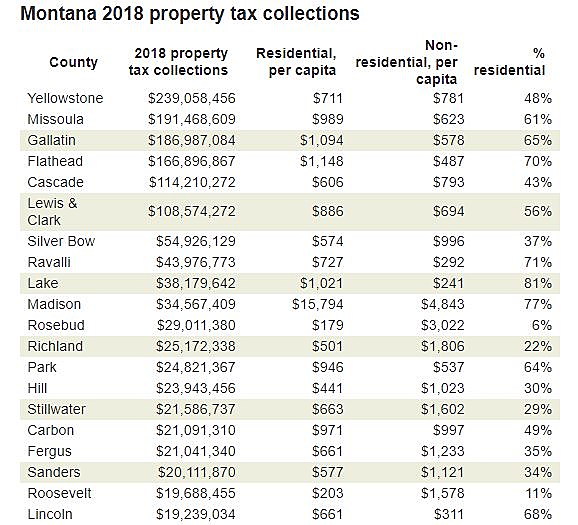

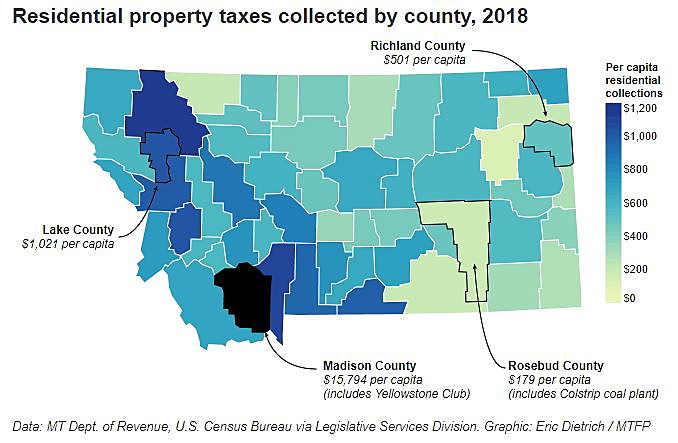

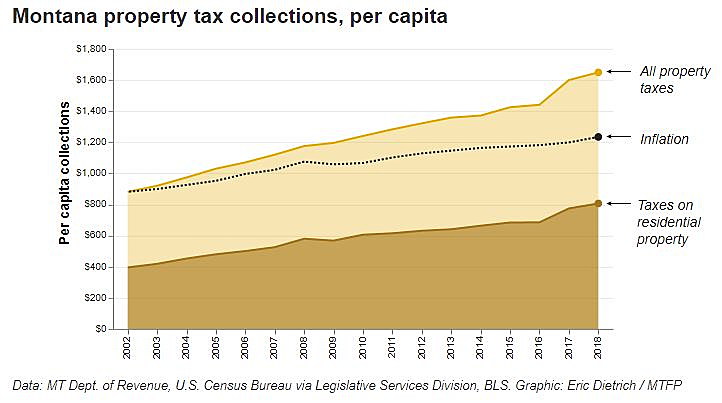

Montana Property Taxes Keep Rising But Missoula Isn T At The Top Missoula Current

Montana Property Taxes Keep Rising But Missoula Isn T At The Top Missoula Current

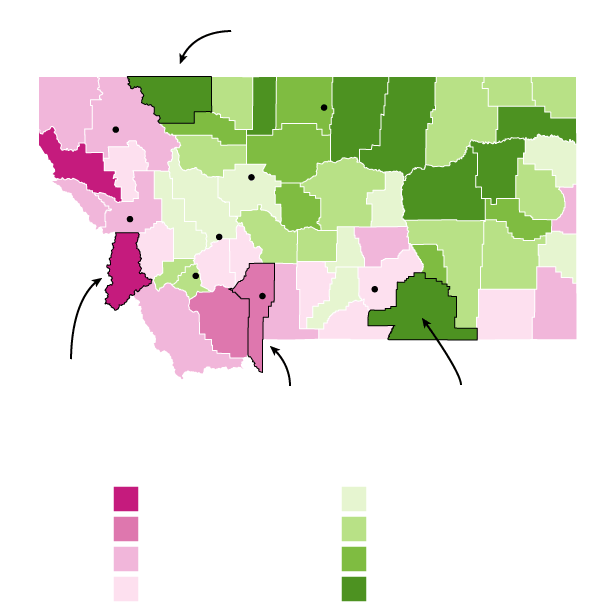

Where Born And Bred Montanans Do And Don T Live Montana Free Press

Where Born And Bred Montanans Do And Don T Live Montana Free Press

Where Born And Bred Montanans Do And Don T Live Montana Free Press

Where Born And Bred Montanans Do And Don T Live Montana Free Press

Montana S Booming Short Term Rental Market Comes With Challenges Study Says Mtpr

Montana S Booming Short Term Rental Market Comes With Challenges Study Says Mtpr

Montana Real Estate Transfer Tax Montana Real Estate Transfer Certificate

Montana Real Estate Transfer Tax Montana Real Estate Transfer Certificate

Nye Montana Where My Husband Worked In A Palladium Mine Big Sky Country Montana Wyoming

Nye Montana Where My Husband Worked In A Palladium Mine Big Sky Country Montana Wyoming

Montana Flag Since 1981 Montana State State Flags Montana

Montana Flag Since 1981 Montana State State Flags Montana

Pin By Jen Clement Broker With Bhhs On Real Estate In Western Montana Bhhs Montana Properties Montana Berkshire Landmarks

Pin By Jen Clement Broker With Bhhs On Real Estate In Western Montana Bhhs Montana Properties Montana Berkshire Landmarks

How Where And Why Montana Became The Grayest State In The West Flathead Beacon

How Where And Why Montana Became The Grayest State In The West Flathead Beacon

Montana Opportunity Zones Oz Funds Investing Mt Tax Benefits

Montana Opportunity Zones Oz Funds Investing Mt Tax Benefits

Wild Goose Island At Glacier National Park Mt Montana Kalispell Montana National Parks

Wild Goose Island At Glacier National Park Mt Montana Kalispell Montana National Parks

Montana Property Taxes Keep Rising But Missoula Isn T At The Top Missoula Current

Montana Property Taxes Keep Rising But Missoula Isn T At The Top Missoula Current

Montana Property Taxes Keep Rising But Missoula Isn T At The Top Missoula Current

Montana Property Taxes Keep Rising But Missoula Isn T At The Top Missoula Current

Montana Property Tax Calculator Smartasset

Montana Property Tax Calculator Smartasset

Epic Holdings Inc To Acquire Integro Usa Send2press Newswire Risk Analytics Legal Advisor Risk Management

Epic Holdings Inc To Acquire Integro Usa Send2press Newswire Risk Analytics Legal Advisor Risk Management

Montana Property Tax Calculator Smartasset

Montana Property Tax Calculator Smartasset

2021 Best Places To Live In Montana Niche

2021 Best Places To Live In Montana Niche

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home