Personal Property Tax Halifax Virginia

Gutridge Going 1 tithe 2 horses 8 cattle frame 4 Susannah 3 horses 3 cattle. William Barber 1 tithe 2 horses 4 cattle frame 5 Peter Wilson 1 tithe 2 horses 3.

To qualify individuals must meet income and net worth limitations.

Personal property tax halifax virginia. Personal Property Relief Act 1998 PPTRA Under Virginia law the Commonwealth of Virginia subsidizes a percentage of the tax on the first 20000 of assessed value for vehicles coded as personal use. David Pinn 2 tithes 3 horses 8 cattle. Halifax County collects on average 052 of a.

Applications for real estate tax exemption are taken in the office of the Commissioner of the Revenue Municipal Center Building 1 by appointment only from February 1 through June 30. Personal property taxes and real estate taxes are local taxes which means theyre administered by cities counties and towns in Virginia. Click Here for a list of Delinquent Personal Property Taxes.

Giles 0630 1980 0830 Gloucester 0695 2950 2950 - Goochland 0530 4000 1000 - Grayson 0490 1750 6700 Greene 0775 5000 2500 - Greensville 0670 5000 4000 - Halifax 0480 3850 1260 -. Tax rates differ depending on where you live. Tax Rates Fiscal Year 2019.

2021 Business Tangible Personal Property Return 2021 Machinery Tools 2021 Return of Tangible Personal Property Tax Relief for the Elderly Disabled Authorization to Release Background Information Building Permit Application Form Erosion and Sediment Control Application Agreement in. Personal Property Tax Records for Halifax County. Click to open image.

Updated - Delinquent Personal Property Taxes as of December 31 2020. 1257 rows 1782 Halifax County Virginia Personal Property Tax List Transcribed by Jeffrey C. The Commissioner of the Revenue determines the method of assessment for personal property and the City Council establishes the tax rate.

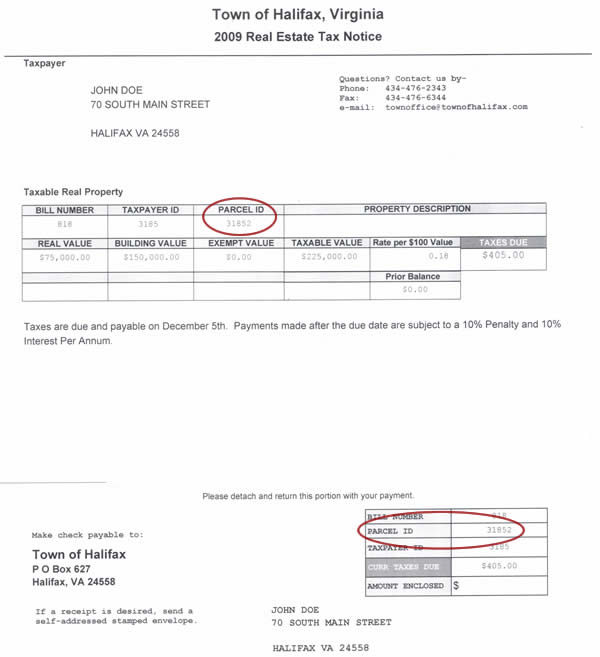

Library of Virginia microfilms 147-150. To pay your Real Estate tax bill online you will need your Parcel ID. We have provided an image that will show you where to find it.

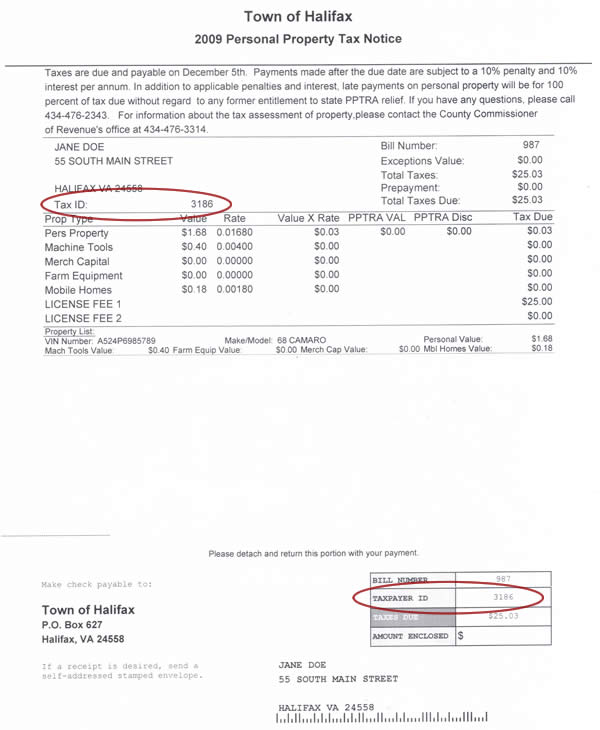

The amounts shown due on this list are the original assessments plus penalty. To pay your Personal Property tax bill online you will need your Tax ID. We have provided an image that will show you where to find it.

Halifax County Property Records are real estate documents that contain information related to real property in Halifax County Virginia. 96 rows return to Personal Property Tax Records. The Board of Supervisors confirms that the Halifax County tax rates for 2020 shall be as follows.

NOTICE OF DELINQUENT TAXES AND SALE OF REAL PROPERTY HALIFAX COUNTY VIRGINIA Pursuant to Virginia Code 581-3975 the following real property will be auctioned for sale to the highest bidder at a timed online-only public auction which will commence Friday March 5 2021 at 100pm EST and close Wednesday March 17 2021 at 100pm EST. Local government records collection Halifax County Court Records. For Tax Year 2018 Fiscal 2019 COUNTY Tax Rates Per 100 of Assessed Value On.

Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents. This list conforms to the facts as they existed at June 30 2020 however is updated for payments received through December 31 2020. Halifax County Tax Rates for 2020 050 per 100 value for real estate Payments due June 5th and December 5th 385 per 100 value for personal property 126 per 100 value for machinery and tools based on 50 of original capitalization costs Personal Property and Machinery Tools Tax Payments are Due December 5.

If you have questions about personal property tax or real estate tax contact your local tax office. 385 per 100 value for personal property. The median property tax in Halifax County Virginia is 502 per year for a home worth the median value of 96000.

The current personal property tax rate is 413 per 100 of assessed value. Click to open image. Halifax County Va Capitation and Personal Property Tax Ledger 1861.

050 per 100 value for real estate - Real Estate Tax payments are due June 5 first half and December 5 second half. The Vehicle Registration Fee is 3300 per annum and is administered directly by the City Treasurer click here to e-mail the Treasurer. Halifax County Personal Property Tax List 1782-1800.

The Library of Virgina Richmond Virginia. View qualifications and procedures for appealing your vehicle assessment on your vehicle.

How To File And Pay Sales Tax In Virginia Taxvalet

How To File And Pay Sales Tax In Virginia Taxvalet

1098 E Oak Hill Dr Halifax Va 24558 Zillow

1098 E Oak Hill Dr Halifax Va 24558 Zillow

Covid 19 Cases In Virginia Rise To 1250 With Stay At Home Order Now In Place

Covid 19 Cases In Virginia Rise To 1250 With Stay At Home Order Now In Place

1050 Evergreen Trl Halifax Va 24558 Zillow

1050 Evergreen Trl Halifax Va 24558 Zillow

2080 Chatham Rd Halifax Va 24558 Zillow

2080 Chatham Rd Halifax Va 24558 Zillow

1061 Holly Ct Halifax Va 24558 Realtor Com

1061 Holly Ct Halifax Va 24558 Realtor Com

:strip_exif(true):strip_icc(true):no_upscale(true):quality(65)/arc-anglerfish-arc2-prod-gmg.s3.amazonaws.com/public/JBDKWPB63VF4FPKWFYMK2QJ6SQ.jpg) Virginia County Offering Some Personal Property Tax Relief Because Of The Coronavirus

Virginia County Offering Some Personal Property Tax Relief Because Of The Coronavirus

Gravestone Inscriptions In Northampton County Virginia Virginia Family History Virginia History

Gravestone Inscriptions In Northampton County Virginia Virginia Family History Virginia History

7908 Halifax Rd North Dinwiddie Va 23805 Mls 2108070 Zillow

7908 Halifax Rd North Dinwiddie Va 23805 Mls 2108070 Zillow

310 Easley St South Boston Va 24592 Mls 47036 Zillow

310 Easley St South Boston Va 24592 Mls 47036 Zillow

Gravestone Inscriptions In Northampton County Virginia Virginia Family History Virginia History

Gravestone Inscriptions In Northampton County Virginia Virginia Family History Virginia History

4185 Melon Rd Halifax Va 24592 Zillow

4185 Melon Rd Halifax Va 24592 Zillow

How To File And Pay Sales Tax In Virginia Taxvalet

How To File And Pay Sales Tax In Virginia Taxvalet

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home