Personal Property Tax Rate Washington State

The median property tax in Washington is 263100 per year for a home worth the median value of 28720000. Census Bureau and residents of the 27 states with vehicle property.

Are There Any States With No Property Tax In 2021 Free Investor Guide

Are There Any States With No Property Tax In 2021 Free Investor Guide

Other types of property exempt from taxation include.

Personal property tax rate washington state. The average American household spends 2471 on property taxes for their homes each year according to the US. The median property tax in Grant County Washington is 1385 per year for a home worth the median value of 141100. Attorney Generals Office The Washington State Attorney Generals Office has some helpful information if you are facing foreclosure on your property.

Personal Property Tax Forms. 275 on homes between 1500000 and 3000000. Every person who uses personal property in a business or has taxable personal property must complete a Personal Property Tax listing form by April 30 each year.

Personal exemption not applicable to tax levied on such property. Due to the pandemic our offices are closed to the public. Welcome to Personal Property Tax.

3 on homes more than 3000000. Because the calculations used to determine property taxes vary widely from county to county the best way to compare property taxes on a large scale is by using aggregate data. See property tax exemptions and deferrals for more information.

128 on homes between 500000 and 1500000. Additional personal property exemptions are allowed by the state. Washington has one of the highest average property tax rates in the country with only eleven states levying higher property taxes.

But home buyers and sellers should note that many local jurisdictions impose their own additional transfer tax in addition to the REET. For example household goods and personal. Taxes - personal property - destruction of the property The tax on personal property destroyed between January 1 and the levy date remains valid.

Counties in Washington collect an average of 092 of a propertys assesed fair market value as property tax per year. Please visit our Contact page for support options. How do I report and pay personal property tax.

Most personal property owned by individuals is exempt. WASHINGTON STATE DEPARTMENT OF REVENUE Personal Property Tax. Grant County collects on average 098 of a propertys assessed fair market value as property tax.

If you use personal property in a business or have taxable personal property you must complete a personal property tax listing form by April 30 each year. Personal property includes machinery equipment furniture and supplies. The tax rate for real and personal property is the same.

Washington is ranked 925th of the 3143 counties in the United States in order of the median amount of property taxes collected. The assessor uses the form to value personal property for taxes due the following year. Depending on where you live property taxes can be a small inconvenience or a major burden.

Here you will find resources specific to personal property assessment in Washington. Property taxes and advises assessors and treasurers on how to assess property to assure uniformity of assessment and taxation throughout the state. Personal Property Tax Most people know that property Bytax applies to real property however some may not know that property tax also applies to personal property.

Personal Property Documents and Links. Deferral of property taxes Depending on your income you can defer property tax payments. The tax rate for real and personal property is the same.

El alivio comercial de COVID-19 está disponible. Custom software livestock inventories held solely for resale licensed motor vehicles and intangible personal property like patents copyrights and trademarks. If you use personal property that is not exempt you must complete.

COVID-19 business relief is available. Top Real Estate Agents in Washington. Washington 092 24 Missouri 091 25 Maryland 087 26 Oregon 087 27 Indiana 0.

A Personal Property Tax Listing Form by April 30 each year. Lowest Tax Highest Tax.

Monday Map State Local Property Tax Collections Per Capita Property Tax Map Best Places To Retire

Monday Map State Local Property Tax Collections Per Capita Property Tax Map Best Places To Retire

5 Financial Reasons To Buy A Home Home Buying Real Estate Buying Real Estate

5 Financial Reasons To Buy A Home Home Buying Real Estate Buying Real Estate

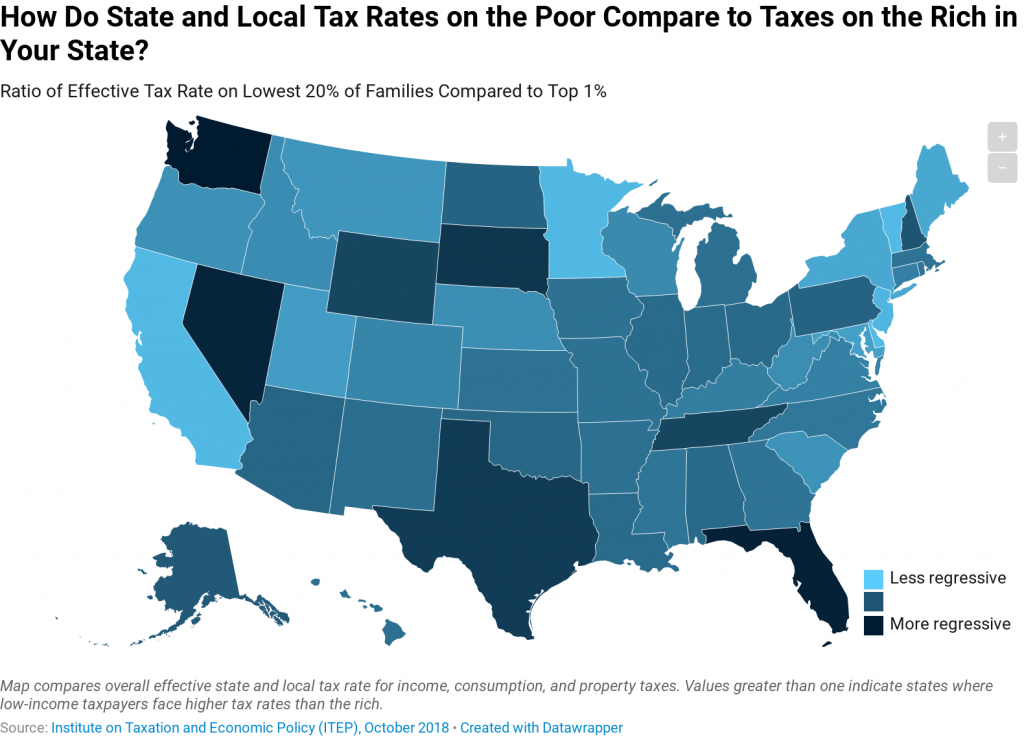

How Do Tax Rates On The Poor Compare To Taxes On The Rich In Your State Itep

How Do Tax Rates On The Poor Compare To Taxes On The Rich In Your State Itep

Washington Property Tax Calculator Smartasset

Washington Property Tax Calculator Smartasset

Property Tax Map Tax Foundation

Property Tax Map Tax Foundation

New Investment Excel Template Exceltemplate Xls Xlstemplate Xlsformat Excelformat Microsoftexc Investment Property Spreadsheet Template Capital Gains Tax

New Investment Excel Template Exceltemplate Xls Xlstemplate Xlsformat Excelformat Microsoftexc Investment Property Spreadsheet Template Capital Gains Tax

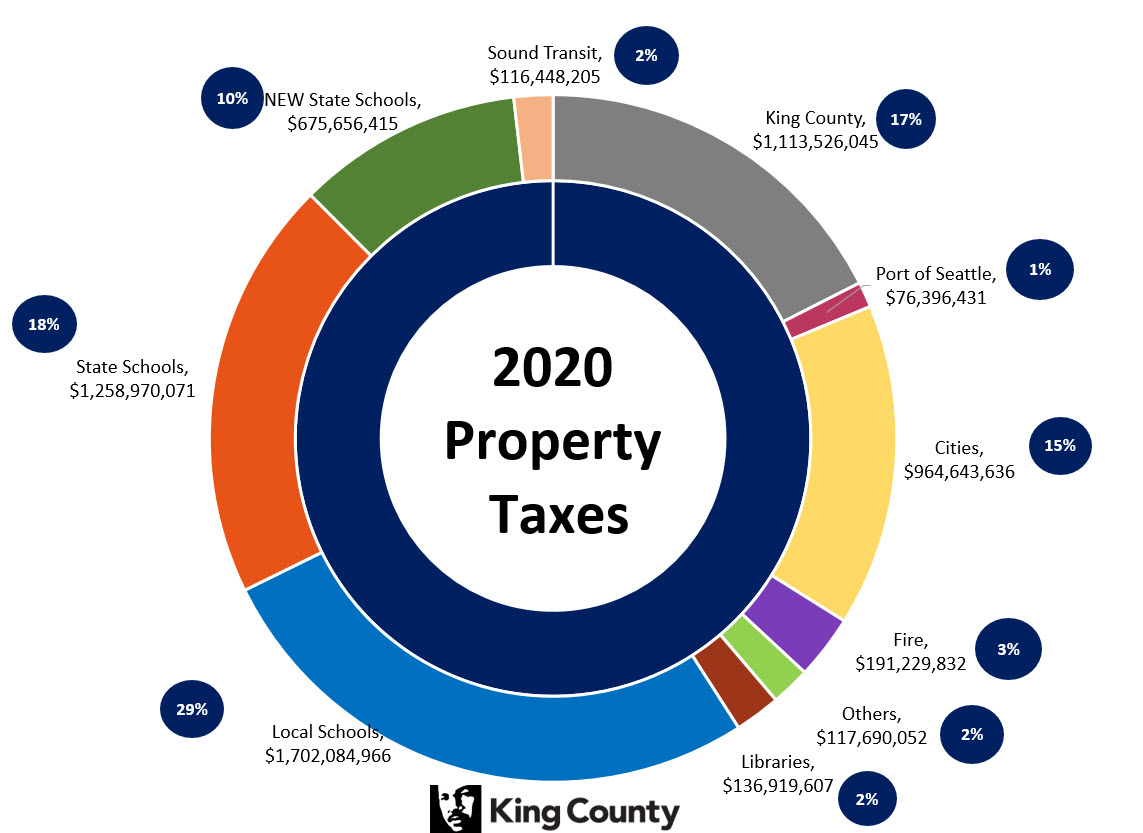

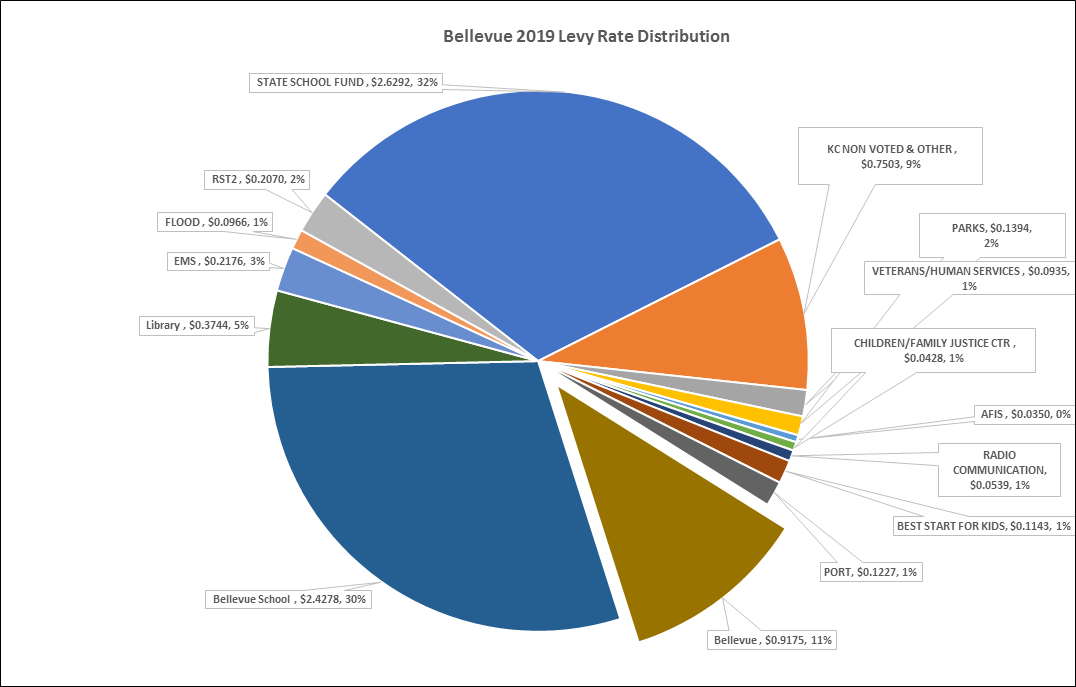

Bellevue Property Taxes City Of Bellevue

Bellevue Property Taxes City Of Bellevue

Image Result For U S National Map Of Property Taxes Property Tax History Lessons Historical Maps

Image Result For U S National Map Of Property Taxes Property Tax History Lessons Historical Maps

Washington Property Tax Calculator Smartasset

Washington Property Tax Calculator Smartasset

Visualoop Adli Kullanicinin Taxes Infographics Panosundaki Pin Okuma

Visualoop Adli Kullanicinin Taxes Infographics Panosundaki Pin Okuma

New Hampshire Property Tax Calculator Smartasset

New Hampshire Property Tax Calculator Smartasset

States With The Highest And Lowest Property Taxes Property Tax Social Studies Worksheets States

States With The Highest And Lowest Property Taxes Property Tax Social Studies Worksheets States

Assessor S Office Frequently Asked Questions Property Tax Q A Property Tax This Or That Questions Types Of Taxes

Assessor S Office Frequently Asked Questions Property Tax Q A Property Tax This Or That Questions Types Of Taxes

Are There Any States With No Property Tax In 2021 Free Investor Guide

Are There Any States With No Property Tax In 2021 Free Investor Guide

Are There Any States With No Property Tax In 2021 Free Investor Guide

Are There Any States With No Property Tax In 2021 Free Investor Guide

Visualizing Unequal State Tax Burdens Across America Visualizing Unequal State Tax Burdens Across America What Percentage Of State Tax Infographic America

Visualizing Unequal State Tax Burdens Across America Visualizing Unequal State Tax Burdens Across America What Percentage Of State Tax Infographic America

Are There Any States With No Property Tax In 2021 Free Investor Guide

Are There Any States With No Property Tax In 2021 Free Investor Guide

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home