Ohio Property Tax Rate By City

35000 x 99511000 348285. The median property tax on a 13460000 house is 183056 in Ohio.

Did You Know De Homeowners Age 65 Are Eligible For A Tax Credit Against Regular School Property Taxes Of Up To 400 Detaxfa Tax Delaware Retirement Benefits

Did You Know De Homeowners Age 65 Are Eligible For A Tax Credit Against Regular School Property Taxes Of Up To 400 Detaxfa Tax Delaware Retirement Benefits

Taxation of Real Property is Ohios oldest tax established in 1825 and is an ad valorem tax based on the value of the full market value of each property.

Ohio property tax rate by city. 93763 3465 of excess over 42100. 136 of home value. 31414 2969 of excess over 21100.

100000 x 35 35000 Assessed Value x Tax Rate1000 Current Real Estate TaxYear Example. Median property taxes paid. The Tax Settlement Budget Department in the Auditor Division of the Fiscal Office maintains all tax rates and distributes tax revenues that have been levied and collected to taxing authorities in Summit County.

2599 990 of excess over 5250. 65 The Plains OH. Real property taxes levied in Ohio are taxes imposed on the value of the property.

The Ohio Department of Taxations role in the municipal income tax is limited to administration of the tax for electric light companies and local exchange telephone companies and for those businesses that have opted-in with the tax commissioner for municipal net profit taxAll other business taxpayers as well as all individual taxpayers should. The Ohio Department of Taxation has assembled the following links to cities and villages that have enacted a municipal individual income tax. 725 Quaker City OH.

City Hall 5555 Perimeter Drive Dublin Ohio 43017. This page offers the latest information on sales tax rates as well as rate changes planned in any of Ohios 88 counties. 725 Franklin Furnace OH.

However tax rates vary significantly between Ohio counties and cities. By law Ohios counties and transit authorities may only enact sales tax rate changes effective at the start of any calendar quarter. Market Value x 35 Assessed Value Example.

Median property tax is 183600. Percentage of Home Value Median Property Tax in Dollars A property tax is a municipal tax levied by counties cities or special tax districts on most types of real estate - including homes businesses and parcels of land. Rates listed by city or village and Zip code.

4th Quarter effective. If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact your county or citys property tax assessor. Median household income owner-occupied homes.

Changes beginning Tax Year 2016. 7797 1980 of excess over 10500. Toll Free Tax Number.

89 rows Ohio. The median property tax on a. This interactive table ranks Ohios counties by.

Most tax increases are due to levies approved by the voters in your community at elections held in 2020. Tax Unit Full Year Cost for 100000 home Tax Unit Full Year Cost for. Tax amount varies by county.

Ohio is ranked number twenty two out of the fifty states in order of the average amount of property taxes collected. Passed in 1976 HB 920 reduces your rate as property values in your district increase during triennial reappraisals and updates. 18291 2476 of excess over 15800.

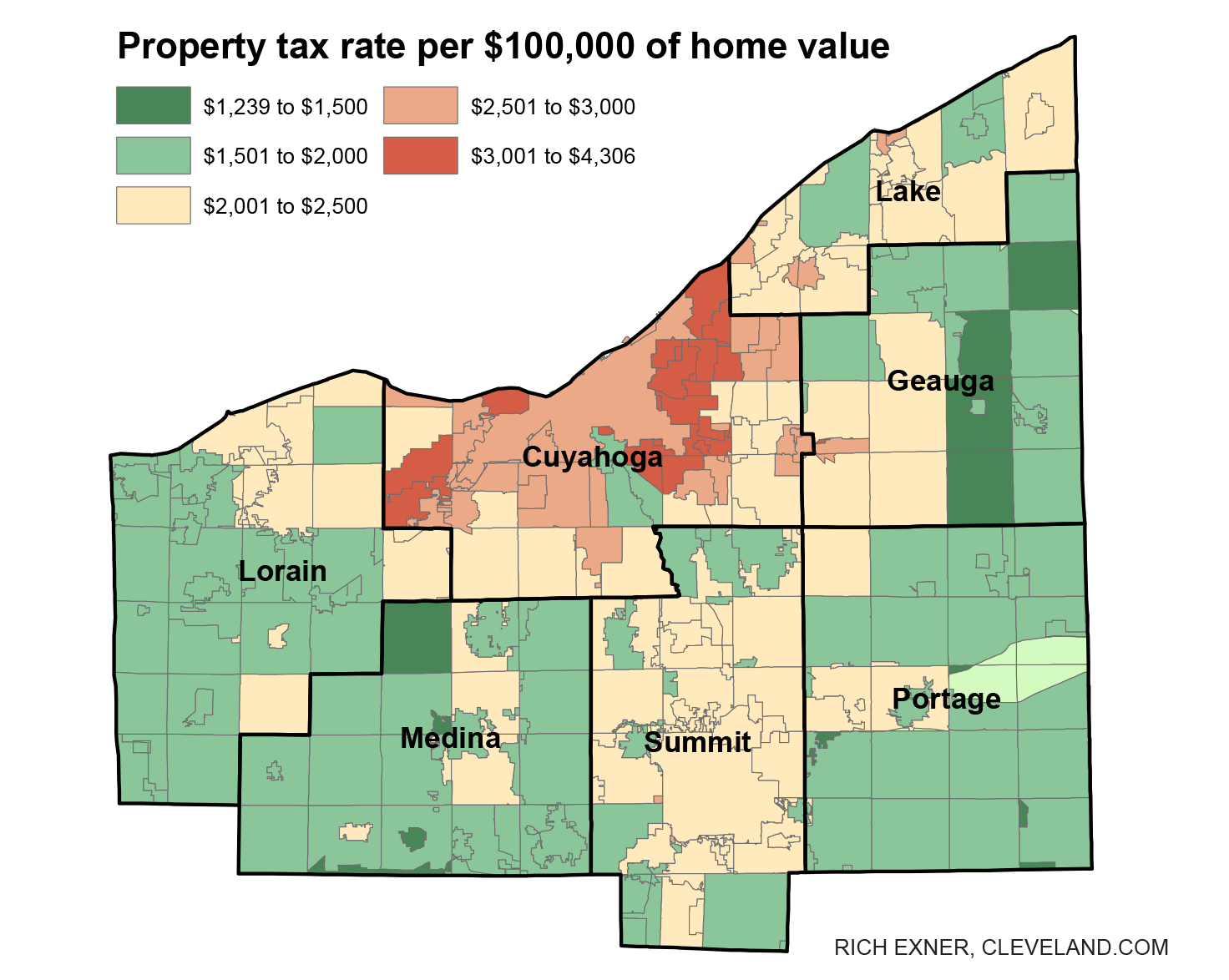

The highest rates are in Cuyahoga County where the average effective rate is 244. Property taxes are calculated based on the value of your property and the tax rate within your community. The average effective property tax rate in Ohio is 148 which ranks as the 13th-highest in the US.

675 Kitts Hill OH. The links below were supplied by the municipalities themselves and are intended to help taxpayers find out more information about the tax. Therefore the City of Norwood tax filing date has also been extended to May 17 2021.

The following lists the formulas that the State of Ohio has authorized for the calculation of property taxes. Counties in Ohio collect an average of 136 of a propertys assesed fair market value as property tax per year. You are protected from unvoted increases in property taxes by Ohio legislation known as House Bill 920.

By October 31st of each year the interest rate that will apply to overdue municipal income taxes during the calendar year will be posted herein as required by Ohio Revised Code Section 71827F. The median property tax in Ohio is 183600 per year for a home worth the median value of 13460000. The amount of property tax owed depends on the appraised fair market value of the property as determined by the property tax assessor.

7 Mineral City OH. Your 2020 property value was used in calculating this tax bill. Taxes are determined by voters.

Chardon Ohio 44024 216 447-4070 440 226-3535 Example of taxes on a home in. Effective property tax rate. Tax as a Percentage of Market a simple percentage used to estimate total property taxes for a property.

The State Department of Taxation Division of Tax Equalization helps ensure uniformity and fairness in property taxation through its oversight of the appraisal work conducted by each County.

Find Out Where Your City Or Township Ranks For Property Tax Rates In Greater Cleveland Akron Area Cleveland Com

Find Out Where Your City Or Township Ranks For Property Tax Rates In Greater Cleveland Akron Area Cleveland Com

How High Are Cell Phone Taxes In Your State Tax Foundation

How High Are Cell Phone Taxes In Your State Tax Foundation

New Hampshire Property Tax Calculator Smartasset

New Hampshire Property Tax Calculator Smartasset

States With The Highest And Lowest Property Taxes Property Tax Social Studies Worksheets States

States With The Highest And Lowest Property Taxes Property Tax Social Studies Worksheets States

Find Out Where Your City Or Township Ranks For Property Tax Rates In Greater Cleveland Akron Area Cleveland Com

States With The Highest And Lowest Property Taxes Property Tax Tax States

States With The Highest And Lowest Property Taxes Property Tax Tax States

Greater Cleveland S Wide Spread In Property Tax Rates See Where Your Community Ranks Cleveland Com

Greater Cleveland S Wide Spread In Property Tax Rates See Where Your Community Ranks Cleveland Com

Should You Be Charging Sales Tax On Your Online Store Sales Tax Tax Filing Taxes

Should You Be Charging Sales Tax On Your Online Store Sales Tax Tax Filing Taxes

Compare Property Tax Rates In Each State Property Tax Tax Rate Map

Compare Property Tax Rates In Each State Property Tax Tax Rate Map

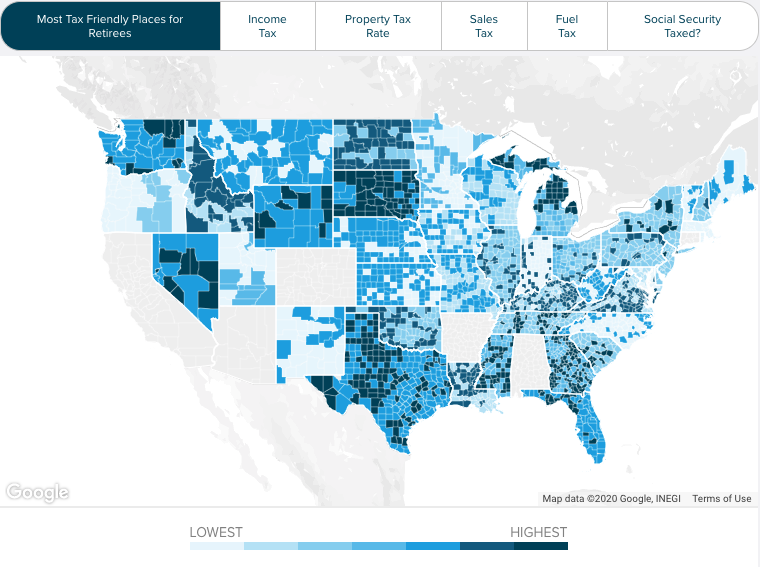

Utah Retirement Tax Friendliness Smartasset

Utah Retirement Tax Friendliness Smartasset

Compare New Property Tax Rates In Greater Cleveland Akron Garfield Heights Now Has Top Rate In Northeast Ohio Cleveland Com

Compare New Property Tax Rates In Greater Cleveland Akron Garfield Heights Now Has Top Rate In Northeast Ohio Cleveland Com

Greater Cleveland S Wide Spread In Property Tax Rates See Where Your Community Ranks Cleveland Com

Compare New Property Tax Rates In Greater Cleveland Akron Part Of South Euclid Now Has Top Rate In Northeast Ohio Cleveland Com

Compare New Property Tax Rates In Greater Cleveland Akron Part Of South Euclid Now Has Top Rate In Northeast Ohio Cleveland Com

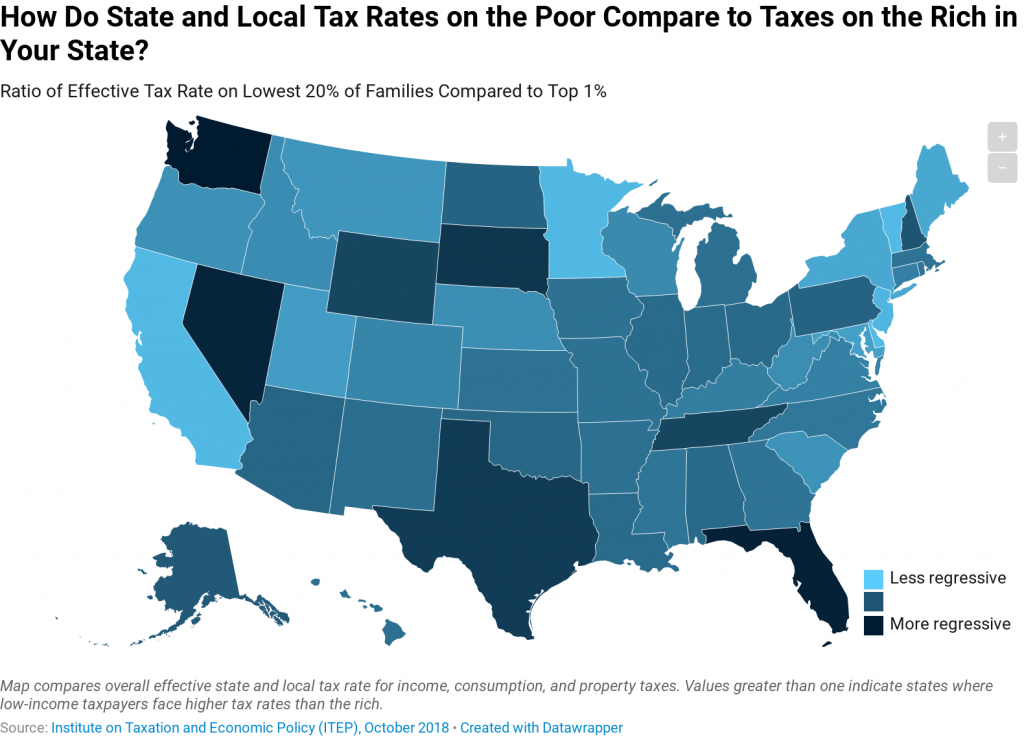

How Do Tax Rates On The Poor Compare To Taxes On The Rich In Your State Itep

How Do Tax Rates On The Poor Compare To Taxes On The Rich In Your State Itep

The Property Tax On My Eaton Ohio Home Is Increasing 14 Percent In 2018 I Knew The Rate Was Abnormal It S Roughly Twi Property Tax Preble County How To Plan

The Property Tax On My Eaton Ohio Home Is Increasing 14 Percent In 2018 I Knew The Rate Was Abnormal It S Roughly Twi Property Tax Preble County How To Plan

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home