How To Check Property Tax Nyc

Submit a written request and include proof of payment front and back of the cancelled check or the receipts from the City Register Division of Land Records showing payment and a copy of the cover pages for the original real property transfer tax return filing to. You can ask for the credits to be applied to other tax periods or you can request a refund by completing a Property Refund Request form.

1031 Exchange Tips Hauseit Capital Gains Tax Capital Gain Exchange

1031 Exchange Tips Hauseit Capital Gains Tax Capital Gain Exchange

Property Taxes Property Assessments Assessment Lookup How to Challenge Your Assessment Assessment Challenge Forms Instructions Assessment Review Calendar Rules of Procedure PDF Information for Property Owners.

How to check property tax nyc. Your prior-year New York State income tax return Form IT-201 IT-201-X IT-203 or IT-203X filed for one of the past five tax years and. That is done by a local official your city or town assessor. Use the Property Tax Credit Lookup tool to view and print a list of your previously issued STAR and property tax relief credit checks.

Changes to your Information. Through a bank or bill pay website. Enter your Social Security number.

Look up information about a property including its tax class and market value. Weve redesigned the page to provide easy access to content and tools for property owners local officials and real estate professionals. To locate the Total payments you reported on your previously filed return see Total.

Is this different from the STAR program. City of Yonkers Assessment Office 40 South Broadway - Room 100 Yonkers NY 10701 914-377-6200. NYC Department of Finance BusinessExcise Tax Refund Unit.

Scroll down to select the content youre looking for regarding local property tax and assessment administration. The state budget enacts the circuit breaker for the tax years of 2021 2022 and 2023. If you are a co-op owner you must get information about your property taxes account and exemption status from your co-op management office.

Property tax bills are due semi-annually twice a year or quarterly four times a year depending on the assessed or actual assessed value of the property. Before you begin youll need. You will need the propertys address or the Borough-Block-Lot BBL number.

Learn more and sign up for email receipts. While the exact property tax rate you will pay will vary by county and is set by the local property tax assessor you can use the free New York Property Tax Estimator Tool to calculate your approximate yearly property tax based on median property tax rates across New York. For more information download the Class 1 and Class 2 property tax guides.

Welcome to the NYC Department of Finances Property Tax Public Access web portal your resource for information about New York City property taxes. This section will help you understand how your property is valued and how those values are used to calculate your property taxes. Some credits are treated differently.

You will receive a Property Tax Bill if you pay the taxes yourself and have a balance. If a bank or mortgage company pays your property taxes they will receive your property tax bill. Bills are generally mailed and posted on our website about a month before your taxes are due.

In Public Access you can. Quarterly and Semi-Annual Property Tax Bills. View your property tax bill and account information.

Calculating Your Property Taxes NYC property owners receive a property tax bill from the Department of Finance a few times a year. You can register to receive a property tax payment receipt by email. View your property tax bills annual notices of property value NOPV and other important statements.

Property Records ACRIS Deed Fraud Alert. The property tax system in New York starts with an assessment of your property to determine the market value. The STAR program either directly reduces property taxes on the bill itself or sends a check to homeowners with the difference.

Pay online or by credit card or Electronic Check. NYC is a trademark and service mark of the City of New York. Check your refund status online 247.

The Total payments amount from the return you use for verification. Property Bills Payments. Any overpaid property tax will be credited to your account.

Tax rate and tax class. Call 311 for assistance. See Refund amount requested to learn how to locate this amount.

Properties that have an assessed value of OVER 250000 receive property tax bills semi-annually or two times a. New York Property Tax Calculator. Welcome to our new Real Property landing page.

Properties that have an assessed value of UNDER 250000 receive property tax bills quarterly or four times a year. All address changes or any other information pertaining to your tax bill shall be directed to the Assessment Department. Select the tax year for the refund status you want to check.

This program rather is a credit for when an income tax return is. Property Tax Bills. While youre here enter your email address in the Subscribe box to sign up for our Tax Tips for Property Owners email list.

Choose the form you filed from the drop-down menu. Enter the amount of the New York State refund you requested. Data and Lot Information.

Pay in person at City Hall 1st Floor Room 108 Cashiers Office. If you do nothing it will be automatically applied to your next tax bill. Check issue date.

Assessments should happen regularly but many cities and towns have not made reassessments in many years. Nassau County Tax Lien Sale Annual Tax Lien Sale Public Notice.

Best And Final Offer Strategy And Tactics For Buyers In Nyc Hauseit Property Marketing Strategies Offer

Best And Final Offer Strategy And Tactics For Buyers In Nyc Hauseit Property Marketing Strategies Offer

States With The Highest And Lowest Property Taxes Property Tax Tax States

States With The Highest And Lowest Property Taxes Property Tax Tax States

What S My Property S Tax Identification Number

What S My Property S Tax Identification Number

Nyc Mortgage Recording Tax Of 1 8 To 1 925 2021 Hauseit

Nyc Mortgage Recording Tax Of 1 8 To 1 925 2021 Hauseit

Nyc Mansion Tax Of 1 To 3 9 2021 Overview And Faq Hauseit

Nyc Mansion Tax Of 1 To 3 9 2021 Overview And Faq Hauseit

Is It Worth Buying A Coop In Nyc Hauseit Nyc Buying A Condo Future Lifestyle

Is It Worth Buying A Coop In Nyc Hauseit Nyc Buying A Condo Future Lifestyle

Closing Costs Nyc Buyer Hauseit Closing Costs Nyc Cost

Closing Costs Nyc Buyer Hauseit Closing Costs Nyc Cost

Nyc Floor Area Ratio And Far Calculation Hauseit Floor Area Ratio Flooring Nyc

Nyc Floor Area Ratio And Far Calculation Hauseit Floor Area Ratio Flooring Nyc

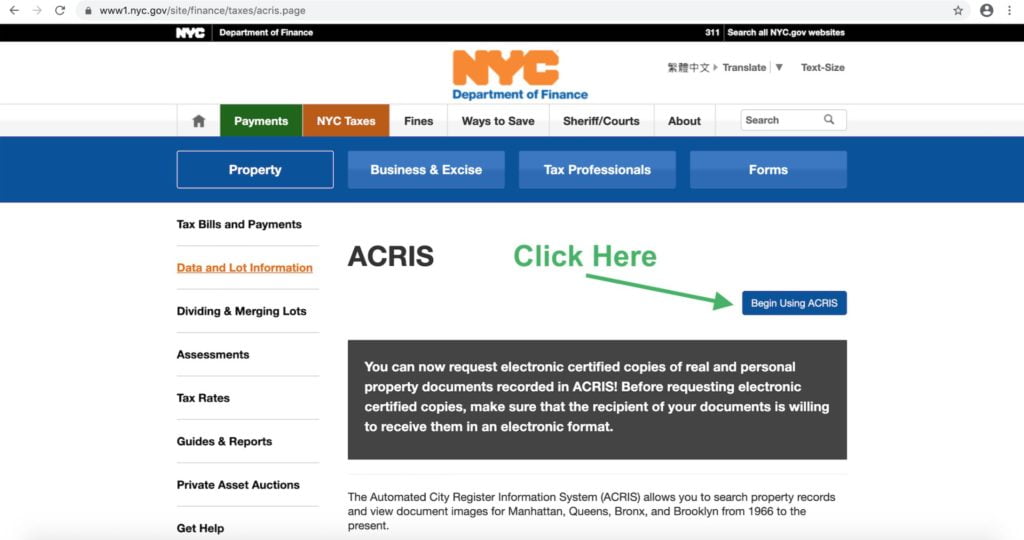

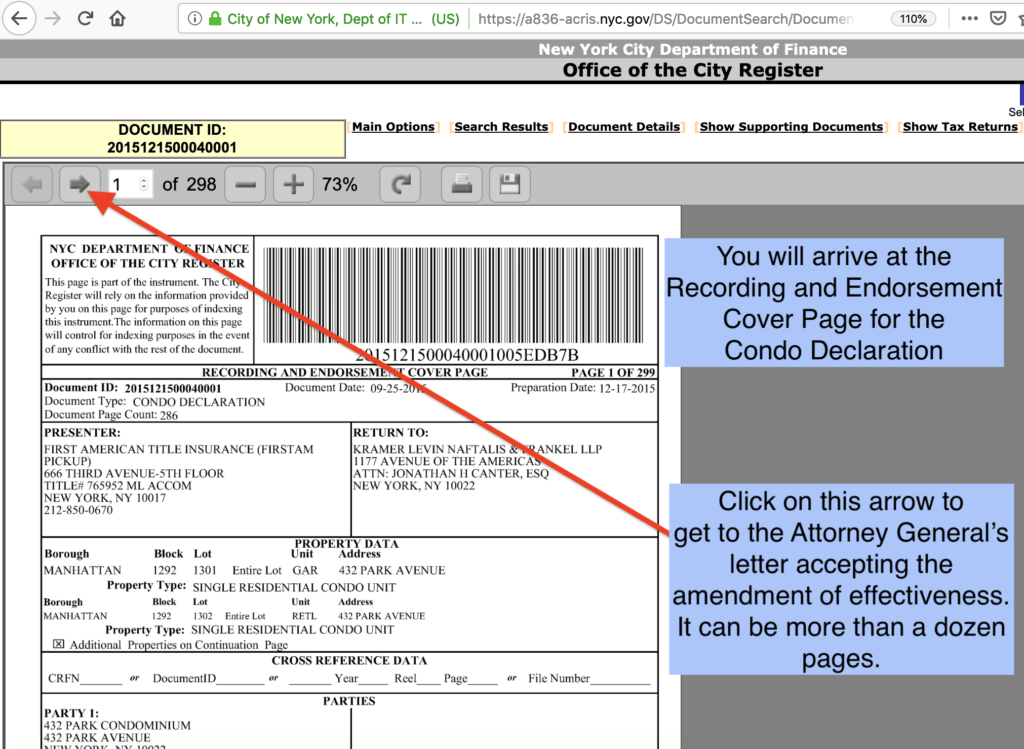

Acris To Search For Nyc Property Records Acris Guide To Search

Acris To Search For Nyc Property Records Acris Guide To Search

Should You Get Home Inspection Before Making Offer Hauseit Home Inspection Inspect Offer

Should You Get Home Inspection Before Making Offer Hauseit Home Inspection Inspect Offer

Co Op Vs Condo In Nyc A Detailed Comparison And Faq Hauseit Buying A Condo Real Estate Infographic Condo

Co Op Vs Condo In Nyc A Detailed Comparison And Faq Hauseit Buying A Condo Real Estate Infographic Condo

Acris To Search For Nyc Property Records Acris Guide To Search

Acris To Search For Nyc Property Records Acris Guide To Search

Making An Offer On A Condo Nyc Hauseit Buying A Condo Nyc Things To Come

Making An Offer On A Condo Nyc Hauseit Buying A Condo Nyc Things To Come

Why Are Buyer Closing Costs In Nyc Lower For Co Ops Than Condos Infographic Portal Real Estate Infographic Closing Costs Nyc

Why Are Buyer Closing Costs In Nyc Lower For Co Ops Than Condos Infographic Portal Real Estate Infographic Closing Costs Nyc

Condo Closing Timeline Nyc Hauseit Nyc Buying A Condo Condo

Condo Closing Timeline Nyc Hauseit Nyc Buying A Condo Condo

Nyc Mansion Tax Of 1 To 3 9 2021 Overview And Faq Hauseit

Nyc Mansion Tax Of 1 To 3 9 2021 Overview And Faq Hauseit

Nyc Coop Closing Costs Seller Hauseit Closing Costs Nyc Cost

Nyc Coop Closing Costs Seller Hauseit Closing Costs Nyc Cost

States With The Highest And Lowest Property Taxes Property Tax Social Studies Worksheets States

States With The Highest And Lowest Property Taxes Property Tax Social Studies Worksheets States

Nyc Property Taxes All You Need To Know Blocks Lots

Nyc Property Taxes All You Need To Know Blocks Lots

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home